Research

May 9, 2017

Impact of the AHCA’s Medicaid Reforms Varies by Category of Eligibility

Executive Summary

Our analysis of the Medicaid reforms included in the American Health Care Act of 2017 (AHCA) such that federal financing for the program is provided through a per capita allotment, rather than its current open-ended financing structure, finds that the impact will likely be different for each of the subsets of populations served. The allotment provided for each beneficiary would be based on the individual’s category of eligibility for the program, and spending growth rates for each of these subpopulations differ. The magnitude of the difference in spending that would occur under the proposal relative to projections under current law depends upon the populations’ projected spending growth rates relative to the factor to which the annual increase in the allotment will be tied—the medical care component of the consumer price index (CPI-MC).

The American Action Forum finds that per beneficiary spending for children in 2025 will be 91.5 percent of what it is projected to be under current law. Spending for non-expansion adults would decrease by a similar amount to 88 percent of current projections. However, spending for expansion population adults and the elderly would actually increase under the proposal, reaching 105 percent of current projections by 2025. The disabled would see a very slight spending decrease by 2023 which would result in spending of 98.4 percent of current projections for 2025.

Given that the primary reason for this policy change is to rein in federal spending, it is important to also consider what these varying impacts mean for overall program spending. Children and adults account for 76.5 percent of all Medicaid enrollees, but only 44.6 percent of Medicaid expenditures. The elderly and disabled account for the remaining 23.5 percent of enrollees but 55.4 percent of spending. If spending for the elderly increases under the reform and spending for the disabled decreases by less than two percent per beneficiary, it is not likely that the reduced spending for the other populations will be enough to achieve the desired result. Program reforms that provide for controlling cost growth and targeting the cost-drivers are necessary to actually provide substantial reductions in program spending.

Introduction

The American Health Care Act (AHCA), which repeals and replaces the Affordable Care Act, also contains provisions to reform the Medicaid program.[1] Specifically, Medicaid would transition from an open-ended entitlement program to a per capita allotment financial model. Under the current open-ended structure, depending on a state’s federal assistance matching percentage (FMAP), each dollar a state contributes toward the program is matched by the federal government without restriction at a greater than 1:1 ratio. This limits states’ incentive to reduce spending, and many have long considered the current financing model to be fiscally unsustainable. In 2016, it is estimated that total Medicaid spending reached more than $575 billion; 63 percent of these funds, or $363.4 billion, came from the federal government.[2] Federal spending growth has outpaced state spending growth on the program year after year; in the past ten years, federal expenditures have grown nearly twice as fast as state expenditures. The proposal to move to a per capita allotment financing structure reflects a desire to rein in federal spending and preserve the program for generations to come, along with the hope that such changes will bring about delivery system reform that results in higher quality care for beneficiaries.

The Proposed Reform

The AHCA (in its current form[3]) would, beginning in fiscal year 2020, provide a set amount of federal funding for medical benefits for each individual enrolled in the program, based on their category of eligibility: child, non-expansion adult, expansion adult, elderly, blind and disabled, with a few exceptions.[4] The amount of funding provided would be based on each state’s medical expenditures in fiscal year (FY) 2016 for each category of eligible individuals, adjusted by the average federal matching percentage for all beneficiaries in the state, as well as the percentage of all enrollees each such category represents in the state in the current fiscal year. Expenditures excluded from this amount include DSH payments, Medicare cost-sharing payments, and safety net provider payment adjustments in non-expansion states. That base historical expenditure amount for each category of individuals will then be increased by a certain percentage to determine the provisional expenditure target for each category in FY 2019. For children, adults, and expansion population adults this percentage will be the percentage increase of the medical care component of the consumer price index (CPI-MC) from September 2016 to September 2019.[5] (If a state expands its Medicaid program as provided under the ACA after 2016 and therefore does not have 2016 expenditures for its expansion population upon which to base its target, these individuals will be grouped together with other non-elderly, nondisabled adults.) Expenditures for the elderly and disabled will be increased using the same index component plus one additional percentage point.

The target expenditure level for FY 2020, when the funding reform takes effect, and subsequent years will be the target determined for FY 2019 increased by the same respective percentage used to set the provisional target (CPI-MC or CPI-MC+1, depending on the category), compounded each year, beginning in 2019.If payments in one year exceed the target, they will be reduced by that amount, on a quarterly basis, in the following year.

Methodology

In this analysis, a comparison is made between current projections of average expenditures for each category of beneficiaries and what average expenditures might be for each category under this proposal. The current projections for each year are based on the most recent Medicaid Actuarial Report.[6] The estimated spending under the per capita allotment proposal discussed here is based on an assumption that CPI-MC from 2017 forward equals 3.7 percent, which is the average from 2000-2016, as well as a steady mix of enrollees across categories and a constant matching percentage from the states. In other words, it is assumed that states continue to contribute the same percentage of funding for each beneficiary relative to federal expenditures.

