Insight

May 6, 2020

Planning for COVID with Energy in Mind

Executive Summary

- The energy sector deemed critical infrastructure has continued to operate but with reduced demand for petroleum products facilities have reduced production capacity.

- Myriad factors—including staffing needs, refining proportions, and transportation bottlenecks—could lead to a shortage of petroleum products and those dependent on them if demand spikes too quickly, and policymakers should keep these challenges in mind as they reopen local economies.

Introduction

The COVID-19 pandemic led to a decreased demand for gasoline, jet fuel, and other petroleum products across the world. As a result, crude oil, the raw material from which these products are derived, was no longer in demand, and the drop in demand left the oil market reeling due to concerns about exhausting available storage in the coming weeks. Oil producers and refiners creating these petroleum products have reduced production in response.

Several states, however, are reopening their economies, and the inevitable result will be an increase in demand for petroleum products. While the oil industry has slowed production in response to the drop in demand, the slowing was not instantaneous, and the industry likewise will not be able to respond immediately to an increase in demand, either.

There is little clarity in the duration of shelter-in-place orders throughout the country, as well as the health and safety measures that will be implemented and American’s willingness to participate in commerce as they are maintained. Additional factors like the likelihood of COVID’s resurgence and the extent to which it will continue to stifle the economy are also unclear. These unknowns in conjunction with the energy sector’s continued reduction in operations create a risk in ensuring the delivery of critical products.

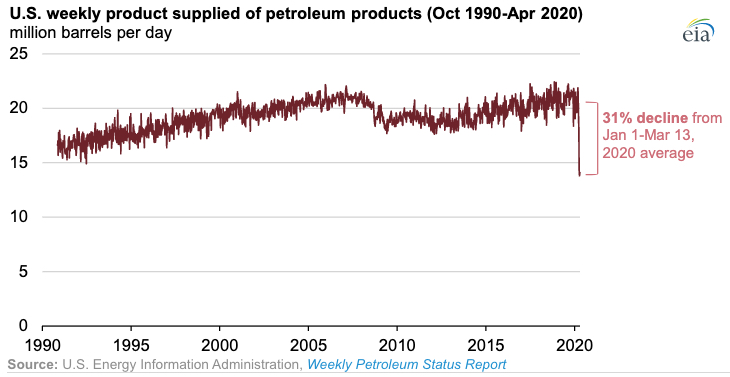

Decreased Demand and Supply

Petroleum product demand reached historic lows in April, with an average delivery of 13.8 million barrels per day (bpd) during the week ending on April 10. The Energy Information Administration’s (EIA) weekly data series, which dates to the early 1990s, does not include any values nearly as low. When compared to the average weekly consumption from January through March 13, 2020, before a national state of emergency was declared, the most recent value reflects a 31 percent reduction in total demand for petroleum products. [1] Similarly, gasoline demand has declined 43 percent when considering the four-week rolling average for the week ending April 24. and jet fuel demand by 62 percent. And jet fuel demand reached record lows during the week of April 10, falling 73 percent.[2]

Note: The EIA measures demand by relying on the product supplied rather than measuring consumption at the retailer.

Since March 13, the number of onshore oil drilling rigs, the physical site where oil is produced, has declined by more than 50 percent.[3] The number of drilled but uncompleted wells has also fallen.[4] Domestic producers expect to continue reducing production voluntarily in the coming months. And global demand is expected to remain deflated throughout the remainder of the year, suggesting that the extent to which refineries will cut production may continue to grow, as well.

The Supply Chain

In 2019, the United States had 135 operable refineries, installations that manufacture finished petroleum products from crude oil, unfinished oils, natural gas liquids, other hydrocarbons, and oxygenates.[5] In recent weeks, some refineries have chosen to reduce output from specific units while Marathon Petroleum, in particular, has idled two facilities. Due to engineering restrictions, refineries typically need to operate at a minimum of 60 to 65 percent capacity in order to keep their interconnected units operational.[6] These values have been reflected by major market participants; Shell, for example, announced that it expects to operate at 60 to 70 percent utilization.

