Insight

January 8, 2026

Virginia’s New Data Center Electricity Rate Class

Executive Summary

- Virginia’s State Corporation Commission (SCC) has approved a new electricity rate for large-scale customers, notably artificial intelligence (AI) data centers; starting in January 2027, affected customers must pay for at least 85 percent of contracted distribution and transmission demand and 60 percent of generation demand.

- The measure is designed to protect other ratepayers from rising electricity costs associated with data center expansion; AI data center demand contributed to an 833-percent increase in PJM’s (a regional transmission organization) capacity market auction price for 2025–2026 compared to the previous year, and Virginia energy demand is projected to rise 183 percent by 2040.

- This insight explains Virginia’s new rate class and the main factors driving this regulation.

Introduction

In November 2025, Virginia’s retail electricity market regulator, the State Corporation Commission (SCC), approved a new electricity rate class for large-scale customers, notably artificial intelligence (AI) data centers. Requested by Dominion Energy and starting in January 2027, affected customers must pay for at least 85 percent of contracted distribution and transmission demand and 60 percent of generation demand.

The measure is designed to protect other ratepayers from rising electricity costs associated with dramatic data center expansion in the Commonwealth. AI data center power demand in Virginia has contributed to an 833-percent increase in the 2024 PJM (a regional transmission organization) auction prices for the 2025–2026 market and is estimated to drive up the Commonwealth’s energy demand by 183 percent by 2040.

This insight explains Virginia’s new rate class for data centers and the main factors driving this regulation and provides an overview of the historic electricity price trends in the Commonwealth.

Virginia’s New Rate Class for Data Centers

Virginia’s retail electricity market is largely regulated by the State Corporation Commission (SCC), which oversees Dominion Energy in Virginia, the other two investor-owned electric companies, and a number of electric cooperatives—which are not-for-profit organizations owned and operated by their members.

Dominion Energy, the largest utility company in Virginia, currently serves about 450 data centers among its approximately 2.7 million customers in the state. The company is required to get approval from the SCC to increase the electricity rates it charges as well as the authorized rate of return on its equity.

In November 2025, the SCC approved Dominion’s request to create a new rate class, “GS-5 rate class,” for the largest electricity users—including data centers, which use over 25 megawatts (MW). This new rate class takes effect in January 2027. Additionally, the SCC requires that these customers “pay a minimum of 85 percent of contracted distribution and transmission demand, and 60 percent of generation demand” to “help insulate ratepayers from the costs around the rapid build-out and construction of infrastructure to support businesses such as data centers.”

The SCC also partially approved Dominion’s request for increased rates on customers and rate of return. Instead of Dominion’s requested base-rate increases of $822 million in 2026 and $345 million for 2027, the SCC has allowed an increase of $565.7 million in 2026 and $209.9 million in 2027. This would lead to monthly increases of $11.24 in a typical residential customer’s electricity bill in 2026 and $2.36 in 2027.

Regarding the rate of return on Dominion’s equity, the SCC rejected Dominion’s request for a 10.4 percent increase, instead approving a slight increase to 9.8 percent from 9.7 percent.

Dominion will require the new rate class of large-scale customers to sign a 14-year contract, regardless of whether they actually end up building the data centers or using all the power they estimate they will need. This requirement is aimed at shielding other customers from incurring part of the rising costs from data centers or other large-scale customers.

Earlier last year, Ohio and Oregon approved similar measures to require data center customers to pay a minimum percentage share of the electricity they estimate they need, even if they use less.

Factors That Motivate the Creation of a New Rate Class for Data Centers in Virginia

AI data centers are sharply boosting Virginia’s power demand

A previous American Action Forum’s (AAF) insight explained why AI data centers are so energy hungry. Electricity demand from AI data centers is estimated to jump from 4.4 percent of total U.S. electricity consumption in 2023 to 6.7–12 percent by 2028. Driven by data centers, Virginia’s energy demand is set to skyrocket 183 percent by 2040, compared to just 15 percent without the growth from AI data centers.

