Insight

October 22, 2024

Treasury’s FY 2024 Statement Paints a Dimmer Fiscal Picture

Executive Summary

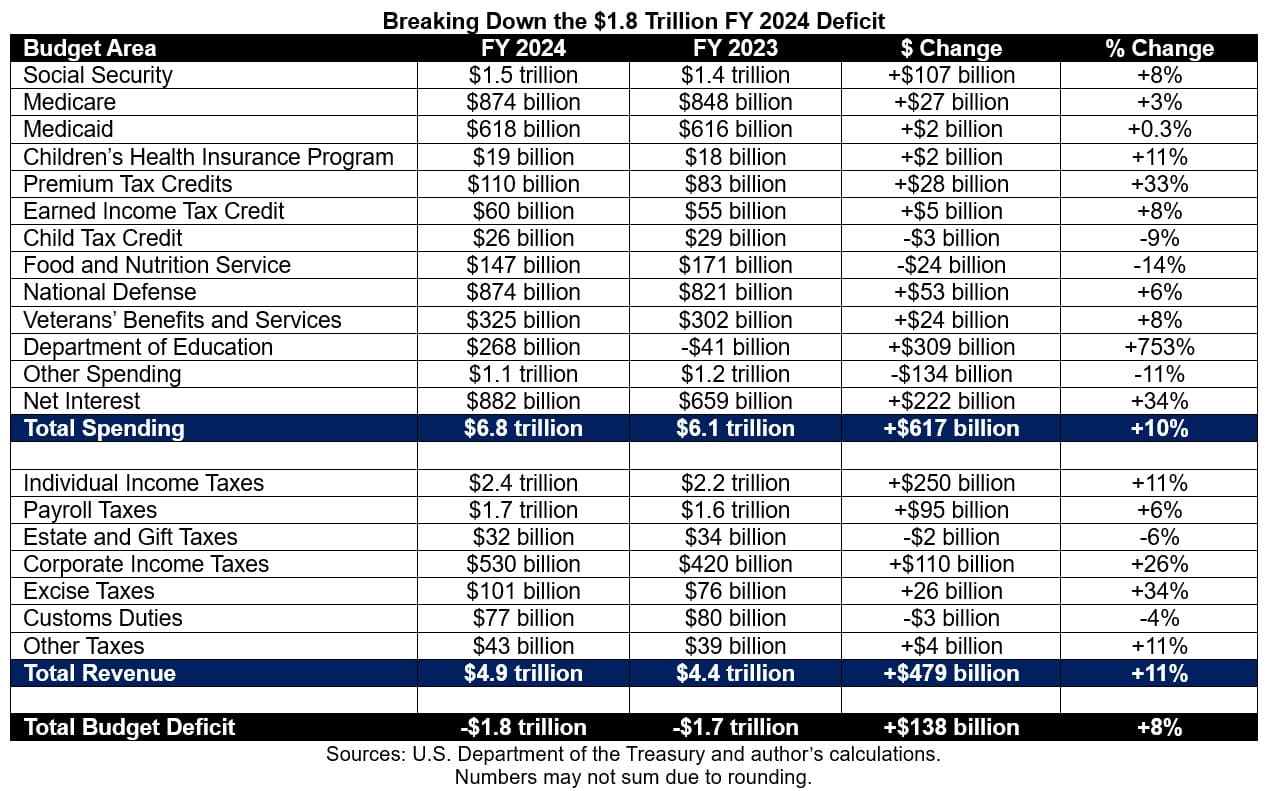

- The U.S. Department of the Treasury has released its final Monthly Treasury Statement for fiscal year (FY) 2024, showing a $1.8 trillion budget deficit, the equivalent of 6.3 percent of gross domestic product (GDP); this is $138 billion higher than the deficit recorded in FY 2023; the FY 2024 deficit is the net effect of $4.9 trillion of revenue collections and $6.8 trillion of spending.

