Insight

October 28, 2025

Sizing Up Interest Payments on the National Debt

Executive Summary

- In fiscal year (FY) 2025, the federal government spent $970 billion on interest payments on the national debt – the equivalent of 19 percent of all federal revenue collections and roughly $7,300 per household.

- Net interest was the third-largest government expenditure in FY 2025, behind Social Security and Medicare.

- The household share of net interest payments was larger than average household spending on health care, home furnishings, gasoline, clothing, or education, among other expenditures.

- Over the decade, interest payments are projected to grow by an estimated 76 percent, from $1.0 trillion in FY 2026 to $1.8 trillion in FY 2035; interest is projected to grow faster than any major budgetary category.

Introduction

One of the consequences of a high and rising national debt is an increase in the net interest payments to service it. According to the U.S. Department of Treasury’s September 2025 Monthly Treasury Statement, the federal government spent $970 billion on interest payments on the national debt in fiscal year (FY) 2025 – equivalent to 19 percent of all federal revenue collections and roughly $7,300 per household. Net interest was the third-largest government expenditure in FY 2025, behind only Social Security and Medicare. The household share of net interest was larger than average annual household spending on health care, home furnishings, gasoline, clothing, or education, among other expenditures. Over the decade, the Congressional Budget Office (CBO) estimates that interest payments will grow by 76 percent, from $1.0 trillion in FY 2026 to $1.8 trillion in FY 2035. Interest payments are projected to grow faster than any major budgetary category over the decade.

