Research

December 19, 2016

The Costs and Benefits of Using Regulation to Achieve Climate Goals

Summary

- Using regulation to achieve 80 percent greenhouse gas reductions would impose costs between $588 billion and $4.5 trillion, depending on policy goals and abatement costs, by 2050. That equals about $10,300 for every person in the U.S.

- The economic impacts of such high regulatory costs would (conservatively) reduce GDP by between 0.6 and 2.3 percent by 2050, with a cumulative economic loss ranging between $1.3 and $7.2 trillion.

- By 2050, the average household will have $41,877 less economic value than it would have absent a regulatory approach to climate change.

- A regulatory approach to deep decarbonization is expensive, especially when compared to the benchmark provided by the research community — a revenue neutral carbon tax.

Introduction

The United States is on a path to reduce carbon emissions to address global climate change. The question remains whether future administrations will continue a regulation-only approach to reducing carbon pollution, or if the nation will adopt a more comprehensive, cost-effective method. There have been gains from past regulation in terms of reduced emissions, but these rules imposed more than $450 billion in burdens.[1] Per household, these actions have imposed regulatory costs of more than $3,350. On average, reducing one ton has cost the nation roughly $34, but this figure will likely increase in the future.

The American Action Forum (AAF) found that simply extending the current regulatory policies will cost the nation more than $1 trillion cumulatively by 2050. Adopting the more stringent 80 percent reduction target currently embraced in the Democratic party platform, for example, will cost at least $300 billion annually and more than $4.5 trillion cumulatively (up to $13,000 per capita). There will doubtless be benefits from these actions, but a sector-by-sector, regulatory approach to climate change will take future administrations decades to move rules through the regulatory process and the courts, and it will impose tremendous costs with little flexibility for states and regulated entities.

History of Greenhouse Gas Regulation

Absent a legislative approach to climate change, the Obama Administration has implemented at least 50 regulations aimed at significantly cutting greenhouse gas (GHG) emissions. From a low of 122,000 fewer annual tons of GHGs (efficiency standards for “Ceiling Fan Light Kits”) to a 265 million-ton reduction (Clean Power Plan (CPP)), the administration has been aggressively attempting to reduce the nation’s GHG emissions through a regulatory process often subject to legal battles. The five largest GHG regulations, including the Clean Power Plan, are projected to reduce GHG emissions by 739 million metric tons annually.

|

Regulation |

Agency |

Annual GHG Reduction (in tons) |

|

Clean Power Plan |

EPA |

|

|

2017-2025 CAFE Standards |

EPA |

|

|

2012-2016 CAFE Standards |

EPA |

|

|

Phase II: Heavy-Duty Truck Standards |

EPA |

|

|

Efficiency for Air Conditioners and Heaters |

Energy |

|

|

Total: |

739 million tons |

|

Although these reductions are quite substantial, they are far short of the Intergovernmental Panel on Climate Change’s (IPCC) recommended reductions (80 percent from 1990 levels) for keeping global average temperature rise under 2 degrees Celsius. According to the Environmental Protection Agency (EPA), the U.S. currently emits roughly 6.8 billion metric tons of GHGs annually, and achieving the IPCC’s goal would require reducing that to 1.28 billion. For policy purposes, the Obama Administration and other advocates of GHG regulations use a 2005 base year (U.S. emissions peaked in 2005), since that is a more lenient target than a 1990 base year. The 2016 Democratic party platform, as well as their presidential nominee, Secretary Hillary Clinton, have supported an 80 percent reduction from 2005 levels, which would require annual emissions of only 1.48 billion tons.

The regulations that have been pursued thus far have imposed significant costs. President Obama’s GHG actions measured in net present value costs are $457.3 billion (more than $3,350 per household). This figure also uses the lower-bound estimate for the recent GHG standards for heavy-duty trucks and engines. Including the higher estimate yields more than $525 billion in total costs. The EPA is responsible for $283 billion of this amount, but the Department of Energy (DOE) has also imposed $173 billion in costs via tighter efficiency standards. Through October 31, 2016, the Obama Administration has finalized thirty “economically significant” DOE standards, compared to just ten combined from the Bush and Clinton Administrations. The net result of these regulations is that every ton of GHG abated has created an average of $34.44 in regulatory burdens, paid for by Americans. For perspective, EPA provides background on one ton of emissions: a car driven during a year releases 4.8 metric tons of CO2. Overall, America’s per capita emissions are 16.4 tons of CO2 annually.

