Research

July 7, 2017

Buy America Regulations May Raise Cost of Subsidized Infrastructure

Summary

- As part of the federal government’s policy toward infrastructure projects in the U.S., it imposes regulatory restrictions which require funds obtained through Federal Transportation Association (FTA) grants only be used on American-made products.

- Any policy that restricts choices may raise costs. In the case of metro system procurements, U.S. metro cars are 34 percent more expensive than foreign procurements, an average of $700,000 per car.

- The current administration has endorsed “buy American” policies, and has directed regulators to minimize the allowed exemptions. However, a policy without these restrictions would likely yield more economic benefit.

Introduction

The U.S. currently enforces federal procurement policies that establish a preference for American suppliers, known as “Buy America” and “Buy American” (Buy America relates to requirements for Federal Transit Authority grants, Buy American relates to a 1933 law ordering government purchases to prefer domestic products). President Trump recently issued an executive order that entrenches these policies and directs regulators to limit waivers for exemption from compliance. This action is a point of contention between free-market oriented groups and populists, the latter of which see the policies as important to preserving American jobs.

The benefits of Buy America/American policies are likely overstated, and they are, at least partially, responsible for higher infrastructure costs. They are also responsible for a slew of regulations imposed on infrastructure development. The cost of U.S. transit infrastructure (often subject to Buy America requirements) is higher than comparable foreign counterparts. Due to the transparent nature of transit authorities in their budgeting processes, analysis can demonstrate whether industries subject to these policies are in fact costlier, and how much more Americans pay than foreign counterparts.

What is Buy America?

Buy America specifically refers to a policy that was implemented in 1983 as part of the Surface Transportation Act of 1982. The policy requires that transit authorities receiving federal funding for capital spending must use the allocated funds to purchase American-made products. In 2015, the Federal Transit Administration (FTA) was authorized to issue $11.6 billion in grants that would presumably be subject to Buy America requirements.

The Buy America policies are explained by the FTA. The policies are essentially a set of regulations imposed in exchange for federal dollars, and requires that purchased products be American-made. This applies to virtually any purchase a grantee can make with an FTA grant, ranging across radios, ticket vending machines, video cameras, rail track, HVAC systems, and more.

Complex items, like rolling stock (buses, metro cars, etc.) must have at least 60 percent of the cost come from American components. The Fixing America’s Surface Transportation Act (FAST Act) stipulates that this requirement will increase to 70 percent by 2020.

The FTA may waive Buy America requirements if FTA determines that: (1) it is not in the public interest to comply with the requirements; (2) the required products are not available domestically; or (3) if the domestic product costs at least 25 percent more than the foreign product. Below is a graph of all Buy America waivers requested and granted between 2010 and 2016.

Source: FTA Buy America Waiver Notices

With respect to rolling stock, the FTA does not issue any waivers. Even though it may seem in some instances that rolling stock would be eligible for a price-differential waiver, since the law stipulates that one should be issued if the contract is 25 percent or more expensive than purchasing from a foreign supplier, the FTA guidance stipulates that price-differential waivers are only issued based on product costs (not contract costs). Even if this was not the case, the American Bar Association explains that the FTA already considers the 60 percent domestic content requirement of rolling stock as a form of waiver (in lieu of a 100 percent domestic content requirement), and as such would not consider rolling stock for other types of waivers. Essentially, there is no way to waive domestic content requirements for rolling stock, even if the price-differentials are much greater than 25 percent.

Policy Opposition to Buy America

Buy America policies can be contentious. While it is impossible for any policy that restricts purchasing options to yield lower cost solutions (at best the American product could already be the lowest-cost/highest-value), defenders of the policies contest that the economic benefit of supporting American industries ripples through the economy.

The burdens of Buy America provisions, while acknowledged by most economists, are harder to quantify. These provisions protect American businesses that might otherwise fail or struggle when faced with foreign competition. This means that there is a forgone benefit that would have been achieved if that business was forced to become more productive to stay competitive, as well as a forgone benefit of specialization in the global economy. Furthermore, the expenditure of more resources to achieve the same outcome means that, ostensibly, the consumer lost an opportunity to spend money on something else. In the case of government subsidies—like the Buy America requirements for federal grants—the need for greater government expenditures is paid for by taxing productive uses of labor and capital, which also has an economic consequence.