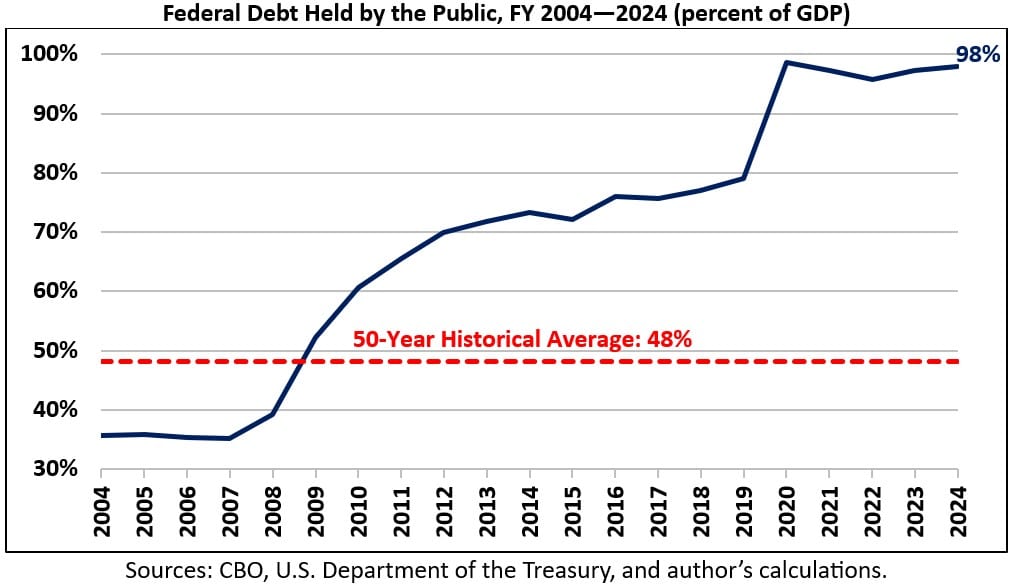

- Federal debt held by the public rose by $2.0 trillion to $28.3 trillion; as a share of the economy, debt grew to an estimated 98 percent of GDP, 1 percentage point higher than last year.

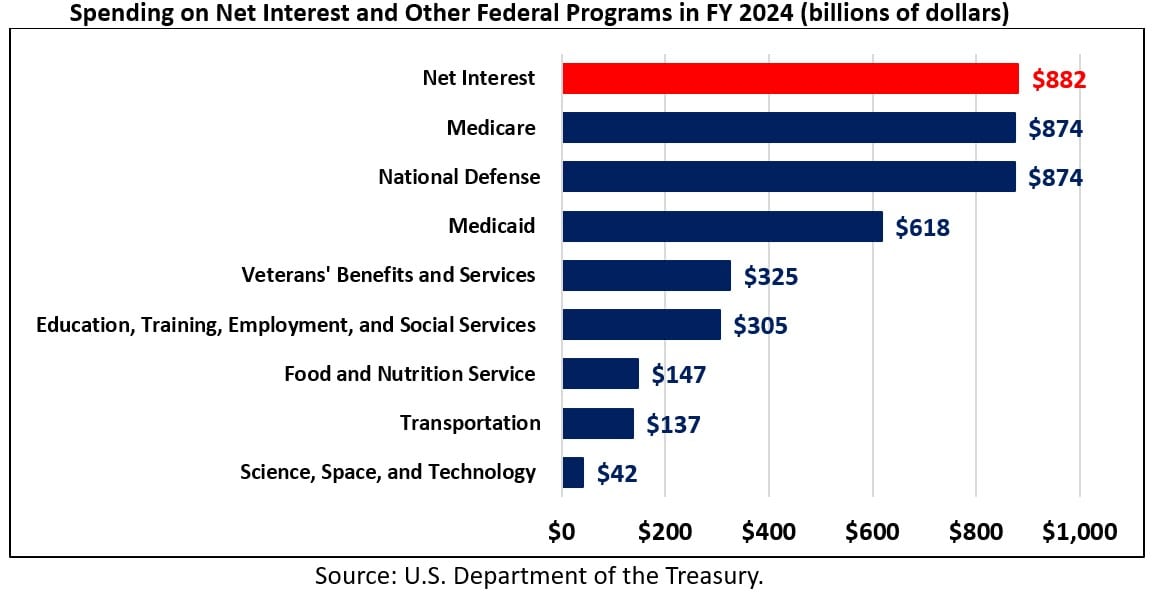

- Interest payments on the national debt topped $1.0 trillion, eclipsing spending on defense and Medicare; net interest was the second-largest government expenditure behind Social Security.

- Of note, Department of Education spending rose by 753 percent in FY 2024 due to an accounting quirk in which President Biden’s announced student debt cancellation of FY 2023 was recorded as a savings after the Supreme court ruled it illegal.

A Closer Look at the $1.8 Trillion FY 2024 Deficit

The U.S. Department of the Treasury has released its final Monthly Treasury Statement for fiscal year (FY) 2024, showing a $1.8 trillion budget deficit for the year. The $1.8 trillion deficit is the net effect of $4.9 trillion of revenue collections and $6.8 trillion of spending. The FY 2024 deficit is $82 billion (4 percent), less than the $1.9 trillion deficit the Congressional Budget Office (CBO) projected in its most recent baseline but $138 billion (8 percent) higher than the $1.7 trillion deficit recorded in FY 2023.

As a share of the economy, the FY 2024 deficit was an estimated 6.3 percent of gross domestic product (GDP), the same as the FY 2023 deficit.

While the FY 2024 deficit was smaller than the FY 2020 and FY 2021 COVID-19 pandemic-driven deficits of $3.1 trillion and $2.8 trillion, respectively, it was higher in nominal dollars than at any other time in history. As a share of GDP, the FY 2024 deficit was greater than at any time in U.S. history outside of a war, recession, or national emergency.

