Insight

March 18, 2021

Impact of a Federal Leasing Moratorium

Executive Summary

- As part of his climate change agenda, President Biden issued executive orders that halt leasing and drilling on federal lands and in federal waters to allow federal agencies to conduct a review, raising concerns about job losses in the affected oil and gas industries.

- A relatively small percentage of total domestic oil and gas production occurs on land managed by the Department of Interior, but the majority of this production is concentrated in a few states.

- While the number of leases or drilling permits do not correlate with the total number of jobs in oil and natural gas industry, the market price of oil does serve as an indicator of the number of extraction jobs.

- Should the moratorium on new drilling be implemented permanently, it will result in concentrated job losses. Policies should target those states where potential future job losses would be most damaging instead of applying to the entire country or industry.

Introduction

As part of his broader commitment to address climate change, President Biden issued two executive orders (EOs) in January that temporarily prevent new oil and gas leasing on federal lands and in offshore waters until the Department of the Interior (DOI) conducts a comprehensive review of federal oil and gas permitting and leasing practices.[1] While the results of the review likely won’t be known for months, the EOs likely signal a pivot toward a clean energy transition, which will impact employment and growth in the oil and gas industry.

One possible outcome of the Biden Administration’s review process involves the continued leasing of federal lands but only for the purposes of developing renewable resources or mining and not for developing fossil fuels such as oil, natural gas, and coal. Alternatively, the federal government could continue leasing lands for the development of fossil fuels but in a more limited geographic area and subject to higher royalties and lease prices.

In turn, the results of this review could have a range of impacts on the oil and gas industry. While much is obviously unknown, the trends in federal leasing, employment in the extraction industry, and market prices can indicate the potential impact of the policies resulting from the Biden Administration’s review. While there appears to be little relationship between the number of leases sold or drilling permits issued and overall employment in the extraction sector, the impact on states where production is relatively large could be concerningly substantial.

Moratorium Update

In January, President Biden initially issued an EO, “Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis,” that halted activities undertaken as part of the oil and gas program in the Arctic National Wildlife Refuge and Arctic waters. It was followed by a Secretarial Order issued by DOI that prevented agency staff for 60 days from carrying out functions such as permitting drilling. Shortly after, President Biden issued an EO, “Tackling the Climate Crisis at Home and Abroad,” which halted leasing of federal lands more broadly until a review was completed.

Both of the EOs issued by President Biden called for a review of existing programming to consider environmental implications. Existing programming may be subject to “appropriate actions” that may include adjusting royalty rates. Neither EO, however, provided a timeline for the duration of the review nor indicated when or if the moratorium would be lifted. On March 9, DOI announced that it would host a forum in response to President Biden’s second EO in order to provide a venue for various stakeholders to express their concerns and provide a comment period to the public.[2]

The Secretarial Order issued on January 20, 2021, placed a 60-day limit on the ability of agency staff to issue decisions “including but not limited to a lease, amendment to a lease, affirmative extension of a lease, contract, or other agreement, or permit to drill.” This 60-day period ends on March 20, suggesting that some agency operations will return to normal, particularly the issuance of permits to drill. Lease sales, however, are likely to remain halted under Biden’s second EO for at least several months.

Federal Leasing

The federal government owns approximately 640 million acres of land in the continental United States, 28 percent of the total area.[3] DOI’s Bureau of Land Management (BLM) oversees the leasing of federal lands for the development of oil, natural gas, coal, mineral, and renewable energy resources.[4] In this capacity, “the BLM administers more than 700 million acres of federal subsurface mineral estate.”[5] Similarly, the Bureau of Ocean Energy Management (BOEM) oversees the leasing of offshore waters on 2.5 billion acres of the outer continental shelf.[6]

Oil and gas lease sales are initially subject to competitive bidding at BLM; if BLM fails to receive bids, leases can be acquired through noncompetitive bidding.[7] BOEM follows a similar leasing process to BLM. Tracts or blocks included in a lease sale are nominated by a member of the public, who is typically a representative of an oil or gas company. The nominated area is subject to agency review and is then made available for bidding.[8] Following a successful bid, a leaseholder holds a tract for a maximum of 10 years and may seek to extend the lease. In order to conduct exploration and drilling, the leaseholder must obtain approval from the regulator. Drilling permits issued by BLM are valid for two years and may also be renewed.

