Insight

December 11, 2023

The Biden Administration’s Fall 2023 Unified Agenda of Regulatory Actions

EXECUTIVE SUMMARY

- The Biden Administration recently released its Fall 2023 Unified Agenda of Regulatory and Deregulatory Actions (UA) detailing the nearly 3,200 rulemakings it plans to put forward within the next year or so.

- In terms of the volume of regulatory measures, the trends detailed in this report largely mirror those from the Spring UA with major rulemakings coming at a historic pace and many of the same agencies remaining atop the leaderboard in terms of planned activity.

- This report also provides a unique look at the nearly 40 potentially major rulemakings – among hundreds of others – that could be vulnerable to recission under the Congressional Review Act in 2025 if the political balance of power in the White House and Congress aligns accordingly after next year’s election.

INTRODUCTION

On December 6, the Office of Information and Regulatory Affairs (OIRA) released the Biden Administration’s Fall 2023 edition of the “Unified Agenda of Regulatory and Deregulatory Actions” (UA). The biannual report lays out “the actions administrative agencies plan to issue in the near and long term.” With the Biden Administration entering both the final year of this term and an election year, the rulemakings outlined in this report will take on pronounced importance for both policymaking and political reasons. While there were no seismic changes in the trends, , perhaps the most useful aspect of this report is to provide the public the clearest view yet of the administration’s regulatory plans for the final half of 2024. In particular, rulemakings finalized within that period may face the possibility of repeal under the Congressional Review Act’s (CRA) “look-back” provision if Republicans win control of the White House and both chambers of Congress.

OVERALL REGULATORY VOLUME

One of the more helpful aspects of a given UA is that it can demonstrate the scope of an administration’s regulatory plans. The following table includes statistics on the volume of prospective actions included over the past decade of Spring UAs. “Active” items include those that agencies reasonably expect to act on within 12 months of the UA’s publication. “Long-Terms” are those that agencies expect to act on outside of that one-year window. The “Total Prospective” category is the sum of those two. “Major” items include rulemakings that agencies expect to meet the definition of a “major rule” under the CRA and include actions from independent agencies. “Significant” items include those that carry the designation of either: 1) “economically significant” as established under Executive Order (E.O.) 12866 (and/or the relevant designation as modified under E.O. 14094), or 2) “other significant” that OIRA defines as: “A rulemaking that is not economically significant but is considered significant by the agency. This category includes rules that the agency anticipates will be reviewed under E.O. 12866 or rules that are a priority of the agency head.”

| Trends in Rulemaking Volume Across Fall Unified Agendas | ||||||||||

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Active Items | 2321 | 224 | 209 | 1977 | 239 | 260 | 263 | 2678 | 2651 | 2524 |

| Long-Term Items | 465 | 499 | 558 | 762 | 655 | 604 | 586 | 624 | 596 | 644 |

| Total Prospective Items | 2786 | 274 | 265 | 2739 | 305 | 320 | 322 | 3302 | 3247 | 3168 |

| “Major” Active Items | 123 | 149 | 112 | 70 | 106 | 116 | 182 | 200 | 236 | 244 |

| “Major” Long-Term Items | 36 | 30 | 34 | 42 | 31 | 32 | 30 | 52 | 32 | 41 |

| Total “Major” Items | 159 | 179 | 146 | 112 | 137 | 148 | 212 | 252 | 268 | 285 |

| “Significant” Active Items | 943 | 861 | 756 | 606 | 863 | 985 | 989 | 1033 | 1079 | 1042 |

| “Significant” Long-Term Items | 188 | 182 | 221 | 252 | 207 | 216 | 207 | 285 | 259 | 289 |

| Total “Significant” Items | 1131 | 104 | 977 | 858 | 107 | 120 | 119 | 1318 | 1338 | 1331 |

For the Spring edition of the UA, the American Action Forum (AAF) examined the report in the context of preceding Spring versions. To maintain a comparable level of context for this iteration, we looked at how this latest report compared to past Fall editions of the UA. Even with this shift in relative samples, the trends remained remarkably similar. The overall volume of planned rulemakings still hovers near the 10-year average of 3,012. As in the Spring report, the number of major rules currently in the works continues to be at a 10-year high.

