The Shipment

October 23, 2025

Higher Inflation and Lower Output

(Not So) Fun Fact: According to Apollo Academy, companies with negative earnings have outperformed companies with positive earnings by roughly 20 percentage points since “Liberation Day.”

Higher Inflation and Lower Output

What’s Happening: Although the government shutdown has delayed the release of inflation data from the Bureau of Labor Statistics, S&P Global recently published research showing a global contraction in profit margins driven by a combination of higher-than-expected inflation as well as lower real output. The report analyzes revenue forecasts and earnings expectations from 15,000 analysts throughout 9,000 public companies that make up 85 percent of the total global equity market. It further reinforces past business surveys and a Goldman Sachs analysis covered by the Shipment that point to the fact that tariff-driven inflationary pressures are still working their way through the U.S. economy. The S&P report emphasizes that U.S. businesses have been absorbing a portion of added costs resulting from tariffs and a multitude of other economic pressures. While this has been the case for most of the year, businesses are passing these costs onto consumers in the form of higher prices, as noted by S&P Global and evidenced by the upward shift in consumer prices. The S&P report authors highlight that much of the positive economic impact and productivity gains from artificial intelligence (AI) are being counteracted by protectionist trade policies.

Why It Matters: In 2025, U.S. companies have incurred an estimated $907 billion in additional costs and lost profits compared to earnings and revenue estimates set in January. Of this added cost burden, roughly $592 billion has been passed onto consumers in the form of higher prices, and $315 billion has been absorbed by businesses resulting in lower profit margins. This estimate is based on 9,000 public companies analyzed in the S&P report, meaning if costs were extended to all remaining firms, the total 2025 cost burden may be $1.2 trillion. If this figure seems exorbitantly high for a direct-tariff cost estimate, that is because it includes much more than tariff costs. The research explains that the $1.2-trillion estimate includes logistics delays, higher freight costs, higher capital expenses, and higher wages, as well as trade barriers and tariffs. When factoring in all these additional variables, the cost estimate begins to make more sense. For instance, global AI infrastructure investment alone is expected to reach $375 billion in 2025. Many of these capital expenditures were only recently announced due to the ever-increasing demand for AI data centers and had not been planned a year ago. The same holds true for other projects in the United States as companies seek to break ground on manufacturing facilities over the next few years to avoid costly tariffs. Investments for the sake of avoiding tariffs, however, can be clearly traced back to erratic U.S. trade policies. While these investments may provide a boost to local economies, they are also contributing to the issue of shrinking margins that reduce the cash on hand for employment, research and development, and other activities. The maintenance of unplanned facilities will inevitably lead to higher operating expenses that will continue to add inflationary pressure to companies that will pass along costs to U.S. consumers – on top of tariff price hikes.

