Comments for the Record

January 2, 2025

Comments for the Record: Competition in Air Transportation

Comments of Fred Ashton[1]

I. Introduction and Summary

The Department of Justice (DOJ) and Department of Transportation (DOT) (together “the agencies”) issued a request for information (RFI) on Competition in Air Transportation published on October 24, 2024.[2] The agencies are seeking “public information on consolidation, anticompetitive conduct and a wide range of issues affecting the availability and affordability of air travel options.”

While these comments are not an exhaustive analysis of the competitive state of air travel, I will focus my attention on several themes that merit consideration.

II. Background

a. Regulatory History

In 1938, President Franklin Roosevelt signed the Civil Aeronautics Act (CAA). In 1940, the CAA was split into two agencies, the CAA and the Civil Aeronautics Board (CAB). Responsibilities of the CAB included, in part, the economic regulations of airlines. Specifically, the CAB determined how many airlines could fly a route and the fares charged by the airlines. Deregulating the airlines industry became a priority under President Gerald Ford. In 1978, the Airline Deregulation Act replaced the heavy hand of the CAB for routes and fares that were determined by the competitive market. The Reason Foundation provides a more comprehensive regulatory history of the airline industry.[3]

A recent flurry of regulatory actions taken by the Biden Administration targeting specific industry practices has begun to swing the deregulatory agenda of the past 45 years in the other direction.[4],[5],[6] In a recent opinion column featured in The Wall Street Journal, Continental Airlines former CEO Frank Lorenzo offered several examples of the Biden Administration’s attempt to “reregulate” the airlines.[7]

Many of the recent regulatory changes enacted by the DOT are directly related to the information sought by the RFI including ticket sales, pricing, and rewards practices.

b. Recent airline competition regulatory actions

On July 9, 2021, President Biden signed the Executive Order on Promoting Competition in the American Economy (EO).[8] The principal concern of the EO was market concentration, which the president asserted had become “excessive” and “threaten[ed] economic liberties, democratic accountability, and the welfare of workers, farmers, small businesses, startups, and consumers.” Since the signing of the EO, much of the federal antitrust enforcement agenda has focused on the further consolidation of markets. My past research refutes the assertion that markets have become more concentrated over time and demonstrates that market share is not the proper way to assess competition.[9],[10],[11]

The DOJ has been recently involved in several enforcement actions against the airlines to limit consolidation of the industry. The agency successfully unwound the American Airlines and JetBlue Northeast Alliance and blocked the merger between JetBlue and Spirit Airlines.[12],[13],[14] In previous research, I discussed the merits of the DOJ’s lawsuit against the proposed JetBlue and Spirit merger.[15]

The RFI seeks to better understand “how airline consolidation overall and/or specific mergers between airlines have impacted air transportation…routes, faire prices,” and more.

c. Current barriers to airline competition

As is often the case, regulatory barriers inhibit the consumer benefits of intense competition. Excessive regulations often erect barriers to entry that benefit incumbent firms. Barriers to entry are factors that prevent or limit the creation of new competitors or restrain existing firms from entering new markets.[16] Currently, the perimeter rule and slot rule in effect at Ronald Reagan Washington National Airport (DCA) restricts competition by protecting other D.C. metro area airports. These protections have reduced competition among airlines resulting in higher ticket prices, longer flight times, increased delays, and fewer choices for consumers.[17] On October 16, 2024, the DOT tentatively awarded five new slots for routes outside of DCA’s perimeter rule.[18]

III. Current State of Airline Competition

a. Evaluating airline competition

Competition among airlines presents itself in several forms.[19] My analysis evaluates two of these methods.

The first method is the airline competition for city-pairs. Airlines shuttle customers from city to city, often serving multiple airports in large metropolitan areas. These routes are often referred to as origin and destination city-pairs. Airlines will compete for these routes.

