Insight

March 19, 2024

President Biden’s FY 2025 Budget

Executive Summary

President Biden’s Fiscal Year 2025 Budget continues his vision for the expansion of federal programs whose costs far outweigh the onerous tax hikes intended to offset them. As such, this budget would contribute significantly to the nation’s already significant levels of debt and further balloon debt servicing costs that will soon surpass annual spending on national defense.

- Spending: This budget’s proposed spending provisions include expanding the child tax credit, increasing the maximum Pell Grant, adding federal family and medical leave under Social Security, and providing a mortgage relief credit, among other things; in sum, the president proposes spending almost $87 trillion over 10 years.

- Taxes: This budget calls for increasing the corporate tax rate to 28 percent, raising the alternative minimum corporate tax rate from 15 to 21 percent (thus exceeding the rate set by the global minimum tax), restoring the top marginal tax rate of 39.6 percent for capital gains as well for all single filers earning $400,000 or more ($450,000 or more for married couples), and raising Medicare tax rates on both earned and unearned income from 3.8 to 5 percent, among other tax increases; altogether, these proposals would increase taxes by nearly $5 trillion over the next decade – one of the largest tax increases in history.

- Debt: The budget proposes expanding the largest drivers of future debt, Social Security and Medicare, and would drive debt to $53 trillion by 2034 – the largest increase in debt in U.S. history – adding more than $12 trillion in debt-servicing costs over the period.

Introduction

The President Biden’s Fiscal Year 2025 Budget, released March 12, is a nonbinding document intended to demonstrate the administration’s preferred policy outcomes. This budget highlights the president’s commitment to a variety of spending proposals whose costs far outweigh the onerous tax hikes intended to offset them. As such, this budget would contribute significantly to the nation’s already significant levels of debt and further balloon debt servicing costs that will soon surpass annual spending on national defense.

The President’s Budget would expand the child tax credit, increase the maximum Pell Grant, add national family and medical leave to Social Security, and provide a mortgage relief credit, among other things. Altogether, the spending provisions in the proposed budget would lead to $86.6 trillion in total spending over 10 years.

Rather than addressing the most pressing tax-policy issue before lawmakers – the expiration of much of the Tax Cuts and Jobs Act of 2017 – this budget calls for increasing the corporate tax rate to 28 percent, raising the alternative minimum corporate tax rate from 15 to 21 percent – thus exceeding the rate set by the global minimum tax rate – restoring the top marginal tax rate of 39.6 percent for capital gains as well for all single filers earning $400,000 or more (and for married couples earning $450,000 or more), and raising Medicare tax rates on both earned and unearned income from 3.8 to 5 percent, among other tax increases. Altogether, these proposals would increase taxes by nearly $5 trillion over the next decade – one of the largest tax increases in history.

Finally, the President’s Budget proposes expanding the largest drivers of future debt, Social Security and Medicare, and would drive debt to $53 trillion by 2034 – the largest increase in debt in U.S. history. It would also add more than $12 trillion in debt service costs over the period.

Notably, many of the president’s proposed policy changes are not new and have failed to gain sufficient support to become law in the past. Nevertheless, this document serves as a statement of intent for the administration’s future policy pursuits. In a nutshell, the President’s Budget can be described as a path to expand the federal government’s role to an even greater extent in Americans’ lives and encourage them to rely on taxpayer-funded programs, often regardless of need. It serves as a sharp reminder of why the United States has the unsustainable level of debt that it does.

Spending

The President’s Budget proposes to spend $86.6 trillion over 10 years. Its new spending provisions include expanding the child tax credit, increasing the maximum Pell Grant, adding national family and medical leave under Social Security, and providing a mortgage relief credit, among other things.

During the president’s State of the Union Address, he repeated his promise not to cut Social Security benefits, but failed to note that the program is projected to become insolvent by 2033[1] – requiring, by law, an automatic benefit cut of roughly 25 percent if no action is taken. While the president promised not to even consider necessary reforms to make the program sustainable, such as further raising the retirement age, his budget instead calls on higher earners to pay more. This is not a serious solution as under this plan spending would continue to grow faster than revenues, thereby guaranteeing that the trust fund will face insolvency again in the future. The president also proposes increasing the burden on the Social Security program by adding a federal family and medical leave component that would cost $325 billion over the next decade.

The President’s Budget proposes to expand and increase the Child Tax Credit and return to the COVID-era proposals that remove the credit’s work requirements, a policy that would cost more than $300 billion, even though the credit is not made permanent.

The budget also proposes spending $90 billion on taxpayer-funded community college – tagged as “free” community college – and increases the cap for Pell Grants in a path to double the maximum grant by 2029. With so much attention paid to the fact that 45 million Americans have student loans, and with President Biden’s significant efforts to have taxpayers bail out student loans, increasing Pell Grants, which has been shown to correlate with increased tuition costs,[2] seems questionable at best.