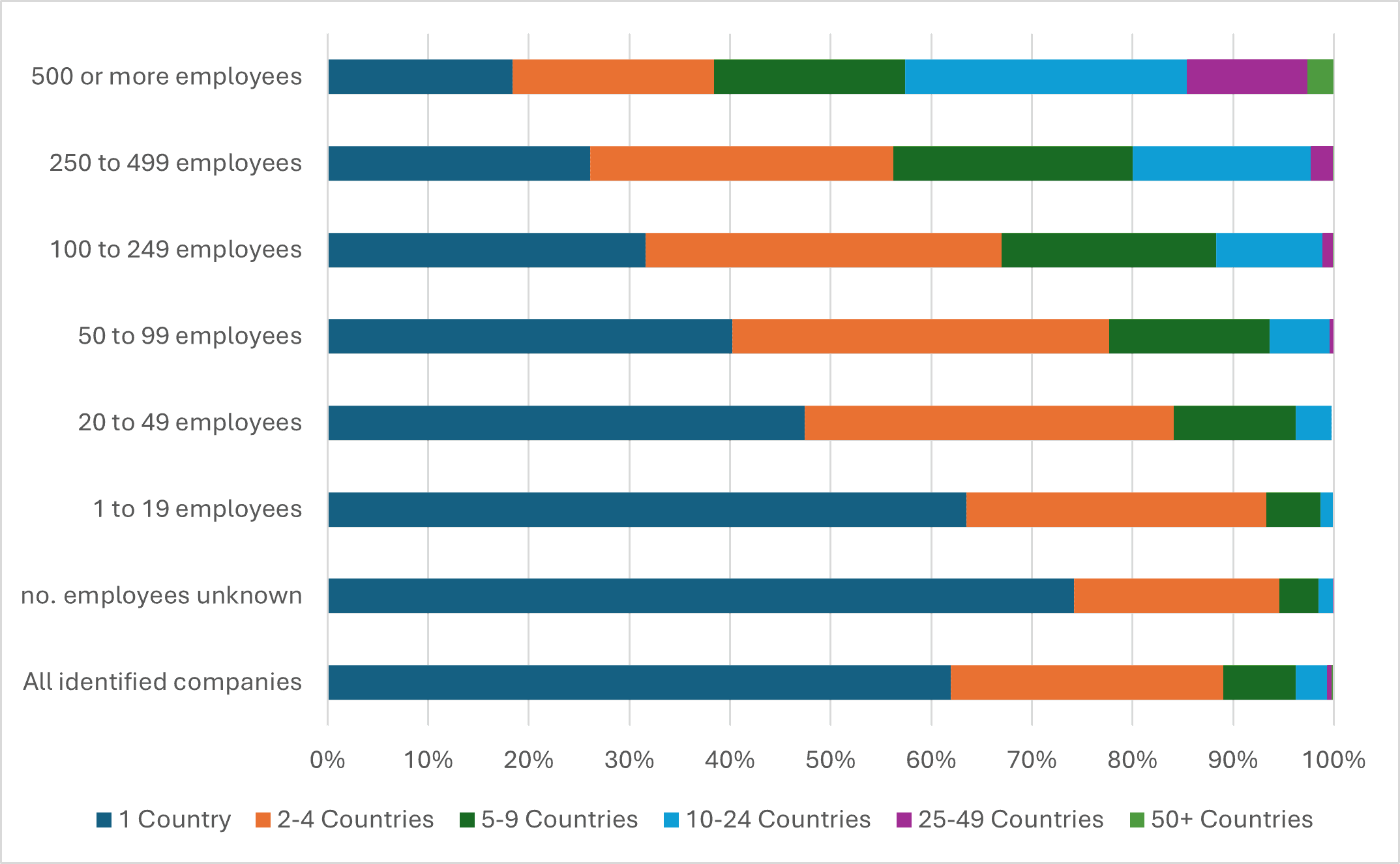

As recent American Action Forum research highlights, S&P Global finds that unexpectedly higher expenses disproportionately harm smaller-firm margins. One reason is that a company’s supply chain – both upstream suppliers and downstream customers – matters significantly to profitability and performance. As Figure 1 illustrates, if a firm’s supplier outperforms their industry, then it is likely that firm will also outperform since the ability of a supplier to manage costs is a significant benefit. This holds true even if a firm’s downstream customers are underperforming their industry. Additionally, diversified firms were found to be in a better position to mitigate the effects of trade-related cost increases compared to firms with highly consolidated supply chains. After examining U.S. import data broken down by company size, it becomes clear that the smaller a firm is the more consolidated its supply chain is, and the more at risk the firm is to price hikes from suppliers (Figure 2). This does not bode well for U.S. small businesses, which are currently struggling with access to credit, lower sales expectations, and declining employment.

Looking Ahead: While businesses and policy analysts have been warning about an uptick in inflation – primarily citing U.S. tariff – the consumer price index (CPI) has likely only captured a small fraction of what is to come. The last CPI report for the month of August came in hotter than anticipated, at 2.9 percent year over year. All eyes will be on the September CPI data, which is scheduled for release tomorrow, more than a week late due to the government shutdown. If reports from Goldman Sachs, S&P Global, and federal reserve banks are any indication, it is more likely than not that CPI will read higher than the expected rise of 0.4 percent month over month and 3.1 percent year over year. Even coming in at expectations would represent a continued rise in consumer inflation and set back the U.S. Federal Reserve in its 2-percent inflation target. The Shipment expects that core CPI – which excludes food and energy – will remain elevated between 3.1–3.3 percent due to the continued transfer of tariff costs from businesses to consumers and the higher tariff rates on certain durable goods. If CPI overall were to come in lower than expected, it will likely be due to lower energy prices, or it could signal weak consumer demand. No matter the result, the Fed will have to continue to balance inflation data with a weaker labor market.

Figure 1: Firms With Outperforming Supply Chains Are Also Outperforming in 2025

Source: S&P Global

Figure 2: 2023 U.S. Importers by Business Size and Number of Partner Countries

Source: U.S. Census Bureau