Insight

November 12, 2025

Unpacking Trump’s Meat Packing Allegations

Executive Summary

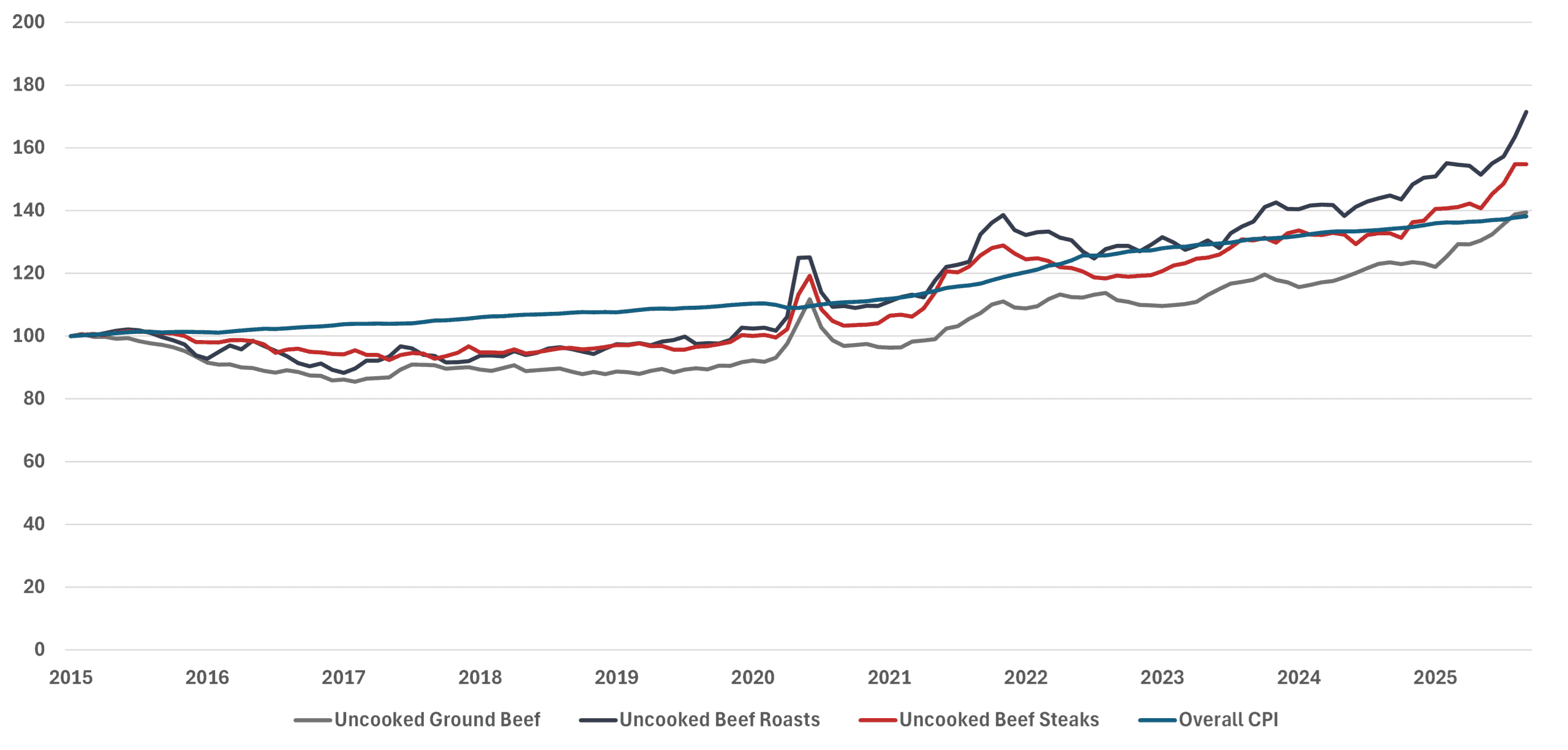

- On November 7, 2025, President Donald Trump directed the Department of Justice to launch an investigation into the nation’s largest meat packing companies as the prices of ground beef and beef steak are up 12.3 percent and 12.7 percent from a year ago, more than four-times the rate of overall inflation.

- This action follows the president’s social media post accusing the nation’s meat packing companies of driving up beef prices through “Illicit Collusion, Price Fixing, and Price Manipulation,” and specified “Majority Foreign Owned Meat Packers” are artificially inflating prices.

- The meat packing industry is highly concentrated, dominated by four firms; yet the data show that the inflation-adjusted farm-to-wholesale choice beef price spread narrowed in recent years following a multi-year expansion that began in 2016, suggesting meat packers were unable to exercise market power and that other economic and natural forces could be behind rising beef prices.

Introduction

On November 7, 2025, President Donald Trump directed the Department of Justice to launch an investigation into the nation’s largest meat packing companies as the prices of ground beef and beef steak are up 12.3 percent and 12.7 percent from a year ago, more than four-times the rate of overall inflation.

