Weekly Checkup

July 6, 2018

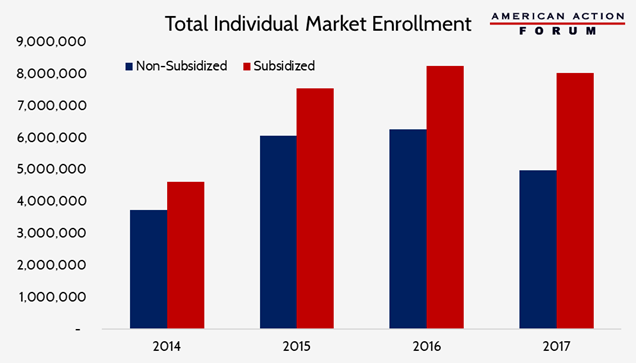

Rising Insurance Premiums Pushing Out Non-Subsidized Buyers

Earlier this week, the Centers for Medicare and Medicaid Services (CMS) issued enrollment data for the Affordable Healthcare Act’s (ACA) individual health insurance Exchanges, as well as trends regarding subsidized and unsubsidized coverage in the total individual market from 2014-2017. The biggest takeaways are that while overall enrollment in Exchange-sold plans remained roughly the same this year as last year, over the past two years enrollment by non-subsidized individuals in individual market plans (including those bought off-Exchange) has declined, driving an overall decline in individual market enrollment. This decline perhaps is not surprising, as premiums have risen quite substantially.

As of March 2018, 10.6 million people had enrolled in an individual market Exchange plan and paid their premiums (if they owed one). This figure represents a 9 percent drop from the number of individuals who selected a plan during the 2018 open enrollment period last Fall, but a 3 percent increase from the 10.3 million people with effectuated enrollment in February of last year. The average premium increased 27 percent from 2017, to $597 per month, but the average premium subsidy increased 39 percent, to $520, more than offsetting the increased cost for most subsidy-eligible enrollees. And there are more subsidy-eligible enrollees this year than last: 87 percent of current Exchange enrollees qualify for a subsidy, up from 84 percent last year.

There are a greater share of Exchange enrollees qualifying for subsidies largely because individuals who do not qualify for a subsidy are simply dropping out of the market, as the chart below shows. In 2014, subsidized enrollees comprised barely more than half of all individual market purchasers, including those buying plans off-Exchange; in 2017, 62 percent of all individual market enrollees had subsidized coverage. Nearly three-fourths of individuals who visit the federal Exchange platform and who do not purchase insurance consistently cite cost as the reason they ultimately chose not to buy. From 2016 to 2017, enrollment among individuals who were not eligible for subsidies dropped 20 percent (or 1.3 million people) at the same time that average premiums increased 21 percent; subsidized enrollment only decreased by 223,000 people for an overall decline of 10 percent in total individual market insurance enrollment (including plans bought off-Exchange). The impact varied across the states: 44 states experienced declines in overall enrollment, and 20 states lost more than a quarter of their non-subsidized enrollees, while five states plus the District of Columbia saw an increase in non-subsidized enrollment.

The upshot here is that the higher prices are leading to fewer people purchasing insurance, and the data bear this conclusion out: The overall uninsured rate ticked up in 2017 for the first time since the ACA was implemented.

Worth a Look

Axios: How the next Supreme Court justice could change Medicaid

Wall Street Journal: How Holograms Are Helping Medical Training

ESPN: Barcelona deny reports Eric Abidal’s liver was illegally purchased by Sandro Rosell