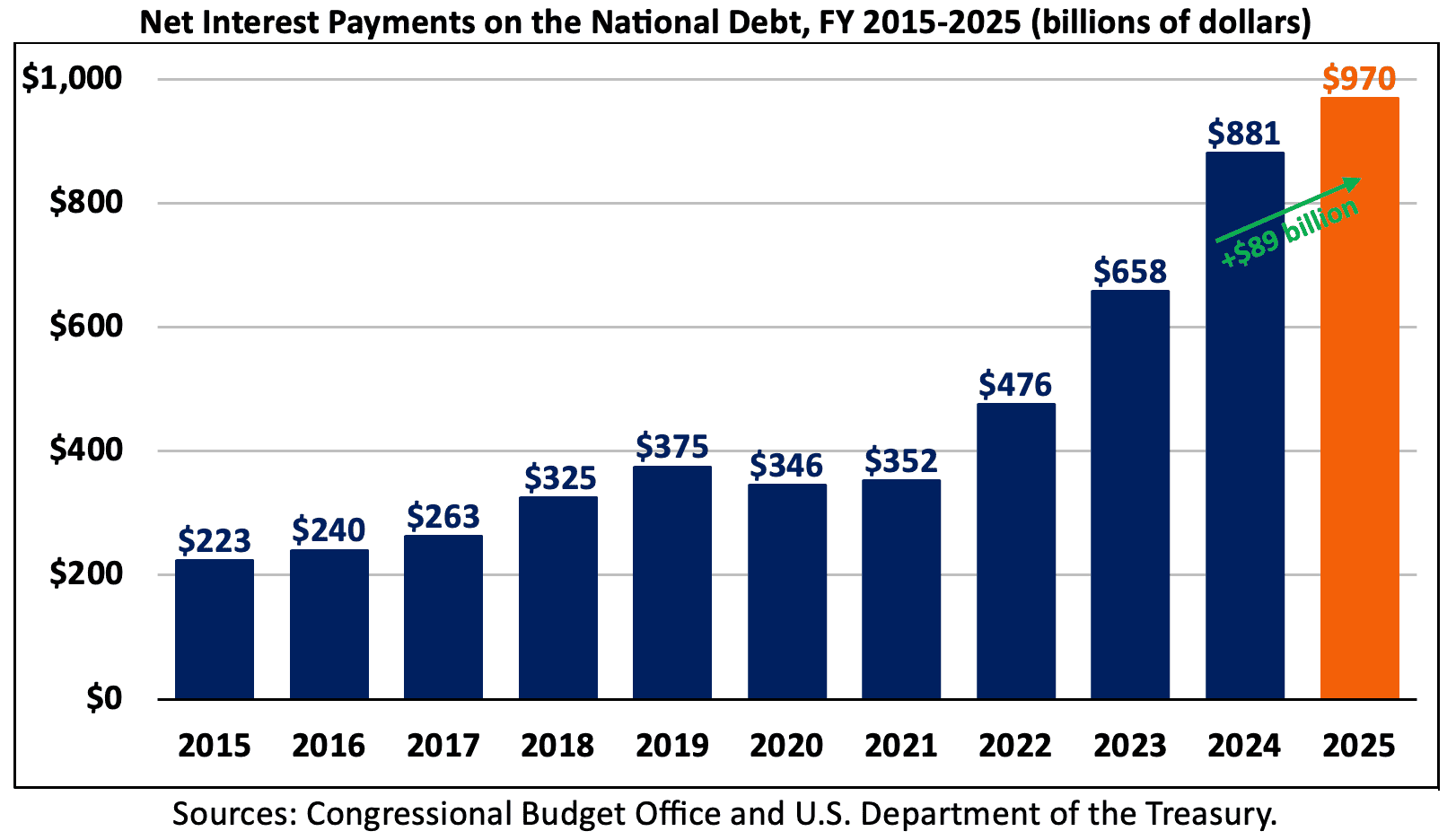

Interest Payments Totaled $970 Billion in FY 2025

Between FY 2024 and FY 2025, interest costs increased by $89 billion (10 percent), from $881 billion to $970 billion. As a share of the economy, net interest was an estimated 3.1 percent of gross domestic product (GDP).

The $970 billion the federal government spent on net interest payments in FY 2025 was more than it spent on national defense ($917 billion), Medicaid ($668 billion), veterans’ benefits and services ($377 billion), food and nutrition services, including the Supplemental Nutrition Assistance Program ($148 billion), transportation ($146 billion), natural resources and the environment ($88 billion), Supplemental Security Income ($69 billion), international affairs ($45 billion), science, space, and technology ($42 billion), and energy ($21 billion).

The $970 billion in interest costs were equal to 19 percent of all federal revenue collections in FY 2025. That means for every dollar of taxes and fees the government took in, 19 cents went to pay interest on the national debt. Interest payments effectively consumed all corporate income tax revenue, 56 percent of all payroll tax revenue, or 37 percent of all individual income tax revenue. They were nearly five times as large as receipts from customs duties and over nine times larger than receipts from federal excise taxes.