The second method of competition is the airline’s business model. Historically, the airline industry was dominated by a few global network carriers (GNC) including United Airlines, Delta Air Lines, and American Airlines. The ticket price on these global network carriers regularly includes, among other things, bags, meals and snacks, seat selection, and in-flight entertainment (WiFi, television screens, etc.). Ultra low-cost carriers (ULCC), by contrast, charge a price for the seat and charge ancillary fees for bags, in-flight drinks or snacks, and pre-selecting a seat. Low-cost carriers (LCC) are a middle ground between the GNC and the ULCC. Ticket prices for these airlines will include one or a combination of baggage fees, drinks, snacks, pre-selected seats, and even in-flight entertainment.[20] Simply put, some airlines use an all-in pricing model where others unbundle their offerings to varying degrees.

b. Number of Competitors[i],[ii]

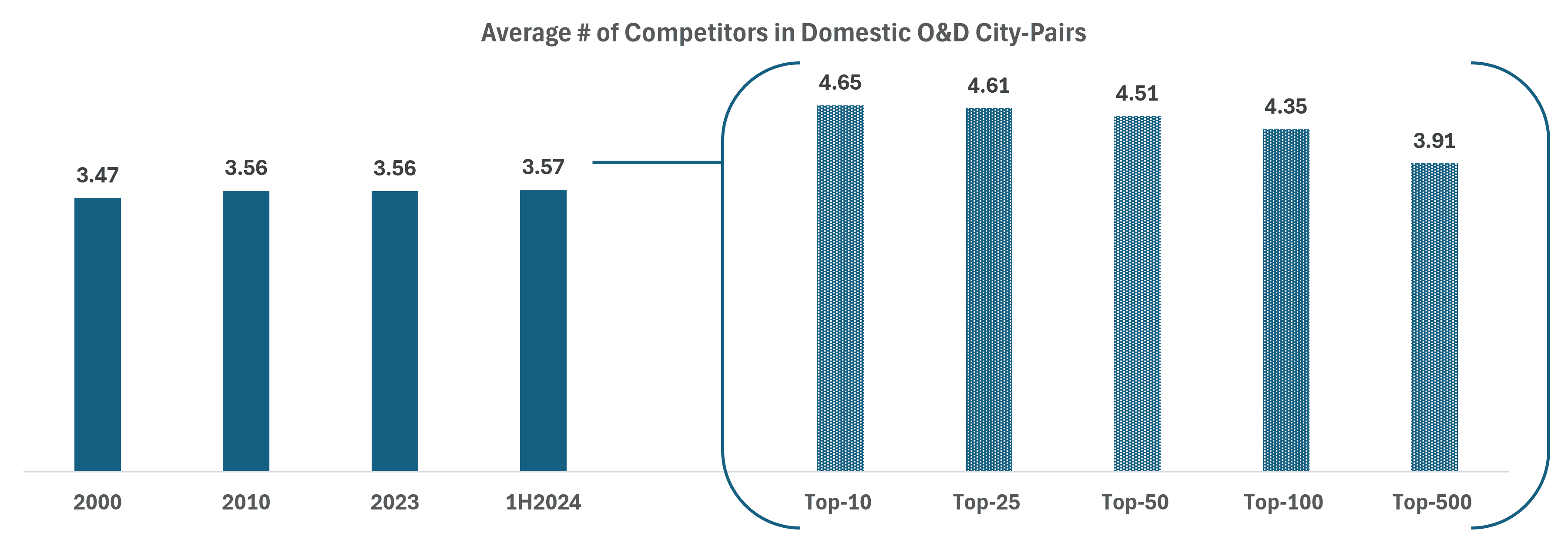

The late 1990s through the early 2010s brought a flurry of airline mergers acquisitions, including mergers involving U.S. global network carriers United Airlines, American Airlines, and Delta Air Lines.[21] While these mergers reduced the number of independently operating airlines, they did not reduce the level of competition in the industry. In fact, my research shows that the number of competitors with at least 5 percent market share for each city-pair increased from 3.47 to 3.57 between 2000 and the first half of 2024. Moreover, the city-pairs serving the greatest number of passengers faced even more intense competition. The top 10 busiest city-pairs had an average of 4.65 competitors in the first half of 2024. A more detailed breakdown can be found in Figure 1.

