Research

October 19, 2016

The Budgetary Impact of Candidate Trump’s Proposals

Donald Trump’s policy proposals as a candidate for president would have a deleterious effect on the federal budget.[1] Until recently, the Trump campaign did not provide a sufficient degree of specificity in its policy proposals to make an analysis feasible. However, more recent proposals have included greater detail, while other organizations, most prominently the Tax Policy Center (TPC) and the Committee for a Responsible Federal Budget (CRFB), have provided excellent third-party estimates of the current candidates’ proposals. This analysis primarily relies on public statements provided by the Trump campaign, news reports, and third party estimates, specifically from TPC, CRFB, the American Action Forum, and the Center for Health and the Economy.

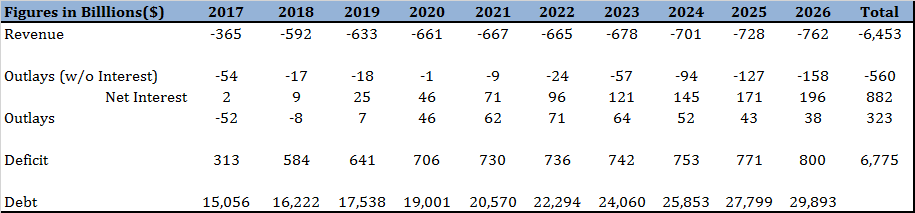

Based on these estimates, Mr. Trump’s proposals would, on net and over a ten-year period (2017-2026), reduce revenues by $6.5 trillion and increase outlays by $323 billion, for a combined deficit effect of nearly $6.8 trillion over the next decade.

Table 1: Budgetary Effects of Mr. Trump’s Proposals

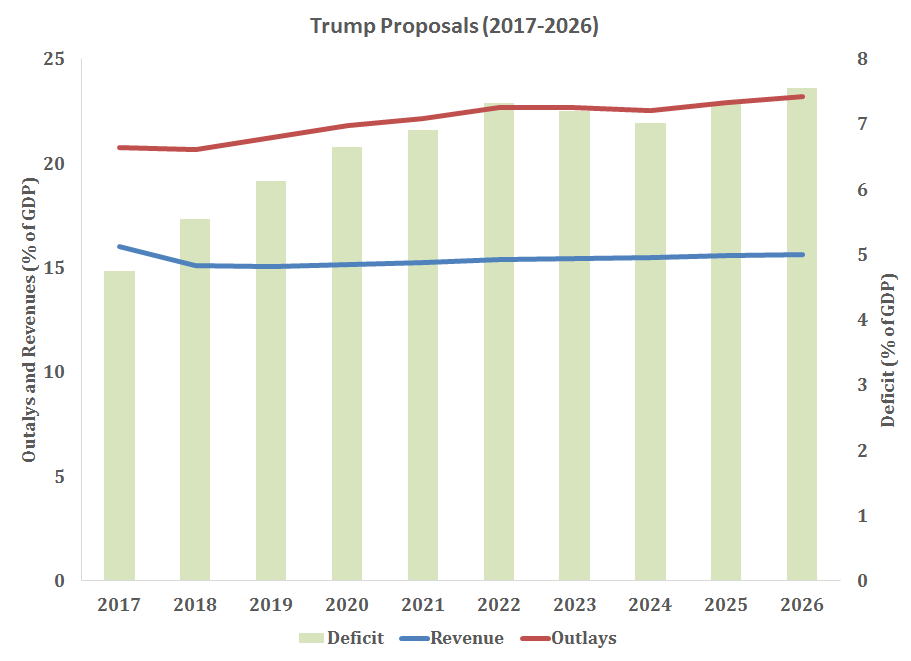

As a share of the economy, Mr. Trump would increase deficits to 7.6 percent of Gross Domestic Product (GDP), with outlays increasing to 23.2 percent of GDP, compared to revenues of 15.7 percent of GDP.

