Research

September 27, 2023

Estimating the Impact on the U.S. Economy of Revoking Permanent Normal Trade Relations for China

Executive Summary

- In response to the Chinese Communist Party’s well-documented human rights abuses and the significant threat it poses to U.S. national security, many in Congress and several presidential candidates have proposed revoking permanent normal trade relations (PNTR) for China.

- Revoking PNTR would mean increasing the average tariff rate for imports from China from 3.5 percent to 40 percent – a dramatically higher rate than is applied under the Section 301 tariffs that have cost Americans $190 billion since 2018.

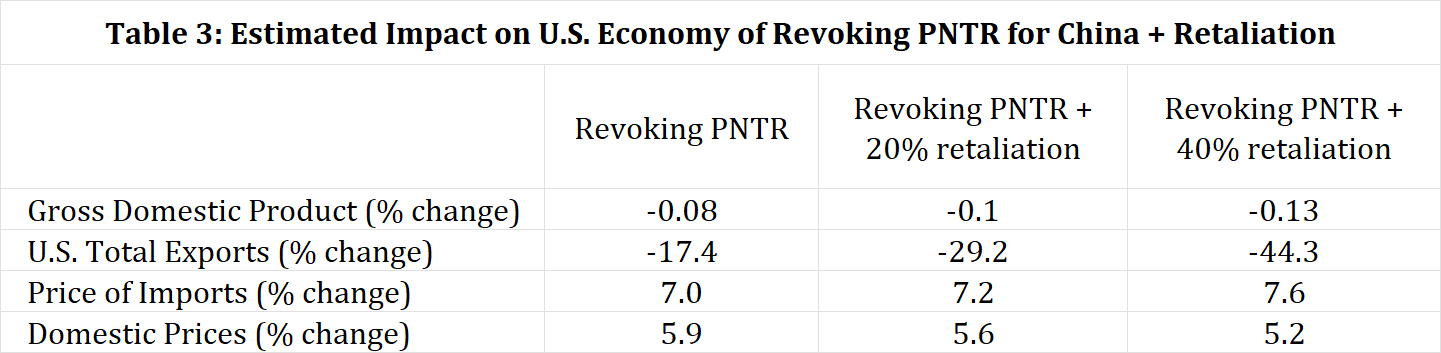

- This research estimates that revoking PNTR would decrease U.S. gross domestic product (GDP) by $15.9 billion, decrease total exports by more than 17 percent, and increase consumer prices by 5.9 percent; in the event China retaliates in a reciprocal manner, U.S. GDP would fall by $24.8 billion, total exports would decrease by 44.3 percent, and consumer prices would rise by 5.2 percent.

Introduction

In response to the Chinese Communist Party’s well-documented human rights abuses and the significant threat it poses to U.S. national security, many in Congress and several presidential candidates have proposed revoking permanent normal trade relations (PNTR) for China. Revoking PNTR would mean dramatically increasing the average tariff rate applied to imports from China from 3.5 percent to 40 percent and would have broad consequences for the U.S. economy. Tariffs act as a sales tax on imports, a cost that is ultimately borne by American consumers. The United States currently applies extra tariffs, first imposed in 2018, ranging from 7.5 percent to 25 percent on more than $250 billion worth of imports from China. Americans have paid an extra $190 billion in tariffs on those products since the tariffs were imposed.

Using the Global Trade Analysis Project (GTAP) database and a computable general equilibrium model, this research presents the estimated effects of revoking PNTR for China. Doing so would decrease U.S. gross domestic product (GDP) by $15.9 billion, decrease total exports by more than 17 percent, and increase consumer prices by 5.9 percent. China has retaliated to past U.S. tariffs and would be expected to do so in response to the United States revoking PNTR. If China retaliated in a reciprocal manner, U.S. GDP would fall by $24.8 billion, total exports would decrease by 44.3 percent, and consumer prices would rise by 5.2 percent.

Background

The normalization of economic relations between the United States and the People’s Republic of China (PRC) dates to President Richard Nixon’s official trip to the country in 1972 and the passage of the Taiwan Relations Act in 1979, which established formal diplomatic relations with the PRC as the official government of China. In 1986, China sought to join the General Agreement on Tariffs and Trade, which would become the World Trade Organization (WTO) in 1994. China did not officially join the WTO until 2001 after negotiating its accession protocol, the list of commitments it must uphold as a WTO member in addition to the various WTO agreements.

