Research

October 20, 2017

Multiemployer Pension Financing and the Implications for the Federal Budget

Executive Summary

- Over 10 million Americans participate in 1,400 multiemployer defined benefit pension plans

- Multiemployer plans as a whole face significant long-term funding challenges – holding assets equal to less than half of their liabilities – while a small subset face near-term insolvency

- Some observers and policymakers have suggested the federal government provide credit assistance at favorable terms to struggling plans

- This analysis estimates that one potential credit-assistance design would cost taxpayers at least $7 billion

- There is an essential role for multiemployer pension plan stakeholders to contribute to the future stability of these plans and reduce risks to the taxpayer

Introduction

Multiemployer defined-benefit plans are collectively bargained, i.e. union, pension plans maintained by more than one employer. Over 10 million workers are covered under about 1,400 such plans. The system as a whole has deteriorated in recent years, and some plans are severely underfunded. The likely collapse of these plans could precipitate federal intervention. Indeed, recent legislation has already attempted to mitigate this challenge, but is unlikely to materially alter the pending insolvency of some large plans. Moreover, the federal backstop for these plans, the Pension Benefit Guarantee Corporation (PBGC) is itself facing insolvency. The intersection of the likely insolvency of multiple pension plans and the projected insolvency of the federal backstop raises the likelihood of federal intervention. This report examines the current state of multiemployer pensions and their interaction with federal policy, and assesses the budgetary effects of federal credit assistance and related policies to severely distressed pension plans.

The Multiemployer Pension System

The modern multiemployer pension system was established by the Labor Management Relations Act of 1947, commonly known as the Taft-Hartley Act, which governs the structure and operation of multiemployer plans.[1] Multiemployer plans must at a minimum cover two separate employers and two employees, and governance of a multiemployer must reflect equal labor-management representation. Characteristics of plans vary, but many plans represent smaller employers in the building trades, as well as retail trade and service industries, manufacturing, mining, trucking and transportation industries, and entertainment (film, television and theater).[2]

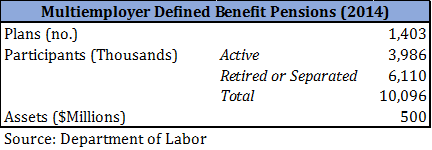

As of 2014, the most recent year for which data is available, there were 1,403 multiemployer defined-benefit pension plans with 10,096,000 participants.[3] Of these 10- million plus participants, 3,986,000 were active participants, and 6,110,000 were retired or separated participants either receiving or eligible to receive benefits. Collectively, these plans held $500.48 billion in assets.

Table 1: Basic Statistics

Plans and participation are concentrated in certain industries, with nearly half of all multiemployer pension participants working (or having worked) in the construction and finance, insurance, and real estate industries.

Table 2: Multiemployer Pension Participation by Industry

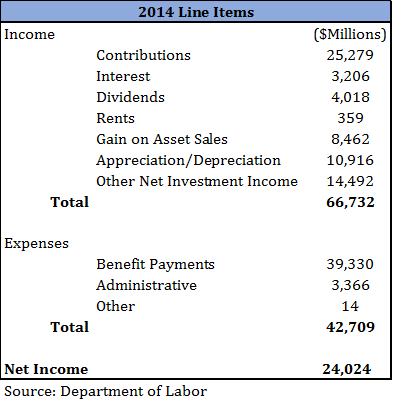

On the whole, multiemployer plans with over 100 participants (99.98 percent of all multiemployer DB plans) collected over $24 billion in net income in 2014.