The pace of significant rules came in slightly below the 2022 level, however. A potential explanation for this dip could be in how OIRA tweaked the categorization of such rules between these reports. In the Spring report, OIRA included rules under both the traditional E.O. 12866 designation and under the new E.O. 14094 definition. In this report, presumably to further establish this updated threshold for “significant” rules as a matter of practice, it has done away with the E.O. 12866 designation entirely. As noted in our Spring UA examination, this new definition represents a narrower set of rules, and thus this may simply be the run-on effect of providing a more limited sample rather than a conscious effort on the administration’s part to limit its regulatory output. Despite this slight decrease, the Biden-era average (from 2021 through 2023) of 1,329 actions under this metric remains appreciably higher than the pace seen during the preceding seven years.

MAJOR TRENDS ACROSS AGENCIES

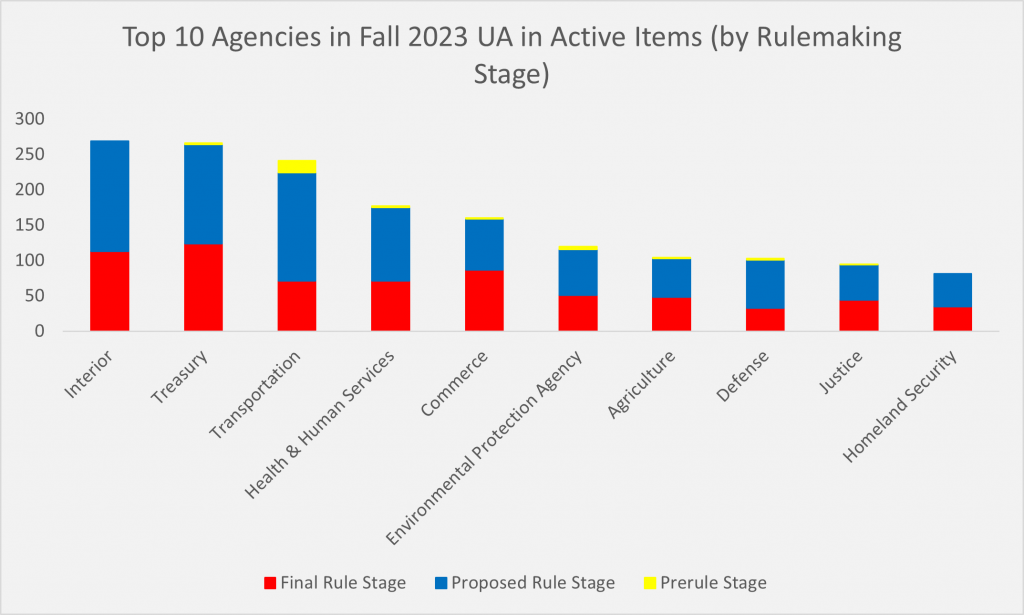

As in other recent examinations of UA activity, it is important to look at which agencies have the busiest agendas planned. The following table details the top 10 agencies in terms of active items. As with the trends in overall volume, there is a remarkable level of stability in this report when compared to the Spring edition. The top six agencies in terms of rulemaking volume remain the same. Similarly, there is only a limited shuffling of the pecking order for the remaining agencies in this top 10. The Department of Agriculture jumps ahead of the Department of Defense for 7th place. The Department of Homeland Security bumps the Department of Energy out of the final slot – albeit by a margin of merely three rulemakings. Perhaps the most interesting insight to draw from this data, however, is how a majority of the actions (roughly 56 percent) for these agencies are still tagged as being in the “Proposed Rule Stage.” While there may be some specific rulemakings slated for a more expeditious timeline (see the following section for more context), this finding suggests that – on a macro level, at least – the current administration is operating under the expectation that it will be able to continue its plans beyond 2024.