This action came on the heels of the president’s social media post accusing the nation’s meat packing companies of driving up beef prices through “Illicit Collusion, Price Fixing, and Price Manipulation,” and specified “Majority Foreign Owned Meat Packers” for artificially inflating prices.

The meat packing industry is highly concentrated, dominated by four firms. Yet the data show that the inflation-adjusted farm-to-wholesale choice beef price spread narrowed in recent years following a multi-year expansion that began in 2016. This suggests that meat packers have been unable to exercise market power and that other economic and natural forces are behind rising beef prices.

President Trump’s Allegations

President Trump posted on social media allegations that the nation’s meat packing companies were “driving up the price of Beef through Illicit Collusion, Price Fixing, and Price Manipulation.” He added that “Majority Foreign Owned Meat Packers, who artificially inflate prices, and jeopardize the security of our Nation’s food supply.”

In response, the White House published an article that detailed the allegations, labeling the foreign-owned meat packers “cartels.”

The president has not shied away from labeling specific industries “cartels,” accusing the nation’s largest home builders in early October of sitting on undeveloped lots to drive up home prices.

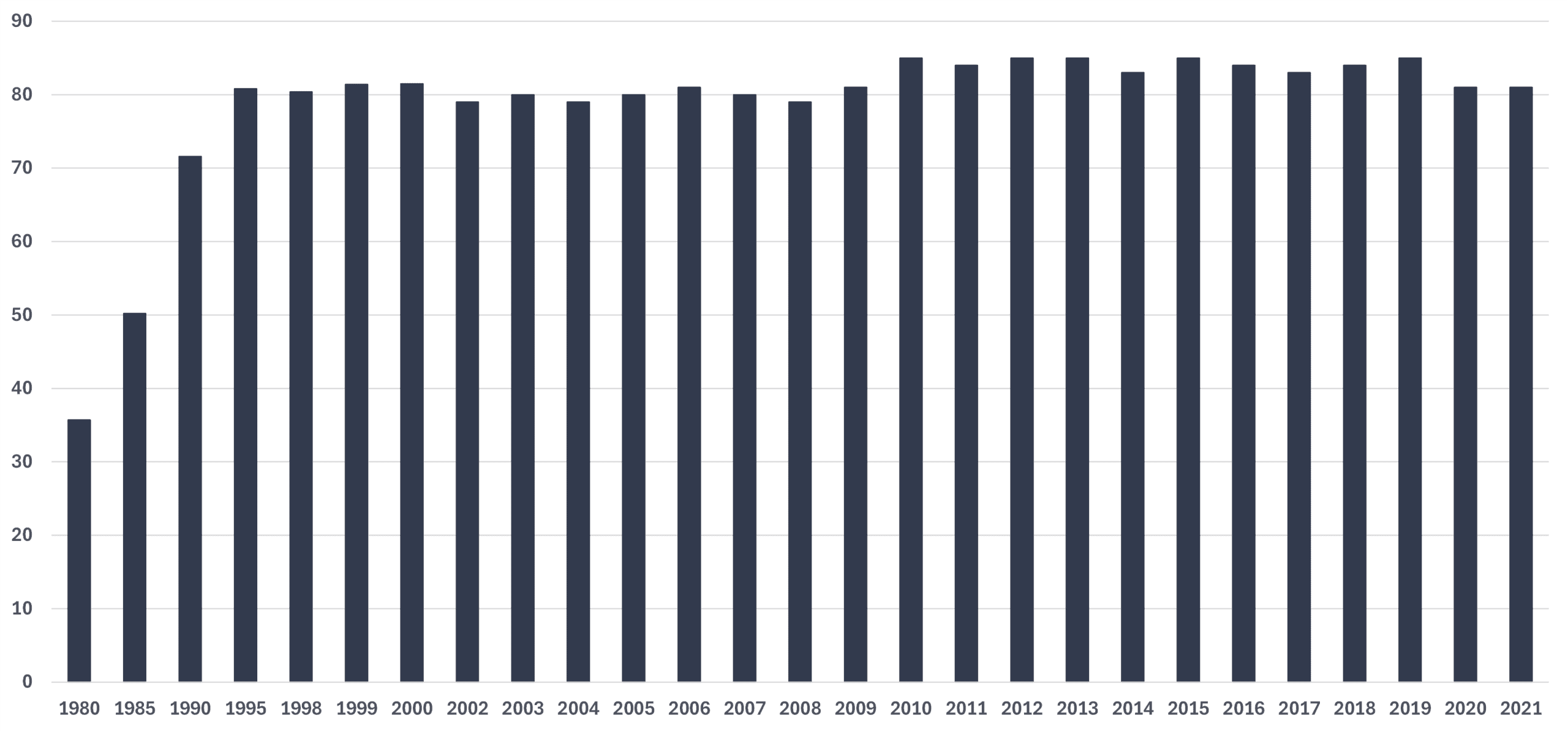

“For too long,” the White House release stated, “a handful of giant meat packers have squeezed America’s cattle producers, shrunk herds, and jacked up prices at the grocery store.” The White House noted that the “Big Four” meat packers – JBS, Cargill, Tyson Foods, and National Beef – account for 85 percent of the U.S. beef processing market, up from 36 percent in 1980, and noted that industry consolidation has “led to the exploitation of American consumers, farmers, and ranchers.”

