Weekly Checkup

October 2, 2020

Scoping Who Needs Help with Health Insurance Coverage

Last week we looked at the impact of the COVID-19 pandemic on insurance coverage in 2020, and while good data are still hard to come by, we are increasingly getting a clearer picture of the state of health insurance coverage in 2019. As many progressives continue to clamor for expanded federal health programs ranging from expansions of the Affordable Care Act (ACA) all the way to single-payer “Medicare for All,” it’s important to have a firm grasp of the actual experience of the uninsured to know how to target programs effectively.

Recently the Census Bureau released its annual Health Insurance Coverage in the United States report for 2019, detailing the results of the Current Population Survey Annual Social and Economic Supplement (CPS ASEC) and the American Community Survey (ACS). Then, this week, the Congressional Budget Office (CBO) issued a report providing a close examination of who went without insurance in 2019. Together these reports provide helpful insights into who is actually uninsured and why.

According to the CPS ASEC survey, in 2019, 26.1 million people residing in the United States were uninsured for the entire year. The ACS survey found similar but slightly higher uninsured numbers with 29.6 million respondents reporting being uninsured at the time they were interviewed. CBO’s finding was virtually the same as in the ACS, estimating that 29.8 million Americans, or 12 percent of the under-65 population, were uninsured in 2019.

According to CBO, of the 29.8 million people who were uninsured in 2019, 20 million (or 67 percent) were eligible for some type of subsidized coverage of which they did not avail themselves. Of those, 5.1 million were eligible for Medicaid or CHIP—2.2 million because of the ACA’s Medicaid expansion. Another 5.5 million were eligible for subsidized coverage through the ACA’s exchanges. Finally, 9.4 million were eligible for employer-sponsored insurance (ESI).

Looking at the 9.8 million uninsured people who did not have access to subsidized coverage in 2019, they fall into three buckets: those with incomes too high to qualify for government assistance (2.6 million), those in non-Medicaid expansion states with income too low to qualify for ACA subsidies (3.2 million), and those who are not lawfully present in the United States (4 million). CBO speculates that the primary reasons people remain uninsured are cost or being unaware of the options available to them. Regarding cost, CBO found that a third of those without insurance coverage in 2019 would have had to pay more than 10 percent of their income to obtain insurance. Of note, this correlates to the share of the uninsured who did not qualify for subsidized coverage in 2019. CBO also estimates that the number of uninsured will increase by roughly 1 million in 2020, suggesting the COVID-19 pandemic has not been as detrimental to insurance coverage as had been feared.

As policymakers, particularly on the left, press for ever more expansive federal health programs, it’s worth noting that the problem is relatively narrow. Of the 12 percent of U.S. residents that CBO estimates to be uninsured, 67 percent had subsidized coverage options. Before rolling out new entitlement programs, policymakers should focus on why those people are forgoing viable coverage options. The problem of the 4 million uninsured individuals not lawfully present in the United States is a broader challenge involving immigration policy, among others, but as federal assistance does not extend to those not lawfully present, a public option, Medicare Buy-In, or single-payer system won’t address that population’s needs. Regarding those with incomes too high to qualify for subsidized coverage, it’s important to note that the ACA’s supporters capped subsidies at 400 percent of the federal poverty level. Individuals and families above that level can still procure individual market coverage, with all the ACA’s protections, if they desire, but they make enough money that Congress has deemed them capable of paying for it themselves.

The challenge, then, is the 3.2 million people, out of 328.2 million, living in non-expansion states. This subset is where policymakers should focus, and it should not require a total remaking of the American health care system to help them.

Chart Review: Employer Sponsored Insurance and the Affordable Care Act

Julia Demeester, Health Care Policy Intern

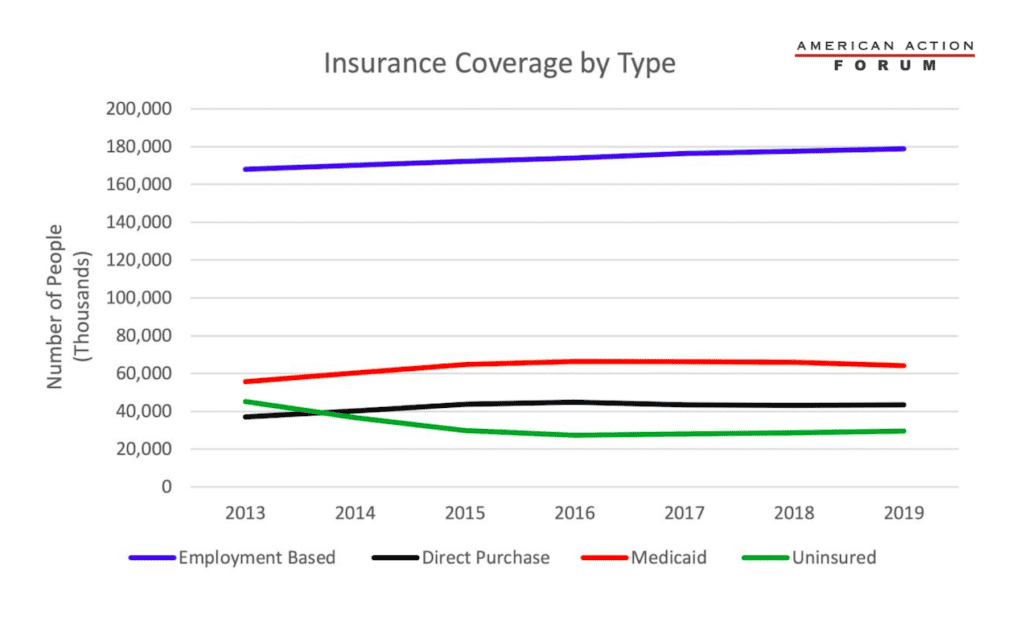

Employer-sponsored insurance (ESI) has long been the primary type of coverage that people receive in the United States. The Affordable Care Act (ACA) provided new avenues for receiving coverage, however, by expanding Medicaid and providing subsidies for purchasing insurance directly on the ACA’s exchanges. Data from the U.S. Census Bureau’s American Survey Tables, illustrated below, show that, since the launch of the Affordable Care Act (ACA), Medicaid and Direct Purchase (i.e. the individual market, including the exchanges) have seen notable growth. The number of Americans with ESI, however, has remained steady throughout the past eight years. In 2016, the number of people with direct-purchase insurance began to decline, as did the number on Medicaid—probably in part due to the falling unemployment rate. As expected, the number on ESI has been increasing throughout the last two years. The coronavirus pandemic could shift some from ESI onto the ACA exchanges, although these data do not capture that shift, if it is occurring.

From Team Health

The Challenges Facing the Trump Administration’s Drug Importation Plan – Director of Human Welfare Policy Tara O’Neill Hayes

There are myriad reasons the administration’s recently finalized policy is unlikely to result in any significant increase in access to more affordable medications.

Assessing the Administration’s Proposal for Reducing Insulin and Epinephrine Costs – Tara O’Neill Hayes

While the Trump Administration’s proposed rule could provide savings for some, its scope is very limited.

COVID-19: Impact and Response

All of AAF’s analysis on the pandemic and the federal government’s response can be found on this organized dashboard.

Worth a Look

New York Times: Companies Ditch Plans for Rapid Coronavirus Spit Tests at Home

FierceHealthcare: Cigna study dives into the lingering effects of COVID-19