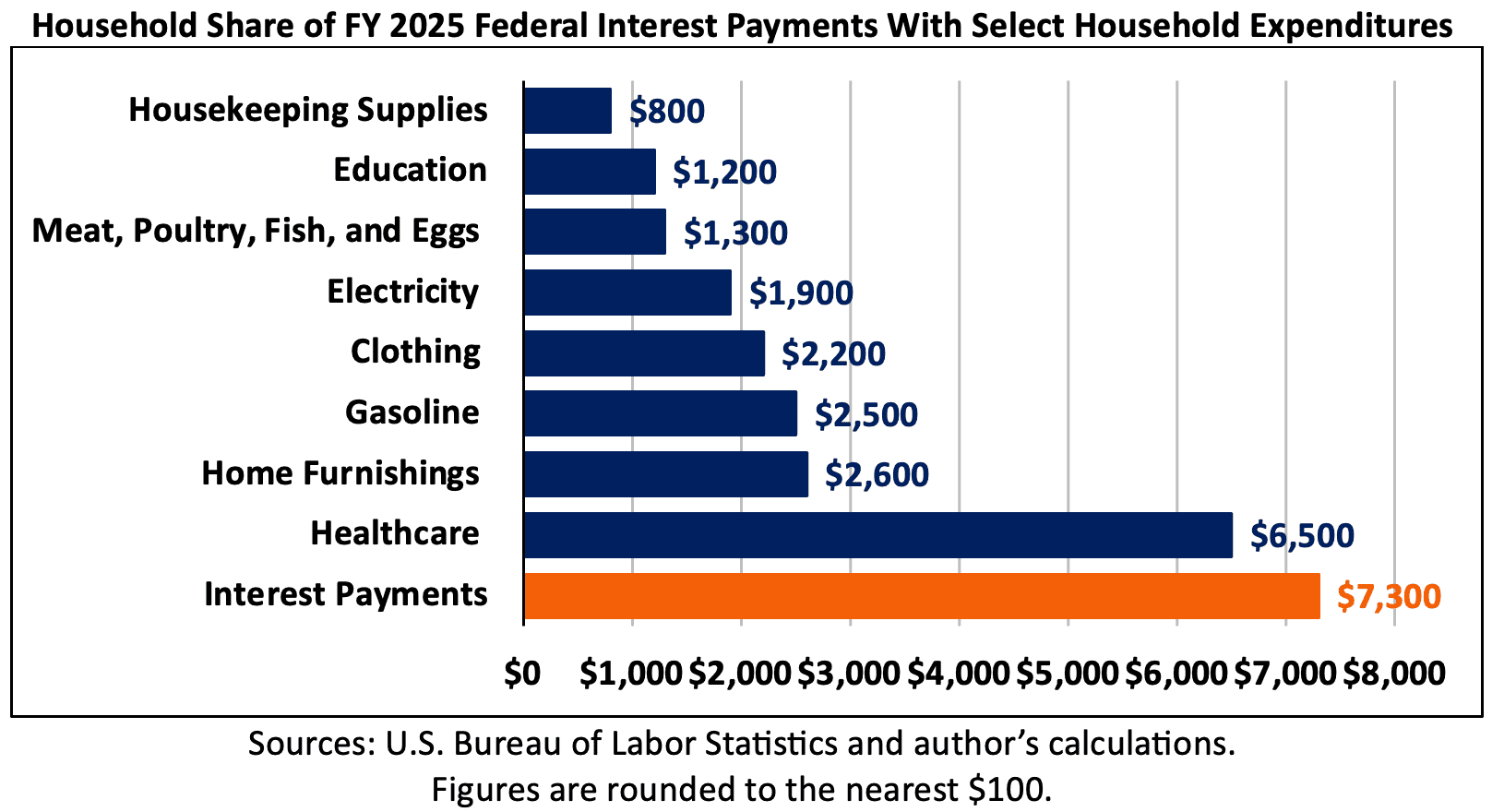

Interest Payments Exceed Many Household Expenditures

The $970 billion the federal government spent on interest payments in FY 2025 was equivalent to roughly $7,300 per household. That’s more than a typical household spends annually on many household expenditures such as healthcare ($6,500), home furnishings ($2,600), gasoline ($2,500), clothing ($2,200), or education ($1,200).