President Bill Clinton signed H.R. 4444 – the legislation establishing PNTR with China – into law on October 10, 2000. The main purpose of the legislation was to grant China most-favored nation (MFN) status, which made imports from China subject to the same base tariff rates as other WTO members. As a result of China’s accession, average tariffs on products imported by China decreased from 17 percent to 9.8 percent between 2000 and 2005.

Since China joined the WTO, Chinese exports to the United States have increased fourfold. Top categories include electrical machinery, machinery, toys and sports equipment, furniture and bedding, and textiles. U.S. exports to China have increased sevenfold over the same period. The top export sectors to China include agriculture (primarily soybeans, pork, cotton, and corn), electrical machinery, machinery, oil and gas, and optical and medical instruments.

Trade Rules and Enforcement

Criticism over China’s accession to the WTO is on the rise. China has been found to have policies that are inconsistent with WTO rules and inconsistent with China’s ascension protocol. Indeed, the United States won 100 percent of its cases against China at the WTO between 2004 and 2018. China corrected the policy found in violation of its commitments in all but one of those cases. In other words, the WTO proved a very effective tool for confronting China and holding it accountable, and the Appellate Body played a key role as all WTO members have the right to appeal dispute decisions. Nevertheless, in 2019 the Appellate Body was rendered effectively defunct. For several years, the United States blocked new judges from being appointed to the Appellate Body and eventually there were not enough left for any appeal cases to be decided. This move directly undermined the United States’ ability to enforce trade rules with China.

Instead of addressing disputes through the WTO, the United States imposed tariffs of 25 percent on roughly $50 billion worth of Chinese imports between July and August 2018. This action occurred after an investigation under Section 301 of the Trade Act of 1974 by the Treasury Department found that Chinese theft of U.S. intellectual property cost an estimated $50 billion annually. After several months of tit-for-tat retaliation by the United States and China, U.S. Section 301 tariffs on Chinese imports now range from 7.5 percent to 25 percent and affect more than $250 billion worth of goods. These tariffs have cost Americans an extra $190.3 billion since 2018. Despite the immense cost to Americans, the tariffs have also not caused China to change its economic policies surrounding intellectual property protection.

Calls for Decoupling and Revoking PNTR

Since the imposition of the Section 301 tariffs, there have been increasing calls for additional restrictions on U.S.-China economic relations – many of which are based on legitimate national security and human rights concerns. For example, after the U.S. government issued an atrocity determination regarding genocide and crimes against humanity in the Xinjiang region, Treasury issued sanctions against Chinese persons determined to be involved with these atrocities. Congress also passed the Uyghur Forced Labor Protection Act to increase scrutiny of imports from Xinjiang. Further, the Biden Administration expanded U.S. export controls – in coordination with the Netherlands and Japan – on products such as semiconductors that have all but cut off Chinese access to semiconductor manufacturing equipment produced by Dutch company ASML, the world’s leading producer of such equipment.

These actions are targeted to address specific problems. Some in Washington, however, are now seriously considering the merits of revoking PNTR for China. For example, Senator Josh Hawley (R-MO) introduced the Ending Normal Trade Relations with China Act in March and the Raising Tariffs on Imports from China Act in May. The former would increase tariffs on imports from China to an average rate of 40 percent. The latter would subject imports from China to an additional 25 percent tariff if the United States has a trade deficit with China. Senator Hawley offered the latter as an amendment to the June debt ceiling bill, which the Senate rejected by a vote of 17–81. Similarly, in his May testimony before the House Select Committee on the Chinese Communist Party (the Select Committee), former U.S. Trade Representative Robert Lighthizer recommended that Congress revoke PNTR for China and either “create a new column of tariffs specific to China or should rewrite U.S. column two tariffs.”

There are currently several proposals in Washington for revoking PNTR. The standard scenario would subject all imports from China to the column 2 tariff rates in the U.S. Harmonized Tariff Schedule, which are currently only applicable to Cuba, North Korea, Russia, and Belarus. Cuba and North Korea are subject to embargoes and Russia and Belarus had PNTR revoked due to the war in Ukraine. This would mean that imports from China would face an average applied tariff rate of roughly 40 percent instead of the 3.5 percent they face under column 1 in the U.S. Harmonized Tariff Schedule. Another proposal that surfaced during a recent debate hosted by the Select Committee is to subject imports from China to an entirely separate tariff regime that Congress would need to regularly vote on.

