Insight

February 12, 2025

Primer: Institutional Investors Aren’t Ruining the Housing Market

Executive Summary

- The Federal Trade Commission launched an inquiry seeking to understand how large institutional single-family home rental investors have affected home prices and rents.

- Federal, state, and local policymakers have accused these large institutional investors of pushing up rental rates and contributing to decreased home affordability and have offered several legislative proposals – often with bipartisan support – to curb or halt such investment.

- Evidence shows that institutional investment increases rental supply and lowers rental prices while adding liquidity to an under-supplied housing market.

Introduction

On January 15, 2025, the Federal Trade Commission (FTC) issued a request for public comment on potential orders – orders that could be issued to companies – seeking to understand how large institutional investors of single-family home rentals have affected home prices and rents. These large investors own more than 1,000 single-family rental properties. The potential orders would gather information from more than 30 large institutional investors regarding their corporate structure, current and historical housing inventory information, rental fee and income, and other business plans, according to the FTC press release.

Federal, state, and local policymakers have accused large investors of pushing up rental rates and contributing to decreased home affordability. Several legislative proposals to curb or halt such investment have been introduced.

Yet evidence shows that through purchasing large blocks of single-family homes and developing and expanding the buy-to-rent business model, large institutional investors increased the rental supply which led to lower rent prices.

FTC Potential Order

The FTC issued a request for public comment on potential FTC orders – orders that could be issued to a company – seeking to understand the role large institutional investors play in the single-family rental market and how they have affected home prices and rents. The request is the first in a series of steps toward starting a new 6(b) study, which are industry-specific fact-finding missions.

In the request, the FTC noted that “local, state, and federal policymakers have expressed concerns about the growth of mega SFR [single-family rental] investors in local markets.”