Figure 1

* Data reflect the number of competitors with at least 5 percent market share for a city-pair.

c. Competition of Business Models

Critical to understanding the level of competition in airlines is answering the question: Are all airlines the same? They are not. Airlines have varying business models that they use to attract customers. These different business models are a form of competition. Some airlines charge a ticket price that is all-inclusive of baggage fees, seat selection, and even in-flight entertainment. Others unbundle these features to offer the lowest possible price for the seat and charge for any additional amenities for which the customer is willing to pay. Other business models lie somewhere in between.

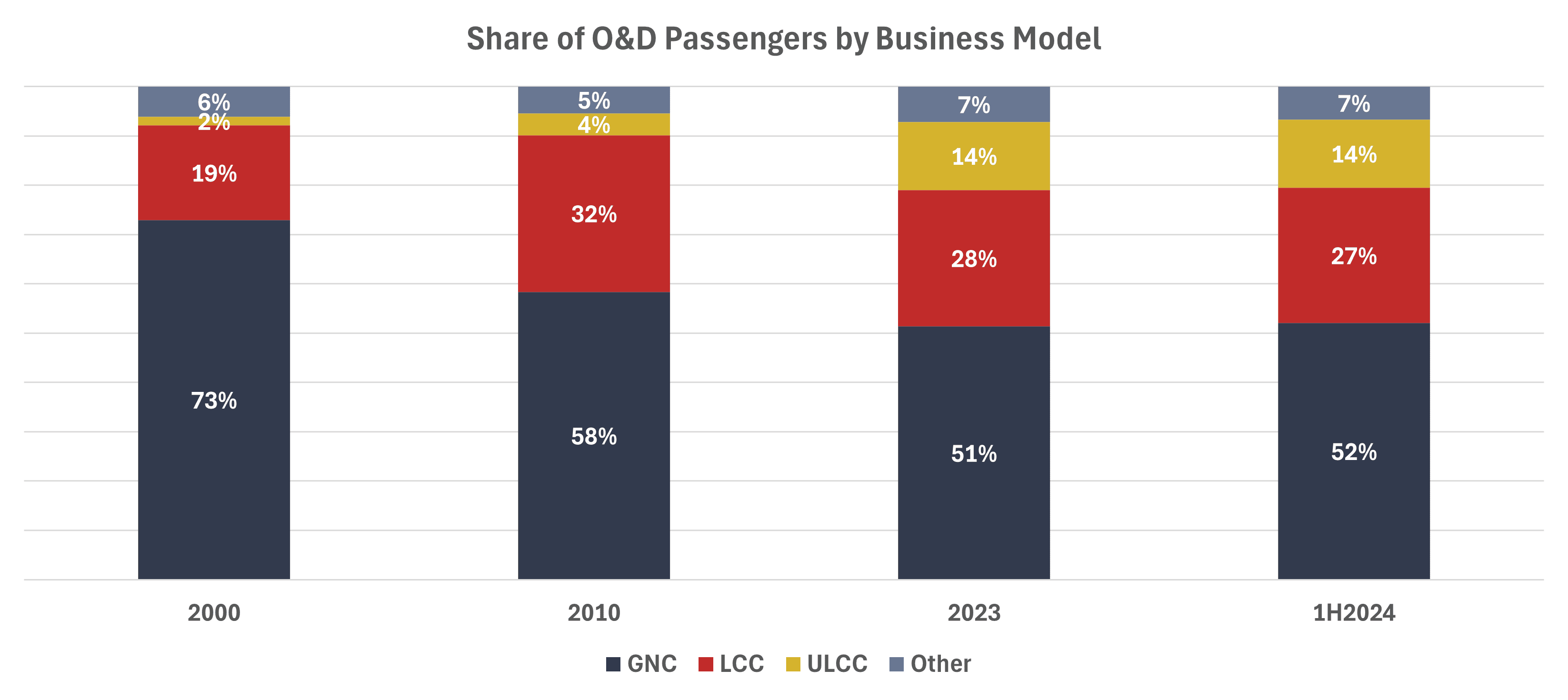

The rise of LCC and ULCC carriers in the early 2000s put pressure on the existing business models of the GNCs. To survive, many GNCs merged. Yet despite consolidation, the share of passengers across city-pairs served by the GNC business model declined from 73 percent in 2000 to 52 percent in the first half of 2024, as shown in Figure 2.

Figure 2

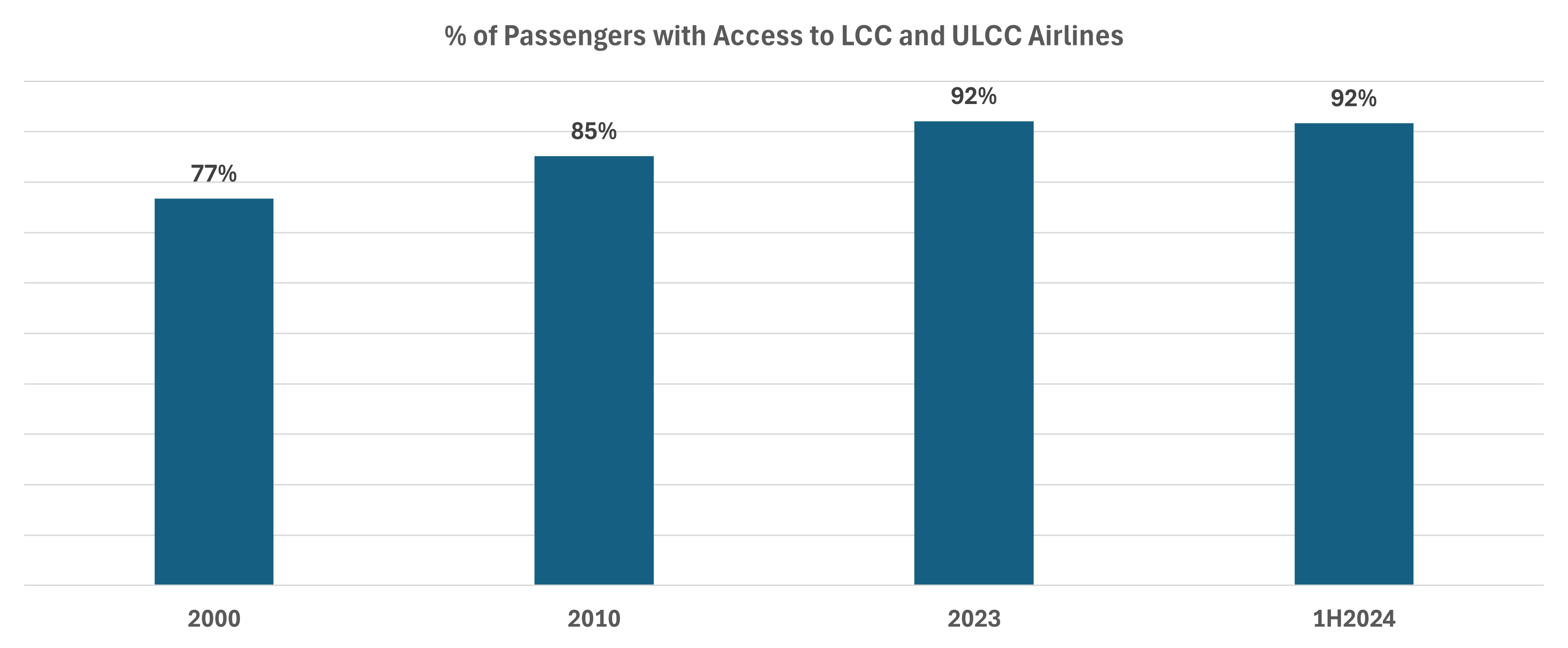

Furthermore, the number of passengers with access to LCC and ULCC business models has increased. As shown in Figure 3, just 77 percent of passengers had access to an LCC or ULCC in 2000. In the first half of 2024, that share increased to 92 percent.

