Research

January 25, 2017

Tax Topics: Border-Adjustments and Exporting Firms

The new administration and Congress have signaled their intention to undertake fundamental tax reform in the coming months. Lawmakers will need to weigh the costs and benefits of numerous policy trade-offs as they undertake this effort. Among the most visible debates already underway concerns “border adjustability,” or moving the U.S. tax code to a cash-flow tax with a destination-basis.[1]

This reform, as proposed in the House Republican Tax Reform Blueprint, moves the U.S. toward a consumed-income tax base.[2] Under this proposal, the current system of deprecation for capital investment would be swapped for full expensing, while the current deductibility of interest expense would be repealed. Levying this tax on a destination basis would remove exports from the tax base, while fully taxing imports.

The latter element has sparked considerable debate among policymakers, industry, and other observers. On its face, the reform appears to favor exports over imports, a misperception that the reform’s proponents and detractors both seemingly feed. However, this ignores the consensus in the economics literature that such a reform would be trade-neutral, owing to currency appreciation.[3] Leaving this effect out of the debate provides as incomplete a picture as ignoring the tax rate or other key elements of the reform.

This potential reform would chart a significant departure from current U.S. tax policy and should be scrutinized carefully. This policy brief seeks to build on existing analysis of this potential reform and provide additional examples of how this proposal would work in practice, in this instance with respect to an exporting firm.[4]

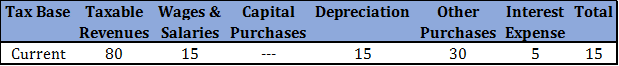

Table 1: Example Firm under Current Law with $10 in Exports

In this example, consider a firm that under current law has $80 in revenues of which $10 come from exports. It has $65 in deductible expenses – $15 in wages and salaries, $15 in depreciation allowances for certain business investments (such as machines or equipment) $5 in deductible interest (such as loans to finance its machines) and $30 other deductible business expenses. This leaves a $15 taxable profit. Now consider the firm’s tax base in a move to a destination-based cash-flow tax.

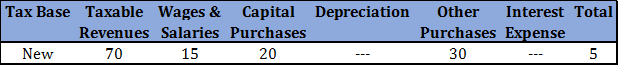

Table 2: Example Firm under Destination-Based Cash-Flow Tax with $10 in Exports

Under the new tax system, a few things change. First, the $10 in export income is removed from the firm’s tax base, leaving $70 that was derived from domestic sales in this example. The move to a cash flow tax also replaced the current system of depreciation and interest deduction in favor of full expensing. For the sake of this example, we assume these are equivalent in dollar terms. What is left, is a taxable profit of $5. If there were no applicable tax rate, then the firm would end up with the same profit of $15 in both cases.

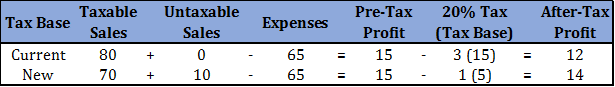

Table 3: After-Tax Profits of Example Firm without Currency Effects

In this example, we consider the same firm’s profitability under the old and new system with a 20 percent rate applied without considering currency effects. In this hypothetical, the exporting firm is clearly better off under the new system, which would seem on its face to be attractive at least for exporters. But the goal of the tax system is not to favor exports or disadvantage imports. The goal of the tax reform is to improve the tax system, and be trade neutral. Consideration of the economics of the proposal and the effect of a proportional currency appreciation reveals this to be the case.

Table 4: After-Tax Profits of Example Firm with Currency Effects

A 20 percent tax rate should lead to a 25 percent dollar appreciation, which would leave foreign buyers with 80 percent of their buying power of U.S. goods. This diminishes the foreign sales in our example in dollar-terms to $8, leaving the exporting firm’s profitability the same under both the current tax system and the new system.[5]

[1] https://www.americanactionforum.org/insight/tax-topics-destination-vs-origin-basis/

[2] https://abetterway.speaker.gov/_assets/pdf/ABetterWay-Tax-PolicyPaper.pdf

[3] See Alan J. Auerbach, “The Future of Fundamental Tax Reform” American Economic Review 87, 2 (1997): 143–46 and artin Feldstein and Paul Krugman, “International Trade Effects of ValueAdded Taxation,” in A. Razin and J. Slemrod, eds., Taxation in the Global Economy (Chicago, IL: University of Chicago Press, 1990), 263–82. Also see https://www.aei.org/publication/border-tax-adjustments-wont-stimulate-exports/ for a further review of the literature.

[4] https://www.americanactionforum.org/research/14344/

[5] Note that this example by design ignores the effects of moving from the current high rate to a lower rate and the positive economic effects of expensing for the purpose of isolating the implications of moving to a destination-based tax system.