Insight

April 13, 2016

Obamacare Regulation: Mistake or the Most Expensive of All Time?

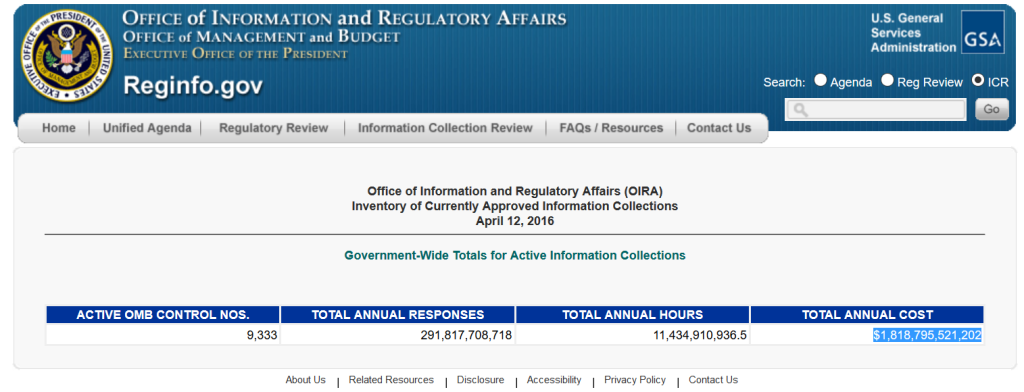

Gallons of proverbial ink have been spilled over the actual costs and benefits of federal regulation. As of today, it appears that the federal government’s own figures peg this burden at $1.8 trillion for just paperwork compliance. To put this number into perspective, there are roughly 116 million households in the U.S.; so, the regulatory burden per household equals $15,650. But is this yet another major typo?

Members of the administration have repeatedly attacked high figures for federal regulatory compliance, especially the Small Business Administration report pegging the costs at $1.8 trillion. In testimony, current “regulatory czar” Howard Shelanski responded to the study’s findings: “I am not sure I can say in polite company, sir, where I would put that study. But let me say pretty clearly that the study has been, I think, pretty thoroughly refuted by everyone who has looked at it.” Shelanski’s predecessor, Professor Cass Sunstein, also rejected the headline figure of $1.8 trillion, calling it “deeply flawed.” Yet now, the government advertises that figure for everyone to see?

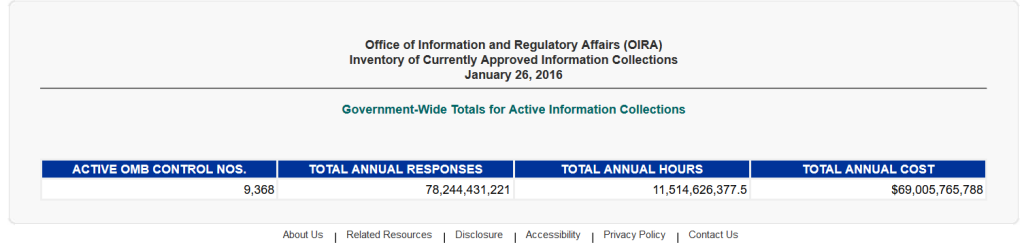

As of January 26, 2016, the cumulative paperwork burden stood at 11.5 billion hours, with only $69 billion in associated compliance costs. To put this new $1.8 trillion figure into context, there are only 14 countries, including the European Union, that produce more than $1.8 trillion annually in GDP. These new government estimates essentially broadcast to the world that federal regulatory compliance costs more than Canada or Australia produce in a year, and that’s just the paperwork portion of regulation, to say nothing of other burdens.

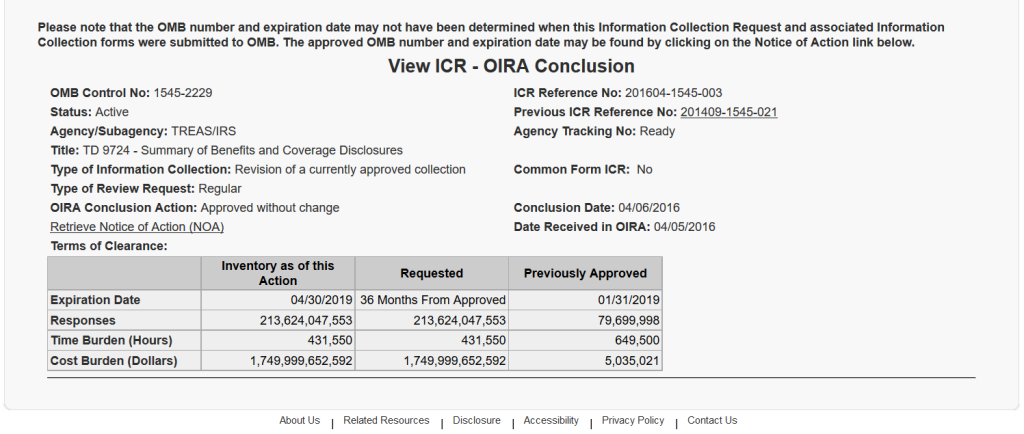

What is the culprit for a jump of $69 billion to $1.8 trillion, a 26-fold increase? When in doubt, blame the Affordable Care Act. Last week, in the period of just one day’s review, the White House received a paperwork requirement requesting to impose 431,550 hours on Americans, down from 649,500. The associated costs of the collection, “Summary of Benefits and Coverage Disclosures,” went from a reasonable $5 million to $1.7 trillion, a scant increase of 34,756,451 percent. How is this possible? See below.

In sum, this is probably not possible and likely a massive typo of some sort. Here are some examples of “Summary of Benefits and Coverage” for health insurance plans. They aren’t overly complicated. However, there aren’t any glaring reasons to explain this foul-up. In the supporting documentation, Treasury’s share of the cost could equal $17.35 million. Is it possible this $17 million figure morphed into something exponentially larger?

There were no public comments on this revised requirement, so it’s possible the administration could only now be learning of the massive error. The total burden from federal regulation might well top $1 trillion, but a requirement on summary benefits for health insurance surely can’t contribute roughly 99 percent of the overall regulatory tally. Surely one Affordable Care Act requirement could not impose burdens greater than the Gross Domestic Product of Australia or Canada? Or could it?