Virginia’s wholesale market (which involves the sale of electricity between utilities and electricity traders) is part of the Pennsylvania-New Jersey-Maryland Interconnection (PJM), a regional transmission organization that coordinates wholesale electricity activities across multiple states including Virginia, Maryland, New Jersey, and the District of Columbia.

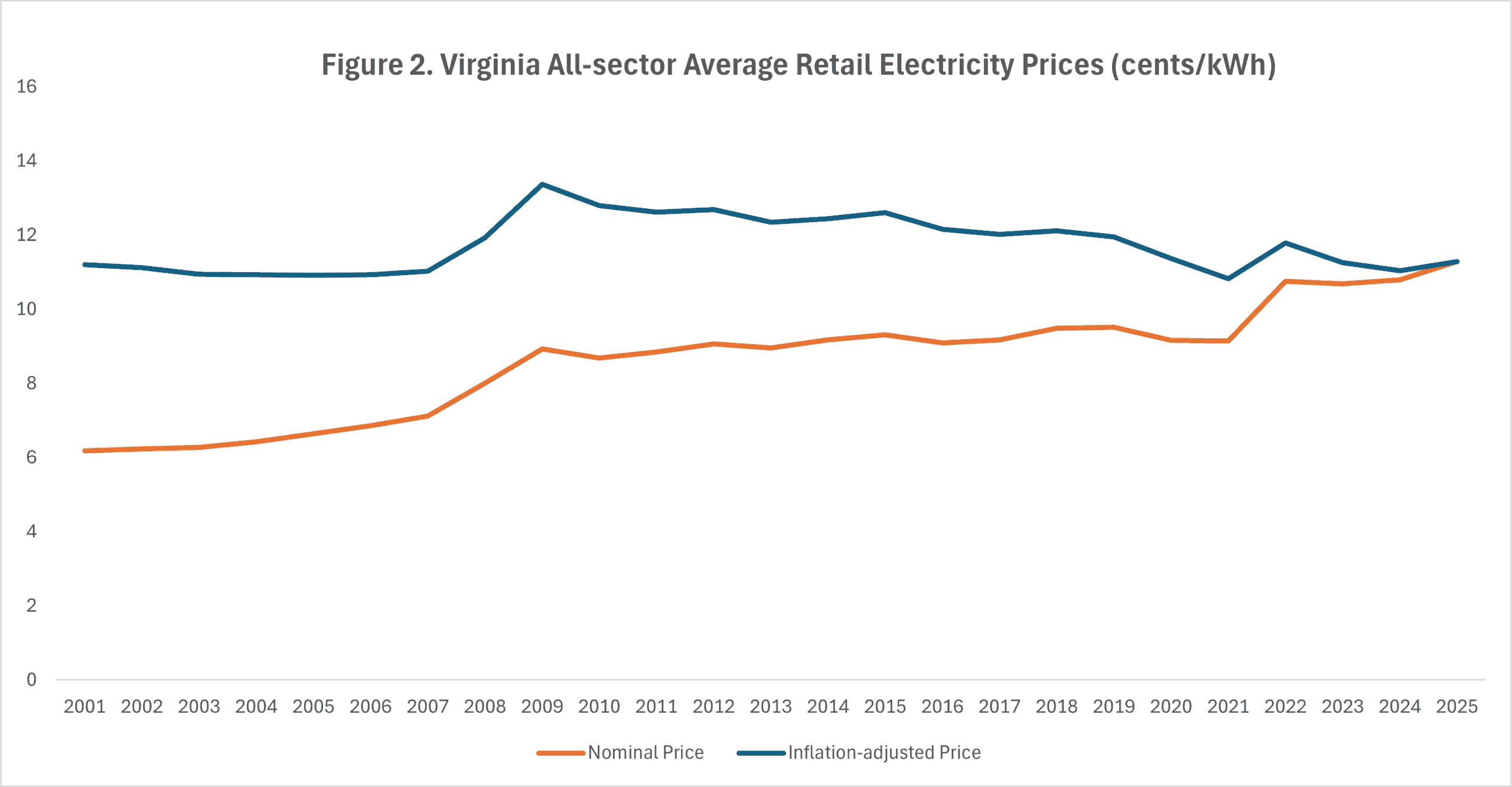

The Dominion Energy delivery zone of PJM (DOM Zone) includes Dominion Energy’s transmission territory in Virginia and parts of North Carolina. Summer peak load across PJM is estimated to rise by 48 percent from 2025–2045, exceeding the current generating capacity in PJM by around 45,000 MW.