The Outlook for Interest Payments

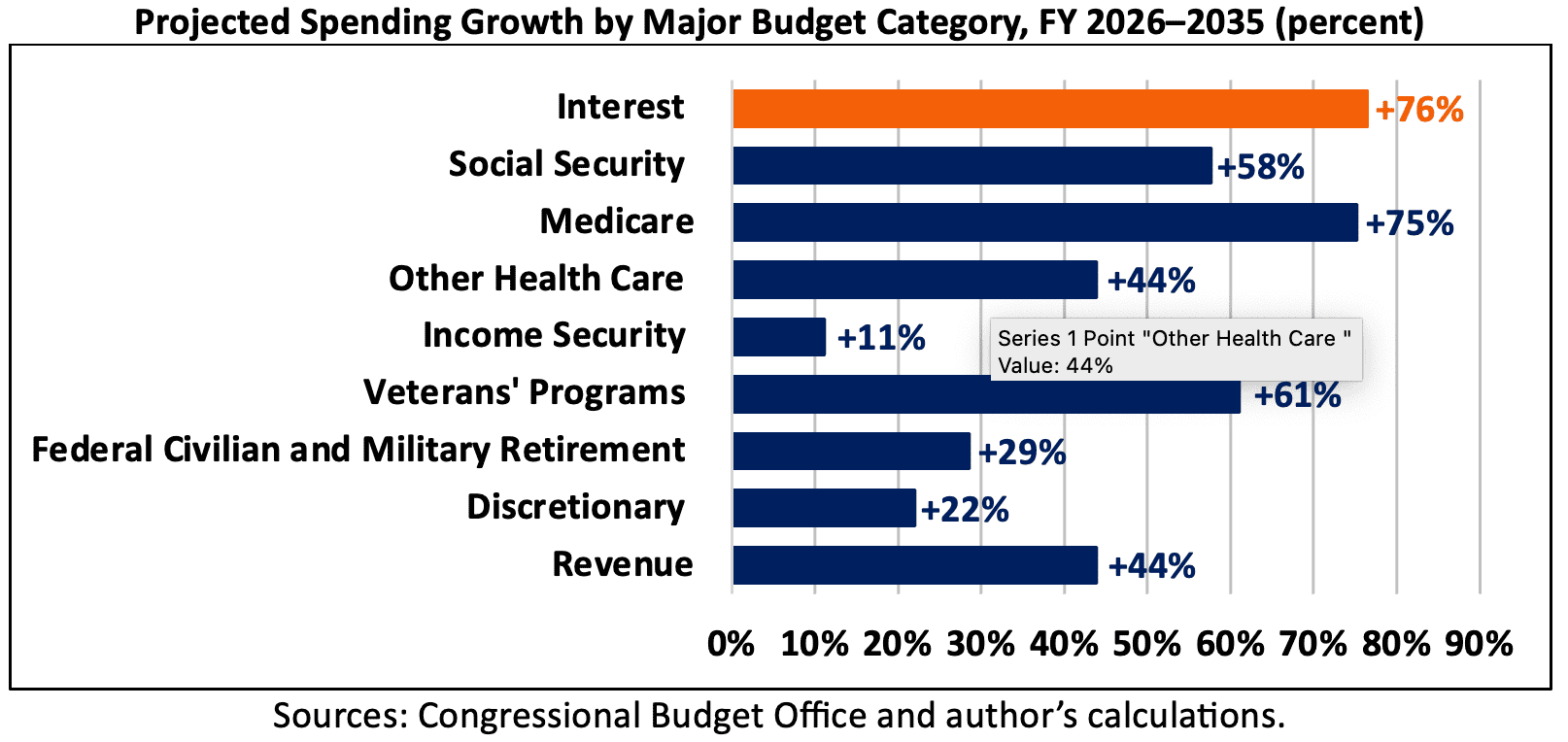

According to CBO’s most recent baseline, interest payments will grow by 76 percent over the FY 2026–2035 budget window, rising from $1.0 trillion in FY 2026 to $1.8 trillion in FY 2035. As a share of the economy, interest will grow from 3.2 percent of GDP to 4.1 percent of GDP.

Interest payments will grow faster than any other major budgetary category through FY 2035. CBO expects spending on net interest to grow by 76 percent while spending on Social Security will increase by 58 percent. Medicare spending will grow by 75 percent while spending on other health care (Medicaid, the Children’s Health Insurance Program, and the Affordable Care Act exchanges) will grow by 44 percent. Spending on income security (including the Supplemental Nutrition Assistance Program and Supplemental Security Income) will increase by 11 percent, spending on veterans’ services will grow by 61 percent, and discretionary spending will increase by 22 percent. Interest costs will outpace projected revenue growth of 44 percent.

Over the long term CBO expects interest payments to grow to $4.8 trillion (5.4 percent of GDP) by FY 2055.

Conclusion

The $970 billion the federal government spent on net interest payments in FY 2025 was the third-largest line item in the federal budget, behind only Social Security and Medicare. As the national debt continues to rise, so will the amount of interest payments needed to service it. As a result, interest will compose an increasing share of federal spending and crowd out other spending priorities.