Weekly Checkup

November 2, 2018

ACA Open Enrollment and the State of the Marketplace

Yesterday marked the start of the sixth open enrollment period for the Affordable Care Act’s (ACA) individual market. The Trump Administration has made much of the decrease in premiums for 2019, reporting that the average monthly premium for the benchmark Silver plan will decrease by 2 percent. The most significant development, however, may be plan year 2019’s increase in competition.

As AAF analyses have observed over the years, averages mask variation. An individual’s premium in 2019 will depend greatly on where they live. For example, in Delaware, premiums are jumping 16 percent, while Tennessee will see a decrease of 26 percent. In fact, despite the average decrease, the majority of federal exchange states will actually see a premium increase for plan year 2019. For the most part, however, these are modest spikes that are generally in line with inflation.

It should also be noted that 2019 premium changes do not take place in a vacuum. On average, monthly premiums have increased by 85 percent since the beginning of the exchanges in 2014 – with much of that coming in the last few years as insurers dealt with more adverse selection than projected, a heavy regulatory environment, and the removal of cost-sharing reimbursement (CSR) payments. Meanwhile, many of the states that will see the most significant decreases in premiums for 2019 (Arizona, Maine, New Hampshire, New Mexico, Pennsylvania, Tennessee) will still feel the pain of the substantial premium increases from earlier years. For example, while Tennessee will see a 26 percent drop in average benchmark premiums, the state’s premiums will still have more than doubled since 2016. 2019’s average decrease in premiums is a positive development, but there is still much more ground to make up.

Looking past premiums, the most encouraging indicator of an improving individual market is the news that more insurers are entering the federal exchange. Twenty-three more insurers are participating in 2019, and 29 current insurers have expanded their offerings. This increase is the first of this kind since 2015. In 2019, 39 percent of counties in the federal exchanges will have only one insurer, down from 56 percent in 2018. Just 5 states will have only one insurer in 2019, down from 10 in 2018. All of this has happened despite the zeroing out of the individual mandate penalty and the introduction of Short-Term Limited Duration Insurance and Association Health plans—three factors that some have speculated would discourage increased insurer participation in the individual marketplace.

Increasing competition in the individual marketplaces will be critical to any further premium decreases, as well as the long-term stability of the marketplace. The introduction of new insurers after the mass exodus of insurers beginning in 2015 is encouraging and could signal continuing premium decreases in the future.

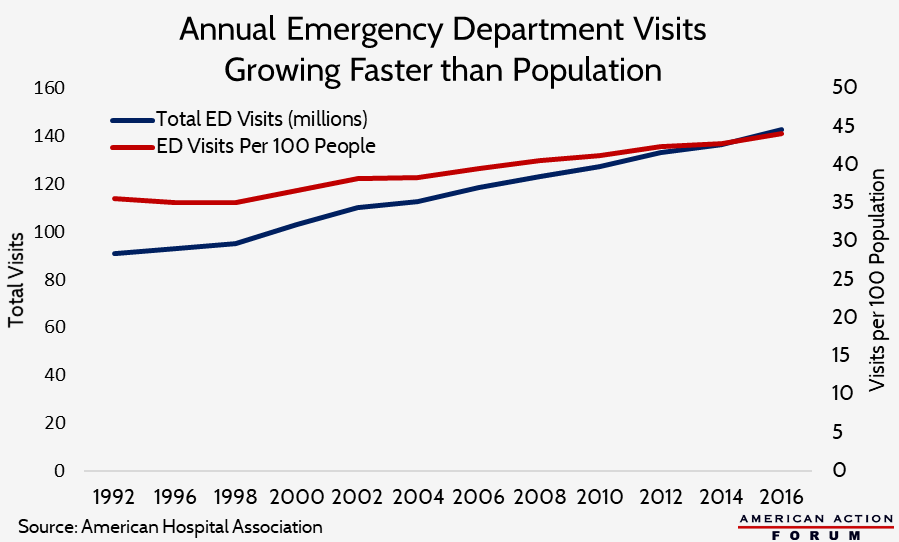

Chart Review

As AAF’s Tara O’Neill Hayes explains in a new primer, patient volume in emergency departments (EDs) has been growing faster than the population for decades. In 1997, annual visits to the ED totaled 94.9 million (35.6 per 100 people). By 2006, that total had increased 26 percent overall to 119.2 million, or 14 percent when adjusting for population growth (40.5 per 100 people). In 2015, ED visits had reached 136.9 million, or 43.3 per 100 people—a 7 percent increase from 2006 on a per capita basis.

Worth a Look

Modern Healthcare: Wisconsin can impose Medicaid work requirements, time limits, but not drug testing

New York Times: Study of Cellphone Risks Finds ‘Some Evidence’ of Link to Cancer, at Least in Male Rats

Health Affairs: State Policies And Enrollees’ Experiences In Medicaid: Evidence From A New National Survey