DOM Zone’s summer peak load is estimated to increase significantly faster than that across the PJM—by 121 percent between 2025–2045. Additionally, for both summer and winter peak load forecasts, DOM Zone is highest among all those in PJM, around double the average load growth across the PJM area over a 10-, 15-, and 20-year period.

As shown in Figure 1, PJM has adjusted its load forecasts for the DOM Zone significantly upward for the past few years, with the steepest jump between the forecast in 2022 and 2023 primarily driven by data centers’ growing demand.

Source: Dominion Energy 2025 Integrated Resource Plan Update

Source: Dominion Energy 2025 Integrated Resource Plan Update

Concerns of higher electricity costs for residential consumers

Surging electricity prices are garnering significant media attention and fueling political debate at both the state and federal levels. U.S. national retail electricity prices increased at a drastic 10-percent nominal growth rate over the first half of 2025. Some states saw larger increases in nominal retail electricity prices from July 2024 to July 2025, such as the District of Columbia (24.5 percent), Maine (22.9 percent), and New Jersey (21.6 percent).

There is significant opposition to the expansion of data centers from local communities. The Data Center Watch reported that community resistance has successfully blocked or delayed $64 billion in data center projects nationwide as of March 2025. In Virginia alone, there are 42 activist groups and 12,000 petition signatures pushing back against the development of data centers.

Local residents typically express concerns about the impact of data center infrastructure in their communities. Common complaints include the negative aesthetic impact of data center infrastructure, heavy water demand, increased noise levels, and environmental concerns. Chief among these concerns, however, are fears that data centers will place a strain on the electricity grid and drive up utility bills for households.

In 2023, the Joint Legislative Audit and Review Commission (JLAR) commissioned an independent study of the impact of data centers in Virginia. AAF’s previous analysis provided an overview of the report’s 20-year projection of Virginia’s future generating capacity and whether it will be able to meet the AI data centers’ growing demand.

The JLAR study concludes that “[d]ata centers are currently paying their full cost of service, but growing energy demand is likely to increase other customers’ costs.” It lists several reasons why that might be the case. First, fixed costs of building substantial new generation and transmission infrastructures to satisfy the rising data center demand will need to be recovered from all customers. Second, power demand outpacing supply will likely drive up electricity prices. Third, utilities’ import of power from other sources will make them more vulnerable to spikes in energy market prices.

Historic Electricity Price Trends in Virginia

What factors affect the utility bill for consumers?

Utility bills are calculated differently based on the customer’s rate schedule, which varies by customer type and energy use patterns. Generally, utility bills are comprised of three sections: electricity supply charges, distribution service charges, and taxes, fees, and charges. Electricity supply charges consist of generation, transmission, and fuel costs, altogether accounting for roughly two-thirds of an electric bill. The distribution service charge covers the cost of equipment and infrastructure used to deliver electricity from local substations to customers.

Additionally, utility bills include several additional charges. The deferred fuel cost charge is a mandatory charge required by the Virginia SCC, allowing utilities to recover previously incurred, unanticipated fuel charges in future billing periods. Utility bills also include various taxes and fees required by the Commonwealth. Most of these charges are calculated based on the customer’s consumption.