Housing Market

Home Affordability

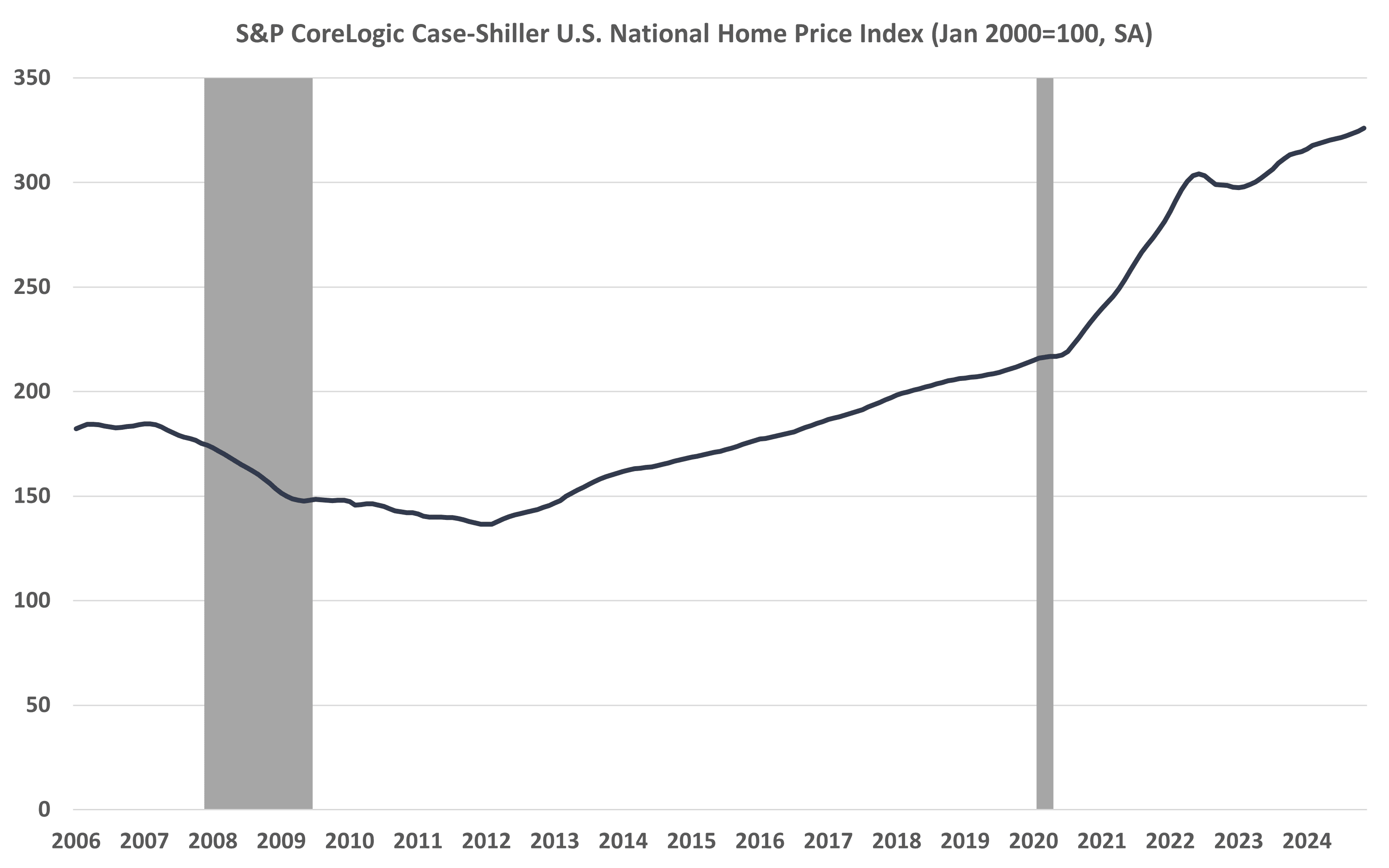

Home prices have experienced periods of booms and busts over the past 20 years. Home prices sank 26 percent from peak to trough – February 2007 to February 2012 – with the financial crisis wedged in between, before recovering 57 percent by December 2019. The surge in home demand during the COVID-19 pandemic sent prices even higher, soaring 52 percent between December 2019 and November 2024. The trajectory of home prices can be seen in Figure 1.

Figure 1

Source: FRED Economic Data; shaded area indicates recession.

