Insight

October 17, 2025

U.S. Treasury: FY 2025 Deficit Totaled $1.8 Trillion

Executive Summary

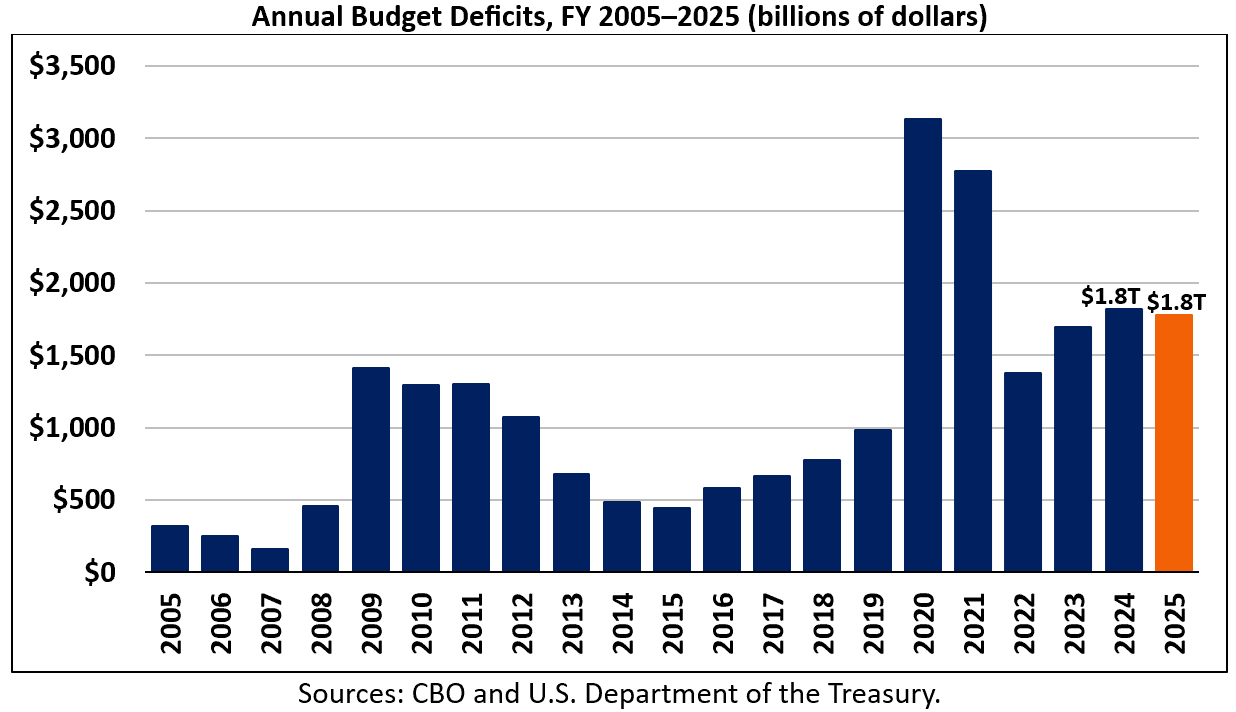

- The U.S. Department of the Treasury has released its final Monthly Treasury Statement for fiscal year (FY) 2025, showing a $1.8 trillion budget deficit for the year – $41 billion lower than the deficit recorded in FY 2024; the FY 2025 deficit was the net effect of $5.2 trillion of revenue collections and $7.0 trillion of spending.

- As a share of the economy, the FY 2025 deficit was an estimated 5.8 percent of gross domestic product (GDP).

