Research

January 25, 2017

Tax Topics: Border-Adjustments and Off-Shoring

The new administration and Congress have signaled their intention to undertake fundamental tax reform in the coming months. Lawmakers will need to weigh the costs and benefits of numerous policy trade-offs as they undertake this effort. Among the most visible debates already underway concerns “border adjustability,” or moving the U.S. tax code to a cash-flow tax with a destination-basis.[1]

This reform, as proposed in the House Republican Tax Reform Blueprint, moves the U.S. toward a consumed-income tax base.[2] Under this proposal, the current system of deprecation for capital investment would be swapped for full expensing, while the current deductibility of interest expense would be repealed. Levying this tax on a destination basis would remove exports from the tax base, while fully taxing imports.

The latter element has sparked considerable debate among policymakers, industry, and other observers. On its face, the reform appears to favor exports over imports, a misperception that the reform’s proponents and detractors both seemingly feed. However, this is a flawed view that ignores the consensus in the economics literature that such a reform would be trade-neutral, owing to currency appreciation.[3] Leaving this effect out of the debate provides as incomplete a picture as ignorance of the tax rate or other key elements of the reform.

This potential reform would chart a significant departure from current U.S. tax policy and should be scrutinized carefully. This policy brief seeks to build on existing analysis of this potential reform and provide additional examples of how this proposal would work in practice, in this instance by demonstrating how a destination-basis system with border adjustments removes incentives for U.S. firms to move manufacturing and production overseas for sales back to the U.S.[4]

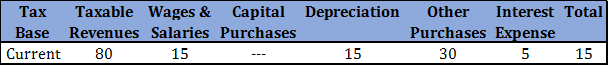

Table 1: Example Manufacturer Under Current Law

In this example, consider a U.S. manufacturing firm under current law. The firm has $80 in revenues, for the purpose of this example, all of which are to domestic consumers. It has $65 in deductible expenses: $15 in wages and salaries, $15 in depreciation allowances for certain business investments (such as machines or equipment) $5 in deductible interest (such as loans to finance its machines) and $30 other deductible business expenses, of which $10 are imported. This leaves a $15 taxable profit.

Now consider the firm’s tax base in a move to a destination-based cash-flow tax.

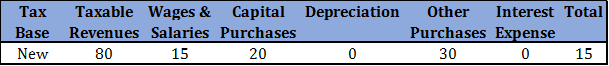

Table 2: Example Manufacturer Under a Destination-Based Cash-Flow Tax

Under the new tax system, a few things change. The move to a cash-flow tax replaces the current system of depreciation and interest deduction in favor of full expensing. For the sake of this example, we assume these are equivalent in dollar terms. Since the example firm has no imports or exports, the firm is unaffected be the border-adjustment elements of the new tax plan. The firm’s tax base remains $15.

Now we consider the incentives of the current system to move production overseas.