The nomination of a tract for leasing does not obligate the interested party to bid. Similarly, obtaining a permit to drill does not obligate the applicant to drill upon receiving permission. Producers may choose to acquire tracts and not drill. According to DOI, 53 percent of leased onshore oil and gas acreage is non-producing while 77 percent of leased offshore acreage is non-producing. In addition, DOI has issued 7,700 unused drilling permits.[9] As a result, the moratorium on new leases will not impact the production of oil and gas in the short term as drilling will likely continue on existing leases.

Production on Federal Lands

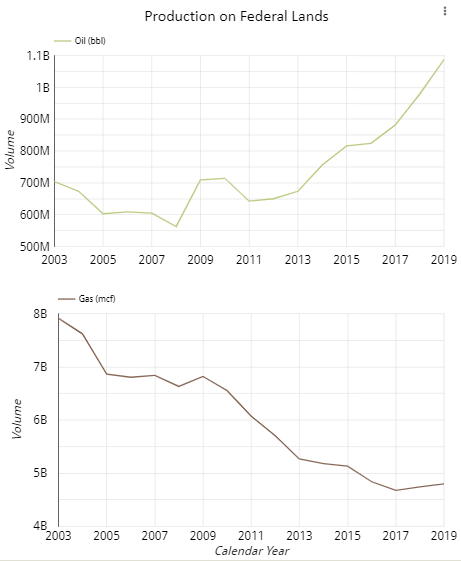

Throughout the past decade, the amount of oil produced on federal lands has increased while the amount of natural gas produced has decreased. These trends are demonstrated in the charts below, which include onshore production for each commodity. These shifts, however, are small in scale when compared to the production on private lands.

In fiscal year 2020, federal land production accounted for 9 percent of crude oil and 9 percent of natural gas produced in the United States, while offshore production accounted for 15 percent of U.S.- produced crude oil and 2 percent of natural gas. In total, federal land and water production accounted for 24 percent of U.S.-produced oil and 11 percent of gas.[10] While these proportions are relatively small, it is worthwhile to note that they are historically high values as oil production peaked in the United States in 2019 and declined by 8 percent in 2020 in response to the COVID-19 pandemic.[11]