Figure 1: Budgetary Effects as a Share of GDP

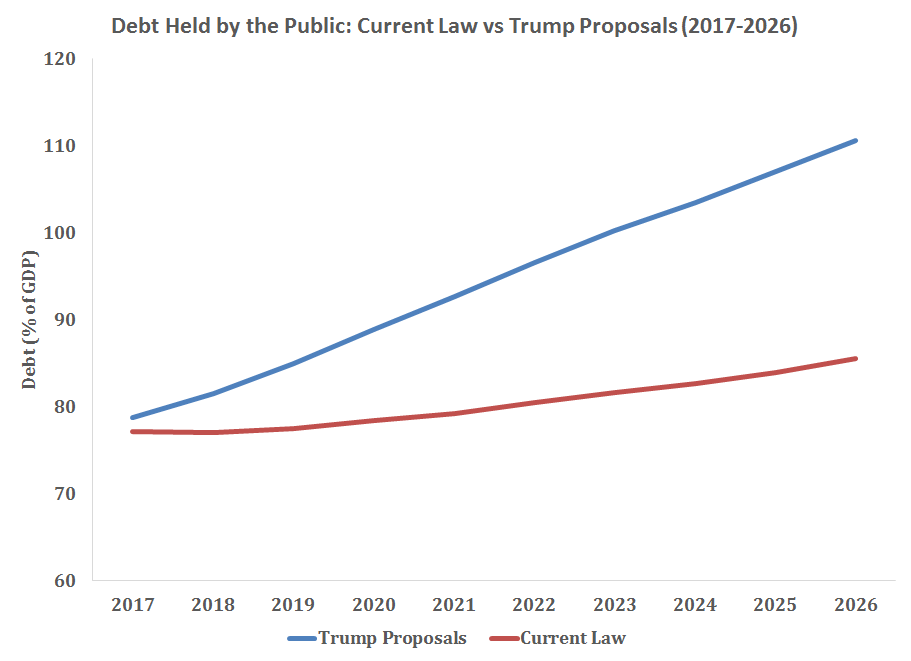

Because of persistent budget deficits over the next ten years, Mr. Trump’s proposals would increase debt held by the public to 110.6 percent of GDP – well above the current law projection of 85.5 percent.

Figure 2: Debt Effects

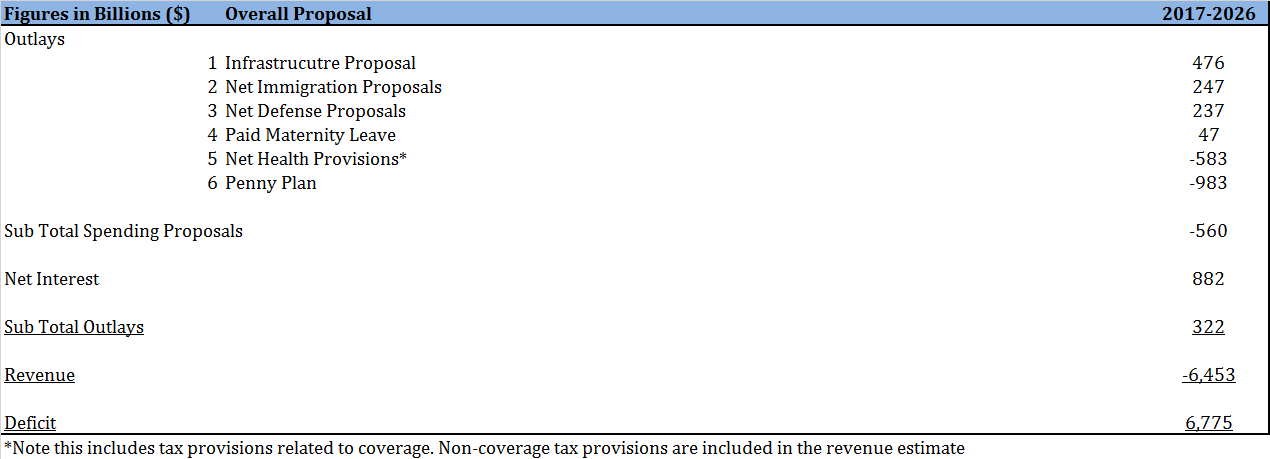

The spending and revenue proposals reflect 6 broad spending proposals, the net effects of Mr. Trump’s tax proposals and the interest effects.

Table 2: Costs Estimates of Proposals

In several instances, these proposals reflect the net budgetary effects of several proposals, particularly with respect to defense, immigration and health care. Moreover, many additional proposals are included in the net revenue effects. The revenue estimate reflects the revenue loss of Mr. Trump’s tax plan as analyzed by the Tax Policy Center, as well as the costs of additional revenue losses from repealing the Affordable Care Act. The Appendix provides more specific details, including cost estimates for more specific elements of the broader proposals, annual spend-out totals and sources for the proposal itself and sources for the basis of the estimate. This estimate does not include proposals where it does not appear evident that the campaign intended to budget for them, for example, Mr. Trump’s education proposal suggests that additional funds would be reprogramed from other areas of the budget. Also absent is a budgetary estimate of Mr. Trump’s trade proposals. Lastly, this budget estimate does not incorporate the macroeconomic effects of Trump’s proposals.[2]

[1] Note that a separate analysis by AAF found that Secretary Clinton’s proposals would add about $1.5 trillion to the debt over the next ten years: https://www.americanactionforum.org/research/estimating-costs-candidate-clintons-proposals/

[2] For example, see: https://www.americanactionforum.org/research/labor-output-declines-removing-undocumented-immigrants/; https://www.americanactionforum.org/research/tariffs-on-chinese-and-mexican-imports-could-cost-consumers-250-billion/