Insight

March 11, 2019

Highlights of FY2020 President’s Budget

By the Numbers

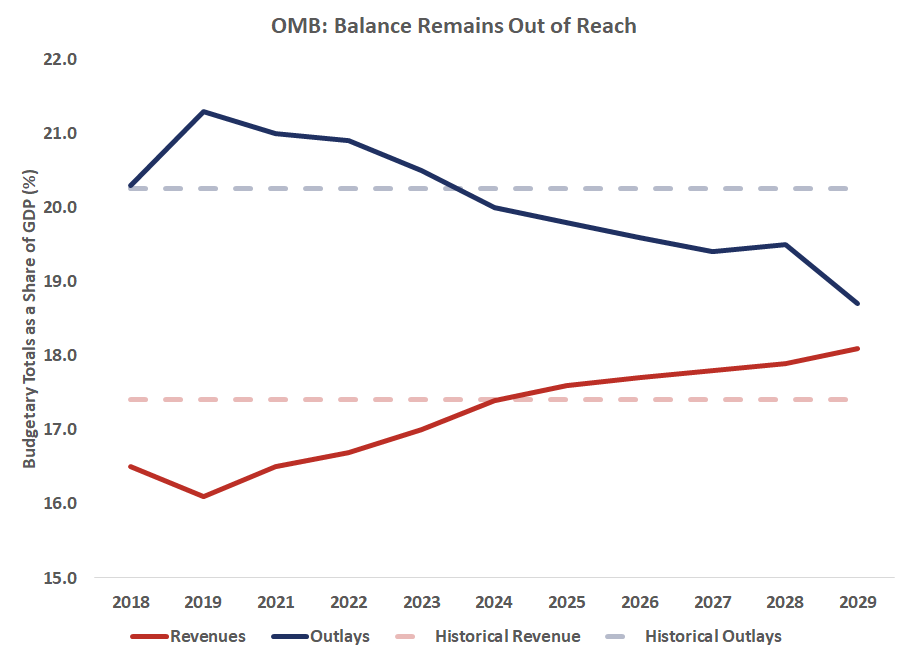

Taxes: Compared to its own baseline, the President’s Budget makes essentially no changes in revenues. As a share of gross domestic product (GDP), however, revenues are projected to increase. For context, the President’s Budget assumes that revenues dip well below the historical average (at levels that are typically seen during recessions) before trending upward.

Spending: By the end of the budget window, the President’s Budget would decrease spending by over $2.7 trillion over the next 10 years, sending outlays 1.6 percentage points below historic norms.

Deficits: The President’s Budget assumes projected deficits decline substantially from 3.8 percent of GDP to 0.6 percent of GDP, based upon the Office of Management and Budget’s (OMB) own assumptions, through a combination of significant spending reductions, optimistic assumed economic growth, and savings on debt service.

Interest Payments: Interest payments on the debt will reach $823 billion in 2029. This sum reflects a more than tripling of debt service costs of $240 billion in FY2016, the year before President Trump assumed office.

Debt Held by the Public: Borrowing from the public would increase as a share of the economy under the President’s Budget, reaching 82.1 percent of GDP in 2022, before dropping to 71.3 percent of GDP by 2029 – which would be the lowest level of debt outstanding since FY2012.

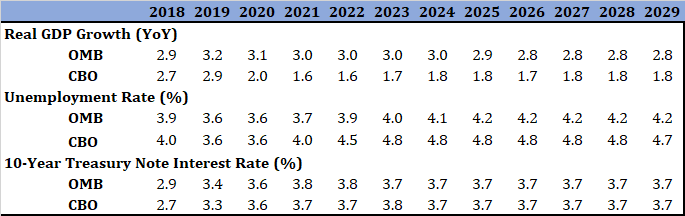

Economic Projections

The President’s Budget includes substantially more optimistic economic projections than does the Congressional Budget Office (CBO) projections in terms of real GDP growth and unemployment. Under the president’s budget, real GDP is assumed to grow about 1.2 percentage points faster than in CBO’s projection. These effects combine to increase tax revenues and reduce debt service. Indeed, persistent, higher growth of just 0.1 percentage points should lead to $307 billion in deficit reduction.