Weekly Checkup

October 5, 2018

The Continuing Success of Medicare Advantage

It can sometimes feel like every new public policy endeavor ends up tangled in unintended negative consequences. Reporters and analysts have fallen over themselves detailing how well-intentioned policy making has caused innumerable problems. Just two weeks ago the Weekly Checkup considered how Medicaid “best price” tripped up charity care, resulting in the creation of the 340B program, which itself had become ensnared in myriad policy problems. It might be encouraging, then, to turn to examples of public policy that have turned out well.

Two examples of highly successful legislative initiatives are the Medicare Advantage (MA) and Medicare Part D programs. These efforts leverage private market competition to provide America’s seniors with better care and better value, and they have been extraordinarily successful for years.

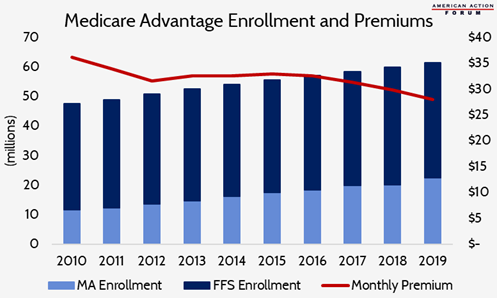

The MA program is noteworthy this week, as the Centers for Medicare and Medicaid Services (CMS) recently announced details about the 2019 plan year. Next year, MA enrollees will see an average monthly premium of $28, down about 6 percent from this year. That drop shouldn’t surprise you—MA premiums have been trending slightly downward for a couple of years—but it might because observers seem constantly to underestimate the power of competition to control costs. CMS also reports that the number of insurance plans offered through MA will increase by roughly 600. Over 91 percent of Medicare beneficiaries will have 10 or more MA plans to chose from if they elect to enroll in the program—up from 86 percent this year.

Even more important, plan sponsors will have new flexibility to offer beneficiaries a broader range of services thanks to rulemaking earlier this year by the Trump Administration. Prior to the 2019 plan year, federal law limited insurers’ freedom to offer unique benefits tailored to the specific needs of beneficiaries. These “uniformity rules” meant that each individual enrolled in a plan had to be given the same benefits at the same cost. Starting in 2019, plans will be able to alter benefits and cost-sharing within a plan to encourage use of the most appropriate services for individuals based on their specific medical conditions. For example, diabetic patients may be offered reduced cost-sharing for visits to the endocrinologist and coverage of additional foot exams. You can read more about the administration’s Medicare rulemaking in this piece by AAF’s Tara O’Neill Hayes.

It shouldn’t be surprising that competition works, or that the programs that are most successful and popular with beneficiaries are the ones that seek to leverage that competition. Nor should it be surprising that enrollment in MA continues to grow (projected to increase by 11.5 percent over 2018) as the administration provides plan sponsors with even more flexibility to meet the needs of their beneficiaries and to compete for new enrollees.

Chart Review

Tara O’Neill Hayes, Deputy Director of Health Care Policy

The Medicare Advantage program continues to enroll a growing share of Medicare beneficiaries. In 2019, it is estimated that nearly 37 percent of beneficiaries will choose to enroll in a privately managed Medicare plan, up from less than 25 percent in 2010. This increase is not surprising, given that premiums have remained relatively flat for years and in 2019 will decline for the fourth straight year. Further, 91 percent of seniors will have 10 or more MA plans from which to choose.

Worth a Look

Reuters: Tech breakthrough offers early warning system for heart attacks

New York Times: These Cholesterol-Reducers May Save Lives. So Why Aren’t Heart Patients Getting Them?

Modern Healthcare: Congress angles for air ambulance cost transparency