Weekly Checkup

December 19, 2025

2026 Key Areas of Interest – Health Insurance

Health policy in 2026 has the potential to be even more tumultuous than in 2025. Several long-running debates are converging in ways that are likely to force more durable policy choices, rather than another cycle of short-term solutions and incremental rule tweaks. While most health care policy challenges emerge as political priorities based on contemporary circumstances rather than careful planning, below are some key areas to watch. The health care policy world’s focus on insurance reforms will continue in 2026 due to expiring Affordable Care Act (ACA) subsidies, premium increases in every type of health insurance market, and the continuous rise in the cost of care.

Premium Rates and Marketplace Stability

The scheduled end-of-2025 expiration of the ACA’s enhanced premium tax credits (ePTCs) is the immediate catalyst for action in 2026. Regardless of whether Congress extends the ePTCs or reverts to the pre-American Rescue Plan Act subsidy structure, the health insurance market will be debated in some way. Will Congress use the ePTC expiration to pursue durable market changes? A new, wider menu of proposals beyond simply “extend or expire” is already being presented and debated. Some of these alternatives include consumer-directed coverage options such as expanding or modernizing health savings accounts (eligibility rules, contribution limits, high-deductible health plan definitions, interaction with marketplace plan designs), formalizing and codifying individual coverage health reimbursement accounts/CHOICE-style arrangements available to employers (improving tax treatment, simplifying administration, and broadening employee eligibility), plans to address market issues including churn and continuity (special enrollment periods, auto-reenrollment, and verification policies), and consideration of guardrails around benefit generosity and network adequacy. This creates two policy debates at once: affordability for consumers and stability for the risk pool and market more broadly. Watch how policymakers frame the issue (temporary extension versus permanent redesign), whether any proposal is paired with offsets (drug, provider, or pharmacy benefit manager-related), and whether states expand reinsurance or other stabilization tools to blunt premium shocks.

Medicare Advantage: Risk Adjustment, Stars, and Utilization Management

Medicare Advantage remains a high-leverage policy arena because incremental technical changes can translate into large fiscal and market effects. On the payment side, expect continued focus on coding intensity and risk adjustment, including how model updates phase in and how Centers for Medicare and Medicaid Services (CMS) and the Medicare Payment Advisory Commission (MedPAC) assess the gap between MA and fee-for-service coding. This will be alongside heightened attention to the government’s ability to validate diagnoses and recover overpayments through Risk Adjustment Data Validation audits. On the quality side, Star Ratings remain both a consumer signal and a payment lever. CMS has continued to update the technical specifications and the measure set for Star Ratings, meaning plans will keep optimizing clinical programs and member outreach around a moving target. Finally, prior authorization will remain prominent, with policymakers balancing beneficiary protections (timeliness, transparency, continuity of care) against plans’ argument that utilization management is a core tool to manage premiums and benefits. Watch for enforcement posture shifts, new reporting requirements, and how plans adapt operationally without creating access disruptions.

Medicaid Financing and Safety-net Stress

Medicaid will be a 2026 watch item less because of a single federal “cliff” and more because financing pressure points are converging: state budget constraints, provider access concerns, and safety-net reliance on supplemental funding. Stakeholders continue to urge Congress to avert acute funding cuts, particularly given uncompensated-care exposure in rural and high-Medicaid facilities. The post–continuous coverage “unwinding” continues to reverberate operationally (renewal workflows, churn, and coverage gaps). Watch for pressure points tied to hospital and safety-net financing, managed care rate setting, and scrutiny of supplemental payment arrangements. States will continue using waivers to pursue delivery reform, behavioral health capacity, and coverage flexibilities, but federal tolerance for certain financing structures can shift quickly. Watch for more overt “financing” decisions in areas that used to be treated as operational: rural hospital stabilization strategies, limits and design choices around supplemental payments, and more aggressive approaches to managing specialty-drug trends while maintaining beneficiary access.

Technological Innovation and AI Governance in Health Care

In 2026, a key policy battleground will be how the health care system governs rapid deployment of artificial intelligence (AI)-enabled tools across clinical decision support, utilization management, and administrative workflows. The immediate task is translating broad principles into practical guardrails: transparency and documentation expectations, accountability when tools influence care or coverage decisions, controls for bias and model drift, and clearer allocation of responsibility among providers, payers, and vendors. Watch for governance to emerge less through sweeping legislation and more through procurement and contracting requirements – effectively setting “conditions of participation” for high-impact AI use cases – alongside tighter expectations around cybersecurity, data provenance, and how regulators treat the boundary between “AI as a medical device” and general-purpose models embedded in workflows.

