Insight

June 14, 2017

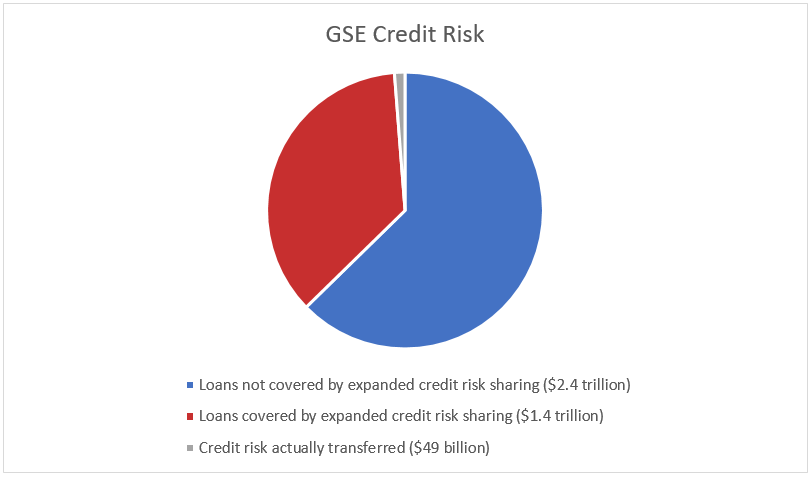

Fannie Mae and Freddie Mac are Actively Dangerous SIFIs

Last month, Federal Housing Finance Agency (FHFA) Director, Mel Watt, delivered remarks at the American Mortgage Conference. There, he spoke about the credit risk transfer (CRT) programs at Fannie Mae and Freddie Mac (the GSEs), what risk they’ve been able to transfer, and how. Specifically, he said that the GSEs “have transferred a meaningful portion of credit losses on a combined $1.4 trillion in mortgages, with a risk in force of about $49 billion. That all sounds great until you realize that the $49 billion in credit risk that the GSEs have successfully transferred is only equal to approximately 1.2 percent of the GSEs overall portfolios.

To make matters worse, Director Watt goes on to explain how FHFA determines what risk to transfer to private investors. He explained that FHFA had previously experimented with selling the first 100 basis points of expected credit loss to investors, and that FHFA had learned that selling the first 50 basis points of expected credit loss is difficult and expensive. That is due in large part because private investors have no desire to buy the 50 riskiest basis points of any given pool of mortgages. As a result, according to Watt, FHFA “determined that it is better if Fannie Mae and Freddie Mac retain the first 50 basis points of expected losses in most transactions.”

Translation: not only are FHFA and the GSEs only transferring about 1 percent of the risk in their portfolio, but the risk that they are retaining is the most risky, most likely to default, and most likely to need another taxpayer bailout. Although the housing market has recovered to some extent since the financial crisis, the GSEs are debatably worse off than ever, having a statutory requirement to hold exactly zero capital by the beginning of next year. So we have undercapitalized SIFIs deciding to retain the most risky assets, and transferring very little of their credit risk. We’ve seen this before. Not a good equation.

The Senate Banking Committee has hinted that GSE reform is a priority this year. And while there are many proposals of how to reform the GSEs, nothing will be an easy or quick fix. In the meantime, FHFA and the GSEs can de-risk their portfolios by using private mortgage insurance (PMI) more extensively to transfer that risk. PMI has traditionally been used to reduce the possibility of loss on low downpayment mortgages to get them to the same level of risk as a 20 percent or greater downpayment mortgage. The GSEs could use PMI to absorb even more of those potential losses so that, in a worst case scenario, they wouldn’t even have to cover 80 percent losses on the mortgage. Rather, they would cover 50 or 60 percent. As a result, there is more private capital behind these risky mortgages, the GSEs exposure to losses is lower, and the risk of a taxpayer bailout of Fannie Mae and Freddie Mac is greatly reduced.