The president called upon the Department of Justice to investigate these meat packers for “potential collusion, price fixing, and price manipulation.” Such allegations, if true, would mean the meat packers are in violation of the nation’s antitrust laws, including Section 1 of the Sherman Act that prohibits contracts or conspiracies in restraint of trade. Price fixing is a per se violation of Section 1, meaning it is intrinsically illegal with no further legal analysis needed.

In response to the president’s directive, U.S. Attorney General Pamela Bondi stated on social media that the agency has launched an investigation led by Assistant Attorney General Gail Slater, head of the Antitrust Division, in partnership with Secretary of Agriculture Brooke Rollins.

Beef Prices

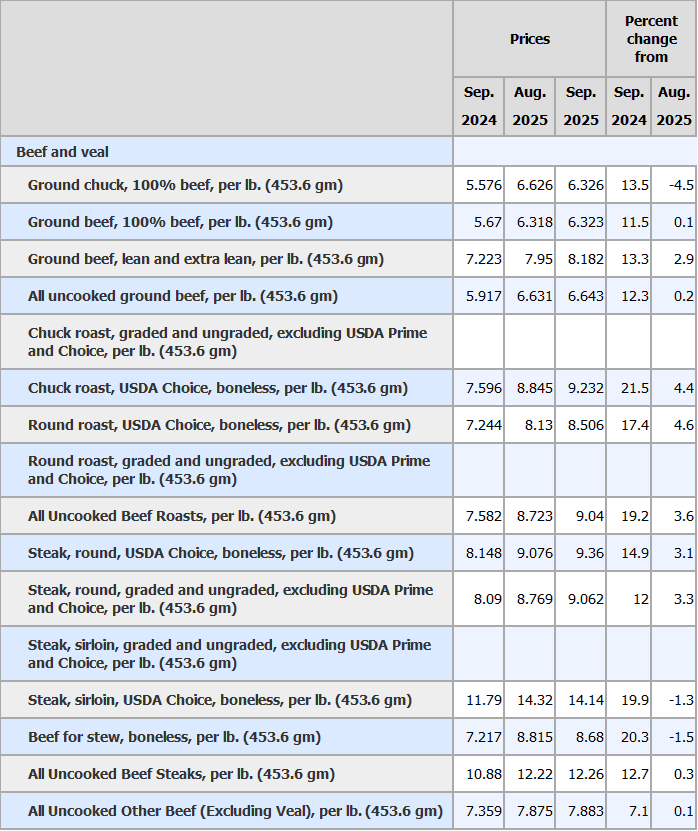

Beef prices have put a noticeable dent in consumers’ wallets, outpacing overall inflation since mid-2023. The price of all uncooked ground beef rose to $6.64 per pound, a 12.3- percent increase from a year ago in September 2025. The price of all uncooked beef steaks reached $12.26 per pound, up 12.7 percent from a year ago, while uncooked beef roasts surged 19.2 percent to $9.04 per pound.

Figure 1: Consumer Price Index: Beef Prices, Seasonally Adjusted, January 2015 = 100

*Source: Bureau of Labor Statistics (CUSR0000SEFC01, CUSR0000SEFC02,

CUSR0000SEFC03, CUSR0000SA0)

Figure 2: Consumer Price Index: Beef Prices, Y/Y % Change

*Source: Bureau of Labor Statistics (CUUR0000SEFC01, CUUR0000SEFC02,

CUUR0000SEFC03, CUUR0000SA0)