Results

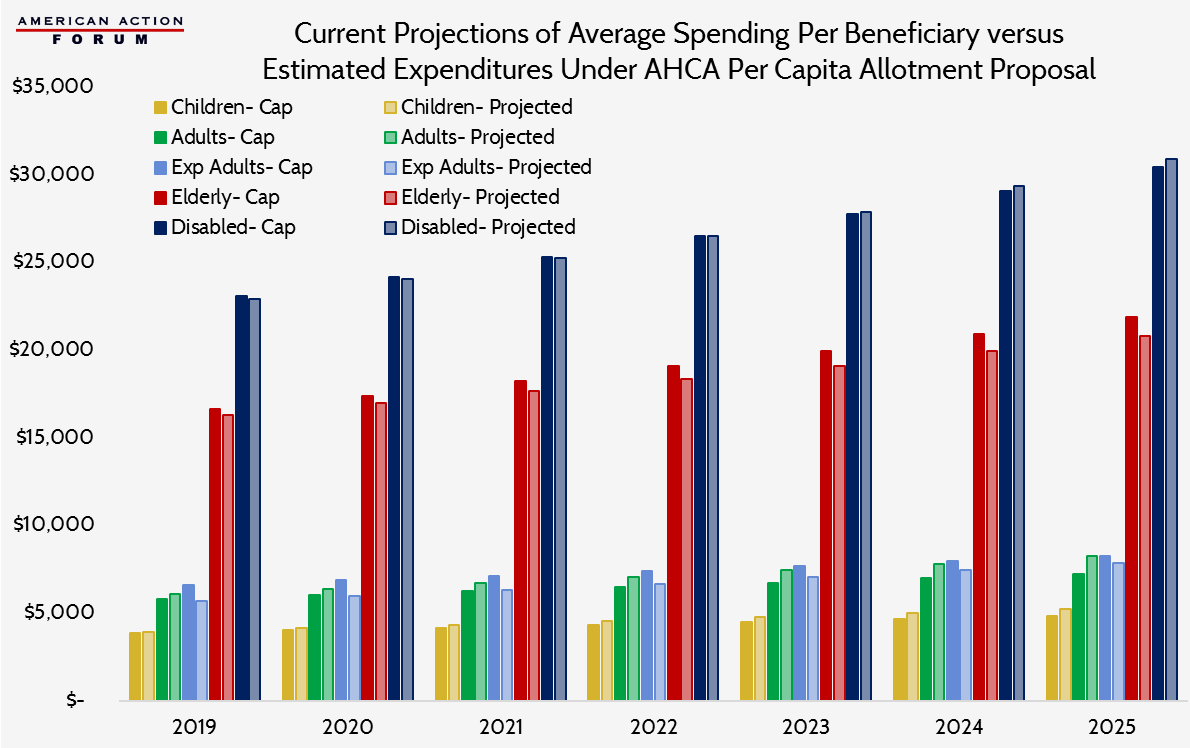

As shown in the chart below, the differences between current projections and estimated expenditures under the proposed reform are minimal for most groups. Whether spending for a population under the proposed reform is estimated to be more or less than projected under current law depends on the current expected rate of growth for that population, which is not equal across categories of eligibility. Spending for children is currently expected to increase by an average of 4.9 percent each year between 2019 and 2025; for adults, 5.2 percent; expansion population adults, 5.6 percent; the elderly, 4.2 percent; and the disabled, 5.0 percent. When you compare these percentages to the assumed average increase in CPI-MC and factor in the extra percentage point added to the target for the elderly and disabled populations, it becomes clear that expenditures for expansion population adults and the elderly should be expected to rise. Expenditures for children and non-expansion adults will likely decline, as well as expenditures for the disabled, though only slightly.

The above assumptions hold true. Under current law, spending per child is expected to increase 33.2 percent from 2019-2025; under this proposal, expenditures during the same period would grow only 24.4 percent, resulting in expenditures per child equal to 91.5 percent of what they otherwise are expected to be in 2025. The difference is slightly more noticeable for non-expansion adults; spending would be only 88 percent under the proposal, compared with current projections. However, spending differences for expansion population adults are interesting because per beneficiary expenditures for this group of individuals is actually expected to decrease each year from 2016 through 2018. Because the proposal would instead set a target based on steady increases between 2016-2019, the starting point in 2019 is approximately $1,000 higher under than it is otherwise expected to be. The result is a much slower rate of growth under the reform proposal—24.4 percent versus 38.4 percent—but expenditures which would be 105 percent of current expectations in 2025. The elderly population would also see average expenditures equal to 105 percent of current projections for 2025 as a result of faster growth than currently projected. The disabled population would see a slightly diminished rate of growth, resulting in per beneficiary spending in 2025 equal to 98.4 percent of current projections.