Source: U.S. Department of the Interior, Natural Resources Revenue Data

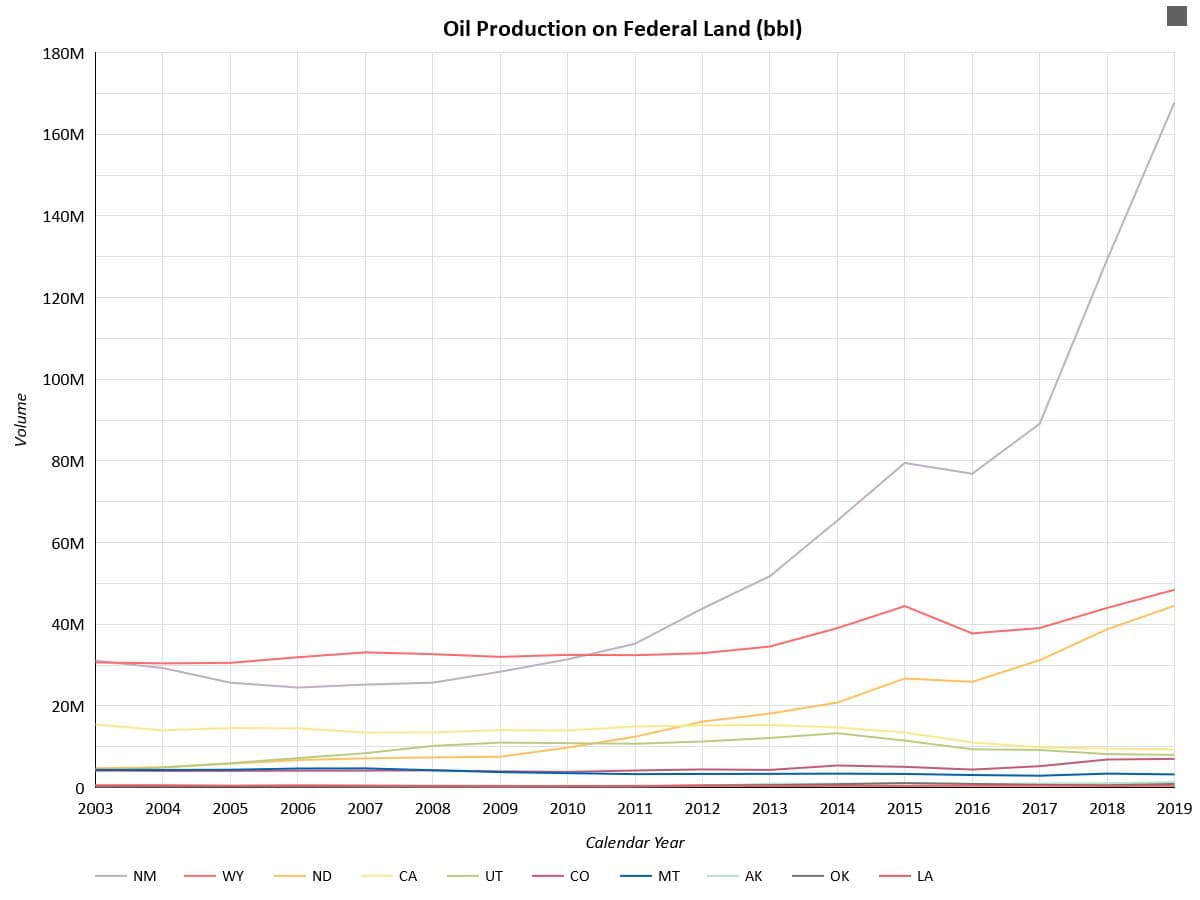

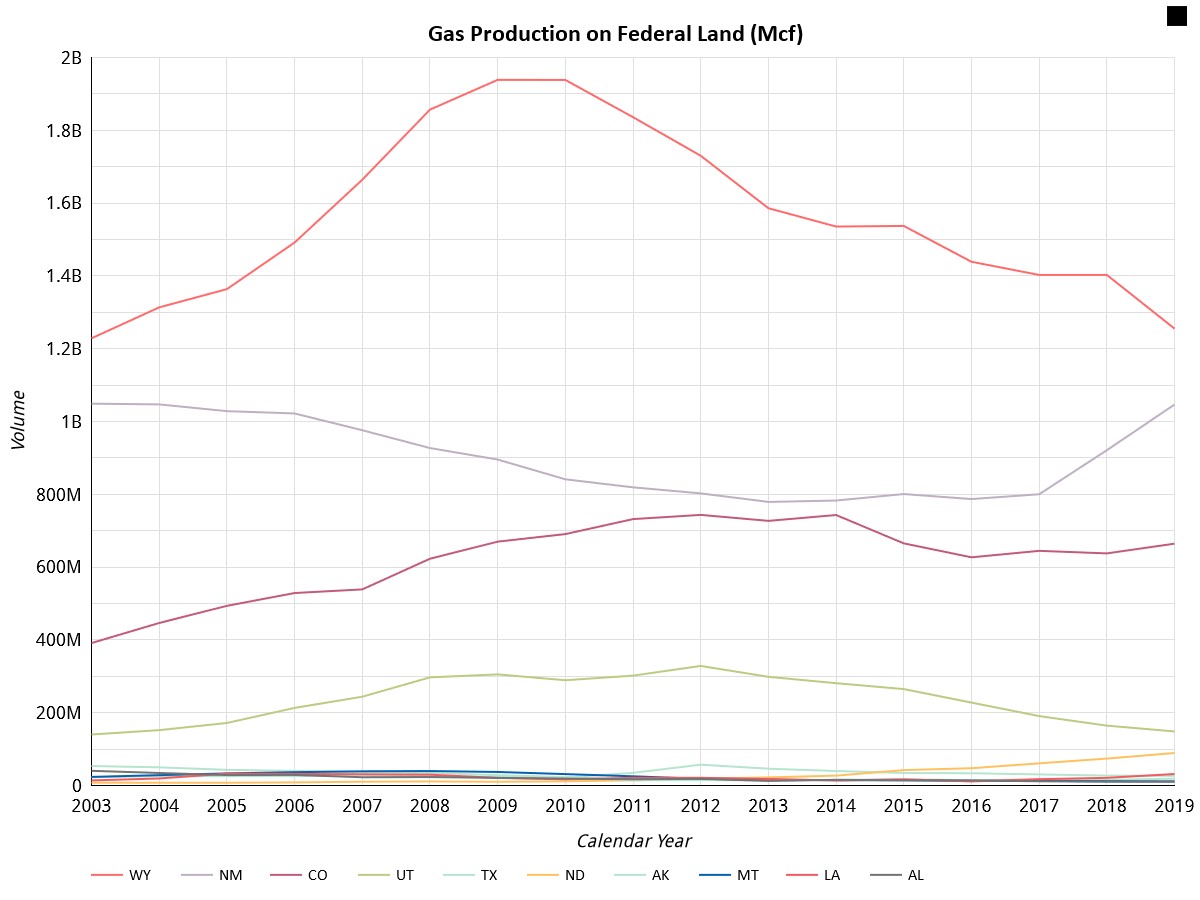

In recent years, some states have seen production concentrate within their borders. Producers move drilling rigs to areas that appear to have advantageous qualities in pursuit of profitable wells. With technological developments such as hydraulic fracturing, new geological formations have proven a worthwhile source of oil and natural gas.

Source: U.S. Department of the Interior, Natural Resources Revenue Data

Source: U.S. Department of the Interior, Natural Resources Revenue Data

While the greatest amount of oil produced on federal lands comes from New Mexico, Wyoming, and North Dakota, the greatest amount of natural gas from federal lands is produced in New Mexico, Wyoming, and Colorado, as depicted in the charts above. New Mexico, in particular, has seen a dramatic increase in production since 2017 and was responsible for about 50 percent of onshore federal production in 2020. Despite seeing a decline in production, Wyoming continues to produce the largest quantities of gas, about a third of all onshore production from federal lands in 2020.

Employment

As market conditions drive producers to new areas of opportunity, the workforce follows. Employment in extraction includes activities undertaken to develop and operate oil and natural gas fields up to the point of shipment from the property.[12] Data from federal agencies allow the relationship between the number of leases and drilling permits issued to be compared to market conditions such as the number of employees or commodities’ market price.

There is little correlation between the number of employees in the extraction industry and the number of federal leases purchased or drilling permits issued. This lack of correlation is likely because production on federal land is a small component of total U.S. production. The price of oil, however, proves to be related to the number of employees in the extraction industry. The chart below shows the relationship between total number of domestic extraction jobs and the price of oil at the Cushing, Oklahoma hub.

Source: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, FRED

