Insight

March 20, 2020

Financial Services Provisions in the Coronavirus Aid, Relief, and Economic Security (CARES) Act

Executive Summary

- Companies with fewer than 500 employees are eligible for a loan for as much as $10 million, with wide flexibility on use; the total cost of this provision is $300 billion. Businesses will be able to achieve loan forgiveness to the value of cost of payroll during the emergency, with loan forgiveness decreasing by number of employees laid off.

- The Department of Treasury is authorized to extend a total of $208 billion in loans to businesses impacted by the coronavirus, but borrowers who take advantage of these loans must cap the salaries of individual employees who earned $425,000 in 2019; the total cost of this provision is $208 billion.

- The Treasury regains the ability to guarantee money market mutual funds, a market intervention that has not been authorized since the previous financial crisis.

Context

In the face of the economic and social disruption caused by the coronavirus, Congress has already passed two significant stimulus packages to provide relief to the American economy, businesses, and consumers. On March 19, Senate Majority Leader Mitch McConnell released the Senate Republican draft of the Phase 3 stimulus package, known as the Coronavirus Aid, Relief, and Economic Security (CARES) Act. With an estimated trillion-dollar price tag, a third stimulus package would be one of the largest and most significant stimulus packages in American history.

This piece summarizes the implications specifically for financial services.

Implications for Financial Services

Division A – Small Business Interruption Loans

The first section of the draft bill, titled “Division A – Small Business Interruption Loans,” sets aside significant resources for the relief of small businesses, entrepreneurial programs, and for use by the Minority Business Development Agency. This relief is predominantly provided in the form of what are known as “7A Loans,” so-called because they derive from section 7(a) of the Small Business Act.

The rule proposes that any business concern, public or private nonprofit, employing fewer than 500 employees is eligible for a loan made under section 7(a) of the Small Business Act for not greater than $10 million (where the loan amount is the lesser of either a calculation based on average monthly expenses or $10 million). That loan may be used for payroll support, employee salaries, mortgage payments, rent, utilities, and any other debt obligations incurred before the covered period. The borrower must not already be receiving support under the Small Business Act, but this Division also sets out generous provisions for existing loan forgiveness. Businesses will be able to achieve loan forgiveness to the value of cost of payroll during the emergency, with loan forgiveness decreasing by number of employees laid off. The administrator of this loan may collect no fees or as few as possible.

This Division also establishes a series of grants available for entrepreneurial development programs, and it empowers the Minority Business Development Agency to provide financial assistance to qualifying small businesses disrupted by COVID-19.

This Division directly appropriates $299.4 billion for the fiscal year ending September 30, 2020, to remain available until September 30, 2021, for the provision of these 7(a) loans, and $265 million for entrepreneurial development programs. Also appropriated is $300 million for the administration of the Small Business Act and $25 million for the Office of the Inspector General (OIG) in connection with overseeing this administration. A final $10 million is appropriated for minority business centers of the Minority Business Development Agency.

The Treasury will establish a list of criteria for insured depository institutions (provided they are sufficiently safe and sound) to participate in a small business interruptions program. The eligibility criteria of 7(a) will not apply to these loans. The Secretary of the Treasury is directed to set out terms, including compensation these institutions may receive.

The program will be administered until the COVID-19 national emergency expires.

The total cost of this provision is $300 billion.

Division C – Assistance to Severely Distressed Sectors of the United States Economy

Division C of the draft bill, titled “Division C – Assistance to Severely Distressed Sectors of the United States Economy,” authorizes the Treasury to make loans directly to businesses impacted by the coronavirus. Particular restrictions are put in place where those businesses are airlines.

The rule proposes to authorize the Treasury Secretary to make or guarantee loans that do not, in aggregate, exceed $208 billion. Passenger air carriers may receive no more than $50 billion, and cargo air carriers no more than $8 billion, with the total provided to other businesses not exceeding $150 billion. The restrictions are as follows: a) Recipients must not have reasonably available credit; b) The intended obligation must be “prudently incurred”; and c) The loan must be sufficiently secured. Any loan will be made at a rate not less than a rate determined by the Secretary on the basis of comparable average yield on instruments of comparable maturity. The Secretary must make application and term details available within ten days after the Act is enacted, and the Secretary must ensure that the federal government is compensated to the extent possible. The Secretary may contract with borrowers such that the federal government participates in the gains of borrowers (for example via equity instruments), and any amount collected must be deposited in the Airport and Airway Trust Fund. $100 million of the total $208 billion may be spent on the administration of these loans.

Any borrower under this provision must undertake, for a two-year period beginning March 1, 2020, that it will cap the pay of any individual employee who earned more than $425,000 in total compensation (including bonuses and equity) in 2019.

If an air carrier, the Secretary may require the maintenance of scheduled air transportation service.

The total cost of this provision is $208 billion.

Division E – Temporary Permit Use to Guarantee Money Market Mutual Funds

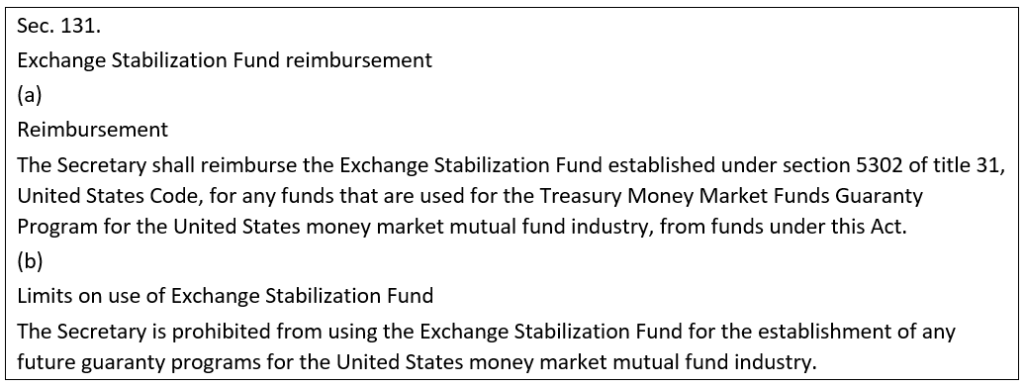

Division E of the draft bill, titled “Division E – Temporary Permit Use To Guarantee Money Market Mutual Funds,” lifts restrictions from the Treasury’s use of the Exchange Stabilization Fund (ESF).

The rule proposes that Section 131 of the Emergency Economic Stabilization Act of 2008 shall not apply during the COVID-19 national emergency.

Although the ESF was originally created for currency market interventions, it is typically well funded and can be used discretionally, which makes it a very tempting target in times of stress. The ESF was therefore tapped to shore up money market funds in the last crisis, although this temporary emergency power was ceded after the financial crisis. Division E restores that power.

Conclusions

If enacted as law, the CARES Act has two key implications for financial services. First, it would significantly expand the scope of loans available to small businesses under the Small Business Act. These potential gains, however, must be offset against the very real costs passed on to small businesses by the Families First Coronavirus Response Act, leaving the true position for small businesses difficult to ascertain. Second, the CARES Act would provide the Treasury with two powerful tools of direct financial intervention: direct loans to businesses impacted by the coronavirus and unlimited use of the Exchange Stabilization Fund to guarantee money market mutual funds, extremely critical financial instruments to short-term liquidity in the market.