Estimated Impact on U.S. Economy of Revoking PNTR for China

Using version 11 of the Global Trade Analysis Project (GTAP) database, the average tariff applied to Chinese exports to the United States is 3.5 percent. For the purposes of this model, this analysis focuses on six broad sectors: agriculture and food, oil and gas, textiles and apparel, industrial goods, electronics, and services. The average U.S. tariff rates for these sectors based on the GTAP database are shown in Table 1. Because China is a member of the WTO, the United States applies MFN tariffs to its exports; these rates represent the column 1 tariffs in the U.S. Harmonized Tariff Schedule. By revoking PNTR, imports from China would be subject to column 2 tariffs in the tariff schedule. The average column 2 rates for the six sectors in this model are in Table 1.

This analysis modeled the effects of setting the tariffs rates for the six sectors at the average column 2 rates for imports from China. It is important to note that column 1 and column 2 rates do not account for the current Section 301 tariffs on imports from China. Many proposals for revoking PNTR suggest that doing so would replace the Section 301 tariffs. Notably, if those tariffs remained and PNTR were revoked, the economic impact on the United States would be more significant than estimated by this research. This analysis demonstrates some of the effects of revoking PNTR for China, including impacts on U.S. GDP, exports, import prices, and domestic consumer prices.

- U.S. GDP falls. Based on this model, revoking PNTR would reduce U.S. GDP by 0.08 percent, or roughly $15.9 billion, based on 2017 levels. As the United States tries to execute a soft landing in its fight against inflation, revoking PNTR would only make weathering this it more difficult for the economy.

- U.S. total exports fall by more than 17 percent. There are many gains from trade, but the one most apparent to many policymakers is the volume of U.S. exports. For U.S. companies this means selling fewer cars, computers, and food products abroad. Revoking PNTR for China would not only impact U.S. trade with China, but also reduce U.S. exports to the rest of the world in nearly all sectors (save some services exports that are not subject to tariffs). For example, exports to Europe would fall by roughly 12.5 percent, whereas exports to Asia (minus China) would fall by more than 18 percent. The hardest hit exports sectors would be textiles and apparel, industrial goods, and electronics. U.S. exports of these products to all countries except China would decrease by 37 percent, 15 percent, and 25 percent, respectively.

- The price of imports increases by roughly 7 percent. Tariffs act as a sales tax on imported products, making these goods more expensive. The increase in tariffs on imports from China that would result from revoking PNTR would significantly raise the price of all U.S. imports. The hardest hit sectors would be textiles and apparel and electronics, which would each increase in price by more than 14 percent. This represents the price of all imported products in these sectors; imports from China would face higher price hikes.

- Domestic prices increase for Americans by 5.9 percent. Two-thirds of all imports are intermediate goods, or products used by domestic manufacturers to make finished goods, and as a result, high tariffs on imports from China would have a ripple effect on domestic prices in the United States. The textile and apparel and electronics sectors would see the largest price hikes of nearly 13 percent and 12.5 percent, respectively.

U.S. revocation of PNTR for China would also impact the rest of the world. China would experience a drop in GDP of 0.64 percent, or roughly $80 billion. While Chinese exports to the rest of the world would increase, its imports would fall. European countries would actually benefit, with the continent’s GDP increasing by 0.11 percent, or $22.4 billion. All other regions would also experience a rise in GDP.

Factoring in Retaliation

Recent history shows that unilateral tariff increases by the United States on imports from China do not go unanswered. China retaliated with reciprocal measures against U.S. Section 301 tariffs each time they were applied, as well as when the United States increased export controls on China or issued sanctions against Chinese officials. China would certainly retaliate if the United States revoked PNTR; the question is to what degree it would retaliate. In response to the Section 301 tariffs, China matched the rates and volume of products affected in each tranche of tariffs.

The rate of possible retaliation is less certain, so this research explores two possible options of Chinese retaliation and the impact on the U.S. economy. The average tariff rate for U.S. exports to China in this model based on the GTAP database is 5.5 percent. In Scenario A, China’s import tariff for U.S. products was set at 20 percent, equal to approximately half the average tariff faced by Chinese exports to the United States if PNTR were revoked. In Scenario B, China’s retaliation is equal to the United States’ column 2 rate, with U.S. exports to China facing an average tariff of 40 percent. Table 3 compares the economic impact of just revoking PNTR for China with the two retaliation scenarios.