Figure 3

d. GNC response to unbundling business model

The unbundled business model of the LCCs, ULCCs, and even some of the GNCs has received recent attention in Congress. A congressional report released on November 26, 2024, found that the “strategy of ‘unbundling’ ancillary products from the base price of a ticket was once largely limited to low-cost carriers, but airline revenue from ancillary fees has become an important source of revenue for airlines across the industry.”[22] The report also found that GNCs introduced “Basic Economy” fares to compete with LCCs and provided an example in which Delta offered this unbundled option specifically on routes where it competed with ULCC Spirit Airlines. This response clearly shows that GNCs had to alter their business models to respond to the market demand for unbundled air travel.

IV. Effects of Competition

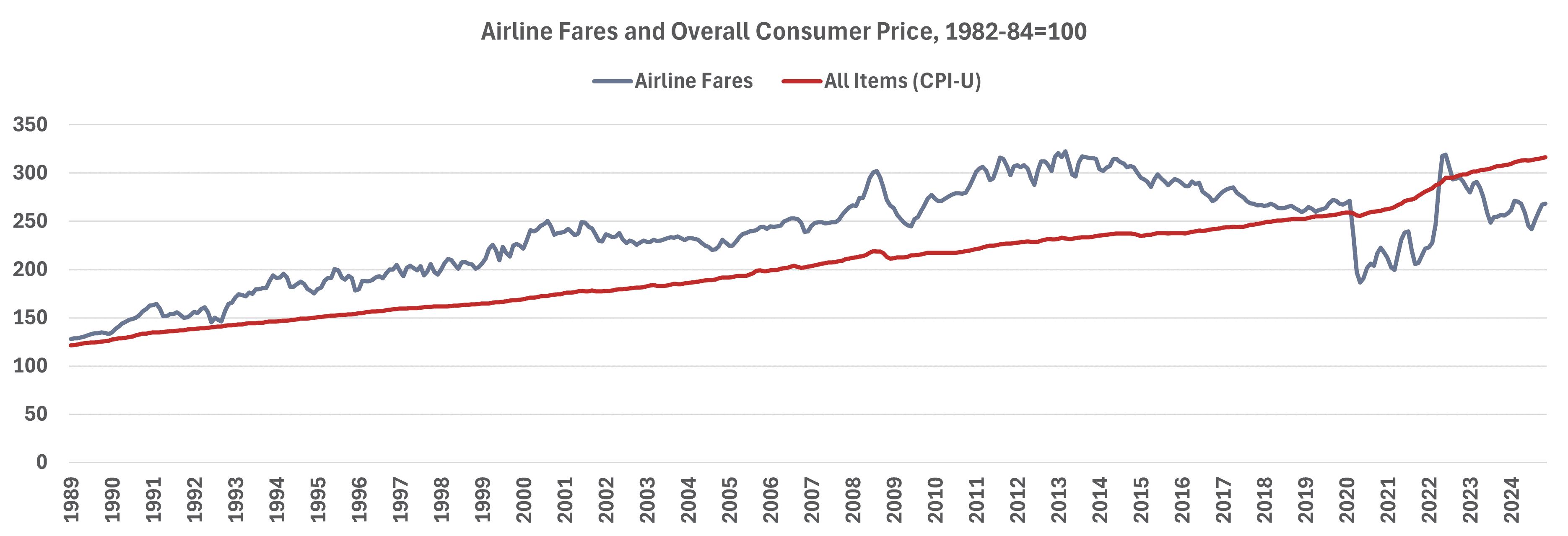

Increased competition is often associated with lower prices, greater choice, and more innovation. Since the airline industry was deregulated and empowered to respond to the demands of the market, it has delivered on all these characteristics. As previously discussed, over time, increased competition resulted in newer business models that provided customers with new options for flying. Further, as shown in Figure 4, inflation-adjusted airline fares have tumbled 38 percent since Q1-1995 while the current dollar price has climbed 28.8 percent.[23]

