Insight

October 17, 2022

Social Security Cost-of-living Adjustments

Executive Summary

- The Social Security Administration recently announced the largest cost-of-living adjustment (COLA) to Social Security benefits in over 40 years.

- This adjustment is based on a formula that measures the percent change from the 3rd quarter of the prior year to the 3rd quarter of the current year in the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W, a relatively narrow price index.

- This system is somewhat outdated and would likely face reform in any meaningful Social Security overhaul.

Introduction

In July of 1972, President Nixon signed into law H.R. 15390, which increased the debt limit and made substantial changes to the Old Age Survivors and Disability Insurance (OASDI) program. Among the changes to OASDI, better known as Social Security, was a new mechanism for automatically adjusting benefits to account for price increases. These cost-of-living adjustments (COLAs) took effect in 1975 and have remained largely unchanged in their operation since. Over the past 12 months, inflation has been historically rapid, and indeed when the 2023 COLA is published later this month in the Federal Register, it will be the largest since 1981. While the preservation of real benefits is critical to this antipoverty program, there are elements of the current system that warrant scrutiny.

How COLAs Are Calculated

The policy rationale for COLAs is the preservation of the real value of Social Security recipients’ benefits. To measure price changes, the Social Security Administration (SSA) relies on a price index, specifically the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W. This index is something of an anachronism. For a time, it was the only price index that the Bureau of Labor Statistics (BLS) produced. As federal statistical agencies have improved data collection and methodologies, however, more comprehensive price indices became available, such as the CPI-U, which covers all urban consumers, or about 87 percent of the population, and is generally the most frequently cited inflation measure. The CPI-W, by comparison, only covers about 32 percent of Americans. The CPI-W has also tended to rise more rapidly than the more representative CPI-U, which likely explains why it hasn’t been replaced.

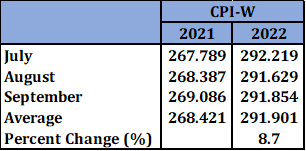

Social Security’s COLAs become effective for December benefits, payable in January of every year. The applicable COLA for those benefits is equal to the percentage increase in the CPI-W from the average for the 3rd quarter of the current year to the average for the 3rd quarter of the last year in which a COLA became effective. As the formula specifies, these COLAs move in only one direction. In the event of deflation, benefits are not reduced. In October, BLS releases CPI data, including that for the CPI-W, for September, the final month of the 3rd quarter and thus the last input for calculating COLAs. The COLA that will apply to benefits payable in January has thus been determined:

The 8.7 percent COLA soon to take effect will be the largest in over 40 years.

COLA Reform

That Social Security relies on a demonstrably obsolete price index reflects broader intransigence among policymakers to reform the program. According to BLS, the CPI-U increased 8.2 percent over the year as of September and, depending on the course of inflation, both the CPI-W and the CPI-U may reflect greater or lesser price changes than 8.7 percent. This disjuncture can confuse. For example, in 2009, the SSA determined that a 5.8 percent COLA would take effect for the next year, and it was at the time the largest COLA since 1982. CPI-W for the year ultimately came in substantially lower, however, and was negative the following year. But again, adjustments in Social Security are always one directional.

Additional improvements in data collection have allowed for the creation of additional price indices that include consumers’ behavioral effects in the face of price growth, specifically substitution. This index, known as the chained CPI, has historically tended to rise less rapidly than conventional indices. This measure has been adopted for the indexation of tax brackets and has been proposed for adoption in the Social Security system.

Conclusion

Every year, the Social Security Administration calculates an automatic adjustment in Social Security benefits to reflect changes in the cost of living. This is currently approximated by reliance on the CPI-W price index. While this approach roughly preserves recipients’ real benefits, it is nevertheless a somewhat outdated index. Historic inflation has made this feature of the entitlement system more salient, and modernization to this process will likely be included in any meaningful reform effort.