The effect of these regulatory burdens begs a question: what would it cost if future presidents continue to pursue regulations as the preferred method of emissions abatement? Are there more effective abatement strategies? The nation’s promised emissions target is 26 to 28 percent below 2005 levels by 2025, and current law (and proposed) regulations put the U.S. on track to only achieve about a 13 percent reduction from 2005 levels by 2025. Even higher regulatory burdens would be needed to achieve this target, or any target beyond the Paris goal.

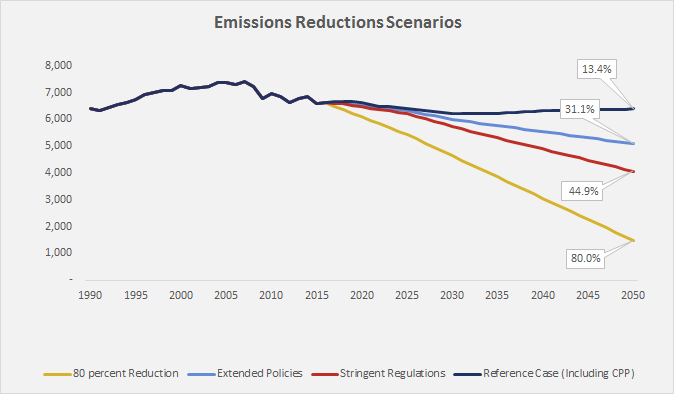

The Burdens of a Regulatory Approach

To evaluate the costs of a regulatory approach, AAF is evaluating three different scenarios. The first is based on the Energy Information Administration’s (EIA) “Extended Policies” emissions projections.[2] Extended Policies are the extension or expansion of laws and regulations that the U.S. currently has, but are expected to expire in the baseline. The second scenario is a “stringent regulations” scenario, which assumes that the EPA would regulate emissions sources in a manner similar to their abatement recommendations (landfill emissions, tighter fuel efficiency for vehicles, different agriculture practices, etc.). The third scenario is an assumption that an 80 percent reduction of emissions by 2050 is possible via regulation, and that those regulations would deliver linear reductions in emissions. These scenarios are based on an AAF projection of GHG emissions, derived from the EIA’s projection of CO2 emissions from energy use.

If it is assumed that regulations would be able to match the cost-effectiveness of past regulations on a per-ton abatement cost ($34.44), the regulatory burdens of each scenario (not counting the $457.3 billion of current law burdens) would be as follows:

|

2025 |

2050 |

|

|

Extended Policies Burdens (billions) |

$22.45 |

$588.24 |

|

Stringent Regulations Burdens (billions) |

$41.14 |

$1,100.29 |

|

80 Percent Reduction Burdens (billions) |

$183.17 |

$2,703.09 |

While these burdens may seem quite large, they are actually optimistic. There are many ways an individual can reduce their carbon footprint, and the benefits of each method are the same regardless. The same cannot be said for the costs. The benefits of using more efficient light bulbs, or using a fan instead of an air conditioner may be the same as buying a hybrid car, but the costs are greatly disparate. It is expected that regulators pursue the lowest cost methods of abatement first, since this keeps the estimated benefits equal to or under the burdens. However, there are finite reductions that can be captured at a low cost, and achieving a much greater goal for emissions reductions would also require pursuing more expensive methods of abatement.

The actual abatement costs of such policies are difficult to determine. While there are estimates of capital costs and investments needed to pursue specific paths to an 80 percent decarbonization, there are few that estimate regulatory burdens. In lieu of estimating regulatory burdens though, it is possible to estimate the benefits that would be used to justify those burdens. Regulators frequently have, so far, had burdens that are roughly equal to or close to the estimated benefits, in terms of compliance costs compared to the Social Cost of Carbon (SCC). However, when comparing domestic SCC benefits to domestic costs, the latter often exceed the former. To this effect, AAF created an estimate of burdens assuming future regulatory burdens would be equal to the SCC (standard 3 percent discount rate). The SCC increases every five years, which would allow for more stringent regulations that capture rising abatement costs. Under this assumption, the burdens would be as follows:

