Weekly Checkup

June 7, 2019

The State of State Medicaid Expansion

Amid long stretches of quiet over the fate of the Affordable Care Act (ACA), punctuated by promises from politicians to either overturn or defend the law, it is easy to forget the raging debate over one of the most consequential aspects of the law: the expansion of Medicaid. Expanding Medicaid was controversial from the very beginning, and the debate over it continues today in the states.

The ACA, as originally passed, mandated that states expand their Medicaid programs to cover all individuals up to 138 percent of the federal poverty line. Eventually, as part of its NFIB v. Sibelius decision, the Supreme Court ruled that the expansion would have to be voluntary.

As a result, states can choose whether or not to expand their Medicaid program. The ACA committed the federal government to paying 100 percent of the newly eligible beneficiaries’ costs, with the federal share phasing down to 90 percent over time—still a much higher rate than the federal contribution for the traditional Medicaid population. Initially states broke largely along ideological lines, with Democratic-controlled states embracing expansion and Republican-controlled states taking a pass. While ideology was a primary motivator, opponents and supporters of expansion also debated the relative merits of expanded coverage for (relatively) little money versus long-term fiscal security. States gain the additional federal dollars, but they also face the risk of expanded state responsibility for these beneficiaries with no guarantee that Congress or future administrations will maintain the flow of federal dollars to the states.

This debate continues in state legislatures to this day. At present, all but 14 states have declined to take the expansion; though, three states have adopted expansion but have not yet implemented it. Interestingly, those three states—Utah, Idaho, and Nebraska—are all Republican-controlled states where expansion was achieved through ballot initiatives backed by expansion advocates.

This week alone saw myriad news stories about ongoing state developments related to Medicaid expansion. In Wisconsin, Republican legislators are working to block Democratic Governor Tony Evers’s proposal to expand the program. In Kentucky, a state that expanded Medicaid in 2015, Democratic gubernatorial nominee Andy Beshear is making a campaign issue of Governor Matt Bevin’s attempts to apply a work requirement to the state’s expansion population. In Utah, where voters passed an initiative to adopt Medicaid expansion in November, the Utah Department of Health held a public hearing to garner feedback on an 1115 Waiver request that would allow for a partial expansion—short of what the voters initially approved. In Florida, the state Supreme Court will review a proposed amendment to the state constitution expanding Medicaid that supporters want to place on the ballot in 2020. And in North Carolina, advocates for Medicaid expansion held vigils around the state to protest the Republican-controlled legislature’s decision to table an expansion bill supported by Democratic Governor Roy Cooper.

With these battles over Medicaid expansion ongoing, PEW released a report this week showing that Medicaid spending has increased as a share of state dollars from 14.3 percent in 2007 to 17.1 percent in 2016. This increase alone might not be surprising, but the research further showed that state Medicaid spending continued increasing well after the economic recovery began following the Great Recession. This latter finding is concerning, to put it mildly, when considering that the economy will almost certainly take a downturn in the future. Safety-net programs such as Medicaid can be expected to grow during economic downturns—many view this counter-cyclical structure as useful—but when they also grow during periods of economic expansion, lawmakers need to consider their long-term sustainability.

While it sometimes takes a back seat in DC policy debates, Medicaid expansion, like every aspect of the ACA, continues to be controversial nine years later.

Chart Review

Ryan Haygood, Health Care Policy Intern

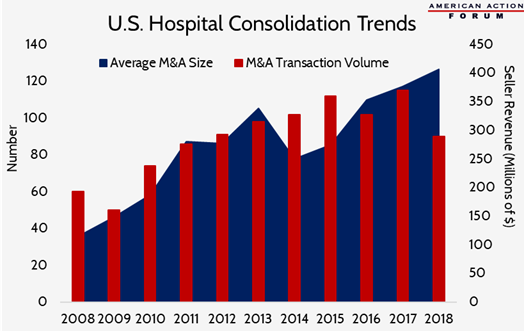

Health care markets have experienced substantial consolidation in recent years as big firms swallow up their competitors in a race for greater market share. These trends have progressed in nearly every sector of the health care industry, from drug wholesalers to insurance companies, pharmacy benefit managers (PBMs), and even providers. Consolidation is also ramping up across these groups, with pharmacy giant CVS and insurer Aetna aiming to clear their $69 billion merger with a federal judge this week. The chart below shows how hospital consolidation has steadily increased in the last decade. Not only are we seeing more hospital mergers and acquisitions, but the typical size of these buyouts (measured in the seller’s revenue) is also growing at an average rate of 13.8 percent each year. Evidence shows that increased market power leads to increased prices for patients, despite the hope that consolidation would reduce costs and streamline delivery.

Data from Kaufman Hall’s 2017 and 2018 “M&A in Review” reports

From Team Health

Comments on the Part D Reform Discussion Draft

Deputy Director of Health Care Policy Tara O’Neill Hayes commented on opportunities to reform Medicare Part D for two committees in the House of Representatives.

Worth a Look

Modern Healthcare: CVS-Aetna attempts to assuage Part D antitrust concerns

STAT News: ‘What’s my real identity?’: As DNA ancestry sites gather more data, the answer for consumers often changes

Reuters: One in four Ebola cases undetected in Congo: WHO