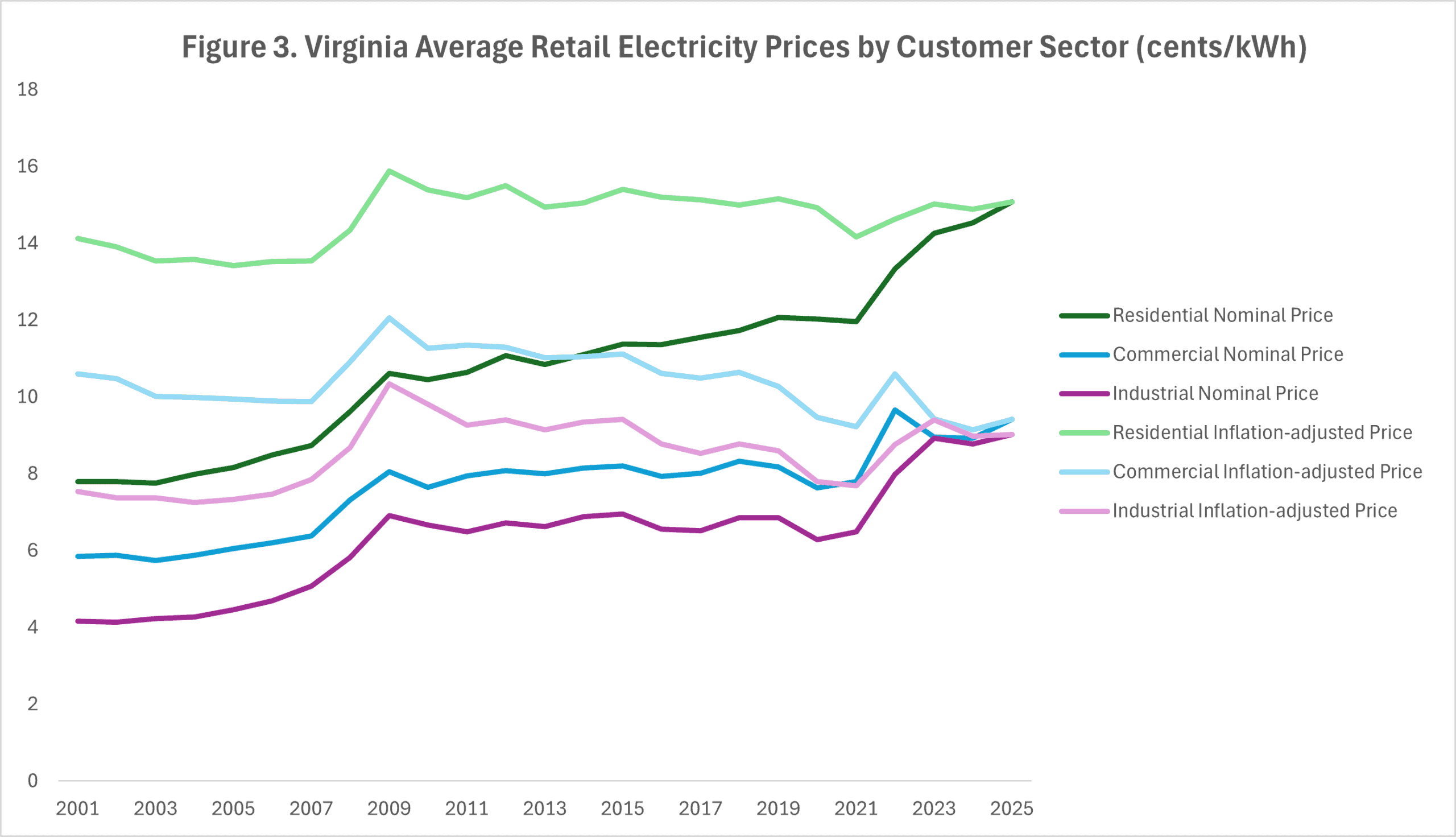

Retail electricity price trends

Electricity prices in Virginia across sectors have been nominally increasing since 2000, with sharp increases from 2007–2009 and 2021–2022 (Figure 2). Adjusting for inflation, however, reveals that retail electricity prices in Virginia have not shown significant growth. The inflation-adjusted average price in 2025 (as of July) is 11.29 cents per kilowatt-hour, which is not much higher than the inflation-adjusted price from 2001, at 11.20 cents per kilowatt-hour.