As with the trends in overall volume, there is a remarkable level of stability in this report when compared to the Spring edition. The top six agencies in terms of rulemaking volume remain the same. Similarly, there is only a limited shuffling of the pecking order for the remaining agencies in this top 10. The Department of Agriculture jumps ahead of the Department of Defense for 7th place. The Department of Homeland Security bumps the Department of Energy out of the final slot – albeit by a margin of merely three rulemakings. Perhaps the most interesting insight to draw from this data, however, is how a majority of the actions (roughly 56 percent) for these agencies are still tagged as being in the “Proposed Rule Stage.” While there may be some specific rulemakings slated for a more expeditious timeline (see the following section for more context), this finding suggests that – on a macro level, at least – the current administration is operating under the expectation that it will be able to continue its plans beyond 2024.

NOTABLE RULES POTENTIALLY DROPPING LATE 2024

While there were not necessarily massive changes in the overall trends discussed above compared to the Spring’s edition of the UA, this Fall edition provides the clearest picture to date of the regulatory landscape heading into 2024 and the upcoming presidential election. The regulatory activity set to happen in the second half of 2024 will have particular importance from both a political and policymaking perspective. From a political angle, these will likely be the rules getting media attention as the general election campaign season begins in earnest. From a policymaking angle, these rules will potentially be vulnerable to recission under the CRA if the election changes the political alignment of both the White House and Congress.

As AAF has covered extensively in recent years, the CRA has increasingly become an actionable item in the world of regulatory policy. In the aftermath of the 2016 and 2020 elections, the relative shifts in which party controlled the executive and legislative branches allowed for incoming policymakers to utilize the CRA’s “lookback” provision to target rules finalized in the later portion of the preceding administration. While it is impossible to predict exactly when this lookback cut-off point will fall in 2024 since it is contingent on how many days Congress is in session next fall, in the most recent cycles it has come in either July or August.

As such, examining rules set to become final from July 2024 onward provides a useful sample here. Below are such rules that also currently carry either: A) a “major” designation or B) an “undetermined” designation (thereby denoting the possibility they still could be major rules upon finalization). This is not intended to be an exhaustive list – both because there are likely hundreds of other rules without these designations that may face CRA scrutiny and because the scheduled timing listed by the agencies is far from definitive – but rather to provide an illustrative snapshot of some the potentially more high-profile items that could be in question.

| JULY 2024 | ||

| Agency | Rule Title | Regulation Identifier Number (RIN) |

| Energy | Energy Conservation Standards for Consumer Boilers | 1904-AE82 |

| Energy | Energy Conservation Standards for Miscellaneous Residential Refrigeration | 1904-AF00 |

| Transportation | Safety Management Systems | 2120-AL60 |

| EPA | Revisions to the Air Emission Reporting Requirements (AERR) | 2060-AV41 |

| EPA | Perchloroethylene (PCE); Regulation Under the Toxic Substances Control Act (TSCA) | 2070-AK84 |

| DOD/NASA/GSA | Federal Acquisition Regulation (FAR); FAR Case 2019-009, Prohibition on Contracting With Entities Using Certain Telecommunications and Video Surveillance Services or Equipment | 9000-AN92 |

| AUGUST 2024 | ||

| Energy | Energy Conservation Standards for Battery Chargers | 1904-AE50 |

| Energy | Energy Conservation Standards for Automatic Commercial Ice Makers | 1904-AE47 |

| Energy | Energy Conservation Standards for Refrigerated Bottled or Canned Beverage Vending Machines | 1904-AE68 |

| HHS | Use of Salt Substitutes to Reduce the Sodium Content in Standardized Foods | 0910-AI72 |

| HHS | Revising the National Drug Code Format and Drug Labeling Barcode Requirements | 0910-AI52 |

| DOL/HHS/

Treasury |

Coverage of Certain Preventive Services Under the Affordable Care Act | 1210-AC13 |

| SEPTEMBER 2024 | ||

| Energy | Energy Conservation Standards for Ceiling Fans | 1904-AE99 |

| HHS | CY 2025 Inpatient Hospital Deductible and Hospital and Extended Care Services Coinsurance Amounts (CMS-8086) | 0938-AV36 |

| SBA | Business Loan Program Temporary Changes; Paycheck Protection Program–Consolidation of Interim Final Rules | 3245-AH58 |

