Weekly Checkup

May 3, 2019

Just How Significant Could Texas v. Azar Be?

The major health policy topic of the week was—surprise, surprise—“Medicare for All.” First came a somewhat unusual House Rules Committee hearing on the Medicare for All Act of 2019 (H.R. 1384), and then the Congressional Budget Office’s release of a report contemplating what a single-payer health system might look like (read my take on that report here). Less noticed but still noteworthy was the administration’s official action late Wednesday supporting the plaintiffs in the Texas v. Azar lawsuit that could potentially take down the Affordable Care Act (ACA) in its entirety. Although, they didn’t quite fully support the plaintiffs, and there’s the rub.

The Weekly Checkup has previously outlined the particulars of the case (here, here and here), so we won’t belabor the details. The relevant facts today are (1) the Department of Justice (DOJ) made good on President Trump’s decision to fully endorse the plaintiff’s position that the entire law must be invalidated, and (2) despite that position, DOJ somehow argued that criminal provisions related to fraud should be allowed to stand independent of the rest of the law. (This selective severability argument—and speculation as to the motivation—was noted by law professor Nick Bagley both on Twitter and in an interview with Politico PULSE.)

This legal contortion draws attention to an under-appreciated aspect of the implications of Texas v. Azar: The ACA is a massive piece of legislation touching almost every aspect of the U.S. health care system, and its policies and impact go far beyond federal subsidies for health insurance. If the entire law is struck down, the American public (and perhaps some lawmakers) might be surprised at all that entails.

To illustrate the point, think back to H.R. 3762, which aimed to “repeal” the ACA and was vetoed by President Obama in January 2016. That legislation left much of the ACA intact, as a result of the rules governing the reconciliation process in the Senate. Provisions both large and small that were not repealed in H.R. 3762, but could be gone if the courts ultimately strike down the law, include: most if not all of the insurance market reforms, including prohibitions on pre-existing condition exclusions and limits on annual or lifetime benefits; mental health parity; concurrent Medicaid coverage for both treatment and hospice care for children; a host of quality reporting initiatives; the entire Center for Medicare and Medicaid Innovation (CMMI); the closing of the Medicare Part D coverage gap (the “donut hole”); a background check program for employees of long-term care facilities; the Elder Justice Act; and numerous other programs, authorizations, and policies.

The point here is not the relative merits of these programs, but rather that there are an awful lot of them, and disentangling them from the rest of the health care system will be no small task. CMMI, for example, has undertaken numerous models and demonstration projects since its inception. These initiatives have altered the Medicare and Medicaid programs and had tangible impacts on providers and patients. If CMMI goes away, what happens to these ongoing demos? What is the effect on providers who have substantially changed their practice and business models to participate in CMMI initiatives (sometimes unwillingly)? While I’d argue the establishment of CMMI is an egregious example of Congress ceding its constitutional powers and responsibilities to the executive branch and that the agency should be eliminated, such an undertaking would require a nuanced approach.

In short, striking down the ACA as a whole would have effects on a scale perhaps not immediately evident to all observers. Small provisions—such as the criminal statutes DOJ is seeking to protect—along with major initiatives will be impacted equally, and the fallout will be far reaching.

Chart Review

Tara O’Neill Hayes, Deputy Director of Health Care Policy

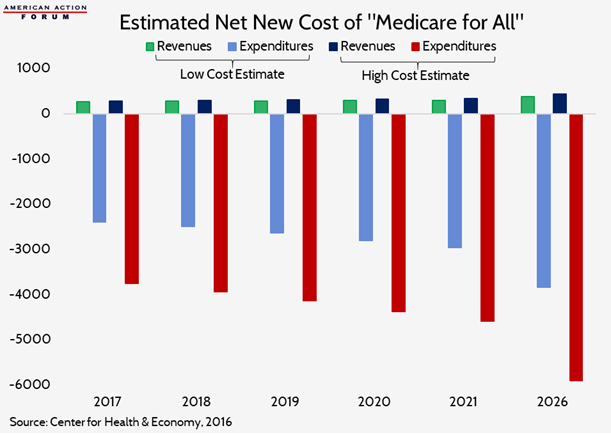

In 2016, the Center for Health and Economy (H&E) scored Sen. Sanders’s “Medicare for All” campaign proposal. At that time, H&E estimated overall program costs would increase the federal deficit between $31.2 trillion and $44.1 trillion from 2017-2026, if implemented immediately, relative to current spending projections. In the years since, multiple other studies, such as that discussed at the House Rules Committee hearing this week by Charles Blahous, have produced similar estimates. It is important to note, however, that the legislation discussed this week was H.R. 1384, introduced by Rep. Pramila Jayapal, and her legislation includes coverage of long-term care services. Neither the H&E estimate nor that of Dr. Blahous included the cost of those services, which would significantly increase the overall cost and deficit impact.

Team Health Around Town

Event: The State of Care – Future of Medicare

Deputy Director of Health Care Policy Tara O’Neill Hayes will discuss the financial outlook for Medicare at an event at the Newseum hosted by The Atlantic on Wednesday morning, May 8th.

From Team Health

What the Congressional Budget Office Just Said About Single-Payer

Christopher Holt examines the potential implications of the Congressional Budget Office’s report this week on a single-payer health care system.

Video: The 2019 Medicare Trustees Report

Tara O’Neill Hayes discusses the 2019 Medicare Trustees Report and what it says about the future of Medicare.