Subsidizing projects that may have higher costs is also problematic due to the poor fiscal position of the nation. Federal infrastructure projects are paid for by debt, meaning that for the project to be net beneficial it must generate enough economic activity to recoup both its price and the interest on the debt that financed the activity. If a Buy America policy raises cost without also raising the benefits yielded, it will result in an inferior cost-benefit outcome.

Another critique of Buy America policies is that although they ensure products are made in the U.S., oftentimes the contracted company is a subsidiary of a foreign company. For example, Boston’s new metro cars will come from CRRCA MA, which is a subsidiary of CRRC, a state-owned Chinese train manufacturer. Profits made from U.S. subsidiaries can flow to parent companies, meaning that the profits may not even remain in the United States.

The Buy America debate hinges on whether the benefits of sourcing products domestically (particularly maintaining strategic industries like steel) outweigh the economic cost burdens associated with protecting them. Ostensibly, since the law stipulates that projects with a cost differential exceeding 25 percent should be waived from the Buy America requirements, the cost associated with Buy America should not exceed 25 percent. However, cost comparisons between domestic and foreign infrastructure show larger differentials.

Comparing U.S. And Foreign Costs for Transit Infrastructure

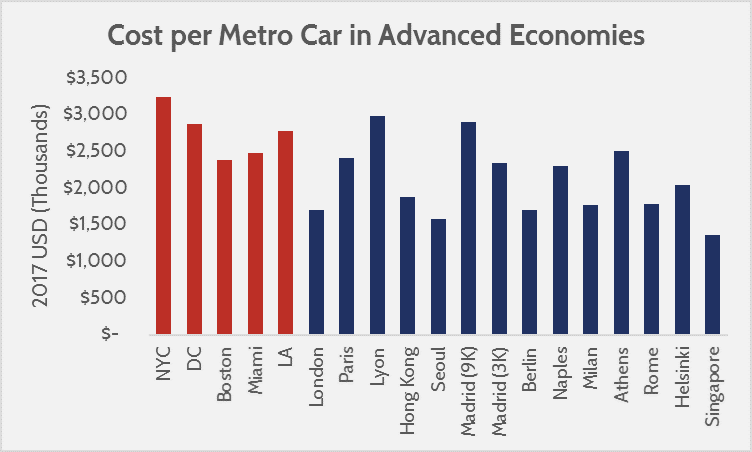

If it is true that Buy America contributes to higher transit infrastructure costs, then higher domestic costs vis-à-vis comparable foreign costs should be plainly visible. AAF observed the rolling stock procurement costs for metro systems in advanced economies (as defined by the International Monetary Fund (IMF)), and found that there is indeed a cost-differential, and it exceeds 25 percent. Below is the cost of metro cars in 14 foreign cities, compared to 5 domestic cities. The cases were selected based on the data availability. The costs are based on a purchasing power parity comparison (meaning the cost-difference would not be explained by short-run market exchange rate variations), and are adjusted for inflation.

Source: AAF estimates based on reported statements.[1]

| 2017 US Dollars | Average Cost per Car | Geometric Mean | Price Difference |

| US | $2,751,840 | $2,735,232 | 34% |

| Foreign | $2,090,964 | $2,038,444 | – |

Using a geometric mean (and indicator of typical value that is robust in the presence of outliers), the cost difference is nearly $700,000 per car, making U.S. metro cars 34 percent more expensive than their foreign counterparts. To put this figure in perspective, the Washington Metropolitan Area Transit Authority (WMATA) has a procurement contract for 528 new metro cars for $1.46 billion, and exercised an option for an additional 220 metro cars at a cost of $431 million, or an average cost of $2.6 million per car (after inflation). If WMATA had been able to purchase metro cars at a price equaling the foreign average, it would have saved $441 million. The value of procurements in the U.S. that AAF sampled exceeded $5 billion, representing significant infrastructure investments that are subject to Buy America regulations.