|

2025 |

2050 |

|

|

Extended Policies Burdens (billions) |

$26.41 |

$1,008.85 |

|

Stringent Regulations Burdens (billions) |

$49.20 |

$1,877.39 |

|

80 Percent Reduction Burdens (billions) |

$221.78 |

$4,510.59 |

Consider what $4.5 trillion would mean to many Americans. Regulatory costs must be borne by some entity, and usually it’s the consumer in the form of higher prices. As AAF has detailed in the past, even regulators frequently admit consumers often pay for the cost of regulation. For example, the average person pays $100 more health insurance costs annually because of regulation and a new car will be $3,100 pricier because of efficiency rules. After $4.5 trillion in additional regulatory burdens, consumers could expect to pay more for energy, household goods, and a host of other products and services. The cost of using a car would rise by over $300 per year by 2050 if the abatement costs of CAFE regulation remain unchanged. The entire suite of burdens necessary to cut emissions by 80 percent through regulation would end up costing the average American $10,300 from 2017-2050.

These burdens would be roughly in line with the capital cost investments required for an 80 percent decarbonization by 2050. A recent National Bureau of Economic Research (NBER) paper from Professor Geoffrey Heal estimated the net capital costs for an 80 percent reduction to be $1.3 trillion to $5.3 trillion.

Potential Benefits

This paper has so far focused on burdens, but regulations also have benefits. Ideally, regulations should correct for market failures. Such failures occur when a polluter has incentives to pollute to minimize costs, but the costs to others from the damage of its pollution exceeds the value they saved. Under such a scenario, regulations can capture more economic benefit than the cost of their burdens. Ideally, all regulations should achieve this. However, this is not always the case. AAF has analyzed a sample of DOE rulemakings, and all but one generated more costs than the reported GHG benefits. Across all government agencies, there have been 24 rules during the Obama Administration where costs have exceeded benefits. Regulators often rely on consumer savings and “co-benefits” to justify regulations that have burdens greater than their benefits.

If future administrations continue this approach, they will likely use reductions in Nitrogen Oxides (NOx), ozone, and particulate matter (PM) to justify burdens that exceed AAF’s estimates based on the SCC. Many of the sources of GHG emissions, such as combustion engines for cars and fossil fuel power plants, generate PM and NOx. The five largest EPA rules (CPP, the 2012 and 2017 CAFE standards, and the old and new heavy-duty truck rules) are estimated to cut PM and NOx by 1.3 million tons. This has generated incredible benefits, according to agency analysis. By 2030, EPA projects a rate-based approach to its CPP will add $20 billion in GHG benefits, but up to $31 billion in co-benefits, largely stemming from “reduced exposure to PM2.5 and ozone.” Generally, co-benefits exceed the social welfare gains of the target (CO2) of the regulation.

Using the example of those five rules, on average every 35,370 tons of GHG abated correlates to one ton of PM or NOx abatement. The average benefits from past rules per ton of PM or NOx abated has been roughly $185,000. This means that an 80 percent reduction of GHG emissions could also abate 5.5 million tons of PM or NOx (a 32 percent reduction in annual emissions), which would generate more than $1 trillion in clean air benefits (assuming constant ratios and values). If regulators continue their past practices of using co-benefits to justify burdens beyond the SCC benefits, then that would allow regulators to increase the burdens by potentially another $1 trillion and still be considered net beneficial on paper.

What should be acknowledged, though, is that capturing these benefits is not guaranteed. The SCC, for example, is derived from modeling global economic trends. Not only are the benefits of the SCC not directly recaptured by those who bear the cost of abatement, but they are also predicated on an assumption that other nations will not increase emissions as the U.S. decreases emissions (a concept known as carbon leakage). For example, reduced fossil fuel consumption in the U.S. could cause prices to fall in other nations, and increase their consumption, which would offset estimated climate benefits.

Co-benefits are also contentious in regulatory impact analyses because they are not directly tied to the regulation they are justifying. As a result, some believe that co-benefits may be double-counted, since the benefit to a particular party may already be captured by another regulation. Regulators also face criticism for using simplistic means of calculating co-benefits, which assume there are additional benefits from reducing PM and NOx, even though the nation has already achieved required reductions in those pollutants. In other words, this air is already legally “clean” for PM and NOx, but regulators claim additional benefits when regulating GHG emissions. More specifically, they assert that every ton of reduction implies the same benefit, no matter how clean the air is – even if pollution levels are below the legal threshold.

The U.S. will certainly receive some benefits from regulations focused on GHG abatement, but the current methods for calculating those benefits may be overstating the gains, and leading to burdens that create—rather than correct—market failure.