Figure 3: Average Retail Food Prices, U.S. City Averages, $

*Source: Bureau of Labor Statistics Average Retail Food and Energy Prices

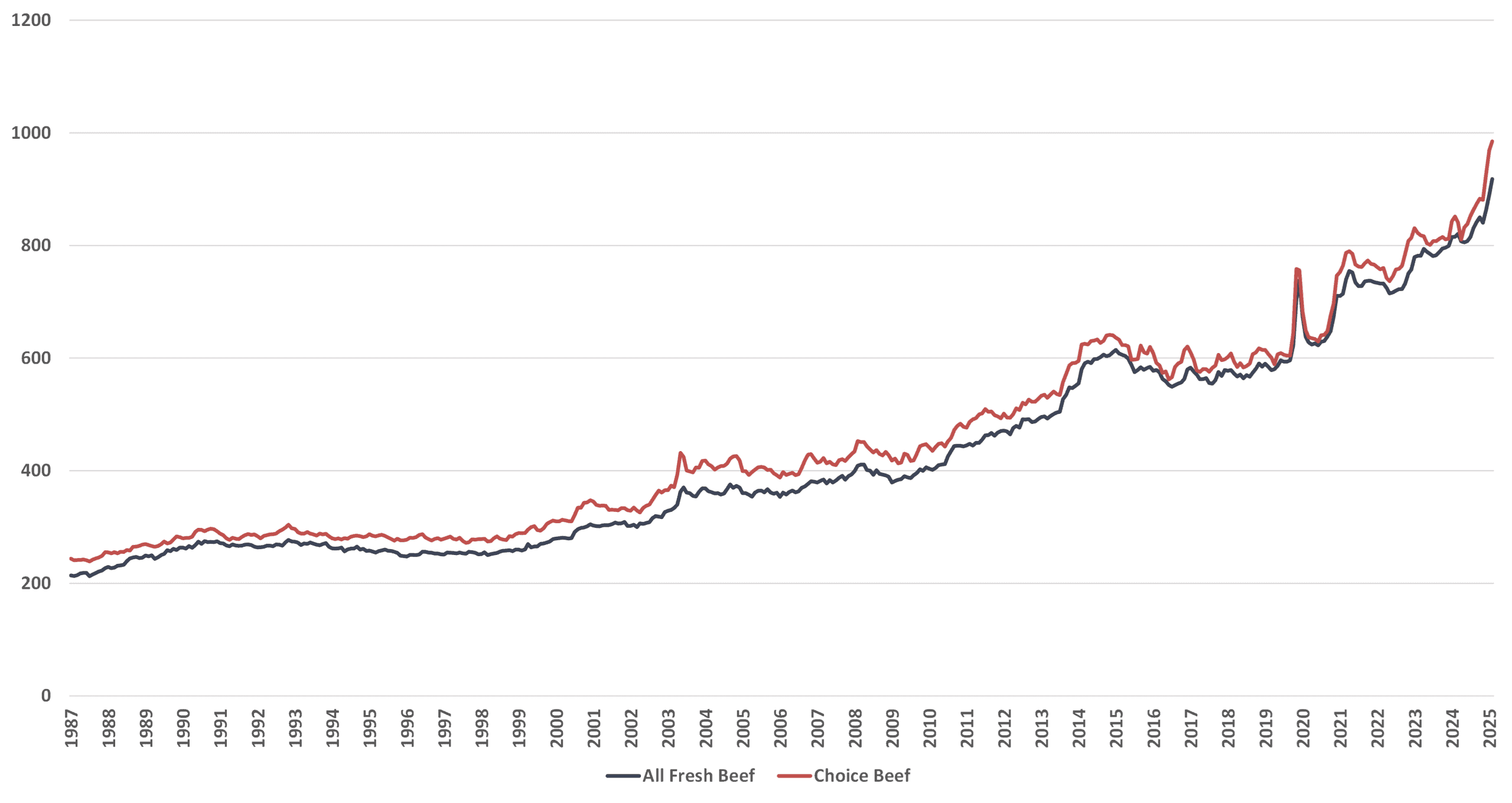

Figure 4. Nominal Beef Prices (Cents per Pound)

*Source: USDA Meat Price Spreads

Meat Packing Concentration

The meat packing industry is highly concentrated, dominated by four firms – JBS, Cargill, Tyson Foods, and National Beef – with 81 percent market share according to the most recent report from the United States Department of Agriculture (USDA). Notably, the four-firm concentration ratio has not materially changed over the past 30 years.

Figure 5: Annual Meat Packing Four-firm Concentration Ratio, Steers and Heifers, %

Source: 2002 Assessment of the Cattle and Hog Industries; 2012 and 2021 & 2022 Packers and Stockyards Division: Annual Report