Figure 4

Moreover, airline fare inflation has grown at a slower pace than overall inflation. Since January 1989, airline fare inflation has increased 109 percent while overall consumer prices have grown 161 percent, as shown in Figure 5.[24]

Figure 5

V. Conclusion

This response to the agencies’ request for information shows that competition in the airline industry is strong and has intensified over the past two-and-a-half decades. The increased competition for city-pairs and competition among business models has helped depress inflation-adjusted airline fares and keep air fare inflation below the rate of overall consumer prices.

Attempts to reregulate the airlines, such as through limiting competition for city-pairs and restricting business models, will only return the industry to a time of higher fares and limited choice for consumers.

[1] Fred Ashton is the Director of Competition Policy at the American Action Forum. These comments represent the views of Fred Ashton and not the views of the American Action Forum, which takes no formal positions as an organization.

[2] “Justice Department and Department of Transportation Launch Broad Public Inquiry into the State of Competition in Air Travel” U.S. Department of Justice (October 24, 2024), https://www.justice.gov/opa/pr/justice-department-and-department-transportation-launch-broad-public-inquiry-state

[3] “Airline Deregulation: Past Experience and Future Reforms” Scribner, Marc (April 6, 2023), https://reason.org/policy-brief/airline-deregulation-past-experience-and-future-reforms/

[4] “USDOT Seeks to Protect Consumers’ Airline Rewards in Probe of Four Largest U.S. Airlines’ Rewards Practices” U.S. Department of Transportation (September 5, 2024), https://www.transportation.gov/briefing-room/usdot-seeks-protect-consumers-airline-rewards-probe-four-largest-us-airlines-rewards

[5] “Biden-Harris Administration Proposes Ban on Family Seating Junk Fees Charged by Airlines” U.S. Department of Transportation (August 1, 2024), https://www.transportation.gov/briefing-room/biden-harris-administration-proposes-ban-family-seating-junk-fees-charged-airlines

[6] “Biden-Harris Administration Announces Final Rule Requiring Automatic Refunds of Airline Tickets and Ancillary Service Fees” U.S. Department of Transportation (April 24, 2024), https://www.transportation.gov/briefing-room/biden-harris-administration-announces-final-rule-requiring-automatic-refunds-airline

[7] “Biden and Buttigieg are Reregulating the Airlines” Lorenzo, Frank (September 3, 2024), https://www.wsj.com/opinion/biden-buttigieg-reregulating-airlines-decrease-consumer-choice-kamala-harris-889d4094

[8] “Executive Order on Promoting Competition in the American Economy” The White House (July 9, 2021), https://www.whitehouse.gov/briefing-room/presidential-actions/2021/07/09/executive-order-on-promoting-competition-in-the-american-economy/

[9] To the contrary, market concentration measured at the six-digit NAICS level using market share of the four largest firms remained stable between 2002 and 2017. Just nine percent of all six-digit NAICS industries were considered highly concentrated in 2002 before falling to eight percent by 2017. “Are Monopolies Really a Growing Feature of the U.S. Economy?” Ashton, Fred (May 26, 2022) https://www.americanactionforum.org/research/are-monopolies-really-a-growing-feature-of-the-u-s-economy/

[10] “FTC and DOJ Publish New Merger (Mis)guidelines” Ashton, Fred (July 20, 2023) https://www.americanactionforum.org/insight/ftc-and-doj-publish-new-merger-misguidelines/

[11] “Industry Concentration is the Wrong Way to Judge Meatpacking Mergers” Ashton, Fred (September 21, 2023) https://www.americanactionforum.org/insight/industry-concentration-is-the-wrong-way-to-judge-meatpacking-mergers/