Explaining the Cost-Differential

The cost-differential between U.S. metro cars and foreign metro cars is likely explained by more than just Buy America regulations. The Government Accountability Office (GAO) wrote a report on factors that raise the cost of metro cars in the U.S., and noted that specifications for necessary turn radii and dimensions vary substantially from city-to-city, limiting opportunities for standardization of metro cars. Furthermore, because the procurement process of metro cars in the U.S. tends to favor large procurements in a short amount of time, there are also startup costs baked into the contracts (since new manufacturing plants may need to be built), as well as baked in risk costs for the volatility of materials prices.

Although the GAO identifies potential factors that could make U.S. procurements more expensive than foreign counterparts, the reality is that metro cars are a globalized market. SCI Verkehr, a consulting firm that analyzes transportation markets, noted that global metro rolling stock markets are growing due to urbanization trends around the world. They also found that a major source of growth for rolling stock producers was increased market penetration in new regions, with Chinese manufacturer CRRC claiming 57 percent of the global market share for metro cars. It seems unlikely that the U.S.’ metro system requirements would render it unable to purchase rolling stock from foreign suppliers the same as other countries, and there is no reason to believe that CRRC MA is better suited to manufacturing metro cars than its parent company, CRRC. By refusing to take advantage of established global supply chains for metro cars, U.S. procurements for metro cars are merely paying a premium for the companies to open manufacturing locations within U.S. borders.

From an analytical perspective, it would take substantially more data than was available for this study to pinpoint exactly how much of the cost-differential is due to Buy America, and how much is due to unrelated factors. However, the fact that the price differentials hold true across both Europe and Asia, means that policy is more likely to be an explanatory variable, and is worthy of further study and scrutiny.

Openness to Trade

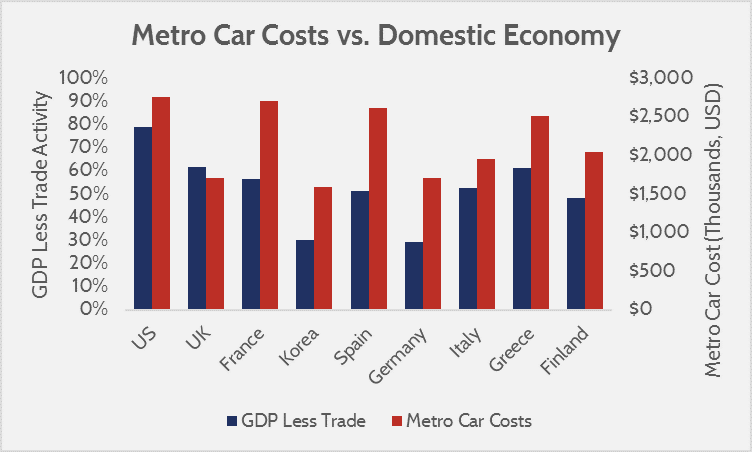

If Buy America policies do in fact contribute substantially to the cost-differential, another variable that could indicate this is openness to trade (total trade value relative to GDP). Buy America is a policy that restricts trade options, and one would expect that nations that are less restrictive on trade policy would also have lower metro car costs. This is an imperfect measure, because there are many facets of trade policy that can affect openness to trade, but the expected trend is still present.

Source: The World Integrated Trade Solution

To further illustrate the comparison between trade openness and metro car costs, below is a comparison of metro car costs relative to GDP less trade value.

Source: AAF Estimates Based on Reported Statements[2], The World Integrated Trade Solution

The at-a-glance comparison shows that nations less open to trade also have higher metro car costs, and nations more open to trade have lower metro car costs.

The sample size, as well as the lack of longitudinal data, means that broad conclusions from this data alone should be avoided. However, since the results are quite close to the expected relationship if Buy America policies are responsible for higher costs, they are worthy of further analysis to determine to what extent they raise costs.