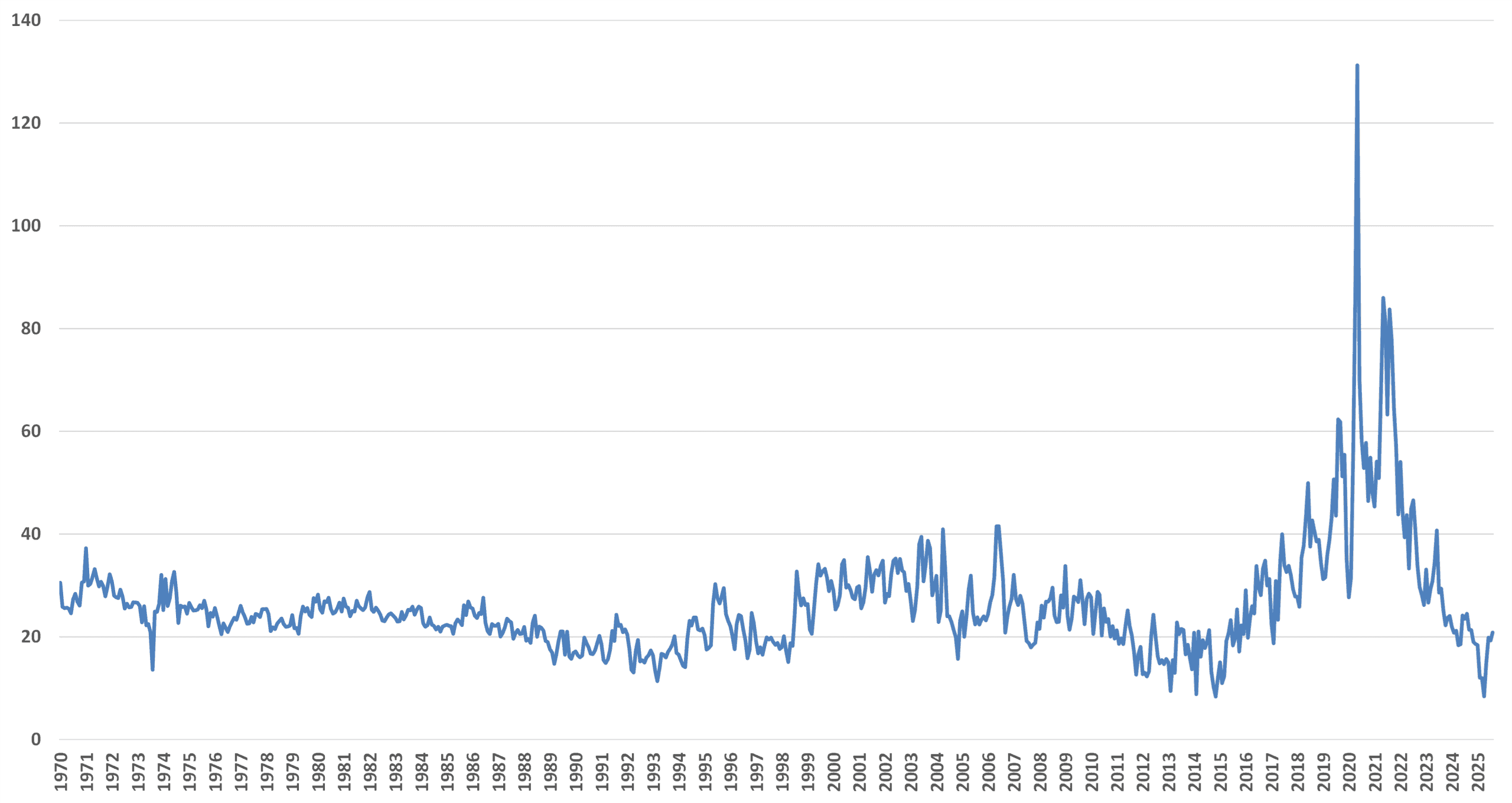

President Trump claims that the high level of market concentration enables firms to coordinate to fix or manipulate prices. If this were true, we would expect to see a growing gap between the prices meat packers pay to farmers and what they receive at the wholesale market. Yet the inflation-adjusted farm-to-wholesale choice beef price spread from the USDA – which is the difference between the average monthly price paid by meat packers for choice-graded cattle and the wholesale value received by the meat packers – has narrowed in recent years. This suggests that the meat packers have been unable to flex market power or collude to fix prices to increase margins. After reaching a COVID-19 pandemic-related high of $131 per hundredweight (as a result of several plant closures and reduced capacity) – which is a unit of measure equal to 100 pounds of beef – that spread fell to just over $20 in August 2025.

Figure 6: Inflation-adjusted Farm-to-wholesale Choice Beef Price Spread (Dollars per Hundredweight)

*Source: USDA Meat Price Spreads; author’s calculations; deflated using Bureau of Labor Statistics PPI industry data for Animal, except poultry, slaughtering, not seasonally adjusted (PCU311611311611)