[12] “Justice Department Statements on District Court Ruling Enjoining American Airlines and JetBlue’s Northeast Alliance” U.S. Department of Justice (May 19, 2023), https://www.justice.gov/opa/pr/justice-department-statements-district-court-ruling-enjoining-american-airlines-and-jetblue-s

[13] “Justic Department Statements on District Court Decision to Block JetBlue’s Acquisition of Spirit Airlines” U.S. Department of Justice (January 16, 2024), https://www.justice.gov/opa/pr/justice-department-statements-district-court-decision-block-jetblues-acquisition-spirit

[14] After the DOJ successfully blocked the JetBlue and Spirit merger, Spirit Airlines filed for bankruptcy on November 18, 2024. “Budget travel icon Spirit Airlines files for bankruptcy protection after mounting losses” Josephs, Leslie (November 18, 2024), https://www.cnbc.com/2024/11/18/spirit-airlines-files-bankruptcy-protection.html

[15] “The Turbulent Battle for Spirit Airlines Shows the Nuance of Defining the Relevant Market” Ashton, Fred (July 14, 2022) https://www.americanactionforum.org/insight/the-turbulent-battle-for-spirit-airlines-shows-the-nuance-of-defining-the-relevant-market/

[16] “Excessively Burdensome Regulation Negatively Impacts Competition” Ashton, Fred (May 9, 2023) https://www.americanactionforum.org/insight/excessively-burdensome-regulation-negatively-impacts-competition/

[17] “DCA Perimeter Rule Grounds Competition” Ashton, Fred (July 19, 2023) https://www.americanactionforum.org/insight/dca-perimeter-rule-grounds-competition/

[18] “Order to Show Cause” Department of Transportation (October 11, 2024), https://www.regulations.gov/document/DOT-OST-2024-0065-23579

[19] “Domestic Airline Merges and Defining the Relevant Market: From Cities to Airports” Naumovich, Alexa, (2018), https://scholar.smu.edu/cgi/viewcontent.cgi?article=4103&context=jalc

[20] “The Turbulent Battle for Spirit Airlines Shows the Nuance of Defining the Relevant Market” Ashton, Fred (July 14, 2022), https://www.americanactionforum.org/insight/the-turbulent-battle-for-spirit-airlines-shows-the-nuance-of-defining-the-relevant-market/

[21] “U.S. Airline Merger and Acquisitions” Airlines for America, https://www.airlines.org/dataset/u-s-airline-mergers-and-acquisitions/

[22] “The Sky’s the Limit The Rise of Junk Fees in American Travel” Majority Report (November 26, 2024), https://www.hsgac.senate.gov/wp-content/uploads/2024.11.25-Majority-Staff-Report-The-Skys-the-Limit-The-Rise-of-Junk-Fees-in-American-Travel-1.pdf

[23] “National-Level Domestic Average Fare Series” U.S. Department of Transportation, https://www.bts.gov/content/national-level-domestic-average-fare-series

[24] Bureau of Labor Statistics Consumer Price Index Data, https://www.bls.gov/data/home.htm

[i] This analysis uses data from the Bureau of Transportation Statistics DB1B Market Database, https://www.transtats.bts.gov/DL_SelectFields.aspx?gnoyr_VQ=FHK&QO_fu146_anzr=b4vtv0%20n0q%20Qr56v0n6v10%20f748rB

