Weekly Checkup

November 22, 2019

The Pitfalls of Expanding Coverage Options

AAF’s Center for Health and Economy (H&E) recently released two analyses. The first one, looking at the impact of a recent Medicare buy-in proposal, was discussed in last week’s edition of the Checkup. The second analysis imagined a world where the Affordable Care Act (ACA) was “fully implemented.” With the Democratic presidential contenders churning out myriad proposals for expanding, modifying, or even wholesale replacing the ACA, looking at a fully implemented ACA provides a useful comparison for these expensive spending programs. When these reports are taken together, one can infer that increased federal spending on health care does not necessarily lead to coverage increases.

As discussed in our most recent episode of The AAF Exchange podcast, one of the issues driving Democrats to pursue ever-expanding health programs is frustration and disappointment with the ACA’s failure to cover all Americans. The Kaiser Family Foundation found evidence of this frustration in recent polling when 40 percent of those in favor of a national health care plan supported such a policy because they wanted to expand health coverage to everyone.

A single-payer system would cover everyone, but it would be massively expensive and disruptive, so many are looking for an alternative. A Medicare buy-in offers one, but H&E’s analysis of H.R. 1346, “The Medicare Buy-in and Health Care Stabilization Act of 2019,” found that it would increase the deficit by $187 billion over 10 years and would reduce the number of uninsured in 2029 by less than 500,000.

Those changes are relative to current law, however, so what would happen if the ACA were fully implemented? Such a counterfactual offers a useful comparison point because it is a reform that arguably involves the least. H&E’s modeling found that if the ACA, as originally written, were fully implemented—every state adopts the Medicaid expansion, the mandate penalty to buy insurance is in place and enforced, and cost-sharing reduction payments are once again made to insurers—premiums paid would drop by 2 to 11 percent, and the total number of uninsured in 2029 would be lower by 3 million. But the budget deficit would increase by $136 billion dollars over 10 years, and most coverage gains would come simply through Medicaid expansion.

In analyzing these proposals, it is useful to get a handle on the nature and scope of the problem they are trying to solve. At their core, they seek to expand insurance coverage to more people, but the reality is that of the 28 million or so individuals still uninsured in the United States, most of them have coverage options they aren’t accessing. That number includes roughly 10 million people who are already eligible for subsidized coverage through the ACA or who have an offer of employer-sponsored insurance (ESI) but haven’t elected to purchase it. Further, there are in the neighborhood of 3 million people without ESI but with incomes too high to qualify for subsidies who have decided not to purchase unsubsidized individual market coverage. All of these people seem to have decided that buying health coverage simply isn’t worth the cost.

Those who most accurately can be said not to have options are the roughly 2.5 million Americans who make less than 100 percent of Federal Poverty Level but live in states that did not take the ACA’s Medicaid expansion. The plight of these people is real, but solving this much narrower challenge is very different than insuring 30 million people. The fact that only about 10 percent of the uninsured have no options should shift the entire debate away from the question of how to expand coverage. The central problem for most of the uninsured doesn’t seem to be coverage options, but cost.

For Democrats who are pursuing coverage expansion as a matter of principle, checking their impulse to propose new programs against a baseline of what they (mostly) already have in place would likely be worthwhile, both substantively and politically: Kaiser polling also showed that 55 percent of Democratic voters would prefer a nominee who wants to build on the ACA rather than replace it with Medicare for All.

But pouring more money into Medicaid and the ACA, creating a Medicare buy-in option, or enacting Medicare for All won’t bring down the underlying costs of health care, which raises the question of whether these reforms are the right approach. The data indicate that lowering the number of uninsured is more a matter of lowering the cost of health care, but few proposals are focused there.