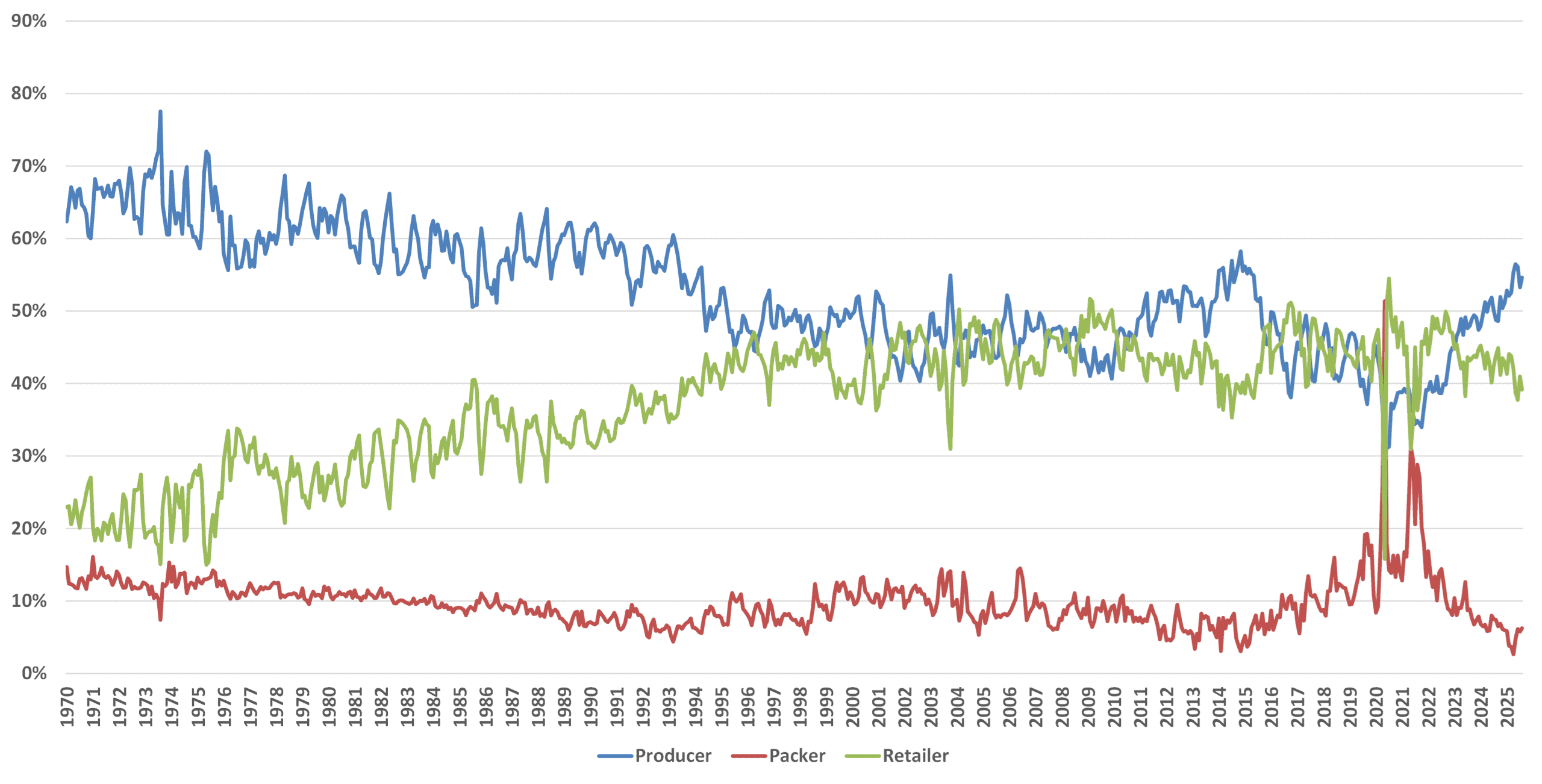

Moreover, the USDA data show that meat packers receive the lowest share of each retail dollar for choice beef, averaging 5 percent from January–August 2025. Producers, meanwhile, averaged a 54-percent share, and retailers accounted for the remaining 41 percent.

Figure 7. Share of the Retail Value for Choice Beef, %

*Source: USDA Meat Price Spreads; author’s calculations

Recent profit tracking data from Drovers showed that meat packer margins were -$170.55 per head (a standard industry measure representing a single live animal), during the week ending November 1, 2025, a slight improvement from the -$253.28 in the prior week. The group estimated that meat packer margins will average -$165.96 per head in 2025, a much steeper loss than the -$75.43 in 2024. In other words, meat packers will have been operating at a loss for two consecutive years.

There is little evidence to support the president’s claim that the concentrated meat packing industry is engaging in price fixing or other illegal behavior to earn greater margins at the expense of farmers and consumers. In fact, meat packer margins have been shrinking for several years.

Other Forces Better Explain Rising Beef Prices

Economic Forces

The laws of supply and demand offer a more plausible explanation for rising beef prices than does market concentration. Supply shocks – like those that caused egg prices to soar and led to similar accusations of market power by egg producers – likely had the same effect on beef prices.