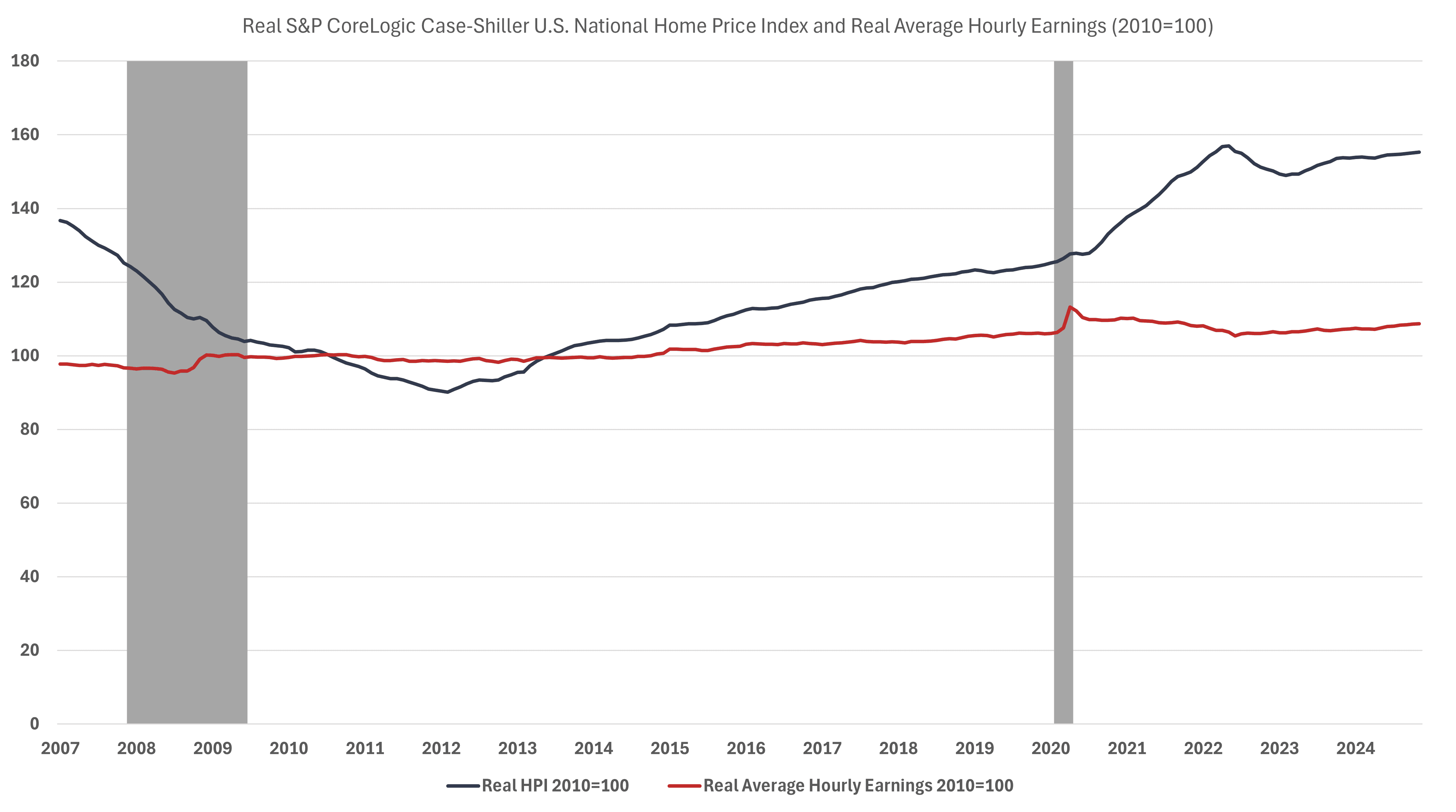

Wages, however, failed to keep up with the rapid appreciation in home prices following the financial crisis and left many unable to afford a home, as seen in Figure 2.

Figure 2

Source: FRED Economic Data, Bureau of Labor Statistics, Author’s calculations; shaded area indicates recession.

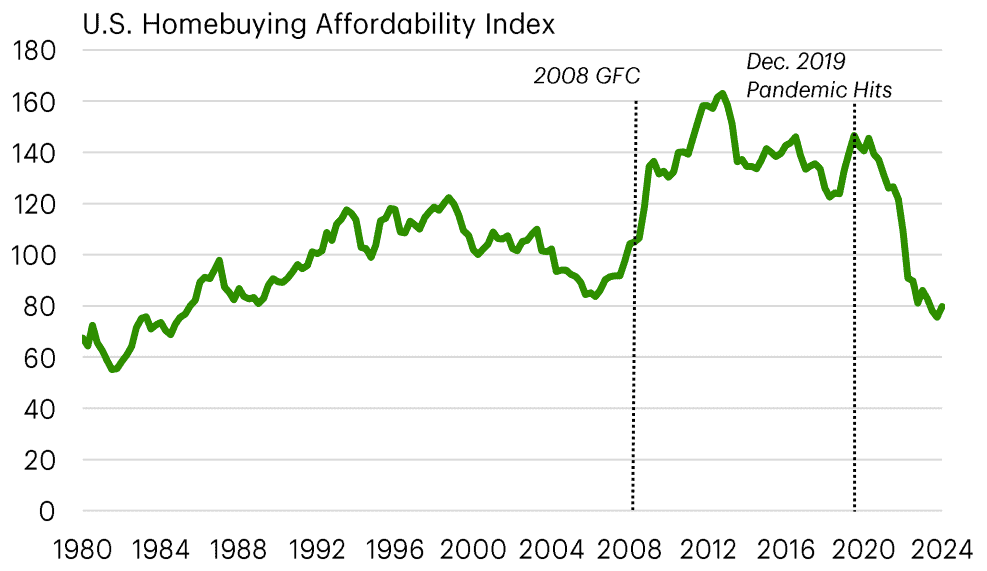

Moreover, mortgage interest rates have recently reached their highest levels since late 2000, the cost of home insurance jumped, and property taxes – in part, reflecting an increase in home values – rose, contributing further to a lack of affordability. TD Economics charts the U.S. Homebuying Affordability Index from the National Association of Realtors, seen in Figure 3.