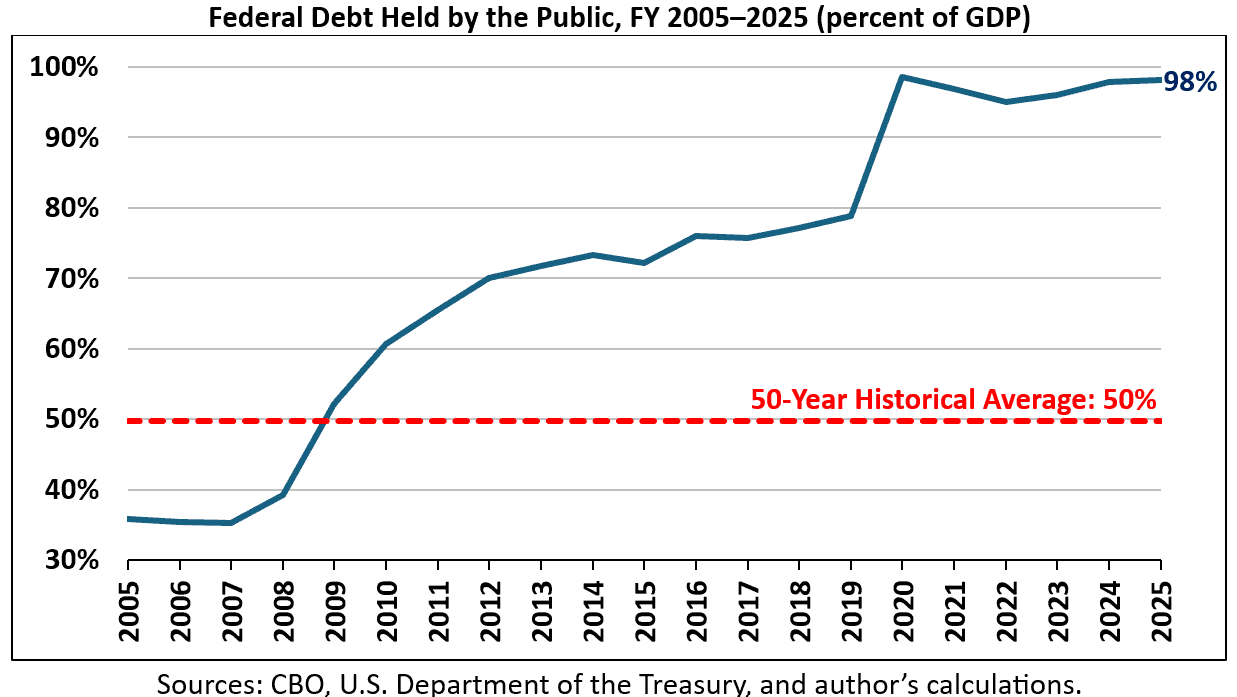

- Federal debt held by the public increased by $2.0 trillion to $30.3 trillion; as a share of the economy, debt totaled an estimated 98 percent of GDP.

- Interest payments on the national debt totaled $970 billion, surpassing spending on national defense; net interest was the third-largest federal government expenditure behind Social Security and Medicare.

A Closer Look at the $1.8 Trillion FY 2025 Deficit

The U.S. Department of the Treasury has released its final Monthly Treasury Statement for fiscal year (FY) 2025, showing a $1.8 trillion budget deficit for the year. The $1.8 trillion deficit was the net effect of $5.2 trillion of revenue collections and $7.0 trillion of spending. The FY 2025 deficit was $90 billion (5 percent) less than the $1.9 trillion deficit the Congressional Budget Office (CBO) projected in its most recent baseline and $41 billion (2 percent) below the $1.8 trillion deficit recorded in FY 2024.

As a share of the economy, the FY 2025 deficit was an estimated 5.8 percent of gross domestic product (GDP), 0.6 percentage points below the 6.4 percent of GDP FY 2024 deficit.

In nominal dollars, the FY 2025 deficit was the fourth largest in history. The FY 2024 and FY 2025 deficits of $1.8 trillion were greater than at any time in U.S. history outside of a war, recession, or national emergency.

As budget deficits remain high, the already unsustainable trajectory of national debt accumulation continues to grow rapidly. In FY 2025, federal debt held by the public increased by $2.0 trillion, from $28.3 trillion at the end of FY 2024 to $30.3 trillion at the end of FY 2025. As a share of the economy, the national debt was an estimated 98 percent of GDP in FY 2025, the same as FY 2024 debt-to-GDP. At a projected 98 percent of GDP, the national debt is nearly twice the 50-year historical average of 50 percent of GDP and within eight percentage points of the record of 106 percent of GDP set just after World War II in FY 1946.

