Insight

June 9, 2021

Examining the NDC: Methane from Oil and Natural Gas

Executive Summary

- The United States’ plan to reduce greenhouse gas emissions 50-52 percent from 2005 levels by 2030, introduced as part of rejoining the Paris Agreement on climate change, relies in part on new methane-emission regulations on the oil and natural gas industries.

- Those regulations would likely consist of more stringent requirements on new sources and, for the first time, federal standards for existing sources.

- While the regulations could reduce methane emissions by up to 69 percent from 2020 levels, according to one estimate, the requirements of the rulemaking process and near-certain litigation mean those reductions are virtually unachievable by 2030.

Introduction

On Earth Day, the Biden Administration notified the United Nations about how it intends to reduce greenhouse gas emissions in the United States, which was necessary following the country’s re-joining of the Paris Agreement on climate change. This brief document, known as the Nationally Determined Contribution (NDC), set an economy-wide target of reducing greenhouse gas emissions by 50-52 percent from 2005 levels by 2030. The document approaches emissions reductions on a sector-by-sector basis, and the American Action Forum is releasing a series of analyses following that same sector-by-sector approach. The first analysis explored a potential regulatory scheme the administration could rely on to reduce emissions in the electricity generation sector, including possible abatement potentials and costs. This second analysis focuses on similar potentials from further regulation on methane emissions from the oil and natural gas industries. Methane regulations could reduce emissions by nearly 70 percent once fully implemented, but any regulatory effort is likely to be tied up in litigation for years, making the 2030 goal likely unattainable.

Current Regulations on Methane Emissions from Oil and Natural Gas

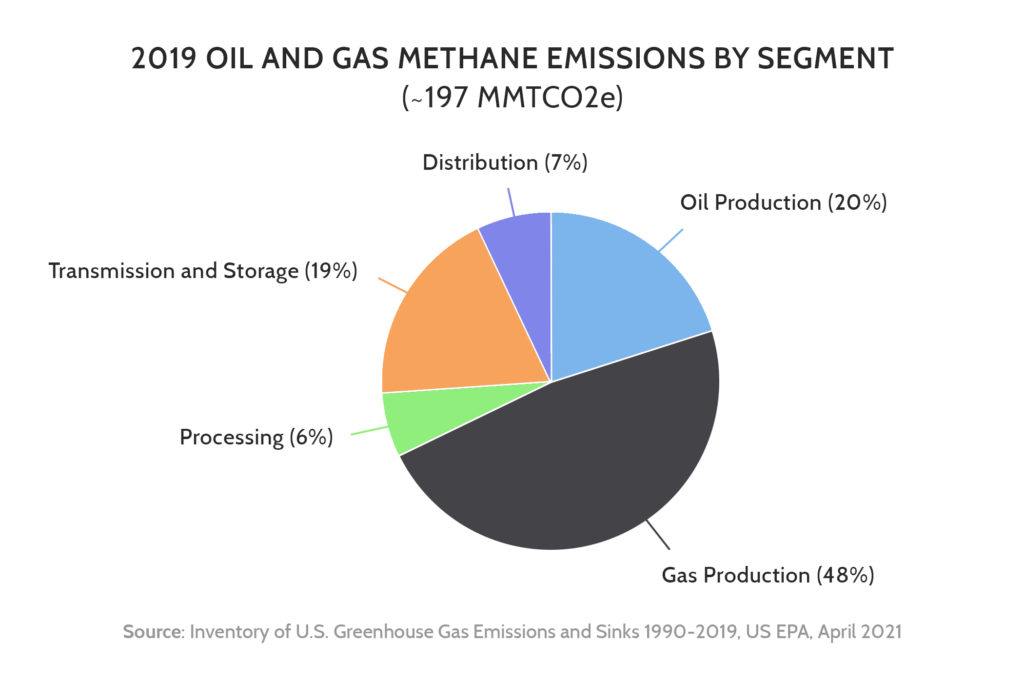

Methane releases are a significant part of greenhouse gas emissions, as methane has a global warming potential of about 25 times more than carbon dioxide over a 100-year time horizon (although it remains in the atmosphere for a far shorter period than carbon dioxide). The oil and natural gas industries combine to represent the largest source of methane emissions, with releases throughout the chain of production, transmission, and distribution. According to Environmental Protection Agency (EPA) data, emissions within those industries break down as follows.

To assess the possible next generation of methane rules, it is essential to first consider the current state of regulation in this sector. In 2016, the Obama Administration’s EPA issued a rule that set New Source Performance Standards (NSPS) for methane emissions from oil and natural gas production. The rule essentially required site operators to use technologies to capture emissions from equipment and established standards for finding and sealing leaks.

In 2017, amid ongoing litigation over the 2016 rule, the Trump Administration began a process to ease some of the rule’s requirements. The process culminated in a 2020 rule that removed some sources of emissions from the regulation’s coverage and eliminated NSPS coverage of methane emissions from the sector because EPA said the Obama Administration had never issued a finding that methane emissions from covered sources endangered public health. (The Obama EPA had used a finding that volatile organic compounds, which include methane, from oil and natural gas production endanger public health to set specific requirements for methane.)

The Trump Administration rule itself is in peril on two fronts. The first is via the Congressional Review Act (CRA), which if successful would revert requirements back to the 2016 rule. The second threat is through administrative action. President Biden issued an executive order directing EPA to update methane standards on new sources and propose a rule on existing sources by September 2021. In either of these scenarios, however, the litigation over the 2016 rule (or its Biden Administration successor) will likely be revisited.