Chart Review

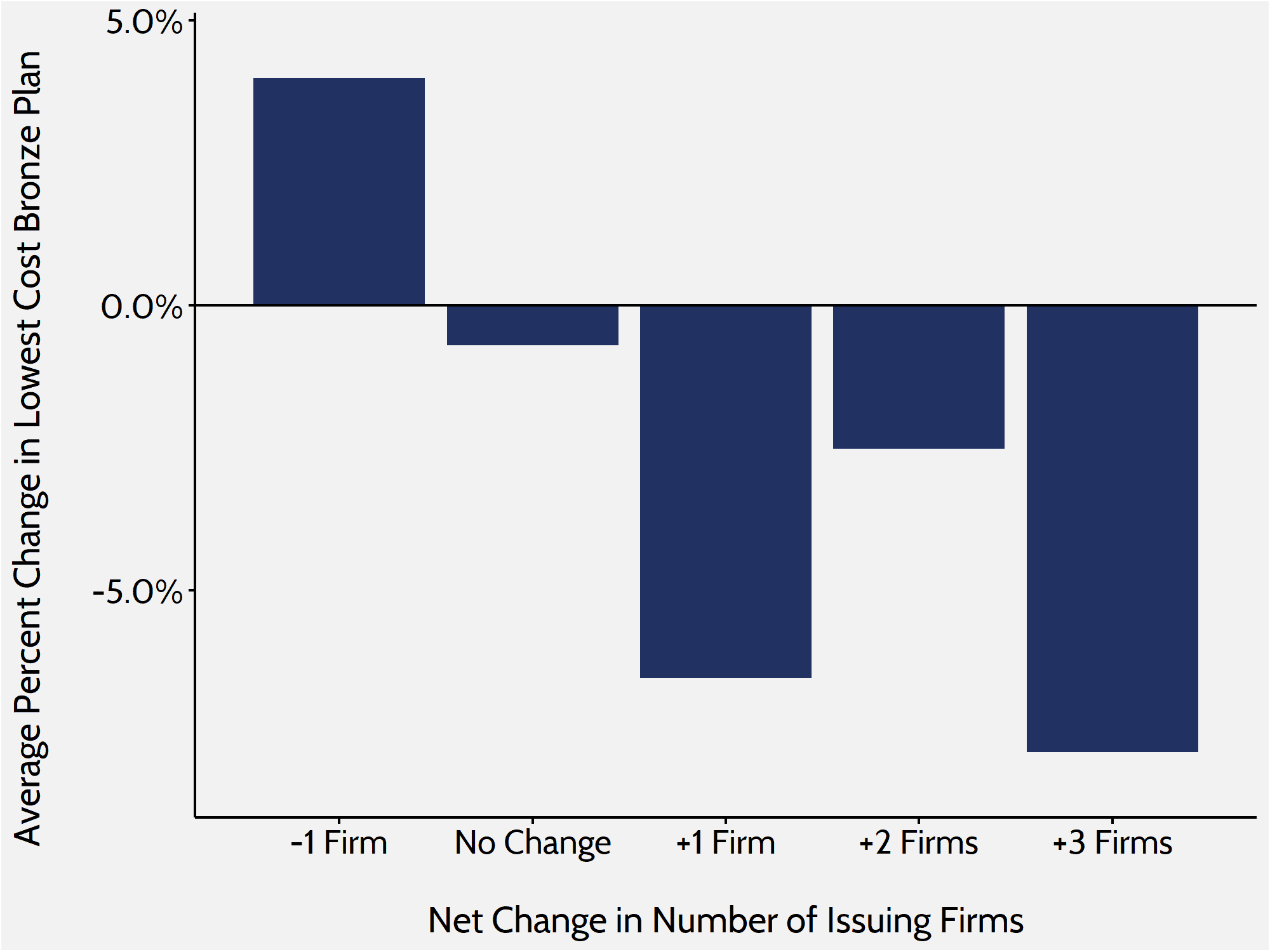

A new analysis by AAF’s Jonathan Keisling and Andrew Strohman of 2020 premiums on the Affordable Care Act’s exchanges examined the effect of changes in the number of firms offering Bronze-level plans within rating areas to the premium for the lowest-cost Bronze plan. The chart below illustrates that as the number of insurers increased (i.e. competition increases), premiums dropped. For those areas where there are fewer firms (less competition), premiums increased by an average of 4 percent. Where the number of firms went unchanged, the average premium decreased by about 1 percent. Overall, rating areas with more firms in 2020 compared to 2019 demonstrated an average premium decrease of 6 percent.

From Team Health

Daily Dish: Alternative Paths to Universal Coverage – AAF President Douglas Holtz-Eakin

The route to universal coverage runs through reforms that make the health care sector more productive and efficient.

Video: Medicare Buy-In or ACA? – Douglas Holtz-Eakin

Neither a Medicare buy-in nor the Affordable Care Act is an efficient choice for expanding health insurance coverage.

Research: 2020 ACA Marketplace Premiums – Jonathan Keisling and Andrew Strohman

2020 premiums for health insurance plans offered through the Affordable Care Act’s exchanges indicate the individual market is stabilizing.

Team Health Around Town

Event: Opportunities for Lowering Health Care Costs

Deputy Director of Health Care Policy Tara O’Neill Hayes spoke on a panel discussing ways to slow the growth in health care costs.

Worth a Look

Modern Healthcare: Investors bet Obamacare insurers will win court battle for billions in payments

New York Times: How the Brain Can Rewire Itself After Half of It Is Removed