Insight

May 25, 2016

Senate Votes to Rescind Labor’s Fiduciary Rule

Yesterday, the U.S. Senate voted to repeal the Department of Labor’s (DOL) costly “Fiduciary Rule.” The procedure, under the Congressional Review Act, allows the House and Senate to jointly disapprove of a final regulation from a regulatory agency. Yesterday’s vote marks one of several measures Congress has taken to rescind President Obama’s regulations. However, given that the president’s Secretary of Labor promulgated the rule, the resolution of disapproval will likely meet another veto.

The Fiduciary Rule

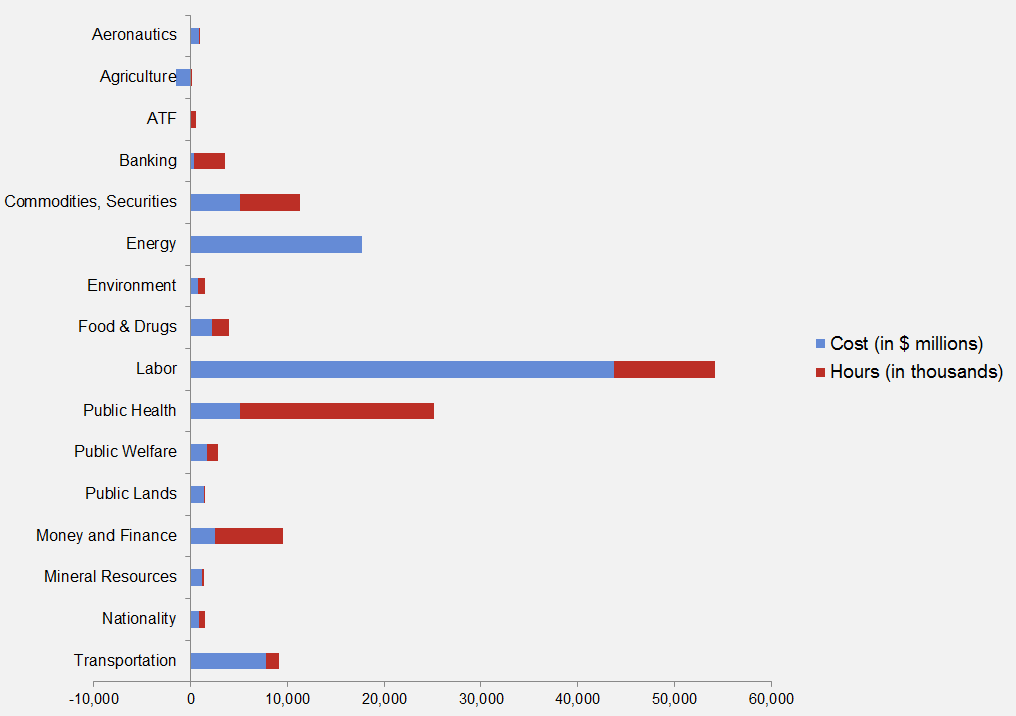

Winding its way through the regulatory process since 2011, the Fiduciary Rule is one of the most expensive regulations of the Obama Administration. At $31.5 billion, it is easily the most expensive DOL rulemaking since at least 2006, more than three times as costly as the next closest rule. With the publication of the Fiduciary Rule and the recently finalized overtime measure, DOL continues its trend to publish more regulatory costs and impose more paperwork than any other agency. The graph below depicts the agency as the clear leader in regulatory burdens (by costs and paperwork hours) this year.

DOL has imposed more than 55 percent of all regulatory costs this year and more than 20 percent of all new paperwork. It shouldn’t surprise anyone that these actions are occurring during the waning days of the Obama Administration. From 2009 to 2015, DOL averaged three major rules annually. In 2016, the agency has already rolled out four major rules, with two additional major rules under review; DOL is set to double is major rulemaking activity in 2016.

As American Action Forum (AAF) research has found, the $31 billion in total regulatory costs for the Fiduciary Rule will have profound implications for the average investor. For example, recent data suggest households could be forced to pay $1,500 in duplicative fees because of the perverse incentives in the rule. In addition, approximately seven million retirement accounts would fail to qualify for an advisory account due to insufficient balance funds. The rule would also affect Americans seeking to enter financial markets; as many as 360,000 fewer IRAs would be opened each year because of the regulation. In other words, these $31.5 billion in costs must be borne by someone. They will likely result in less investment advice, and for those that still have advisors, investors will pay more for those services.

The Vote

Predictably, the CRA vote to repeal the regulation fell mostly along party lines, 56-41. All Republicans present voted for the measure, along with three Democrats (Donnelly, Heitkamp, and Tester). The CRA does not require a super-majority to pass in the Senate—a simple majority suffices. The resolution has already passed the House, 234-183, and now heads to the president’s desk. President Obama is almost certain to veto the disapproval measure.

Conclusion

Yesterday’s vote to overturn the Fiduciary Rule demonstrates how much power the executive branch has over policymaking and how little oversight Congress currently possesses. Aside from a CRA vote the president will likely veto, an oversight hearing, or an appropriations rider, Congress is often on the sidelines as the administration ushers in 70 to 80 major rules annually. Either a future president abdicates some of the incredible rulemaking power currently in hand, or strong majorities in Congress seek to take back some of authority they have delegated over the previous decades. Otherwise, regulators will continue to wield incredible authority with only the courts standing in their way.