The $41 billion reduction in the deficit between FY 2024 and FY 2025 was the result of $186 billion higher mandatory and discretionary spending and $89 billion higher interest payments on the national debt that was more than offset by $317 billion in greater revenue collections.

Revenue collections increased by $317 billion between FY 2024 and FY 2025, growing from $4.9 trillion (17.1 percent of GDP) to $5.2 trillion (17.0 percent of GDP). Individual income tax revenue increased by $230 billion (9 percent), from $2.4 trillion to $2.7 trillion. Payroll tax revenue – which primarily comes from the 12.4 percent Social Security payroll tax and the 2.9 percent Medicare payroll tax – increased by $39 billion (2 percent) to $1.7 trillion. Specifically, Social Security payroll tax revenue grew by $24 billion (2 percent) to $1.3 trillion, while Medicare payroll tax revenue increased by $8 billion (2 percent), from $387 billion to $395 billion. Other payroll tax revenue grew by $7 billion (11 percent), from $62 billion to $69 billion. Estate and gift tax revenue fell by $2 billion (7 percent), from $32 billion to $29 billion.

Corporate income tax revenue declined by $78 billion (15 percent), from $530 billion to $452 billion, driven in part by a provision in the One Big Beautiful Bill that allowed businesses to take larger tax deductions for certain investments in 2025. In addition, a delay in tax payments for corporations located in areas affected by natural disasters shifted corporate income taxes that would’ve been collected in FY 2023 into FY 2024, thus inflating the amount of corporate income tax revenue collected in FY 2024.

Excise tax revenue grew by $5 billion (4 percent), from $101 billion to $106 billion. Customs duties surged by $118 billion (153 percent), from $77 billion to $195 billion, because of the Trump Administration’s tariffs. Revenue from other sources grew by $5 billion (11 percent), from $43 billion to $48 billion. Specifically, remittances from the Federal Reserve to the U.S. Treasury grew by $2 billion (75 percent), from $3 billion to $5 billion.

Breaking Down the $1.8 Trillion FY 2025 Budget Deficit

| Budget Area |

FY 2025 |

FY 2024 | $ Change |

% Change |

| Social Security |

$1.6 trillion |

$1.5 trillion | +$120 billion |

+8% |

| Medicare |

$997 billion |

$874 billion | +$123 billion |

+14% |

| Medicaid |

$668 billion |

$618 billion | +$51 billion |

+8% |

| Children’s Health Insurance Program |

$23 billion |

$19 billion | +$4 billion |

+19% |

| Affordable Care Act Premium Tax Credits |

$129 billion |

$110 billion | +$19 billion |

+17% |

|

Earned Income Tax Credit |

$66 billion | $60 billion | +$6 billion |

+10% |

| Child Tax Credit |

$27 billion |

$26 billion | +$0.3 billion |

+1% |

| National Defense |

$917 billion |

$874 billion | +$43 billion |

+5% |

| Veterans’ Benefits and Services |

$377 billion |

$326 billion | +$52 billion |

+16% |

| Department of Agriculture |

$227 billion |

$203 billion | +$24 billion |

+12% |

| Department of Education |

$35 billion |

$268 billion | -$233 billion |

-87% |

| Department of Homeland Security |

$115 billion |

$89 billion | +$26 billion |

+29% |

| Federal Deposit Insurance Corporation |

-$31 billion |

$37 billion | -$68 billion |

-184% |

| Environmental Protection Agency |

$37 billion |

$14 billion | +$23 billion |

+170% |

| Other Non-Interest Spending |

$872 billion |

$874 billion | -$2 billion |

-0.3% |

| Net Interest |

$970 billion |

$881 billion | $89 billion |

+10% |

|

Total Spending |

$7.0 trillion | $6.7 trillion | +$275 billion |

+4% |

| Individual Income Taxes |

$2.7 trillion |

$2.4 trillion | +$230 billion |

+9% |

| Payroll Taxes |

$1.7 trillion |

$1.7 trillion | +$39 billion |

+2% |

| Estate and Gift Taxes |

$29 billion |

$32 billion | -$2 billion |

-7% |

| Corporate Income Taxes |

$452 billion |

$530 billion | -$78 billion |

-15% |

| Excise Taxes |

$106 billion |

$101 billion | +$5 billion |

+4% |

| Customs Duties |

$195 billion |

$77 billion | +$118 billion |

+153% |

| Other Taxes |

$48 billion |

$43 billion | +$5 billion |

+11% |

| Total Revenue |

$5.2 trillion |

$4.9 trillion | +$317 billion |

+6% |

| Total Budget Deficit |

-$1.8 trillion |

-$1.8 trillion | -$41 billion |

-2% |

Sources: U.S. Department of the Treasury and author’s calculations. Numbers may not sum due to rounding.