Table 3: Income Statement of Multiemployer Defined-Benefit Plans with 100 or More Participants

While table 3 is instructive in highlighting the financial structure of multiemployer plans financing in the aggregate, it disguises the fact that the multiemployer pension system faces considerable financial difficulty. Though just over half of multiemployer pensions are adequately financed (“green status”), the system as a whole faces net liabilities of $611 billion.[4]

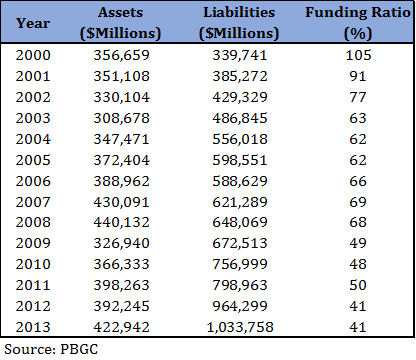

Table 4: Multiemployer Pension Finances (2000-2013)

Since, 2000, funding for multiemployer plans has deteriorated significantly. However, funding challenges represent liabilities that extend to the long term, and for many plans facing difficulty, there remains time to address funding challenges and recoup losses from past investment performance. Meanwhile, a significant number of plans face severe challenges. The PBGC recently estimated that 103 multiemployer plans, with over one million participants, are likely to face insolvency.[5] A small subset was deemed in “critical and declining status” because they meet certain criteria for distressed financing and face projected insolvency within 15 years (or 20 years in certain circumstances).[6]

“Orphan” Participants of Pension Plans

Many factors have contributed to the challenges faced by multiemployer pensions, including the withdrawal of firms from plan contributions. Its former employees, or “orphan participants,” remain beneficiaries of the multiemployer plan to which their former employer no longer contributes. Firms may choose to withdraw from plans, and pay a withdrawal liability, or the withdrawal may stem from firm bankruptcy or other corporate change. Even if firms pay their withdrawal liability, payments are limited by law. Thus, plans with large “orphan” liabilities can be uniquely challenged by the combination of a relative decline in assets and/or contributions to support a population of largely inactive participants. Accurately estimating the scope and scale of “orphan” liabilities is difficult because reported data likely understates the scale. According to the PBGC, reporting “orphan” participants is a relatively new reporting requirement, and pension processing systems are not designed to identify these populations. Moreover, the concept of an “orphan” varies, with a different population, captured by criteria specified in the Multiemployer Pension Reform Act of 2014, than is reported by firms’ Form 5500 filings. According to these data, there were 1.4 million plan participants whose employer did not make a contribution to the plan in the previous year, up from over 1.3 million in 2010.[7] However, this figure likely understates the “orphan” population by a significant degree.[8]

Federal Policy Issues

While troubling, financial distress of private firms or contractual arrangements need not precipitate federal involvement. The pensions in question reflect employer-employee agreements in private industry. Those agreements necessarily reflect the risks inherent to those firms and industries and should be borne by the parties to those agreements – not the taxpayer. However, the federal government is already to a degree entangled in the performance of these pensions.

The PPBGC is a federal agency that insures both single and multiemployer pensions. The terms of PBGC’s insurance of single-employer pension plans differs considerably from that of multiemployer plans, but in general, both types of plans pay premiums in exchange for a guaranteed benefit in the event of bankruptcy or plan insolvency. The PBGC’s cash operations are reflected in the federal budget, however the PBGC has no claims on resources outside of the premiums, assets and investment income it collects. On a cash basis, the Congressional Budget Office (CBO) expects financial assistance claims from multiemployer pensions to the PBGC to total $9 billion over 2017-2026. This represents the total projected cost of guaranteed benefits to participants in multiemployer plans estimated to be in insolvent over that period.[9] Over the subsequent decade, when still more plans are facing insolvency, that amount increases to $35 billion. Notably, the PBGC multiemployer program is itself projected to be insolvent in 2025.

Over the 2017-2036 period, premium collections and other income would only cover $11 billion of the total $45 billion in estimated claims over that period. However, because the PBGC has no claims to federal resources, under current law, this shortfall has no budgetary effects. Rather, PBGC can only pay benefits to the degree it has resources to do so, resulting in significant reductions below guaranteed benefit, which is itself only a fraction of average multiemployer pension benefits.