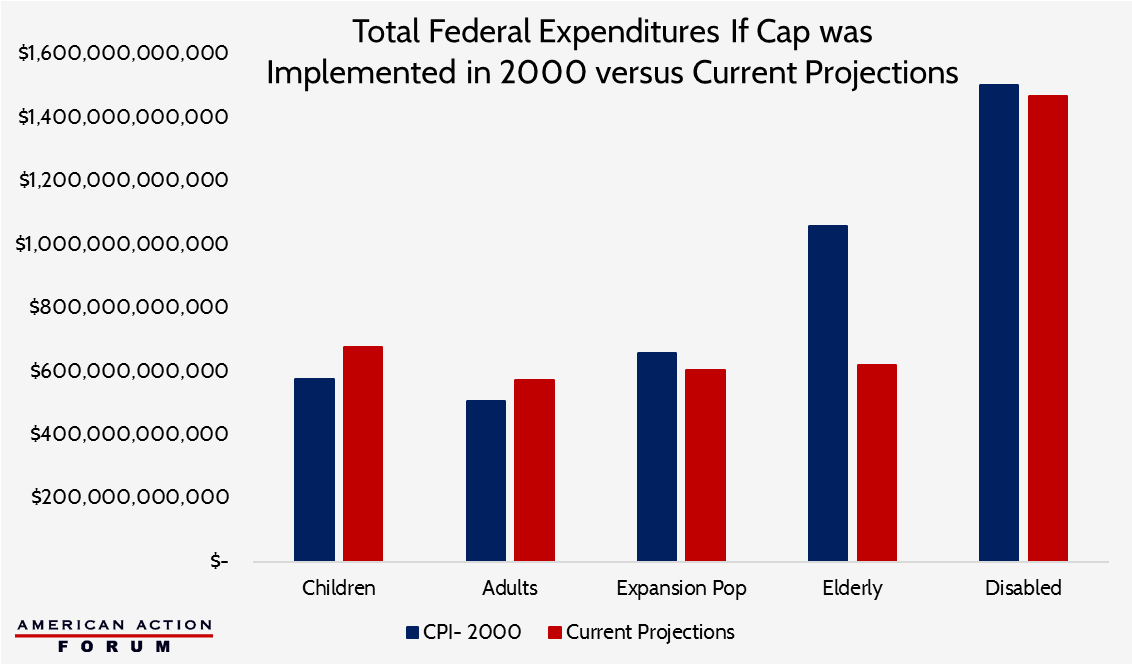

However, if one were to consider only historical expenditure growth rates for each category of individuals, a much different expectation would result, particularly for the elderly and disabled populations. Historical spending growth for children and adults is slightly less than what is currently projected. Between 2000 and 2016, average annual expenditure growth for children was 4.4 percent; for adults, 4 percent; expansion population adults (since 2014), 4.3 percent. Expenditures for the elderly and disabled, on the other hand, have grown very slowly, sometimes even declining from one year to the next. Between 2000 and 2016, the average rate of growth for spending per elderly beneficiary was 0.2 percent, and 3.2 percent per disabled beneficiary. If current projections more closely matched historical averages, spending for children and adults would likely be nearly equal under the two scenarios and would be far greater for elderly and disabled individuals under the per capita cap proposal. In fact, the following chart compares estimated total federal expenditures for each group of beneficiaries between 2018 and 2025, if the per capita cap reform proposal had been implemented in 2000, growing each year based on CMPI-MC with current projections based on current law. The American Action Forum estimates that federal expenditures across the five eligibility categories over eight years would actually be $357 billion more if the reform would have been implemented in 2000, driven primarily by greater expenditures for the elderly.

The two charts show just how much different assumptions can lead to drastically different expectations. Similarly, the ultimate impact of any policy change will depend on how much actual spending varies from current projections.

[1] https://www.gpo.gov/fdsys/pkg/BILLS-115hr1628rh/pdf/BILLS-115hr1628rh.pdf

[2] https://www.medicaid.gov/medicaid/financing-and-reimbursement/downloads/medicaid-actuarial-report-2016.pdf

[3] https://rules.house.gov/sites/republicans.rules.house.gov/files/115/policy_mngr_01.pdf

[4] Partial benefit dual-eligibles, children covered by CHIP, individuals covered by the Indian Health Service, and individuals eligible under the breast and cervical cancer category would be excluded from this funding change and would continue to receive open-ended federal funding.

[5] https://data.bls.gov/pdq/SurveyOutputServlet

[6] https://www.medicaid.gov/medicaid/financing-and-reimbursement/downloads/medicaid-actuarial-report-2016.pdf