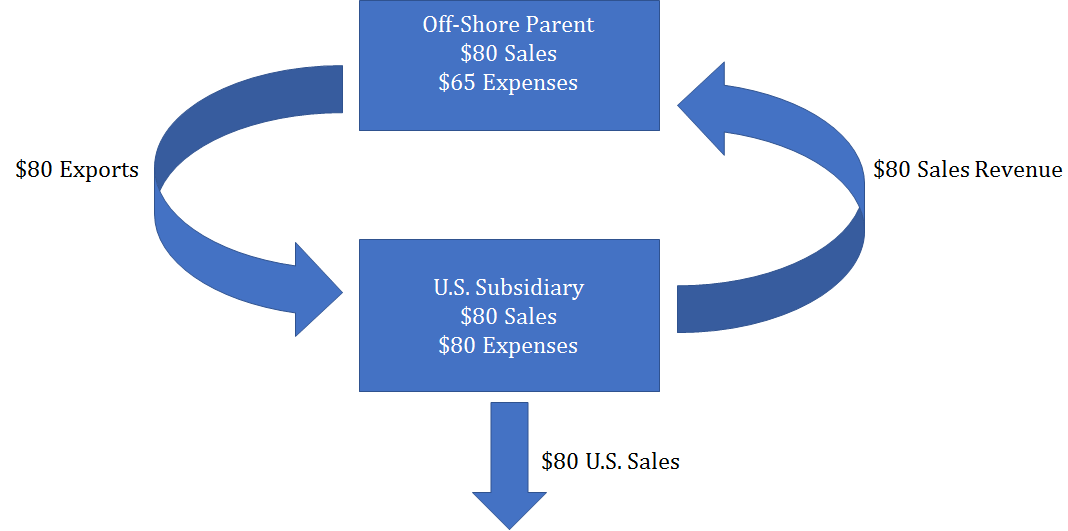

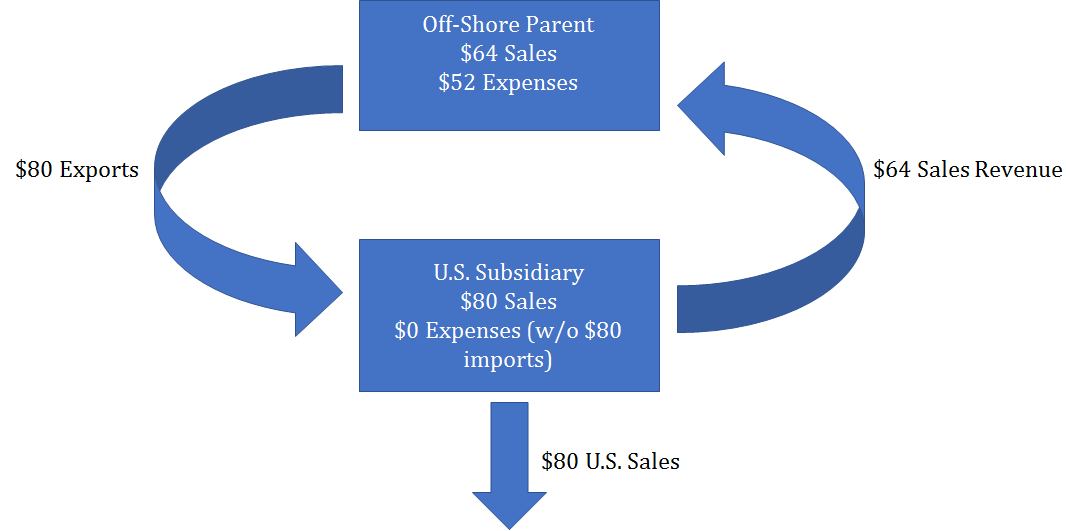

Figure 1: Example Manufacturer Moves Production Overseas Under Current Law

In this example, we assume the formerly U.S.-based firm moves its production facility to a lower tax jurisdiction and sells its products back to the U.S. through a U.S. subsidiary.

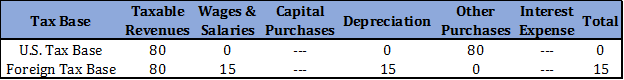

Table 3: Example Manufacturer Moves Production Overseas Under Current Law

Under current law, the new U.S. subsidiary would have no taxable income, as it can deduct all imports received from the off-shored parent. The parent’s tax base remains the same as if it remained in the U.S., but insofar as we assume the tax rate is lower in the new jurisdiction, the firm’s after-tax profit would be higher.

Now consider how this firm would fare under a destination-based cash-flow tax.

Figure 2: Example Multinational Firm Under a Destination-Based Cash-Flow Tax with Currency Effects

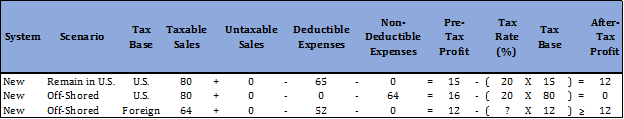

The off-shored manufacturer faces a much different calculation under a destination-based cash-flow tax.

Table 4: Example Off-Shored Manufacturer Under a Destination-Based Cash-Flow Tax with Currency Effects

Table 4 illustrates the combined effects of currency appreciation and moving to a destination basis on the example firm. First, the U.S. subsidiary can no longer deduct the costs of its imports, exposing the full $80 in sales to tax. For the purposes of this example, we assume the U.S. tax rate is 20 percent. This leaves $64 in after-tax income for the U.S. subsidiary, which covers the costs for the $64 in imported goods – the value of the goods will have declined in dollar terms owing to currency appreciation. Currency appreciation also would shrink the parent firm’s costs in dollar-terms, leaving deductible costs at $52, and netting to a foreign-tax base total of $12 in taxable income.

Table 5: After-Tax Profits of Example Off-Shored Manufacturer Under a Destination-Based Cash-Flow Tax with Currency Effects

As table 5 demonstrates, under a destination-based cash-flow tax the manufacturer has no incentive to move overseas for tax purposes. Under this example, if the firm had remained in the U.S., it’s after-tax profit on its $15 taxable income would have been $12 – while the example off-shored firm has pre-tax income of $12.

[1] https://www.americanactionforum.org/insight/tax-topics-destination-vs-origin-basis/

[2] https://abetterway.speaker.gov/_assets/pdf/ABetterWay-Tax-PolicyPaper.pdf

[3] See Alan J. Auerbach, “The Future of Fundamental Tax Reform” American Economic Review 87, 2 (1997): 143–46 and artin Feldstein and Paul Krugman, “International Trade Effects of ValueAdded Taxation,” in A. Razin and J. Slemrod, eds., Taxation in the Global Economy (Chicago, IL: University of Chicago Press, 1990), 263–82. Also see https://www.aei.org/publication/border-tax-adjustments-wont-stimulate-exports/ for a further review of the literature.