While the PBGC has no authority to pay benefits beyond what it has assets to finance, many policymakers and observers view its obligations as having an implicit federal guarantee.[10] Thus while under current law dozens multiemployer pensions are expected to face insolvency and a loss of guaranteed benefits from PBGC for hundreds of thousands of participants, the resulting hardship and disruption would likely precipitate congressional action. Indeed, Congress recently enacted the Multiemployer Pension Reform Act of 2014, which increased premiums and allowed certain eligible plans to reduce payable benefits. However, only 11 plans have applied to the Treasury Department to approve benefit reductions, of which only one has been approved.[11]

Credit Assistance

There are several policy options that could improve the outlook for both multiemployer pensions, and relatedly, the PBGC. One such option would be the provision of low-interest financing for distressed plans provided these plans meet certain criteria. This option has been raised or otherwise proposed by some observers and stakeholders as a potential policy option for assisting the most distressed plans.[12] While as a matter of public policy, this option raises several questions and concerns, as a budgetary matter, it is straightforward.

This analysis considers the federal budgetary costs of providing low-interest financing to the most distressed multiemployer pension systems – those designated as critical and declining according to their Form 5500 filings with the IRS, Department of Labor and PBGC as of 2015.[13]

According to these filings, there were 55 multiemployer pensions in critical and declining status in 2015. Combined, these plans had over $28 billion in net assets at the end of 2015. This analysis estimates a credit program that provides up to three rounds of financing beginning in 2017 over five-year periods. Eligible plans would receive loans equal to five times the shortfall of their projected annual benefit payment less projected income and contributions. The loans would be for 30 years at one-percent interest. However, during the five-year loan period, and during any successive funding round, the loans would be interest-only. During this period, plans would reduce payable benefits by 20 percent.

Based on projections of each of the 55 plans’ cash flows, total projected loan volume under this plan would amount to $23.3 billion disbursed in three tranches over the next 15 years on a cash basis. Not all 55 plans would be eligible or need full use of the plan. Rather, some plans in the 2015 data set were at-or-nearing insolvency and were assumed to be ineligible. Virtually all remaining plans were estimated to utilize all three rounds of credit assistance.

While on a cash basis, the gross loan disbursement under this potential proposal is estimated at $23.3 billion payable over 15 years, estimating the cost to the federal government requires estimating loan payments and potential default risk. In addition, to comport with the treatment of other credit programs in the federal budget, this analysis discounts the estimated cash flows under this potential program consistent with Federal Credit Reform Act (FCRA) methodology.[14]

Most, but not all, plans were projected to accept three tranches of credit assistance over 15 years, during which the plans would pay interest-only on each successive loan. At the end of that period, plans would begin paying off the loan balances amortized over 30 years, for a total of 45 years of payments. Combined, and assuming no default risk, these payments were estimated to total $29 billion on a cash-basis. However, consistent with FCRA, these payments must be netted with the loan disbursements and discounted at the cost of long-term Treasury borrowing rates.[15] Assuming no default risk, this program would cost taxpayers $7.2 billion, principally reflecting the favorable credit terms.

These plans are by definition in precarious financial condition, raising the likelihood of some plans being unable to pay back the loans. The loan volumes estimated in this analysis are based on the projected cash flows of each participating plan, however, this analysis does not assess the default risk of each individual plan after its hypothetical participation. All else being equal, this credit assistance program would necessarily have significant default risk associated with it. For the purpose of illustration, a 33- percent default risk would increase the risk to taxpayers by $3.7 billion compared to a no-risk scenario. This element is subject to a high degree of uncertainty particularly over 45 years, and this analysis presents this assumption to illustrate how risk could raise cost to the taxpayer.[16] This has the effect of reducing payments, and raising the net budgetary cost to $10.9 billion.