In Scenario A, U.S. GDP would fall by $19.7 billion, or 0.1 percent. Total exports would decrease by more than 29 percent, a substantially higher margin than without Chinese retaliation. The textiles and apparel and electronics sectors would take the largest hit, with exports falling to all regions. The average price of all U.S. imports would increase by 7.2 percent and domestic prices would rise by 5.6 percent. The results of the model represent a snapshot in time as economies adjust to a new equilibrium given the shocks applied. Due to trade diversion caused by the shocks, domestic prices vary when Chinese retaliation is added trade diversion. This model does not represent long-term price impacts, however it is likely that prices would rise in the long run.

In Scenario B, U.S. GDP would decrease by $24.8 billion, or 0.13 percent. Total exports would take the largest hit in this scenario, falling more than 44 percent. Global exports for the oil and gas, textiles and apparel, and electronics sectors would all decrease by more than 60 percent. This scenario presents the worst outcome for import prices, which would increase by 7.6 percent. Domestic prices would rise by 5.2 percent, which is less than Scenario A or the initial revocation of PNTR for China, suggesting that the greatest impact to domestic prices would be caused by the United States revocation of PNTR, not Chinese retaliation.

In both scenarios, China would experience economic harm of a greater magnitude due to retaliation. China’s GDP would decrease by 0.73 percent, or $92.5 billion, in Scenario A and by 0.87 percent, or $110.3 billion, in Scenario B. China’s exports to the rest of the world would rise in both retaliation scenarios, but imports would fall. Similar to the impact of only revoking PNTR, European countries, as well as the rest of the world, would be the primary GDP beneficiaries in cases where China retaliates. In short, revoking PNTR for China would be a self-inflicted wound for the United States from which other countries would benefit, and in the case of Chinese retaliation those effects would only deepen.

Conclusion

Revoking PNTR for China would have a substantial impact on U.S. GDP, exports, and prices, which are all factors that Congress should consider when addressing the challenges that China poses for the United States. This course of action would be a blunt instrument that would also likely invoke Chinese retaliation, further worsening the damage to the U.S. economy. Finally, electing to revoking PNTR for China would likely only worsen the current inflationary environment.

Methodology Appendix

CGE models are “economy wide.” They replicate and describe the relationship and linkages between different actors in an economy via a system of equations. CGE models contain both exogenous and endogenous variables and market-clearing constraints. By changing one or more exogenous variables, each equation in the model is solved simultaneously to return an economy-wide equilibrium where at the equilibrium set of prices, supply and demand are equal in every market.[1]

Actors in CGE models include firms that purchase inputs, hire workers, and use capital to produce output as responses to economic demand. The income generated from firm output is accrued by households since they provide factors of production such as labor. They then spend their income on goods, services, taxes, and savings. Tax revenue funds government spending and savings funds investor spending. The combined demand by private households, government, and investors is met by firms. Firms in turn purchase more inputs and hire more workers and capital. This completes the circular dynamic flow of income and spending and the overall relationship between actors of an economy.

This research uses the 2017 GTAP database to develop a six-sector and five-factor database for the United States, China, the ASEAN countries, Europe, Rest of Asia, and Rest of World. The sectors are agriculture, extraction, textiles, industrial inputs, computer and electronic goods, and services. The three factors of production are land, unskilled labor, skilled labor, capital, and natural resources. Each factor of production is fixed.

In the GTAP model, tariffs on imports from China to the United States are increased to model the global and region-specific economic impact of the United States stripping China of its most-favored nation trading status. Similarly, tariffs on imports from the United States to China are increased to model possible Chinese retaliation. In the retaliation simulations, shocks are applied simultaneously as the authors assume that China would respond very quickly to U.S. action of revoking PNTR. Increasing the tariffs serves as an economic shock which in the model creates a disequilibrium that changes the intra-behavior and interactions of the economies in the model. The GTAP model is static, so it shows the before and after effect of an economic shock. It does not necessarily provide insight into the economy’s dynamic adjustment process.[2]

To determine the increased tariff rates to serve as the economic shocks, U.S. imports from China by HTS codes were collected from the USITC Dataweb Tool. The column 2 duty rates were calculated for these imports.[3] The imports were then mapped to the GTAP database industries.[4]

[1] Burfisher, M. E. (2016). 1: Introduction to Computable Generable Equilibrium Models . In Introduction to Computable General Equilibrium Models (Second). Cambridge University Press.

[2] Burfisher, M. E. (2016). 1: Introduction to Computable Generable Equilibrium Models . In Introduction to Computable General Equilibrium Models (Second). Cambridge University Press.

[3] https://www.usitc.gov/harmonized_tariff_information

[4] https://www.gtap.agecon.purdue.edu/databases/contribute/concordinfo.asp