Weekly Checkup

July 31, 2020

Contrasting the Health Provisions in HEALS and HEROES

This week saw negotiations on the next round of COVID-19 response legislation start up in earnest with the release of Senate Republicans’ Health, Economic Assistance, Liability Protection, and Schools (HEALS) Act. HEALS is primarily focused on the economic response to the pandemic and is light on health policy. It does, however, provide some additional pandemic response funding, doubles down on administrative deregulatory activity, and seeks to protect Medicare recipients from financial hardship as a result of the pandemic. As HEALS represents Senate Republicans’ starting point for negotiations, it’s worth considering how these provisions compare to what House Democrats previously proposed as part of the their own bill, the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act.

For starters, there is the simple question of appropriations. HEALS includes $25 billion in additional funding to assist health care providers with expenses and lost revenue resulting from the pandemic. This sum is on top of $175 billion Congress has already allocated for this purpose and which the Department of Health and Human Services has not yet completely distributed. It is, however, less than the $100 billion called for in HEROES. Expect this provision to be a sticking point in negotiations.

HEALS also provides roughly $3.4 billion for the Centers for Disease Control and Prevention, compared to $3.1 billion in HEROES, with both bills allocating the lion’s share to grants for state, local, and tribal authorities’ response to the pandemic. In addition, HEALS contains $15.5 billion for the National Institutes of Health (NIH) versus $4.7 billion in HEROES, but much of the difference in funding totals is attributable to $10.1 billion that HEALS specifically aims at reopening NIH-funded laboratories that have been closed because of the pandemic. HEALS allocates $4.5 billion for the Substance Abuse and Mental Health Services Administration compared to $3 billion in HEROES; $20 billion for the Biomedical Advanced Research and Development Authority to conduct vaccine, therapeutic, and diagnostic development, while HEROES offers up $4.5 billion; and $16 billion for testing and contact tracing in states, contrasted with roughly $75 billion in HEROES.

More controversial will be the things not included. HEROES included 100 percent federal financing of COBRA premiums between March 1, 2020, and January 31, 2021, for individuals and families who have lost their existing employer-sponsored insurance and have transitioned to COBRA. HEROES also included a special enrollment period for coverage through the Affordable Care Act’s health insurance marketplace; mandates for insurers to cover all COVID-related testing and treatment without cost-sharing; and a 7.8 percent increase in the federal share of state Medicaid spending through June 2021. None of these provisions is included in HEALS.

On the other hand, HEALS does seek to extend, in some cases for up to five years, a number of telehealth-related regulatory exemptions the Trump Administration has implemented in Medicare during the pandemic. HEALS also has several provisions intending to prevent and respond to COVID-19 outbreaks in nursing homes, allowing 2020 contributions to Flexible Spending Accounts to roll over into 2021, and, perhaps most notably, keeping 2021 Medicare Part B premiums and deductibles flat at 2020 levels for most beneficiaries.

The biggest sticking points for a deal on the next pandemic legislative response will be around unemployment insurance, liability protections for health care providers and employers, and direct financial assistance to Americans. But more directly health-related issues—such the amount of money to set aside for health providers, additional aid to states in the form of grants and the federal share of Medicaid, and assistance for those who have lost their employer-sponsored health insurance—will continue to roil the discussions, as Senate and House negotiators couldn’t appear further apart going into the weekend.

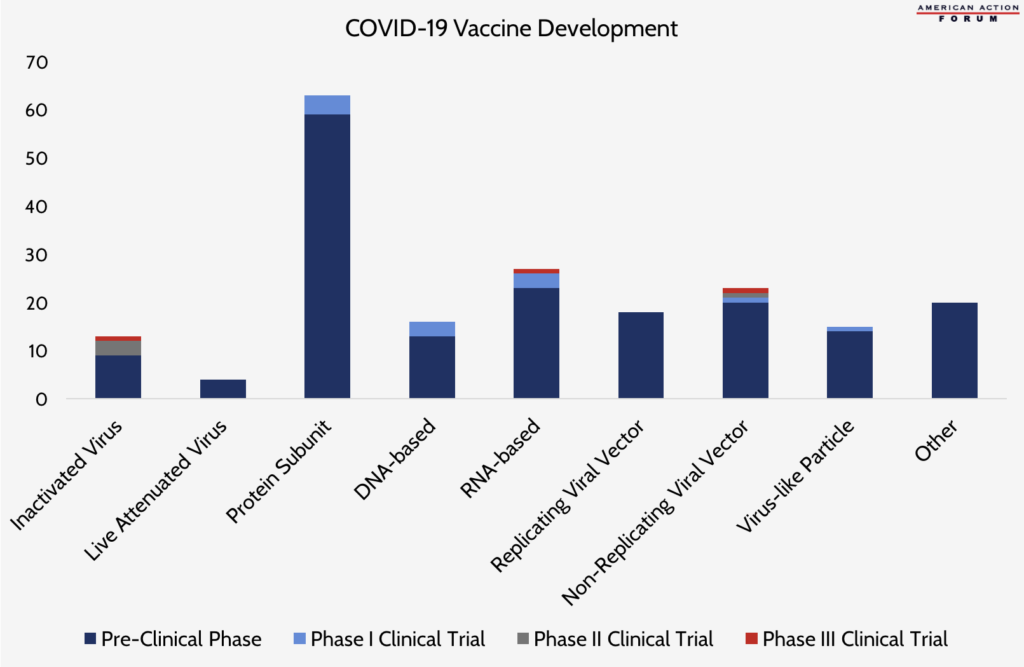

Chart Review: Diversity in COVID-19 Vaccine Development

Margaret Barnhorst, Human Welfare Policy Intern

Following the announcement of an additional $472 million in funding from the Biomedical Advanced Research and Development Authority for biotech company Moderna Inc., a COVID-19 vaccine from Moderna and the National Institutes of Health (NIH) entered the first Phase 3 clinical trials for a coronavirus vaccine in the United States. The RNA-based vaccine from Moderna/NIH joins only two other COVID-19 vaccines in Phase 3 trials around the world, including an inactivated virus vaccine from the Wuhan Institute of Biological Products and Sinopharm and a non-replicating viral vector vaccine from the University of Oxford and AstraZeneca. This diversity in the types of vaccines in development, as shown in the chart below, likely means there is a greater chance of successful immunization around the world. An RNA-based vaccine, such as the one from Moderna/NIH, can be mass produced and deployed much more quickly than other vaccines because of its ability to grow in a cell-free environment (meaning it does not require extended periods of time for cells to grow in a laboratory). Non-replicating viral vector vaccines stimulate two different biological immune responses and therefore often require only one vaccine dose to provide protection. According to the Milken Institute, however, neither an RNA-based nor a non-replicating viral vector vaccine has ever been approved for human use. Vaccines that use an inactivated virus, such as the one from the Wuhan Institute/Sinopharm, are sometimes favored because they can be administered to immunocompromised individuals, but they are often not as efficient as other vaccine types at producing immune responses and may require multiple doses.

Data source: Milken Institute Vaccine Tracker (last updated July 28, 2020)

Worth a Look

Reuters: AstraZeneca to be exempt from coronavirus vaccine liability claims in most countries

Fierce Healthcare: Cigna saw utilization ‘closer to normal’ in June, expects similar trends in July despite COVID-19 spikes