Research

June 30, 2016

Outer Continental Shelf Oil and Gas Leasing: A Review of the Economics

Summary:

- 13 Outer Continental Shelf (OCS) lease sales located in Alaska and the Gulf of Mexico are currently being considered by the Bureau of Ocean Energy Management (BOEM). An alternative approach being considered by BOEM would ban all new leasing. This paper documents the detrimental impact on the U.S. economy if such a ban were imposed.

- The Alaska leases alone could provide $474.6 billion in oil revenues and $39.15 billion in natural gas revenues over the next 50 years – using today’s price of both oil and natural gas.

- According to BOEM, in total, the U.S. Outer Continental Shelf holds 89.82 billion barrels of oil and 327.42 trillion cubic feet of natural gas which equates to $4.62 trillion in oil and $854 billion in natural gas[1].

Waiting Game

June 16th was the final day in a 90-day comment period for BOEM’s 2017-2022 OCS Oil and Gas Leasing Program. The proposal, submitted in March 2016 was the second in a series of proposals for this leasing program that is designed to provide information to the Secretary of Interior, currently Sally Jewell, in terms of the size, timing and location of leasing in the 2017-2022 program.

While public comment periods are commonplace for these types of proposals, the BOEM public comment period included an alternative that suggests no new leasing be allowed. This would be detrimental to the communities and states that depend upon these revenues, as well as the country as a whole.

Champions of the ban on new leases include environmental groups and activists who are advocating for the immediate prohibition of any new offshore leasing in the Gulf of Mexico and the Arctic and are intent on precluding any future oil and gas exploration.

The Economic Impact

According to Environment News Service, last year OCS oil and gas leases accounted for roughly 16 percent of domestic oil production and five percent of domestic natural gas production. BOEM states, “This production generates billions of dollars in revenue for state and local governments and the U.S. taxpayer, while supporting hundreds of thousands of jobs.” Barring exploration and development in Alaska and Mexico will result in an overall net loss of jobs and revenue.

Alaska Leases

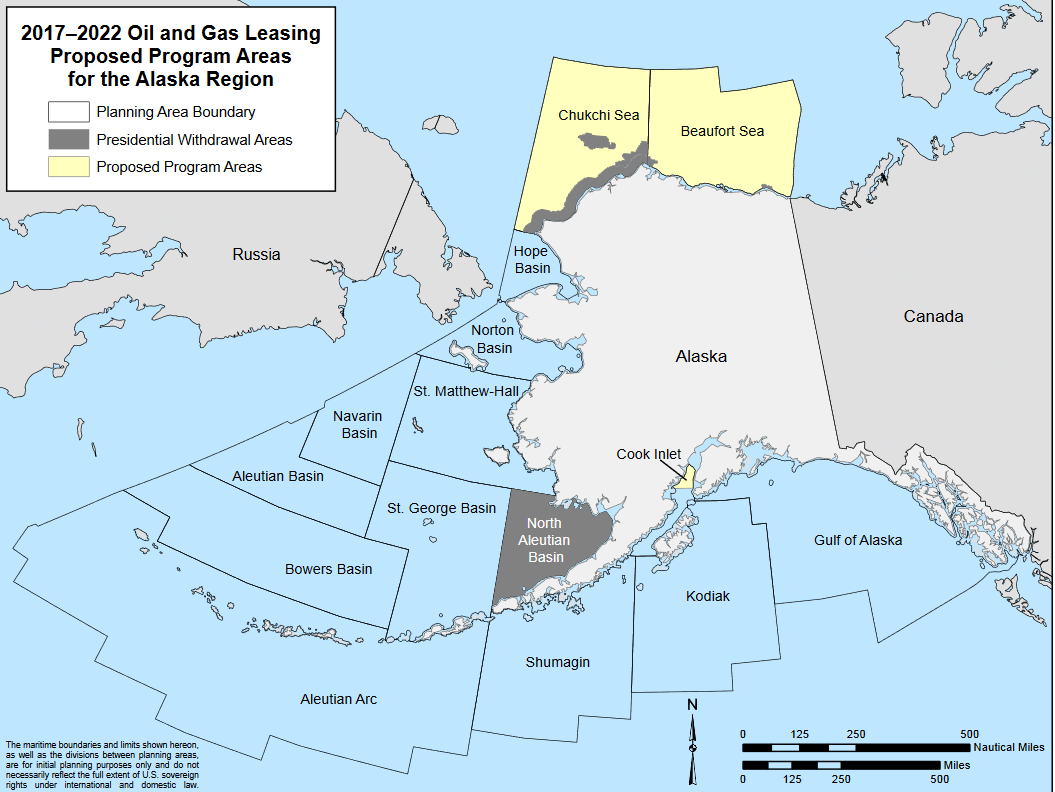

The first proposal, released in March of this year assessed three leases off the coast of Alaska which include areas in the Chukchi Sea, Beaufort Sea and Cook Inlet.