Companies are siting low prices resulting from a lack of demand as one of the drivers. Others have exhausted their ability to store products onsite that have not made it to the market in recent weeks. Marathon, for example, has chosen to idle its Martinez, California, refinery, which produces gasoline, diesel fuel, distillates, petroleum coke, propane, heavy fuel oil, and refinery-grade propylene. Citing reduced demand, the facility has no specific timeline in mind to ramp up production and simply provided that it is contingent on “when people start driving again.”

While the Martinez refinery has maintained its employees, it has let go nearly all the 800 to 1,000 contractors it employed before the pandemic. It is estimated that it will take between seven and 14 days to get the refinery back to full production. It is unclear if that timeframe accounts for the rehiring necessary contractors as well as the time needed to modify operations to ensure worker safety.

Constricted Production

The efforts to ramp production back up will be further complicated by the relatively fixed ratios of products produced by refineries. In 2019, oil refining resulted in the following products:

- Gasoline – 45 percent

- Diesel – 25 percent

- Jet Fuel/Kerosene – 9 percent

- Heating oil/Residual Fuel, Feedstock for Plastic – 21% percent

While refineries may vary in the type of oil they are optimized to process and the resulting products (e.g. the Martinez Refinery does not produce jet fuel), they produce them in relatively fixed proportions. As local and regional economies restart and there is, for example, an increase in the amount of gasoline demand that is disproportionate to the production of other fuels, there may be difficulties in producing the necessary quantities while storing other products.[7]

Downstream Industry

Refineries are only one piece of the puzzle. As production is curtailed in one facility throughout the supply chain, those downstream begin to feel the effects. For example, since March 13, the production of ethanol, a component of gasoline, has fallen by 45 percent.[8] As a result, the production of liquid carbon dioxide, a byproduct of ethanol production, has also declined. Liquid carbon dioxide is used in food processing, beverage production, and water treatment facilities as well as other industrial processes.

Constraints throughout the supply chain may result as demand grows and industrial facilities aim to respond. What is initially a slow response by refineries to ramp up production may become a delay in the availability of consumer goods.

Transportation Bottlenecks

The stock of oil and other petroleum products expressed as days of supply has increased each week since the shelter-in-place orders began to take effect. With historically high quantities in storage, it may seem counterintuitive to worry about not being able to meet demand.

Days of supply are calculated by dividing the current stock level by product supplied, which serves as an estimate of demand averaged over the most recent four-week period. The past four-week period, however, is not an accurate reflection of the level of demand we could expect should a state allow workers to return to the workplace. Instead, in the several days preceding such an opening, consumption would increase dramatically as everyone filled up their gas tank in preparation for Monday.

The transportation of oil, natural gas, and petroleum products is reliant on a series of private trucking fleets, interstate and local pipelines systems, and rail operators. These systems, like the companies that own them and the individuals who operate them, are facing unprecedented conditions. Were demand to spike in specific geographic areas, localized constraints to delivery could arise.

Conclusion

As the U.S. economy begins to reopen, facilities—from the well head to the refiner to the downstream plants producing food and plastic—may each require one or more weeks to ramp up production. Plans to restart the economy must consider the necessity to rehire thousands of workers, the engineering complexities of ramping up production, and the limitations in the products available or their delivery. As state, regional, and federal plans are formulated, it is critical that policymakers account for the time the energy sector needs to ensure operability in the face of growing demand. By providing the appropriate signals for demand growth, government plans can help avoid constraints and allow for appropriate market response under unprecedented conditions.

[1] https://www.eia.gov/todayinenergy/detail.php?id=43455

[2] https://www.eia.gov/petroleum/weekly/ released April 29, 2020

[3] https://www.eenews.net/energywire/2020/05/04/stories/1063041497

[4] https://www.eia.gov/petroleum/drilling/#tabs-summary-3

[5] https://www.eia.gov/dnav/pet/pet_pnp_cap1_dcu_nus_a.htm

[6] https://finance.yahoo.com/news/america-oil-refineries-may-brink-090000656.html

[7] https://www.forbes.com/sites/uhenergy/2020/03/22/lower-for-longer-covid-19s-impact-on-crude-oil-and-refined-products/#667a5fb52fe8