Insight

April 13, 2017

Red Tape Burdens on Small Businesses

It’s well-known the regulatory burden falls disproportionately on small business. American Action Forum (AAF) research has discovered they are shedding jobs and wages are falling because of the Affordable Care Act. In addition, as regulation increases, the number of small business establishments decreases, while the largest businesses grow more numerous. Based on AAF’s latest research, the paperwork and compliance burdens alone total more than 3.3 billion hours and $64.6 billion. Given that compliance affects small businesses more acutely, each new hour of paperwork means less productivity, fewer profits, and diminished competitiveness, relative to larger competitors.

Methodology

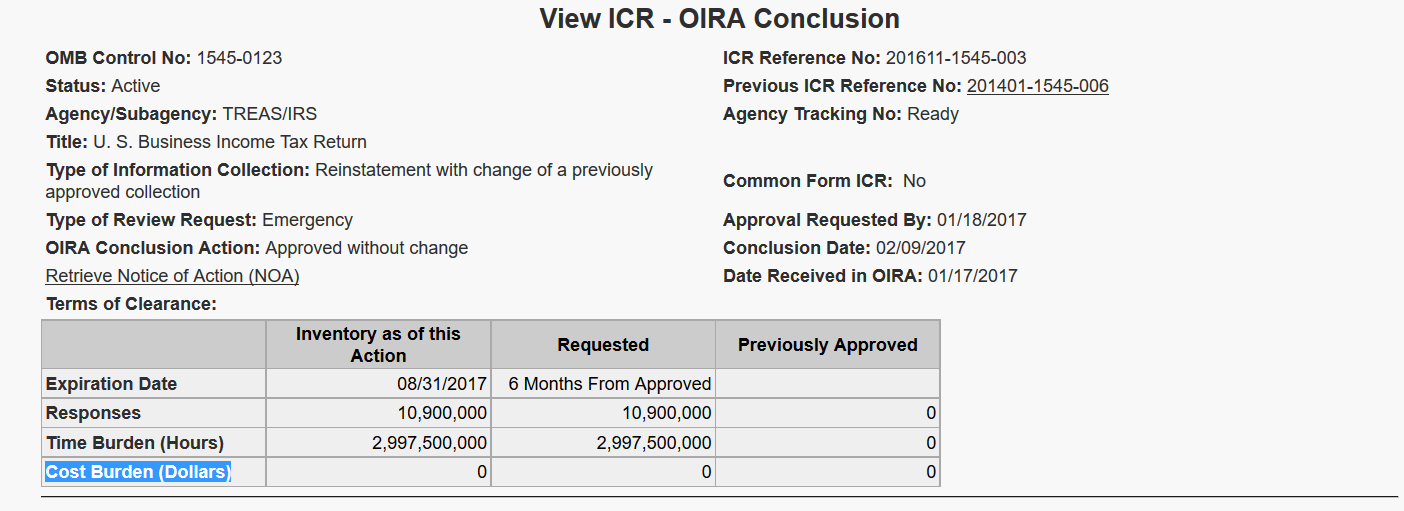

For this study, AAF used the reginfo.gov search function that allows users to query various data from the Paperwork Reduction Act (PRA). For this search, AAF analyzed the largest active collections (one million hours and greater) on small private businesses. This yielded 74 active “control numbers” (paperwork requirements). From these 74 results, AAF then retrieved the listed paperwork hours, responses, and cost.

Results

AAF found the cumulative burden for small businesses was more than 1.3 billion responses, meaning small entities have to report or comply with a paperwork requirement more than 1.3 billion times annually. This totaled 3.3 billion hours of compliance time. To put this into perspective, there are roughly 8.9 million small businesses nationwide with fewer than 50 employees. This means, on average, small businesses must comply with more than 379 hours of paperwork annually, or nearly the equivalent of ten full-time workweeks.

What is the cost of all of this red tape? According to reginfo.gov, only 31 of the 74 largest collections monetized these hourly burdens. However, using a central wage rate of $33.26 for a regulatory compliance officer, and applying that figure to the un-monetized hours, yields more than $111 billion in annual compliance burdens for small businesses. This figure does include a projected figure of $99.6 billion in compliance costs for the U.S. Business Income Tax.

Although, there are no public costs for this collection, the support documents do list $52.5 billion in total costs, or nearly $5,000 in burdens for business simply to fill out taxes. Using this figure reduces annual small business burdens to $64.6 billion, still roughly $7,200 per business from the routine recordkeeping and reporting burdens of the regulatory state.

Most Burdensome Collections

In terms of the most burdensome by total hours, the following impose the highest paperwork hours on smaller entities:

- Insurance Expenses of Small Employers: 34.2 million hours and $1.1 billion in projected costs;

- I-9 Employee Verification: 29.3 million hours and $931 million in reported costs;

- Agricultural Worker Standards: 10.4 million hours and $212 million in reported costs;

- Physician Reporting System: 7.7 million hours and $512 million in reported costs.

Another way to measure burden is the number of hours per response. In other words, how much time does it take to report or retain information for a particular regulation? The following have some of the highest hours per response in AAF’s sample:

- Consolidated Audit Trail: 4,340 hours per response;

- Pipeline Integrity Management: 1,389 hours per response;

- Mandatory Reliability Standards: 1,109 hours per response;

- NSPS for Steam Generating Units: 381 hours per response.

For the “Consolidated Audit Trail,” the Securities and Exchange Commission (SEC) also estimates more than $534 million in annual burdens. For parts of the regulation, the costs “per participant” exceed $3.2 million. Although, like many regulations discussed, not all of the costs are borne by small businesses, but $3.2 million in regulatory impositions for one requirement contained in one paperwork collection is a significant figure for any business.

Conclusion

There is little doubt small businesses are disproportionately burdened by regulation, especially “routine” reporting and recordkeeping requirements. These costs are often fixed, and with smaller revenue pools, many businesses cannot afford to hire dedicated compliance officers. Recent research has found hiring two additional compliance officers would force one-third of small banks to become unprofitable. AAF’s findings, 3.3 billion hours and $64 billion in compliance burdens, only adds to the evidence that regulatory costs affect much more than the largest and most powerful businesses in the nation.