Source: BOEM

Source: BOEM

According to a report by the University of Alaska-Anchorage (UAA), allowing the lease sales to go through would create significant economic effects on the state. Some highlights of the lease sales according to the UAA report would be:

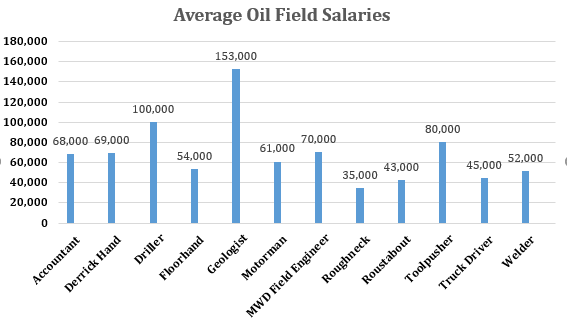

- An estimated annual average of 54,700 jobs, with that number rising to 68,600 during production and 91,500 at peak employment. According to American Action Forum (AAF) research, oil field workers can be divided into 12 categories; the chart below shows the average salary for each category. Overall the average salary from the 12 categories is $69,100, applying that to the estimated annual average number of jobs comes out to $3.77 billion in oilfield wages, at peak time that total rises to $6.32 billion[2].

Source: Tiger General

Source: Tiger General

The UAA report shows that an estimated $63 billion in payroll would be paid to employees in Alaska as a result of OCS oil and gas development and another $82 billion in payroll would be paid to employees in the rest of the United States.

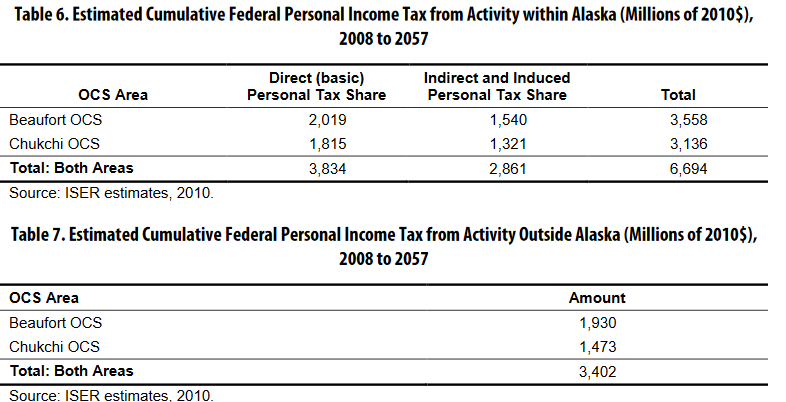

The tables below (6&7), present both the estimated federal personal income tax receipts associated with the direct, indirect, and induced jobs generated within Alaska (Table 6) as well as the estimated federal personal income tax payments associated with the direct, indirect and induced jobs generated outside of Alaska (table 7) that result from activities in the Beaufort and the Chukchi Outer Continental shelf. The estimated total payroll associated with the Alaska-based jobs is $63 billion and $82 billion for total payroll associated with the jobs generated outside of Alaska.

The UAA report also indicates that the federal government would collect revenues from three additional sources associated with OCS development which accounts for the additional U.S. Payroll including corporate income taxes on the income generated in Alaska from indirect sources, taxes and revenues collected on non-petroleum revenues and royalty payments for incremental marginal oil field development[3].

- Federal, state, and local governments would all realize sizeable revenue from OCS oil and gas development, totaling $193 billion[4]:

- $167 billion to the federal government,

- $15 billion to the State of Alaska,

- $4 billion to local Alaska governments, and

- $7 billion to other state governments.

The UAA report further cited that development of these new oil and gas fields in the Beaufort and Chukchi Seas could result in nearly 10 billion barrels of oil and 15 trillion cubic feet of natural gas over the next 50 years. AAF estimates that these leases alone could provide $474.6 billion in oil revenues and $39.15 billion in natural gas revenues using today’s price of both oil and natural gas.

According to BOEM’s National Assessment of Undiscovered Technically Recoverable Reserves, Alaska’s OCS contains roughly 26.56 billion barrels of oil amounting to $1.26 trillion using today’s price of oil at $47.46. AAF research shows that if the price of oil were to rise to $80 or $100, those price tags would dramatically increase to $2.12 trillion and $2.66 trillion respectively. BOEM also estimates that Alaska’s OCS contains around 131.38 trillion cubic feet of natural gas, which AAF estimates would equate to over $342 billion using todays price of natural gas at $2.61 per thousand cubic feet.