[ii] The airlines included in this analysis are as follows: GNC: America West Airlines Inc., American Airlines Inc., Continental Air Lines Inc., Delta Air Lines Inc., Northwest Airlines Inc., Trans World Airways LLC, United Air Lines Inc., US Airways Inc.; LCC: AirTran Airways Corporation, ATA Airlines d/b/a ATA, Breeze Aviation Group DBA Breeze, Independence Air, JetBlue Airways, National Airlines, Pro Air Inc., Southwest Airlines Co., Vanguard Airlines Inc., Virgin America; ULCC: Allegiant Air, Frontier Airlines Inc., Spirit Air Lines, Sun Country Airlines d/b/a MN Airlines, TEM Enterprises dba Avelo Airlines; Other: ADVANCED AIR, LLC, Aer Lingus Plc, Aeromexico, Air Canada, Air Canada rouge LP, Air China, Air Excursions LLC, Air Jamaica Limited, Air Midwest Inc., Air New Zealand, Air Pacific Ltd., AirBridgeCargo Airlines Limited, Alaska Airlines Inc., Alia-(The) Royal Jordanian, Alis Cargo Airlines S.P.A., All Nippon Airways Co., Aloha Airlines Inc., Asiana Airlines Inc., Austrian Airlines, Azul Linhas Aereas Brazileiras S A, Bering Air Inc., Bidzy Ta Hot Aana, Inc. d/b/a Tanana Air Service, Big Sky Airlines Inc., Boutique Air, British Airways Plc, Brussels Airlines N.V., Cathay Pacific Airways Ltd., Cayman Airways Limited, CFM Inc d/b/a Contour Airlines d/b/a One Jet Shuttle, Chautauqua Airlines Inc., China Airlines Ltd., China Eastern Airlines, China Southern Airlines, Compagnie Natl Air France, Compania Panamena (Copa), Continental Micronesia, Czech Airlines, El Al Israel Airlines Ltd., Envoy Air, Ethiopian Airlines, Etihad Airways, Eva Airways Corporation, ExpressJet Airlines LLC d/b/a aha!, Fast Colombia SAS d/b/a Viva Colombia, Finnair Oy, Florida Express Inc., Freedom Airlines d/b/a HP Expr, Frontier Flying Service, Grand Canyon Airlines, Inc. d/b/a Grand Canyon Airlines d/b/a Scenic Airlines, Great Lakes Airlines, Gulf Air Company, Hawaiian Airlines Inc., Homer Air, Horizon Air, Hyannis Air Service, Inc. dba Cape Air, Iberia Air Lines Of Spain, Island Air Hawaii, Italia Transporto Aereo S.P.A DBA ITA S.P.A, Jade Cargo International, Japan Air Lines Co. Ltd., Jet Airways (India) Limited, Kenya Airways PLC, Key Lime Air Corp dba Denver Air Connection, Klm Royal Dutch Airlines, Korean Air Lines Co. Ltd., L.A.B. Flying Service Inc., Lacsa, LAN Argentina, Lan-Chile Airlines, Lufthansa German Airlines, Mesa Airlines Inc., Mokulele Flight Services, Inc., NEW PACIFIC AIRLINES, Pacific Wings Airlines, Pan American Airways Corp., Peninsula Airways Inc., Philippine Airlines Inc., Polskie Linie Lotnicze, PSA Airlines Inc., Qantas Airways Ltd., Qatar Airways (Q.C.S.C), Regions Air, Inc., Republic Airline, Royal Air Maroc, Saudi Arabian Airlines Corp, Scandinavian Airlines Sys., Scoot Tigerair Pte Ltd d/b/a Scoot, Seaport Airlines, Inc., Shuttle America Corp., Silver Airways, Singapore Airlines Ltd., SkyWest Airlines Inc., South African Airways, Southern Airways Express, dba Mokulele Airlines, Swiss International Airlines, Swissair Transport Co. Ltd., Taca International Airlines, TAM Linhas Aereas SA dba Latam Airlines Brasil, Tanana Air Service, TAP-TAP Air Portugal, Tower Air Inc., Turk Hava Yollari A.O., USA 3000 Airlines, Varig Logistica S/A, Varig S. A., Via Airlines d/b/a Sterling Airways, Virgin Atlantic Airways, VRG Linhas Aereas S A, Warbelow, Westjet, Wright Air Service

November 3, 2025

Comments for the Record

Employee Noncompete Agreements

Fred Ashton

Comments of Frederick C. Ashton, Jr.[1] I. Introduction and Summary The Federal Trade Commission (FTC) issued a request for information regarding employee…