The budget also proposes a new Mortgage Relief Credit to entice homeowners to sell and repurchase new homes, despite higher interest rates. Nevertheless, the likely outcome of this type of policy would be to increase the demand for homes without increasing the supply, driving up prices and further pushing homeownership out of reach for many.

Taxes

The President’s Budget attempts to pay for its spending increases with tax hikes intended to generate $4.95 trillion in revenue over the next decade – one of the largest tax increases in history. This would be achieved by increasing the corporate tax rate from 21 to 28 percent, walking away from the pro-growth tax reform that was accomplished with the Tax Cuts and Jobs Act of 2017. The budget also proposes to increase the alternative minimum corporate tax rate from 15 to 21 percent. President Biden claims that this would force corporations to “pay their fair share,” though it should be noted that this proposal comes only seven months after a White House press release boasted that this goal had been achieved. This remarkable goalpost move highlights how relying on increases in revenue from a small share of the population will never solve – let alone keep pace with – unsustainable levels of spending.

The President’s Budget also proposes restoring the top marginal tax rate of 39.6 percent to capital gains as well for all single filers earning $400,000 or more (and for married couples earning $450,000 or more), and raising Medicare tax rates on both earned and unearned income from 3.8 to 5 percent.

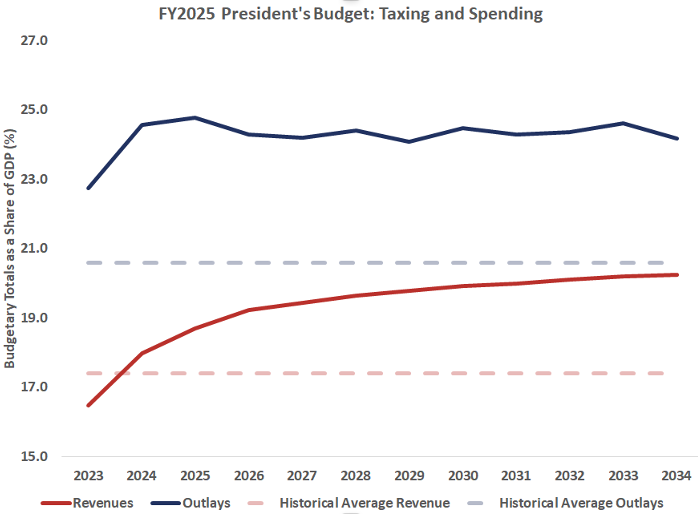

Even with these significant increases, and with the proposed increase achieved by eliminating deductions for corporate executives, the president’s own Office of Management and Budget projects that revenue will rise to 20.3 percent of gross domestic product (GDP)[3]. With outlays at 23 percent and climbing, these tax increases will not curb the unsustainable increase in federal debt.

Debt

The United States is currently $35 trillion in debt – and the country is running out of time to address this in a sober, serious way. The President Budget’s would lead to the largest debt in American history and add more than $12 trillion in debt-servicing costs over the period.

The Congressional Budget Office recently reported that outlays in 2024 will amount to 23.1 percent of GDP and stay close to this level through 2028. After 2028, outlays are projected to increase to 24.1 percent of GDP.

Source: Highlights of the FY2025 President’s Budget by Gordon Gray, American Action Forum.

As it stands, revenues amount only to 17.5 percent of GDP in 2024 and are projected to decline to 17.1 percent of GDP in 2025 – and remain under 18 percent through 2034. Debt held by the public will increase from 99 percent of GDP at the end of 2024 to 116 percent of GDP – the highest ever recorded – by the end of 2034.[4] Even if all the taxes proposed in the President’s Budget were enacted, they would only increase revenues to 20 percent of GDP, still far below what is needed to slow the increase of the federal deficit.

Conclusion

While this budget is merely a wish-list of additional tax and spend policies – designed to entice voters in an election year – it does serve as a weathervane for the administration’s policy priorities. The President’s Budget would impose historically large tax increases, but even this level of taxation would not sufficiently cover the budget’s proposed spending, much less begin to address the current deficit and national debt. If the President’s Budget were enacted, it would further balloon U.S. national debt to the highest level the nation has ever seen.

[1] Trustees Report Summary (ssa.gov)

[2] Credit Supply and the Rise in College Tuition: Evidence from the Expansion in Federal Student Aid Programs – Federal Reserve Bank of New York – FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

[3] budget_fy2025.pdf (whitehouse.gov)

[4] The Budget and Economic Outlook: 2024 to 2034 | Congressional Budget Office (cbo.gov)