As the budget deficit remains high, the national debt continues to grow. In FY 2024, federal debt held by the public increased by $2.0 trillion, from $26.3 trillion at the end of FY 2023 to $28.3 trillion at the end of FY 2024. As a share of the economy, the national debt increased from 97 percent of GDP at the end of FY 2023 to an estimated 98 percent of GDP at the end of FY 2024. At a projected 98 percent of GDP, the national debt is more than twice the 50-year historical average of 48 percent of GDP and within nine percentage points of the record of 106 percent of GDP set just after World War II in 1946.

The $138 billion increase in the deficit between FY 2023 and FY 2024 can be explained by $395 billion in greater mandatory and discretionary spending, $222 billion in higher interest payments on the national debt, and $479 in billion higher revenue collections.

Revenue collections increased by $479 billion (0.5 percentage points of GDP) between FY 2023 and FY 2024, rising from $4.4 trillion (16.5 percent of GDP) to $4.9 trillion (17.0 percent of GDP). Individual income tax revenue increased by $250 billion (11 percent), from $2.2 trillion to $2.4 trillion, driven by a decline in individual income tax refunds and a delay in tax payments for taxpayers in areas affected by natural disasters. Payroll tax revenue – which primarily comes from the 12.4 percent Social Security payroll tax and the 2.9 percent Medicare payroll tax – increased by $95 billion (6 percent), from $2.2 trillion to $2.4 trillion. Specifically, Social Security payroll tax revenue grew by $66 billion (6 percent) – from $1.2 trillion to $1.3 trillion, while Medicare payroll tax revenue increased by $29 billion (8 percent) – from $358 billion to $387 billion. Estate and gift tax revenue fell by $2 billion (6 percent), from $34 billion to $32 billion.

Corporate income tax revenue surged by $110 billion (26 percent), from $420 billion in FY 2023 to $530 billion in FY 2024, in large part due to a delay in tax payments for corporations located in areas affected by natural disasters. Excise tax revenue grew by $26 billion (34 percent), from $76 billion to $101 billion, while receipts from customs duties fell by $3 billion (4 percent), from $80 billion to $70 billion. Revenue from other sources grew by $4 billion (11 percent), from $39 billion to $43 billion. Federal Reserve remittances grew by a staggering 439 percent, from $581 million to $3 billion.

Total federal spending increased by $617 billion (0.5 percentage points of GDP) between FY 2023 and FY 2024, rising from $6.1 trillion (22.7 percent of GDP) to $6.8 trillion (23.3 percent of GDP). Social Security spending increased by $107 billion (8 percent), from $1.4 trillion to $1.5 trillion, driven by the 3.2-percent cost-of-living adjustment for 2024 and an increase in the number of beneficiaries. Medicare spending rose by $27 billion (3 percent), from $848 billion to $847 billion, due to higher enrollment and payment rates for services. Other health care spending (Medicaid, the Children’s Health Insurance Program, and Affordable Care Act Premium Tax Credits) rose by a combined $31 billion (4 percent), from $716 billion to $747 billion.

Spending on the Earned Income Tax Credit rose by $5 billion (8 percent), from $55 billion to $60 billion, while spending on the Child Tax Credit fell by $3 billion (9 percent), from $29 billion to $26 billion. Spending by the Department of Agriculture’s Food and Nutrition Service (which includes spending for the Supplemental Nutrition Assistance Program (SNAP), child nutrition programs, and the Special Supplemental Nutrition Program for Women, Infants, and Children) fell by $24 billion (14 percent), from $171 billion to $147 billion, in large part due to an end of SNAP emergency allotments. Spending on veterans’ benefits and services rose by $24 billion (8 percent), from $302 billion to $325 billion, because of increased per-person spending and use of health care facilities by veterans.

Department of Education spending increased by $309 billion in FY 2024 (753 percent), from -$41 billion to $268 billion, due to an accounting quirk in which President Biden’s announced student debt cancellation in FY 2023 was recorded as a savings after the Supreme court ruled it illegal. Other non-interest federal spending fell by $134 billion (11 percent), from $1.2 trillion to $1.1 trillion.

Net interest payments on the national debt increased by a staggering $222 billion (34 percent), from $659 billion to $882 billion. In FY 2024, interest spending was the second-largest federal government expenditure, exceeded only by Social Security. For the first time, interest costs exceeded federal spending on Medicare and national defense and were also higher than spending on Medicaid, food and nutrition services, and veterans’ benefits and services, among other federal programs.

Put differently, 18 percent of all revenue collections in FY 2024 went toward interest payments on the national debt.

Conclusion

The $1.8 trillion FY 2024 deficit is evidence that reforms are needed to shore up Social Security and Medicare, raise additional revenue, curb wasteful government spending, and put the national debt on a sustainable long-term trajectory. For a possible path forward, the American Action Forum has developed a framework to address the nation’s debt challenge.