As the price of oil rises and falls, the number of employees in the extraction industry follows. These trends are not reserved to the past 20 years. The Bureau of Labor Statistics, upon reviewing productivity in oil and gas production from 1959 through 1990, found that the “trends for employment and hours show little relationship to output, but a very direct relationship to the price of oil. Whenever the price of oil increased, employment increased in an attempt to produce more oil in times of high prices.”[13]

Employment within the extraction industry is driven by forces beyond the leasing of federal lands. The production of oil and gas on federal lands and in federal waters contributes a small portion of total domestic production but it is concentrated in a few states. Much of the growth in recent years has taken place in New Mexico’s oil and gas extraction industry, which quickly rebounded and continued to grow following declines in market prices in 2015. President Biden’s moratorium on new leases and drilling permits will hurt employment in oil and natural gas extraction on federal lands, but the effects will not be felt nationally. Instead, the impact will be concentrated in a few areas, and as a result, policies to address the loss of jobs in the extraction industry, such as transition support, should be targeted to specific regions.

[1] https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/20/executive-order-protecting-public-health-and-environment-and-restoring-science-to-tackle-climate-crisis/; https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/27/executive-order-on-tackling-the-climate-crisis-at-home-and-abroad/

[2] https://www.doi.gov/pressreleases/interior-department-outlines-next-steps-fossil-fuels-program-review

[3] https://fas.org/sgp/crs/misc/R42346.pdf

[4] https://www.blm.gov/programs/energy-and-minerals/oil-and-gas/about

[5] https://fas.org/sgp/crs/misc/R42346.pdf

[6] https://www.boem.gov/sites/default/files/documents/newsroom/fact-sheets/BOEM-FactSheet-About.pdf

[7] https://www.blm.gov/programs/energy-and-minerals/oil-and-gas/leasing/general-leasing

[8] https://www.boem.gov/sites/default/files/uploadedFiles/BOEM/Oil_and_Gas_Energy_Program/Leasing/5BOEMRE_Leasing101.pdf

[9] https://www.doi.gov/pressreleases/interior-department-outlines-next-steps-fossil-fuels-program-review

[10] https://revenuedata.doi.gov/?tab=tab-production; EIA Monthly Oil Production and Gas Withdrawals

[11] https://www.eia.gov/todayinenergy/detail.php?id=47056