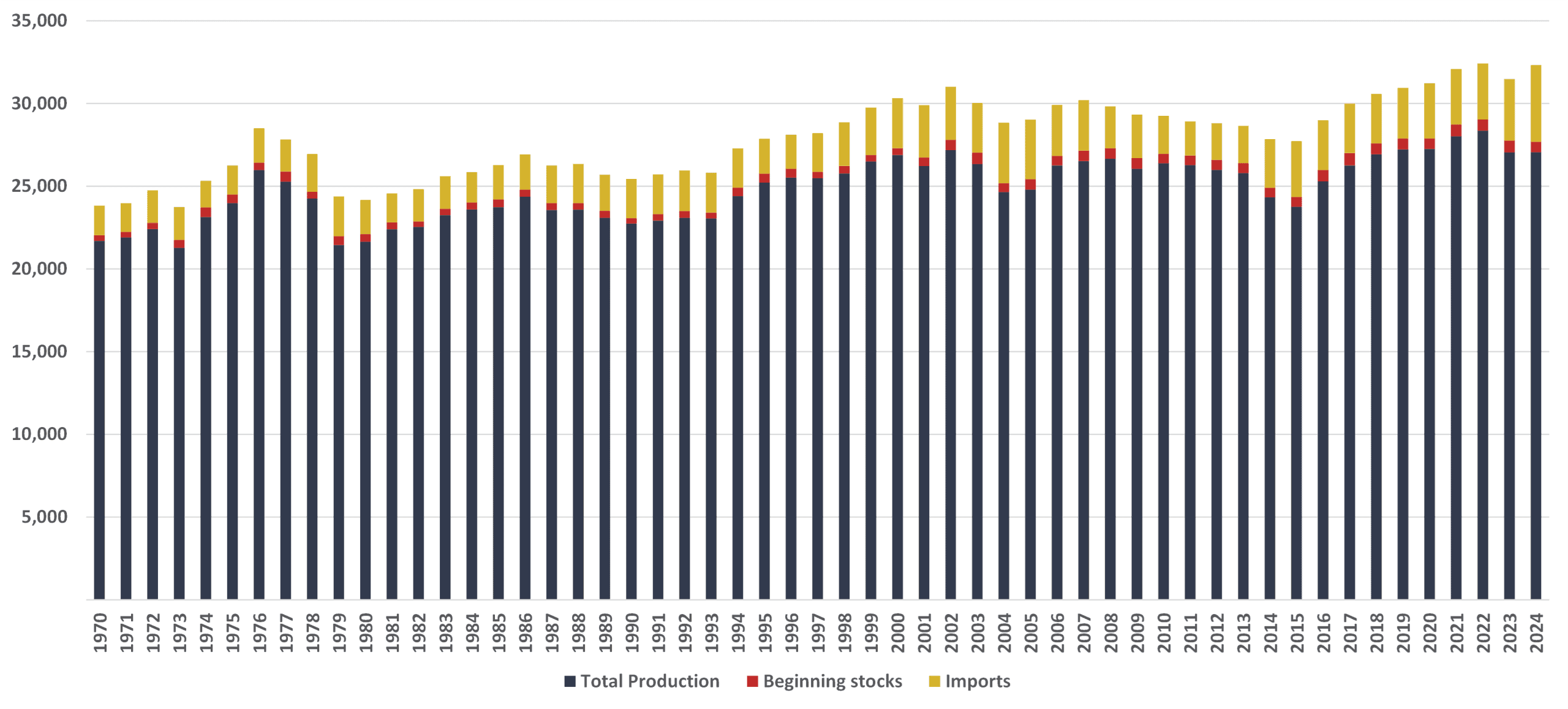

Data from the USDA show that supply increased 3 percent in 2024 to 32,324 million pounds. Domestic production, however, was unchanged from the prior year while beginning stocks – which measures the amount of beef remaining from the previous year’s production – sank 11.9 percent. The gain in supply resulted from a 24-percent surge in imports.