Table 5: Cost Estimates

Recent legislation requires CBO to estimate credit programs using fair-value estimates as well as FCRA estimates.[17] Fair-value estimates follow the same methodology as FCRA estimation but employ a discount rate that incorporates market risk. While this estimate does not present a fair-value estimate, employing a market-based, rather than a Treasury-derived, discount rate would significantly increase estimated costs to the taxpayer under this program.

Risk Pool and Stakeholder Funding

While this credit program would obviate some future claims on the PBGC multiemployer program, it would present considerable downside credit risk if there were significant defaults within the credit assistance program. Accordingly, an additional backstop, funded by multiemployer pension plans and associated stakeholders, could be established to mitigate default risk.

Additional policies could be pursued to mitigate default risk. One option would be the establishment of a risk pool to backstop the credit assistance program. Funded with fees and contributions from plan stakeholders, a risk pool could provide assistance to plans struggling to repay federal loans and mitigate default risk.

Risk Pool

A credit assistance program for assisting the most distressed multiemployer pensions would reduce future claims against the PBGC, but would incur a cost to the taxpayer in the form of a credit subsidy. Given the precarious financial status of the plans likely to receive any federal credit assistance, default risk is potentially quite high, raising the likely cost to the taxpayer. However, it is possible to mitigate this risk through an additional backstop, or risk pool mechanism. The risk pool could be funded through up to five separate revenue streams, which would be administered by the PBGC and invested conservatively to achieve modest but steady returns over time. Such a risk pool would have about $18 billion by year 15 to help plans receiving credit assistance in making timely loan repayment, and mitigate the risk of default. The degree to which plans required access to the reserve pool would be driven by future investment returns and other factors that would affect the solvency of multiemployer plans generally.

PBGC Fees

The multiemployer PBGC insurance program is funded through premiums paid by plan sponsors and assessed on a per-participant basis. Under current law, multiemployer premiums are $28 per participant.[18] Increasing yearly fees by $7 per participant could yield an annual revenue stream of $70 million that could be dedicated to the new risk pool.

Employer Surcharges

Employers could be assessed a surcharge to be contributed to the PBGC. This would be a new revenue stream that could be assessed based on participant levels. For example, assessing a monthly $2 fee on active participants would raise $96 million per year in new contributions to PBGC.[19]

Membership Fees

The multiemployer pension system is largely funded through investment income and employer contributions – employees generally do not contribute to the plans. Broadly raising revenue throughout the multiemployer pension system could be accomplished by creating a new fee paid by employees and beneficiaries. Assessing a $2 monthly fee on active and retired participants could generate an additional $171 million per year that could be used to fund the risk pool.

Union Fees

Each of the 1,403 multiemployer pension plans is collectively bargained, representing a benefit contractual arrangement between employers and union-represented employees. Another revenue source to strengthen the PBGC or offset costs to the taxpayer could be levied on unions based on active participants. For example, assessing a monthly $2 fee on unions based on active participants would raise an additional $96 million per year to fund the risk pool.

Receipts and investment returns would allow for the balance of the risk pool to accumulate to about $18 billion by its 25th year. While highly uncertain, these assumptions would suggest that at year 25, the risk pool balance would equal 78 percent of outstanding loans issued as part of a potential credit assistance program, though this figure is highly uncertain. Under these same assumptions, annual loan payments from plans are estimated at about $900 million annually. Accordingly, there would be adequate assets in the risk pool to absorb significant default risk for a number of years.

Implications

The estimates presented in this analysis suggest that pairing credit assistance with benefit reductions to severely distressed multiemployer pension plans could mitigate the disruption from the pending insolvency of many such plans. Naturally, such a policy would come with significant costs to the taxpayer that, under current law, would be borne by plan participants through benefit reductions. Providing taxpayer funds to private entities necessarily raises concerns about moral hazard and the proper role of government that arise whenever the federal government socializes private risk. Additional policies, including a risk pool funded by pensions stakeholder could mitigate that concern.