Specific Regulations and Associated Challenges

The above statements are assuming that such a regulatory approach to emissions is even possible (both technically and legally). It is a regular occurrence for regulations to be challenged in court, but it was an unusual step for the Supreme Court to stay a regulation before it reached the highest court—as occurred with the Clean Power Plan. If it is assumed that the Clean Power Plan is legal, what other regulations are likely to be pursued for GHG abatement?

If future administrations attempted to use existing regulations as a guideline for achieving an 80 percent reduction, it could take the following form (assuming $34.44 in abatement costs):

Difficulty of Achieving 80% Goal Through Regulation |

||

|

Regulation |

Annual Costs |

Percentage of 80% Goal |

|

CPP with Three Times the Carbon Savings |

$27.3 Billion |

26% |

|

80 Percent Reduction in Industrial Emissions |

$22.8 Billion |

22.2% |

|

Doubling Emissions Reductions of 2017-2025 CAFE |

$15 Billion |

14.5% |

|

Doubling Appliance Efficiency of Obama Era |

$9 Billion |

8.8% |

|

50 Percent Reduction in Aircraft Emissions |

$7.7 Billion |

1.9% |

|

Doubling Emissions Reductions of 2016 Truck Rule |

$6.5 Billion |

3.1% |

|

Eliminating Four Million Tons of Methane |

$3.4 Billion |

3.3% |

|

Totals |

$87.9 Billion |

79.1% |

Note that even with a massive increase in regulations, and assuming the same level of efficiency in abatement, the regulatory burdens are quite large. These regulations only achieve about four-fifths of the 80 percent reduction goal.

There are other potential sources of emissions that regulators could attempt to regulate. This could include landfills, farms (manure storage and fertilization use), livestock diets, hybridization of cars, and more.

It is uncertain if pursuing these regulations would be legal. Regulations are (ostensibly) not allowed to impose burdens beyond what is technologically achievable or economically justified. Is a 50 percent reduction in aircraft emissions possible in the next generation? Future administrations might consider the use of biofuels or a “Low Carbon Fuel Standard” for emissions, but that is unlikely to generate a reduction of 50 percent.

Even if a 50 percent cut were technologically and legally possible, it would likely cost more than the “on paper” burden of $7.7 billion. Agencies must also operate within the authority granted to them by law—but the intent of those laws has been called into question. Furthermore, some laws have sections—specifically 115 of the Clean Air Act—that could allow regulators to use international agreements as a means of granting authority for regulations outside the scope of defined law. However, this section also requires reciprocity from the foreign country.

Future administrations could think big, toward an economy-wide legislative approach like a carbon tax, or attempt to add up every minor regulation and deal with the legal and technological challenges of each rule. A regulatory approach to climate change could easily necessitate hundreds of major regulations (there have already been at least 50). Generally, it takes two years to complete a major rule, absent subsequent legal intervention, so the pace of climate change would not only rush future administrations, but cramming all the rules into an implementation window that courts would approve would pose another set of issues.

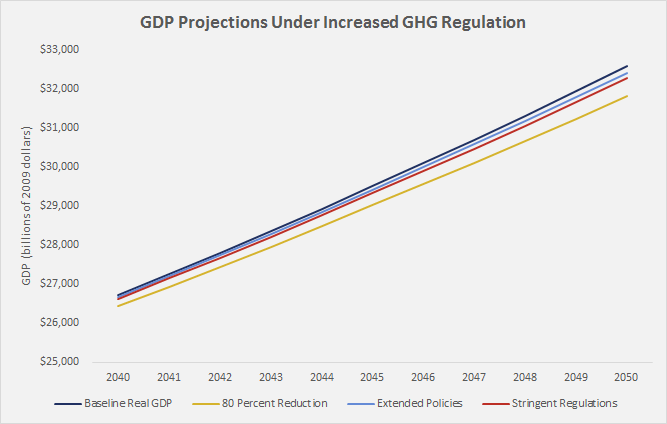

Economic Impacts of a Regulatory Approach to GHG Abatement

The costs of regulation are generally passed on to consumers in the form of higher prices. As such, regulations have an economic impact by causing consumers to spend more for goods and services that do not offer them any increased utility. This extra money spent for goods and services is money that would otherwise be spent on other consumption. As consumption declines, so too do the opportunities for profit, which is the motivator for production. The net effect of higher prices on consumed goods and services is an economic drag that slows growth.