Figure 3

Source: TD Economics: “a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced house, assuming a 20% down payment and monthly payments not exceeding 25% of income. This is considered to be the benchmark for “full affordability”. An index above 100 signifies that a median earning family has more than enough income to qualify for a mortgage loan on a median-priced home.”

The graph shows that home affordability peaked in 2012 following the home-price decline during the financial crisis combined with low mortgage rates. Currently, homebuying affordability is at its lowest level since the mid-1980s as home prices and mortgage rates soared.

Rental Market

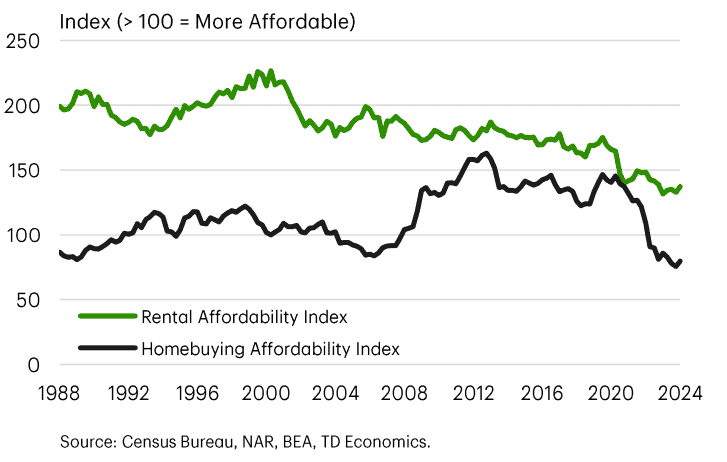

As a result of the financial crisis, an estimated 3.8 million households lost their homes to foreclosure, according to a United States Government Accountability Office (GAO) report. Many of these households, as a result, entered the rental market, driving up demand for rental housing. More recently, as homes became increasingly unaffordable, even more households were pushed to rent. Rental vacancies – the share of rental units that are unoccupied – fell from a high of 10.6 percent in 2009 to 6.7 percent through the first three quarters of 2024. Amid this increase in demand for rentals, affordability declined but homes remained affordable relative to income and homebuying (Figure 4).

Figure 4

Source: TD Economics

Institutional Investors

Breaking into the single-family rental market: Bulk Purchasing

Before the financial crisis began, there were about 10 million single-family rental units in the United States, made up of mostly small investors who owned 10 or fewer units. Institutional investors entered the single-family housing market in the wake of the financial crisis. The study found that no investor owned 1,000 or more single-family rental homes as of late 2011. By 2015, investors had accumulated 170,000–300,000 homes, and by the end of 2022 owned nearly 450,000 – 3 percent of all single-family rental homes nationally.

As the bottom fell out from under home values, the federal government took steps to stabilize markets and meet increased demand for rental units. The Federal Housing Finance Agency, for example, created the Real Estate Owned-to-Rental Initiative in 2012 which allowed prequalified investors to bid on large portfolios of foreclosed properties owned by Fannie Mae with the condition that these homes be rented for a certain number of years.

Build-to-rent

As bulk purchasing slowed, institutional investors adopted a narrower approach, purchasing one single-family home at a time. This became very costly. Over time, investors pursued a “build-to-rent” model and partnered with developers to build “communities of home that [would] be rented once construction [was] complete[d],” according to the GAO.

Institutional investors often purchased homes in a “high-growth and geographically concentrated area” to “achieve operational efficiency and cost savings through economies of scale.” Such efficiencies, according to the GAO study, included acquisition, maintenance, and leasing,” and added that “density was necessary for single-family rentals to be as cost-efficient investments as multi-family rentals.” The GAO study included a chart that estimated the share of single-family rentals owned by investors with more than 1,000 homes as of 2022 (Figure 5).