Figure 8: Total Beef Supply, Carcass Weight, Million Pounds

*Source: USDA Livestock and Meat Domestic Data

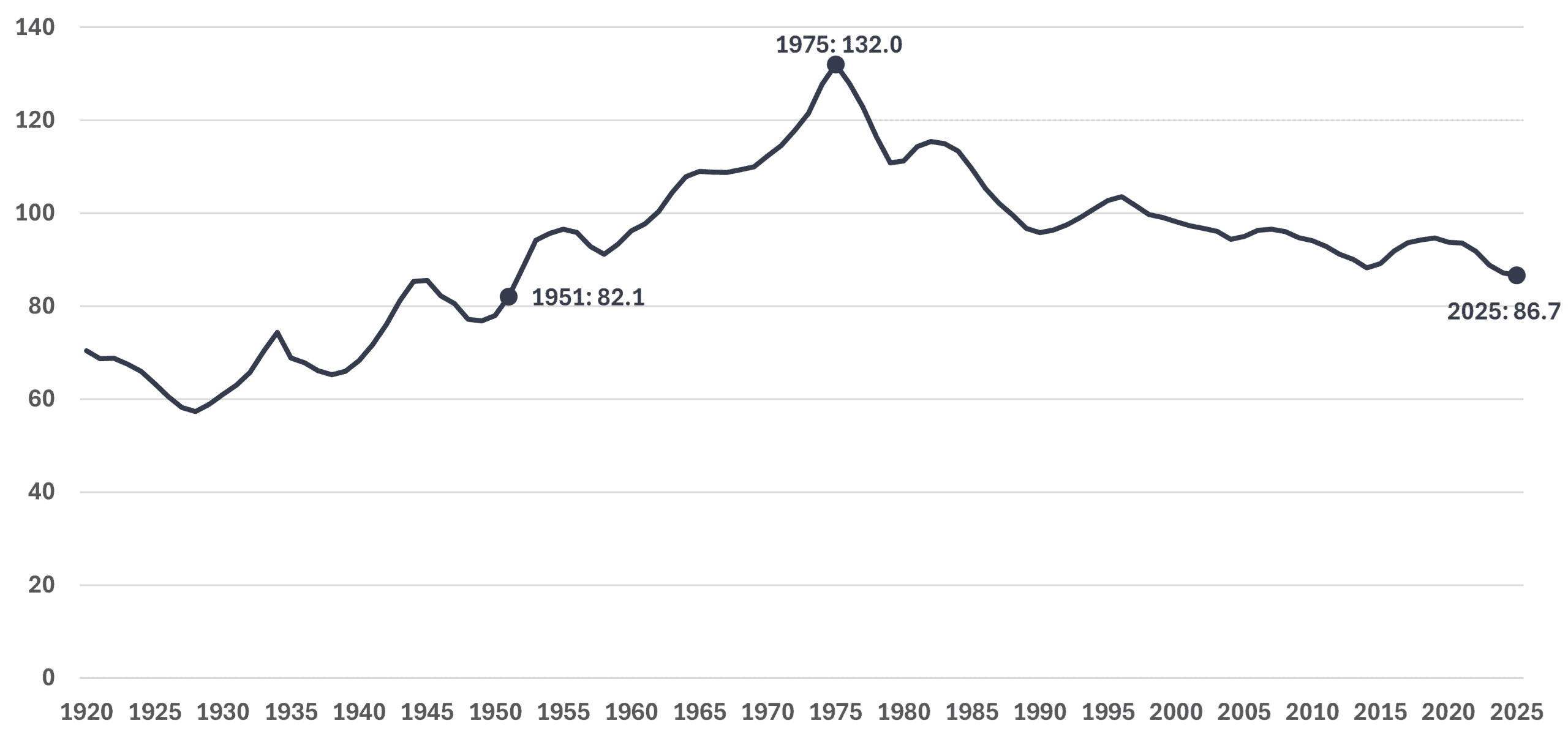

Cattle inventory fell 0.6 percent in 2025 from the prior year to 86.7 million, the lowest since 1951, and the sixth-straight annual decline. Since 2019 – which was the last time beef cattle inventory had an annual increase – inventories have declined by 8.5 percent.

Figure 9: Cattle Inventory, Head Count (Millions)

*Source: USDA National Agricultural Statistics Service

One would expect farmers and ranchers to take advantage of rapidly rising beef prices by expanding sales. Yet with inventory at historically low levels, they cannot readily increase domestic production to meet consumer demand. Chief agricultural economist for the Wells Fargo Agri-Food Institute Michael Swanson stated that “it takes three years to get more cows – between making a decision, having that gestation period, having the calf born, raising the calf until it, too, can have a calf.” In other words, an immediate response to market conditions is limited by basic biology.

Demand, however, is still increasing. Kansas State University’s Monthly Domestic Meat Demand Indices showed demand for all-fresh retail beef was up 7.01 percent in July 2025 from a year ago, while demand for choice retail beef was up nearly 11 percent.

Supply constraints amid rising demand have lifted the price of beef.

Mother Nature

Recently, the USDA took action to mitigate the risk of New World Screwworm (NWS) infestation, restricting the supply of imported live cattle. Reuters described NWS as “a devastating parasite that eats cattle and other wild animals alive” and noted that it has been “traveling north from Central America to Mexico and has crept past biological barriers that kept the pest contained for decades.” According to the USDA, the United States has “ordered the suspension of livestock imports through ports of entry along our southern borders after the continued spread of the [NWS] in Mexico.” This will add further strain to an already dwindling cattle inventory.

Drought conditions have also plagued farmers and ranchers in recent years. The New York Times explained that amid strong profits in 2014, farmers and ranchers expanded their herds over the next five to six years. As supply increased, the price ranchers received for cattle fell, “just as a drought began across the Western United States. … With less grass for their cattle to graze on, ranchers had to buy more feed for their herds to subsist on, raising their costs. As the drought persisted, many ranchers decided to sell some cattle and downsize their herd.” Furthermore, the Times described, meat packing plants closed, which “meant fewer processors needed cattle, depressing the price that ranchers received.” But as Swanson explained, it takes years for ranchers and farmers to rebuild their herds to satisfy demand amid high prices.

Conclusion

President Trump’s accusation that the nation’s meat packing companies have engaged in “Illicit Collusion, Price Fixing, and Price Manipulation” to drive up beef prices is unsupported by the evidence.

While the meat packing industry is highly concentrated, the inflation-adjusted farm-to-wholesale choice-beef price spread has narrowed, while other data show meat packers are operating at a financial loss during a period of high beef prices. This suggests that other forces, both economic and natural, are more likely causes of soaring beef prices for consumers.