| OCTOBER 2024 | ||

| HHS | Requirements for Tobacco Product Manufacturing Practice | 0910-AH91 |

| Labor | High-Wage Components of the Labor Value Content Requirements Under the United States-Mexico-Canada Agreement Implementation Act | 1235-AA36 |

| EPA | Reconsideration of the Dust-Lead Hazard Standards and Dust-Lead Post Abatement Clearance Levels | 2070-AK91 |

| FERC | Electric Transmission Incentives Policy Under Section 219 of the Federal Power Act | 1902-AF70 |

| SBA | Disaster Loan Program Changes | 3245-AH80 |

| SBA | Ensuring Equal Treatment for Faith-Based Organizations in SBA’s Loan and Disaster Assistance Programs | 3245-AH60 |

| Treasury | Guidance Under Section 954(b)(4) (Rules for High-Taxed Subpart F Income) and Section 964 (Rules for Determining the Earnings and Profits of a Foreign Corporation) | 1545-BP62 |

| CFPB | Property Assessed Clean Energy Financing | 3170-AA84 |

| SEC | Covered Clearing Agency Resiliency and Recovery and Wind-Down Plans | 3235-AN19 |

| SEC | Daily Computation of Customer and Broker-Dealer Reserve Requirements Under the Broker-Dealer Customer Protection Rule | 3235-AN28 |

| SEC | Electronic Submission of Certain Materials Under the Securities Exchange Act of 1934; Amendments Regarding FOCUS Report | 3235-AL85 |

| NOVEMBER 2024 | ||

| Treasury | Prescription Drug and Health Care Spending | 1545-BQ27 |

| Treasury | Identification of Monetized Installment Sale Transactions as Listed Transactions | 1545-BQ69 |

| DECEMBER 2024 | ||

| Agriculture | Supplemental Nutrition Assistance Program Requirement for Interstate Data Matching | 0584-AE75 |

| HHS | Protection of Human Subjects and Institutional Review Boards | 0910-AI07 |

| HHS | Institutional Review Boards; Cooperative Research | 0910-AI08 |

| HHS | Investigational New Drug Application Annual Reporting | 0910-AI37 |

| HHS | HIPAA Privacy: Changes to Support, and Remove Barriers to, Coordinated Care and Individual Engagement | 0945-AA00 |

| Transportation | Pipeline Safety: Class Location Requirements | 2137-AF29 |

| OPM | Paid Parental Leave and Miscellaneous Family and Medical Leave Act | 3206-AN96 |

| DHS | Removing Suspension of Enrollment for Certain F, J and M Nonimmigrant Students From Libya and Third Country Nationals Acting on Behalf of Libyan Entities | 1653-AA91 |

OTHER KEY STATISTICS

With more than 2,500 active items included in the pages of this UA, it is not practical to include full lists of the various potential cross-sections of rulemakings. It is, however, possible and potentially helpful to highlight the volume of items that fall into certain subcategories. Some of these totals include:

- 320 “Novel Rulemakings,” or those included in the UA for the first time;

- 200 rulemakings that agencies find “likely to have a significant economic impact on a substantial number of small entities” under the Regulatory Flexibility Act (RFA);

- 189 rulemakings that agencies expect “to have international trade and investment effects, or otherwise may be of interest to our international trading partners”;

- 20 rulemakings set for retrospective review under Section 610 of the RFA; and

- 28 rulemakings that agencies find “likely to result in a mandate that may result in expenditures by State, local, and tribal governments, in the aggregate, or by the private sector of more than $100 million in one year” under the Unfunded Mandates Reform Act.

CONCLUSION

The Unified Agenda is yet another government report that often languishes in relative obscurity. Despite its lack of notoriety, it is an important tool in helping the public to better understand an administration’s plans on the regulatory front. With a presidential election year looming, information on these policies will take on even greater importance. While this latest UA may not differ much from the edition published earlier this year, the absence of such shifts further bolsters an important finding: the Biden Administration continues to put forward rulemakings at a historic pace and does not plan to slow down anytime soon.