Figure 5

Source: GAO report: Information on Institutional Investment in Single-Family Homes

Policy Proposals

Federal, state, and local policymakers have grown skeptical of institutional investment in the single-family rental market, often accusing these large institutional investors of driving up rents and the cost to purchase a home.

To address these concerns, Senator Jeff Merkley (D-OR) introduced the End Hedge Fund Control of American Homes Act which, in part, would ban hedge funds from owning single-family homes and force hedge funds to divest their current holdings or face significant financial penalties.

At the state level, New York Governor Kathy Hochul has called for legislation to prevent institutional investors from bidding on properties for the first 75 days they are on the market and remove certain tax benefits, such as interest deductions, when such investors purchase homes. In Virginia, Senator Glen Sturtevant proposed a bill that would prohibit real estate entities that own more than 50 single-family or duplexes from buying more. The proposal would also incentivize employers to provide down-payment assistance to employees seeking to buy a home. This would be counterproductive and almost certainly push up home prices. Also in Virginia, Senator Schuyler VanValkenburg introduced legislation to block investment groups with $50 million or more in net value or assets from acquiring an interest in single-family homes while forcing groups with current portfolios to divest at least 10 percent of their interest each year until they no longer own any single-family homes.

Impact on Housing

Several federal, state, and local policymakers believe both the bulk purchases of single-family homes to rent and the “build-to-rent” model have allowed large institutions to drive up rents, increase home prices, and suppress homeownership rates. Yet the data cast doubt on these assumptions. Moreover, restricting large investor purchases of single-family rental homes or forcing them to divest their existing stock could have negative effects.