The effect of regulations passing costs to consumers is similar to that of taxes, which also raise costs for consumers. If the government levies additional taxes, then it is reducing the amount of capital that the private sector has available for either consumption or production—the drivers of economic growth. In estimating the economic effects of regulations, it is best to model their effects as taxes.

To estimate the potential economic loss from increased stringency of regulatory policy, AAF applied a Joint Committee on Taxation’s (JCT) analysis on Corporate Income Tax (CIT) relief to AAF’s estimate of burdens.[3] The effects of raising or lowering the CIT should be fairly close to the effects of regulatory burdens, since how businesses respond to both the CIT and regulations are similar (passing the costs on to consumers). The JCT’s estimate of economic effects from CIT changes are conservative, so the estimate of economic effects from regulations are as well.

AAF estimates, conservatively, that the cumulative effects of further GHG regulation would reduce GDP between 2017 and 2050 by $1.32 trillion to $7.22 trillion (real 2009 dollars). Relative to the baseline, this would reduce the size of the economy between 0.5 percent and 2.3 percent by 2050. The Congressional Budget Office currently projects the long-term economic growth rate at 2 percent, and AAF estimates the burdens reducing emissions by 80 percent would cut this to 1.85 percent by 2050.

|

All values in billions of 2009 $ |

2050 GDP |

Cumulative Economic Loss |

Difference from Baseline |

|

Baseline |

$32,349 |

||

|

Extended Policies |

$32,191 |

$1,324 |

0.5% |

|

Stringent Regulations |

$32,051 |

$2,569 |

0.9% |

|

80 Percent Reduction |

$31,605 |

$7,221 |

2.3% |

Overall, the relative changes in economic size may seem quite small when compared to the baseline. However, when considering the cumulative effect of regulatory burdens during a 30-plus year period, even AAF’s conservative estimate shows the potential for significant losses.

Consider the economic impact of these burdens on Americans over the long term. One could think of the increased cost of goods and services due to regulation as cutting into the money that someone can invest. Consequently, the short-term losses are small, since there is little opportunity for such an investment to grow. Reaching a 26 percent emissions reduction by 2025 would cost the average household $1,745 in burdens, but their income flows over those 8 years would be only $740 lower. When considering the totality of burdens out to 2050, the picture is much bleaker. Just like interest on debt, the potential losses can snowball as the economy drifts further from the projected baseline. From $4.5 trillion in total economy-wide burdens and $7.2 trillion in economic losses, the average household would have spent more than $26,100 in regulatory burdens, and their total income flows would be more than $41,800 lower than the baseline by 2050.

These estimates may be quite low though, since they only model the regulations as a tax, and do not model their impact on energy prices. They also assume a constant abatement cost, when in reality abating the last ton will be significantly more expensive than abating the first. The EIA’s estimate of the CPP using an econometric model estimated a cumulative GDP loss of $1 trillion over 25 years, but the burden of the CPP is only $8.4 billion annually. The EIA’s estimated loss is due to reduced economic activity from energy prices, which AAF’s estimate does not include. If GHG regulations increase energy costs (which they undoubtedly will), then the resulting GDP loss could be far greater than AAF’s estimate.

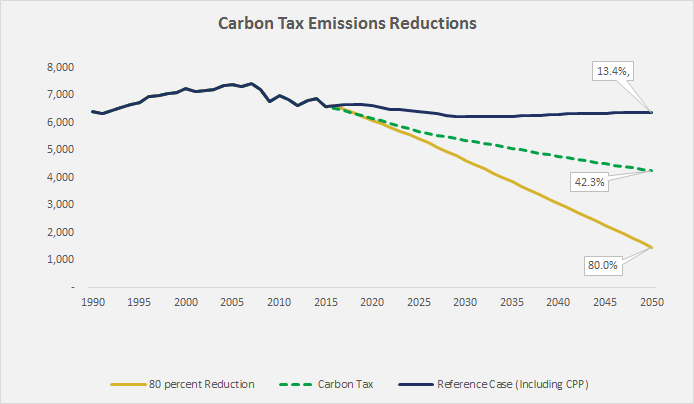

GHG Regulations vs. Carbon Tax

It is expected that the pursuit of increasingly stringent regulations would create higher burdens that have increasingly pronounced negative effects on the economy. It is also possible that the burdens of these regulations would exceed the benefits, which would eliminate net gains from the regulations. These negative economic effects could be avoided if the burdens of regulations were significantly lower, which would improve the likelihood that the benefits match or exceed the burdens.