Chart Review: Biosecure Act and Implications for the Biotechnology Market

Jack Leimann, Health Care Policy Analyst

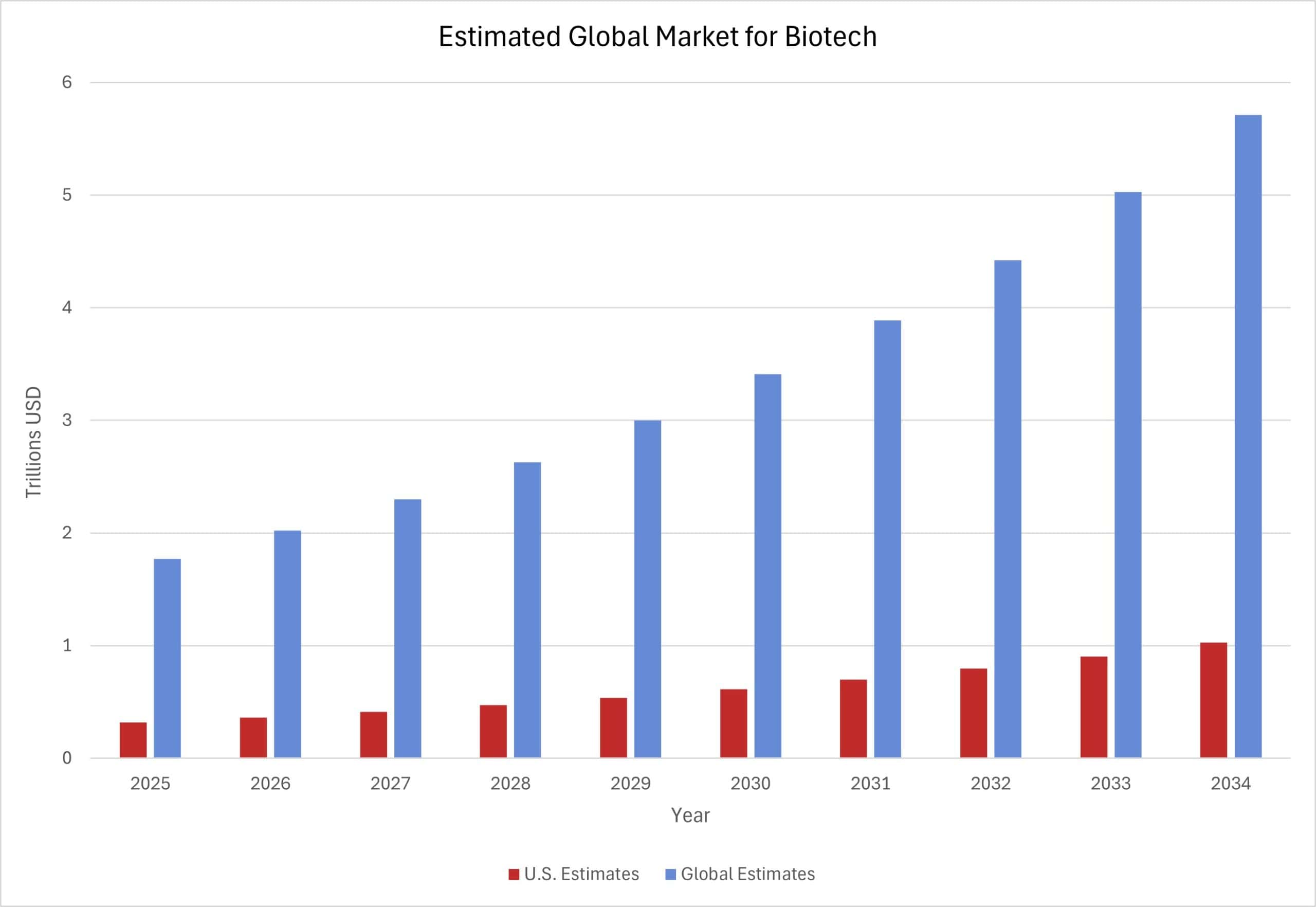

The United States is home to the largest biotechnology market in the world. Biotechnology – the industry of developing health care products and technologies, such as cutting-edge medical therapeutics and diagnostics – is the leading source of the best treatments for rare diseases. The chart below shows projected global revenues in the biotech market, with estimated U.S. revenues alongside the total global estimate. The global biotech market is projected to grow rapidly over the next 10 years, reaching $5.7 trillion in 2034. While the global biotech market, including the U.S. market, is estimated to grow at around 14 percent annually, the U.S. share of the global market is projected to remain static at about 18 percent. The global biotech market relies on complex, international supply chains, including procuring resources and collecting relevant scientific data. This is, in part, due to 80 percent of biotech companies having fewer than 100 employees. The United States, like other countries, relies on these inputs to discover novel therapeutics, and thus are susceptible to disruptions from federal policy changes.

Last week, the U.S. House of Representatives voted to pass the Fiscal Year 2026 National Defense Authorization Act (NDAA). The NDAA includes the Biosecure Act, a provision intended to protect U.S. biotechnology competitiveness and prevent national security risks from foreign adversaries. The bill would prohibit those receiving federal funding from acquiring biotech equipment and services from companies identified on federal watchlists as “biotech companies of concern.” Because of the integrated supply chains of the biotech industry, the Biosecure Act could prove disruptive to U.S. firms sourcing materials and services for research and development. The bill could thus have lasting impacts on the United States’ ability to further accelerate biotech growth and threaten our ability to lead the global market.