Source: Energy Information Administration

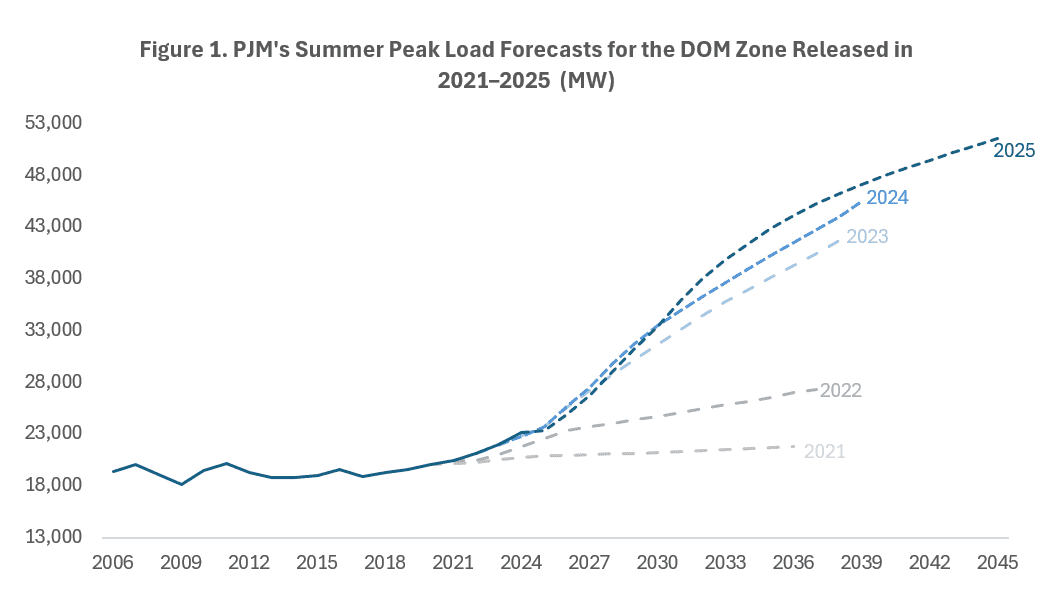

Electricity price trends are more varied when examined by customer sector. As shown in Figure 3, residential and industrial electricity inflation-adjusted prices have increased between 2001–2025—by 0.96 cents per kilowatt-hour for residential and 1.48 cents per kilowatt-hour for industrial. Meanwhile, commercial inflation-adjusted prices showed the opposite trend, decreasing from 10.60 cents per kilowatt-hour in 2001 to 9.42 cents per kilowatt-hour in 2025.

Source: Energy Information Administration

Capacity market price trends

The capacity market under PJM coordinates wholesale electricity among power generators and utilities for reselling the electricity to consumers. The major goal of a capacity market auction is to reward power suppliers that invest in capacity to meet future peak load requirements to ensure reliable operation of the grid. Notably, capacity auctions do not reflect the prices of energy purchased, but the ability to produce energy when needed.

While the impacts of increased power demand by data centers may not yet be prominent in historic retail electricity price trends, signals of increased energy demand have appeared in PJM capacity auctions.

In 2024, the clearing price of the 2025–2026 capacity auction increased by 833 percent from the previous year. The following 2026–2027 auction held this past July saw a further increase of 22 percent, clearing the Federal Energy Regulatory Commission (FERC)-approved cap of $329.17/MW-day, but was expected to be 18 percent higher if the cap did not exist (Figure 4). The sharp jump in the auction prices was largely driven by “data center expansion, electrification, and economic growth.”

PJM stated that it expects this capacity price increase to translate to a year-over-year increase of 1.5 to 5 percent for customer bills. In its 2025 Integrated Resource Plan, Dominion stated that elevated capacity prices “reflect the urgency of resources adequacy concerns not just for the DOM Zone but across PJM.”

Source: PJM

Looking Forward

The ultimate impact of Virginia’s new electricity rate class for large-scale data centers is not clear, but it holds major ramifications for the Commonwealth. The aggressive buildout of data centers will depend on the ability of investors to recover costs. Household ratepayers are likely to remain sensitive to any proposal that could shift costs to them. The SCC has shown its willingness to reject rate increases sought by Dominion. Dominion and the policymakers who oversee it will be challenged as they attempt to keep up with the soaring data center demand without raising electricity bills significantly for residential customers.