GHG regulations struggle with matching burdens and benefits, since there are finite sources of emissions to regulate, and many will likely have abatement costs exceeding the benefits (the 2011 CAFE standard proved this when it cost $85 per ton of CO2 abatement, well above the $36 per ton benefit).[4] As a means of reducing GHGs, regulations are inherently costly and ill-suited to capturing the greatest amount of benefits for the least amount of cost.

The broad research literature has identified that the most economically efficient means of reducing GHG emissions is through a price on carbon, or a carbon tax. If carbon is priced in a manner that dissuades pollution, then market participants will naturally seek the lowest cost methods of abatement, and have incentives to reduce GHG emissions. Unfortunately, a carbon tax is also effectively a tax on energy, which is essential to virtually all aspects of the economy. As such, a carbon tax is a politically contentious policy since it will likely have deleterious effects on the economy if used as a tool to raise revenue.

However, the U.S. government already has taxes in place that create distortions and negative effects on the economy. If the revenue from a carbon tax is used to reduce other distortionary taxes, then the negative effect of the tax is only the difference between the distortion caused by the carbon tax and the tax it replaced.

The EIA estimated that the negative effect of a carbon tax ($20 per ton, increasing by 5 percent annually) would be to reduce GDP by 0.2 to 0.4 percent from the baseline by 2040. However, when the same tax was assumed to be used to reduce business taxes, the economic effect was “near the reference level.”[5] This is consistent with the literature on carbon taxes, which indicates that if used to offset business and corporate taxes (the most distortionary taxes), the economic impact will be small, if any.[6] The emissions reductions associated with a $20 per ton carbon tax (increasing by 5 percent annually) would be roughly 42 percent below 2005 levels by 2050.

A carbon tax would also eliminate the need for current law GHG regulations, and the $457 billion in burdens associated with them. Research indicates that a revenue neutral carbon tax that reduces corporate and business taxes represents the most economically efficient means of reducing GHG emissions, while capturing any benefits that regulations are intended to achieve. Using revenues from the carbon tax to lower the corporate income tax and business taxes would also reduce the number of U.S. firms relocating to foreign jurisdictions for tax purposes, and the associated expatriation of capital.

Conclusion

A regulation-only approach to GHG emissions has already imposed significant economic costs, in absence of a comprehensive legislative approach. Currently, the nation plans to spend more than $450 billion in cumulative costs, and that figure is not enough to achieve the goals of the Paris Climate Agreement. To reach the ambitious goal of an 80 percent reduction in GHG emissions by 2050, the nation must spend an additional $4.5 trillion cumulatively (assuming such a target could even be achieved at abatement levels under the SCC), and these costs could cumulatively reduce GDP by more than $7.2 trillion, burdens that every household would bear. There will be clean air and climate benefits to this approach, but these costs will have a profound impact on consumers, the energy sector, and overall economic growth.

[1] “Regulation Rodeo,” American Action Forum. http://www.regrodeo.com/.

[2] “Annual Energy Outlook 2016, Extended Policies Case,” U.S. Energy Information Administration, (August, 2016: Washington, D.C.) https://www.eia.gov/forecasts/aeo/policies.cfm

[3] Staff of the Joint Committee on Taxation, “Macroeconomic Analysis of Various Proposals to Provide $500 billion in Tax Relief,” Joint Committee on Taxation, (March, 2005: Washington, D.C.). https://www.jct.gov/publications.html?func=startdown&id=1189.

[4] AAF Estimate, $1.5 trillion in burdens divided by 17 million metric tons of reductions.

[5] U.S. Energy Information Administration, “Further Sensitivity Analysis of Hypothetical Policies to Limit Energy-Related Carbon Dioxide Emissions,” Supplement to the Annual Energy Outlook 2013, (July, 2013: Washington, D.C.) https://www.eia.gov/forecasts/aeo/supplement/co2/pdf/aeo2013_supplement.pdf.

[6] Jared Carbone, Richard Morgenstern, Robert Williams, and Dallas Burtraw, “Getting to an Efficient Carbon Tax: How the Revenue is Used Matters,” Resources for the Future, (January, 2014: Washington, D.C.). http://www.rff.org/research/publications/getting-efficient-carbon-tax-how-revenue-used-matters.