There is also an important counterfactual that must be weighed. Insofar as credit assistance would diminish future claims on the PBGC, the budgetary effects would be diminished to the extent that federal policymakers intervene and provide additional federal resources to the PBGC. Moreover, assuming the credit assistance program forestalls the severe benefit reductions that would arise from the PBGC’s insolvency, the local economies of affected participants would face less disruption. Retirees that would otherwise receive a fraction of their pension benefits would contribute to greater local economic activity, and consume fewer government services.

Conclusion

The U.S. multiemployer pension system has deteriorated over the past decade and as a whole is facing financial difficulty. A small subset of these plans is facing near-term insolvency. Furthermore, the federal backstop for these programs, the PBGC, is also facing insolvency in less than a decade. While there is a legitimate concern about potential federal intervention, some observers and policymakers have contemplated credit assistance as one possible avenue of support. This analysis does not endorse such a proposal, but rather assesses potential budgetary costs and the factors that inform those costs. While this estimate is subject to a high degree of uncertainty, examining the finances of likely participants in the program suggests a cost to the taxpayer of $7 billion assuming no default risk. If plans receiving assistance fail to repay loans, the costs would be significantly higher – though other policies, specifically a stakeholder-funded risk pool, could be pursued to mitigate this risk. The credit assistance program would represent a new and significant cost to the taxpayer, and raises legitimate policy concerns. However, those concerns must also be weighed against an alternative scenario in which the eventual collapse of these plans results in even greater federal exposure and potential economic disruption.

[1] While there are also multiemployer defined-contribution plans, this report is specific to defined-benefit plans.

[2] http://www.pbgc.gov/prac/multiemployer/introduction-to-multiemployer-plans.html#1

[3] https://www.dol.gov/sites/default/files/ebsa/researchers/statistics/retirement-bulletins/private-pension-plan-bulletins-abstract-2014.pdf

[4] http://www.pbgc.gov/documents/2014-data-tables-final.pdf

[5] http://www.pbgc.gov/Documents/2016-Annual-Report.pdf

[6] https://www.dol.gov/sites/default/files/ebsa/about-ebsa/our-activities/public-disclosure/status-notices/critical/2015/retirement-benefit-plan-of-gciu-detroit-newspaper-union-13n-with-detroit-area-newspaper-publishers.pdf

[7] http://www.pbgc.gov/documents/pbgc-report-multiemployer-pension-plans.pdf

[8] Based on author’s discussion with PBGC

[9] https://www.cbo.gov/publication/51536

[10] https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/66xx/doc6646/09-15-pbgc.pdf

[11] https://www.treasury.gov/services/Pages/Plan-Applications.aspx

[12] https://www.bna.com/ups-proposal-fix-n73014461711/; https://nysteamstersfundretireerep.com/wp-content/uploads/2017/04/NYS-Teamsters-PRF-Retiree-Rep-UPS-Legislative-Proposal.pdf; https://www.gpo.gov/fdsys/pkg/CHRG-113hhrg81335/html/CHRG-113hhrg81335.htm

[13] https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/public-disclosure/foia/form-5500-datasets

[14] See https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/57xx/doc5751/08-19-creditsubsidies.pdf

[15] While there is no 45-year Treasury bond, this analysis extrapolates the current yield curve to approximate the appropriate discount rate.

[16] The basis for the illustrative one-third estimate reflects the value of the $23 billion on a cash-basis in estimated loan disbursement as a share of the potential $34 billion federal net exposure of unfunded multiemployer PBGC liabilities.

[17] Section 3105 of the Conference Report of the Concurrent Resolution on the Budget for Fiscal Year 2016

[18] https://www.pbgc.gov/prac/prem/premium-rates

[19] https://www.dol.gov/sites/default/files/ebsa/researchers/statistics/retirement-bulletins/private-pension-plan-bulletins-abstract-2014.pdf