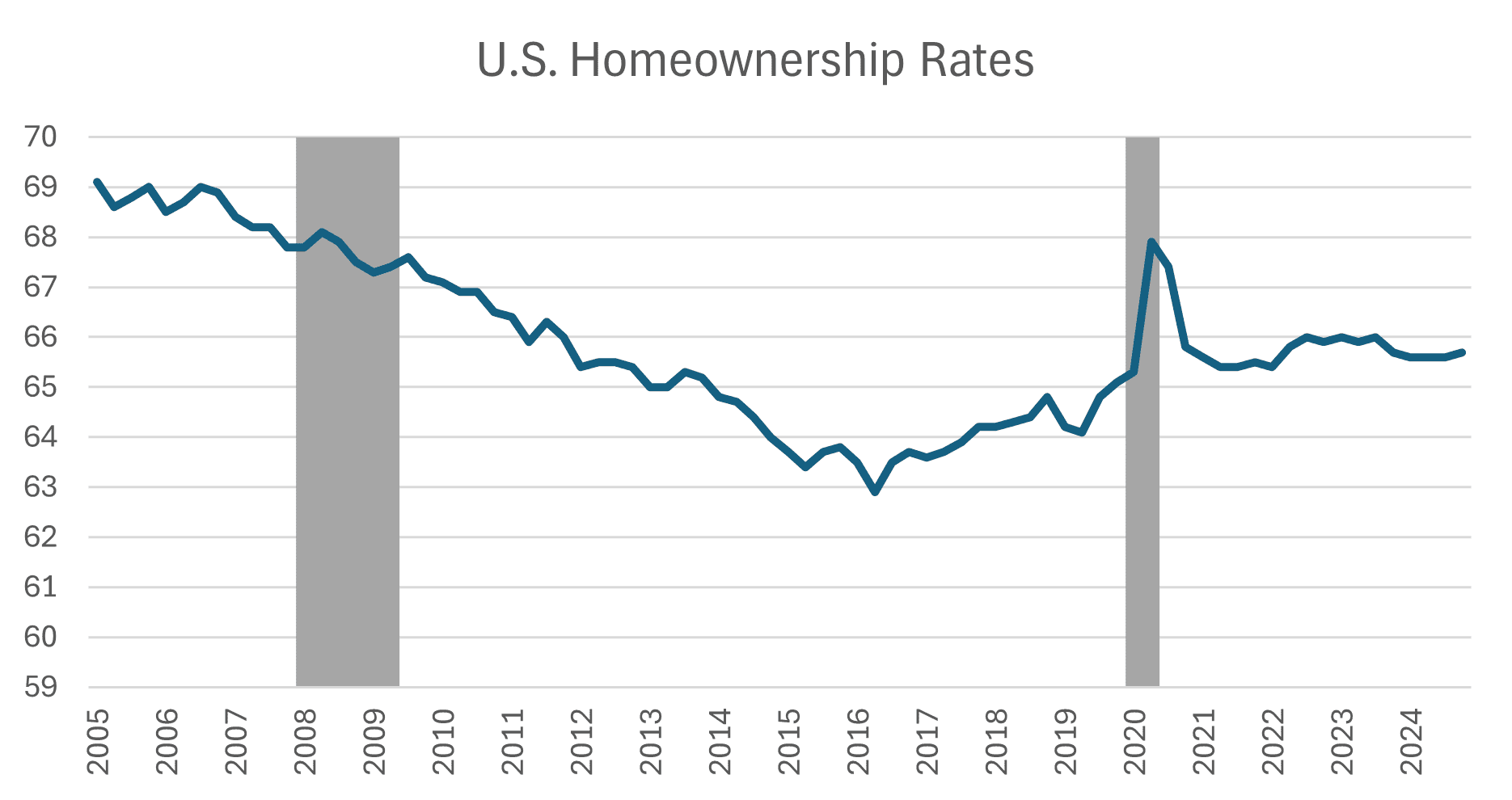

The most recent data on homeownership show that the rate has stabilized at levels higher than those prior to the pandemic, as shown in Figure 6. This suggests that large institutional investors are not driving homeowners out of the market.

Figure 6

Source: FRED

A 2023 study found that the impact of institutional investors was a trade-off between owner-occupied housing and rental units. The study concluded that large institutional investors “reduced supply of owner-occupancy homes” but “increased the supply of homes available for renter occupancy by 69% of the houses they converted, and lowered rents by 2.3 [percentage points] per 1 [percentage point] of housing they purchased.” The study also found that this increase in rental supply “allowed the financially constrained to move into neighborhoods that previously had few rental units.”

Research from the Urban Institute found that institutional investors are more likely to purchase homes in need of repair and can typically make these repairs more quickly than an owner-occupant. The study found that the two largest single-family institutional buyers “spent $39,000 per home for up-front renovations completed during 2020” which was “considerably more than the $6,300 we calculate the typical homeowner spends during the first year after purchasing a home.” These upgrades lead to significantly improved housing stock.

Often missing from the conversation are the effects large institutional investors have on sellers. Institutional investors often pay cash for these homes, which reduces the risks to the sellers that often comes from buyers needing to qualify for a mortgage.

What Policymakers Should Do

The surge in home prices should have sparked a supply boom, yet the supply of new single-family homes failed to keep pace with increased demand. Nationally, the annual pace of 1.05 million newly started privately owned single-family units in December 2024 is about the same as it was at the end of 2019. Rising construction costs – including the effects of tariffs on softwood lumber from Canada and gypsum from Mexico – and a lack of available labor hampered new construction. Other factors, including a surge in immigration, exacerbated the supply and demand imbalance, pushing home values higher. State and local restrictions on permitting and zoning also inhibit supply from coming to the market.

This is where policymakers should focus their attention – expanding the supply of homes rather than trying to exclude certain buyers from the market. Further, a potential 6(b) study from the FTC reviewing the role large institutional investors play in the housing market should, in part, investigate the supply side of the housing market to help inform policymakers of supply-side restraints.

Conclusion

The FTC’s inquiry into how large investors of single-family rental homes have affected home prices and rents comes after years of significant home price increases.

Federal, state, and local policymakers have accused large investors of pushing up rental rates and contributing to decreased home affordability and have offered several legislative proposals – often with bipartisan support – to curb or halt such investment.

Yet the evidence shows that large institutional investors have expanded the much-needed supply of rental homes, thus driving down rents, while enabling the financially constrained to move into neighborhoods that previously had few rental units. Finally, institutional investors tend to improve the quality of the existing housing stock, while also adding liquidity to an under-supplied housing market.