Gulf of Mexico Leases

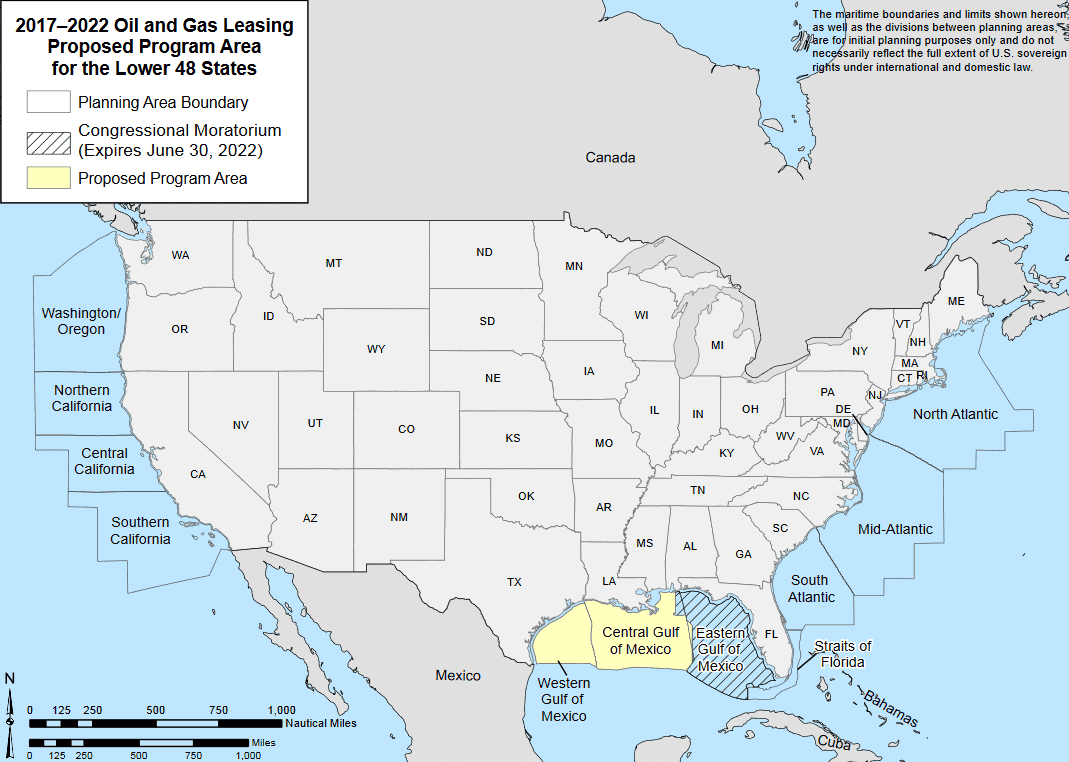

The proposal also examined ten sales in the Gulf of Mexico.

Source: BOEM

Source: BOEM

According to the Proposed Program Decision released by BOEM, the Gulf of Mexico is known to contain significant oil and gas resources and already has “world-class, well-developed infrastructure including spill response capacity. BOEM’s Assessment of Undiscovered Technically Recoverable Oil and Gas Resources of the Nation’s Outer Continental Shelf estimates that the Gulf of Mexico OCS holds approximately 48.46 billion barrels of oil and approximately 141.76 trillion cubic feet of natural gas which AAF estimates equates to $2.3 trillion at today’s price of oil and just under $370 billion using todays price of natural gas.

OCS Around the Country

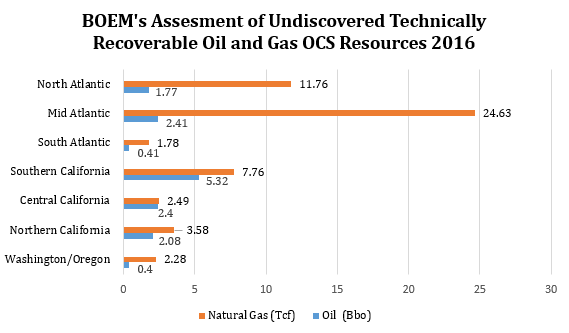

Alaska and the Gulf of Mexico are not the only areas with undiscovered technically recoverable oil and gas resources. The chart below shows BOEM’s estimates on U.S. Recoverable OCS oil and gas resources.

Source: BOEM

Source: BOEM

In total, the U.S. OCS houses around 89.82 billion barrels of oil and 327.42 trillion cubic feet of natural gas which equates to $4.62 trillion in oil and $854 billion in natural gas.

Conclusion

There is great economic value in the United States’ Outer Continental Shelf. Barring Alaska, the Gulf of Mexico and other areas from OCS Oil and Gas Leasing would have a significant detrimental economic impact.There are proven technologies to extract these valuable resources in a safe and environmentally sound way which will in turn provide jobs and generate revenue throughout the country while also reducing U.S. dependence on foreign sources of oil and natural gas.

[1] http://www.boem.gov/2016-National-Assessment-Map/

[2] http://www.tigergeneral.com/average-roughneck-oil-field-salaries/

[3] http://arcticenergycenter.com/wp-content/uploads/2015/08/National-Effects-Report-FINAL.pdf

[4] http://www.offshoreenergytoday.com/study-highlights-national-level-benefits-of-drilling-offshore-alaska/