Total federal spending increased by $275 billion between FY 2024 and FY 2025, growing from $6.7 trillion (23.4 percent of GDP) to $7.0 trillion (22.7 percent of GDP). Social Security spending increased by $120 billion (8 percent), from $1.5 trillion to $1.6 trillion, driven by the 2.5-percent cost-of-living adjustment for 2025 and an increase in the number of Social Security beneficiaries. Medicare spending rose by $123 billion (14 percent), from $874 billion to $997 billion, due to increased enrollment and higher payment rates for services. Medicaid spending increased by $51 billion (8 percent), from $618 billion to $668 billion, because of higher per-enrollee costs. Children’s Health Insurance Program spending rose by $4 billion (19 percent), from $19 billion to $23 billion, and spending on the Affordable Care Act’s (ACA) Premium Tax Credits increased by $19 billion (17 percent), from $110 billion to $129 billion, because of increased in enrollment in health insurance purchased in ACA marketplaces.

Spending on the Earned Income Tax Credit rose by $6 billion (10 percent), from $60 billion to $66 billion, while spending on the Child Tax Credit increased by just $0.3 billion (1 percent), from $26 billion to $27 billion. National defense spending increased by $43 billion (5 percent), from $874 billion to $917 billion, while spending on veterans’ benefits and services rose by $52 billion (16 percent), from $326 billion to $327 billion, because of increased per-person spending and use of health care facilities by veterans.

Department of Agriculture spending increased by $24 billion (12 percent), from $203 billion to $227 billion, because of funding provided in December 2024 for expenses related to crop losses experienced in 2023 and 2024. Department of Homeland Security spending rose by $26 billion (29 percent), from $89 billion to $115 billion, mostly because of greater spending on disaster response by the Federal Emergency Management Agency.

Department of Education spending decreased by $233 billion (87 percent), from $268 billion to $35 billion, for several reasons. One is an accounting maneuver in which the Trump Administration recorded a $131 billion reduction in outlays in September to reflect the One Big Beautiful Bill’s modifications to the federal student loan program. Another reason is a roughly $50 billion reduction in the estimated costs of outstanding federal student loans. The final reason is a $42 billion reduction in spending from the Education Stabilization Fund.

Federal Deposit Insurance Corporation (FDIC) spending fell by $68 billion (184 percent), from $37 billion to -$31 billion. In FY 2024, the FDIC’s spending was substantial as it helped resolve bank failures from 2023. In FY 2025, the FDIC’s spending was offset by the proceeds from liquidating the assets of failed banks. Spending by the Environmental Protection Agency increased by $23 billion (170 percent), from $14 billion to $37 billion, because of a disbursement of funds in November and December of 2024 for a grant program established by the Inflation Reduction Act.

Other non-interest spending fell by $2 billion (0.3 percent), from $874 billion to $872 billion.

Interest payments on the national debt increased by $89 billion (10 percent), from $881 billion to $970 billion. As was the case in FY 2024, interest spending was the third-largest federal government expenditure, exceeded only by Social Security and Medicare. Interest costs exceeded federal spending on national defense and were also higher than spending on Medicaid, food and nutrition services, and veterans’ benefits and services, among other federal programs.

Put differently, 19 percent of all revenue collections in FY 2024 went toward interest payments on the national debt.

Conclusion

While the budget deficit fell modestly between FY 2024 and FY 2025, annual deficit spending has long been far too high, as evidenced by the rapid growth in national debt. As has also long been the case, lawmakers must act to shore up Social Security and Medicare, raise additional revenue, and curb wasteful government spending to get the national debt on a sustainable long-term trajectory.