The Shape and Costs of a New Methane Regulation

The NDC aims to address methane from oil and natural gas production by promising to “update standards and invest in plugging leaks from wells and mines and across the natural gas distribution infrastructure.”[1] Updating standards means two things: new regulations that increase the stringency of requirements on new sources, and, for the first time, standards on existing sources.

The NSPS rule that the Biden Administration is likely to issue would closely track the Obama Administration’s version from 2016, though there could be tweaks that make it more stringent. Based on the most stringent alternative identified in the regulatory impact analysis (RIA) to the 2016 rule, the Biden EPA could require more frequent monitoring at well sites, for instance. While this change would result in $150 million more in monetized benefits in 2025, according to the RIA, it would come at a cost of $350 million.[2] The fact that this specific regulation would result in net costs is likely a reason why the Obama Administration did not choose it. The Biden Administration might need to find more emissions reductions to achieve its NDC goals, however, such that EPA could redo the math in a way that makes it appear more net beneficial.

A federal regulation for existing sources would likely mirror the requirements for new sources. California, for example, issued a regulation covering both new and existing sources that had identical requirements in 2017. There is a substantial difference in the total amount of sources covered, however. In its 2016 rule EPA estimated that 220,000 new sources would be covered in 2025.[3] An agency projection from a simultaneously issued document estimated there were about 1.4 million existing sources, although EPA acknowledged it did not have complete data and that figure was likely an underestimate.[4] EPA’s effort to better assess the possible universe of existing sources was scuttled by the Trump Administration in 2017.

While there is no complete EPA data on abatement potentials from existing sources, the International Energy Agency’s (IEA) 2021 Methane Tracker Database offers information on potential emissions abatement measures and their costs. The IEA estimates if the United States implemented all available measures, methane emissions from oil and natural gas production, transmission, and distribution would be reduced by 69 percent from its estimated 2020 levels.[5] The cost of implementing these measures, using the IEA’s cost per million-Btu estimate, is $688.4 million. This cost, however, is a limited measure. It assumes a one-time cost of adopting its recommended abatement measures. It does not assume ongoing maintenance costs, nor does it include any possible paperwork costs.

EPA’s previous estimates offer some clues on potential paperwork costs. The since-scuttled EPA data collection request from 2016 estimated industry costs for gathering information at $40 million. The Biden Administration would likely need to resurrect this effort to properly gauge the universe of existing sources. For ongoing paperwork and recordkeeping costs implementing the NSPS rule’s requirements (which applied only to new or modified sources), EPA estimated annual costs to industry of $3.4 million annually, or about $682 per response. One can assume a similar per-response cost for existing sources if a rule is eventually promulgated, but with the number of responses likely several times greater, annual costs would likely dwarf those of the NSPS rule.

Implications and Challenges

The Biden Administration’s likeliest course for dealing with methane emissions from the oil and natural gas industries is to rely on the Clean Air Act’s section 111, which underpinned the 2016 NSPS rule. As with regulations on the electricity-production sector, this path is full of hurdles that will slow the rollout of any new rules.

EPA’s action to regulate new sources is necessary to trigger a requirement that the agency issue a regulation on existing sources. If congressional action through the CRA is successful, the 2016 NSPS rule would go back into effect, although that would restart litigation over whether that rule exceeded EPA’s authority. If the Biden Administration issues a new, enhanced NSPS rule, similar litigation would follow. EPA may also be treading on fraught legal territory if it proposes a rule on existing sources while its prerequisite NSPS rule is facing a legal challenge. Even if an existing source rule is promulgated in late 2022, it too will be contested.

These rules will be challenged because of the requirement that EPA consider costs when issuing rules under section 111. Opponents of the rules would likely ask a court to examine the feasibility of the costs imposed by EPA. These hurdles make it exceedingly unlikely that the Biden Administration would have the abatement measures identified by IEA fully operational for both new and existing sources by 2030, making these regulations insufficient to meet the NDC’s (admittedly non-specific) objectives.

Conclusion

Of the regulatory schemes promised in the NDC, enhanced regulation of methane emissions from the oil and natural gas industries is likely the most straightforward. That does not mean that the scheme would be easy to put in place in short order, however, compromising the rules’ effectiveness in achieving emissions reductions at the level needed to reach the NDC’s goal. As with rules aimed at cutting emissions from electricity generation, the requirements of the rulemaking process and near-certain litigation will substantially postpone implementation – even if the rules are eventually cleared by federal courts.

[1] The United States’ Nationally Determined Contribution Reducing Greenhouse Gases in the United States: A 2030 Emissions Target. April 2020. p. 5.

[2] U.S. Environmental Protection Agency. Regulatory Impact Analysis of the Final Oil and Natural Gas Sector: Emission Standards for New, Reconstructed, and Modified Sources. 2016. pp. 1-8 (Table 1-3) & 1-9 (Table 1-4).

[3] Ibid. p. 3-11 (Table 3-3).

[4] U.S. Environmental Protection Agency. Supporting Statement for Public Comment: Information Collection Effort for Oil and Gas Facilities. 2016. p. 3.

[5] Value obtained from “IEA-estimated abatement potential” table for the United States available on the IEA Methane Tracker Database.