Conclusion

Buy America policies almost certainly contribute to higher infrastructure costs in the U.S., but it is hard to gauge just how much economic harm these policies cause. However, when comparing the metro car procurement costs in the U.S. to notable foreign systems, the U.S. is clearly more expensive. Furthermore, when comparing procurement costs and openness to trade in each nation, there is a correlation between open economies and low metro car procurement costs.

Considering that the federal government spends billions of dollars on transit infrastructure subsidies every year, it seems worthwhile to consider if federal policies associated with those investments are resulting in less efficient use of capital. The U.S. should, if anything, curtail Buy America policies to yield greater benefits from government expenditures.

[1] Sampled systems are metro car procurements only (suburban train systems, like double-decker commuter trains, are excluded).

Automated metro car procurements were excluded.

Chicago excluded from sample due to accusations that a Chinese company subsidized the contract.

To the best possible extent, base contracts were used for cost-estimates rather than contracts plus options.

http://web.mta.info/capital/pdf/MTA_15-19_Capital_Plan_Board_WEB_Approved_v2.pdf

https://www.washingtonpost.com/news/dr-gridlock/wp/2014/09/26/metro-says-its-new-generation-rail-cars-are-on-track-for-passenger-service-in-january/?utm_term=.b8d0234c86f7

http://www.railjournal.com/index.php/north-america/more-crrc-trains-for-boston-red-line.html

http://www.railjournal.com/index.php/rolling-stock/hitachi-delivers-first-metro-train-to-miami.html?channel=529

http://www.metro-report.com/news/single-view/view/crrc-signs-los-angeles-metro-train-contract.html

http://www.bbc.com/news/uk-england-london-10835655

http://www.railjournal.com/index.php/rolling-stock/alstom-wins-%E2%82%AC2bn-paris-metro-train-contract.html

http://www.railjournal.com/index.php/metros/lyon-orders-metro-trains-from-alstom.html

http://www.railjournal.com/index.php/asia/mtr-orders-trains-for-shatin-%E2%80%93-central-link.html

http://www.railjournal.com/index.php/rolling-stock/seoul-orders-hyundai-rotem-metro-trains.html

https://www.metromadrid.es/export/sites/metro/comun/documentos/memoria/2015/Annualreport2015.pdf (Madrid leases rolling stock, and the shown figure is an estimation of lifetime cost based on lease duration and annual expenditures.)

http://www.railjournal.com/index.php/metros/more-stadler-trains-for-berlin-u-bahn.html?channel=529

http://www.railjournal.com/index.php/metros/caf-selected-for-naples-metro-train-order.html?channel=529

http://www.railjournal.com/index.php/metros/milan-to-order-more-leonardo-metro-trains.html?channel=000

http://www.railjournal.com/index.php/metros/new-athens-metro-trains-set-to-enter-service.html?channel=529

http://www.railjournal.com/index.php/metros/more-caf-trains-for-rome-metro.html?channel=529

http://www.railjournal.com/index.php/metros/caf-to-supply-20-trains-for-helsinki-metro.html?channel=525#.UIqL72dBDyA

http://www.railjournal.com/index.php/metros/singapore-lta-orders-132-metro-cars.html?channel=529

http://www.railjournal.com/index.php/metros/istanbul-orders-hyundai-rotem-metro-trains.html

http://www.railjournal.com/index.php/central-south-america/more-alstom-trains-for-panama-line-1.html?channel=000

http://www.railjournal.com/index.php/central-south-america/santiago-and-medellin-order-extra-caf-metro-trains.html?channel=529

http://www.railjournal.com/index.php/metros/izmir-launches-crrc-metro-trains.html

http://www.railjournal.com/index.php/africa/hyundai-rotem-wins-cairo-metro-vehicle-contract.html?channel=000

http://www.railjournal.com/index.php/metros/st-petersburg-metro-orders-more-tmh-trains.html?channel=000

http://www.railjournal.com/index.php/central-south-america/medellin-orders-more-caf-metro-trains.html?channel=529

http://www.railjournal.com/index.php/metros/more-caf-trains-for-bucharest-metro.html?channel=529

http://www.railjournal.com/index.php/central-south-america/first-line-5-train-arrives-in-sao-paulo.html?channel=529

[2] Ibid.