Insight

May 9, 2023

Excessively Burdensome Regulation Negatively Impacts Competition

Executive Summary

- President Biden’s executive order on Promoting Competition in the American Economy blamed government inaction, in part, for the weakened competitive state of the U.S. economy.

- The Biden Administration has increased the regulatory burden by $318 billion in total costs and more than 218 million hours of paperwork during its first two years.

- An increased regulatory burden erects barriers to entry that are negatively associated with firm births, firm deaths, and increased profits among incumbent firms – meaning regulations inhibit new market entrants while cementing the position of existing firms.

Introduction

On July 9, 2021, President Biden issued an executive order (EO) on Promoting Competition in the American Economy outlining the administration’s “whole-of-government” approach to “promote the interests of American workers, businesses, and consumers.”

In the EO, President Biden claimed that over the last several decades, industry consolidation and weakened competition have negatively affected workers, small businesses, startups, and consumers. The president attributed this weakened competitive environment – which he asserts had contributed to “widening racial, income, and wealth inequality” – on, at least in part, federal government inaction. American Action Forum research casts doubt over this claim of corporate consolidation and its effect on startups. Included among the many policy priorities and strategies directed in the EO, the president instructed federal agencies to “[adopt] pro-competitive regulations” and “[rescind] regulations that create unnecessary barriers to entry that stifle competition.”

Yet, in President Biden’s first two years in office, his administration has increased the regulatory burden by $318 billion in total costs and more than 218 million hours of paperwork. An increased regulatory burden erects barriers to entry that discourage new business formation and existing businesses from entering new markets while further entrenching incumbent firms’ market control.

One study found that “a 10 percent increase in the intensity of regulation…leads to a statistically significant 0.5 percent decrease in overall firm births.” The study also concluded that a “10 percent increase in regulation is associated with a 0.9 percent decrease in the deaths of large firms.” Another study concluded that “large increases in regulations are followed by large increases in relative profits.”

Rather than promoting competition, an increase in federal regulations creates an environment conducive to existing firms while inhibiting business dynamism.

Regulations Create Barriers to Entry

Creating a business climate conducive to firm entry and exit is necessary to foster greater market competition. Barriers to entry – factors that prevent or limit the creation of new competitors or restrain existing firms from entering new markets – inhibit this process. While there are some natural barriers to entry – economies of scale, market understanding, and access to resources – government at the local, state, and federal levels often creates additional barriers to entry. Governments frequently require occupational licensing, charge operational licensing fees, impose tariffs on goods used in production, and implement regulations that add additional, and often insurmountable, costs associated with starting and operating a business. These increased costs limit the formation of new competitors and impede existing firms from entering new markets. Furthermore, incumbent firms better able to absorb these increased burdens are poised to strengthen their market position as regulatory barriers keep competitors out of the market.

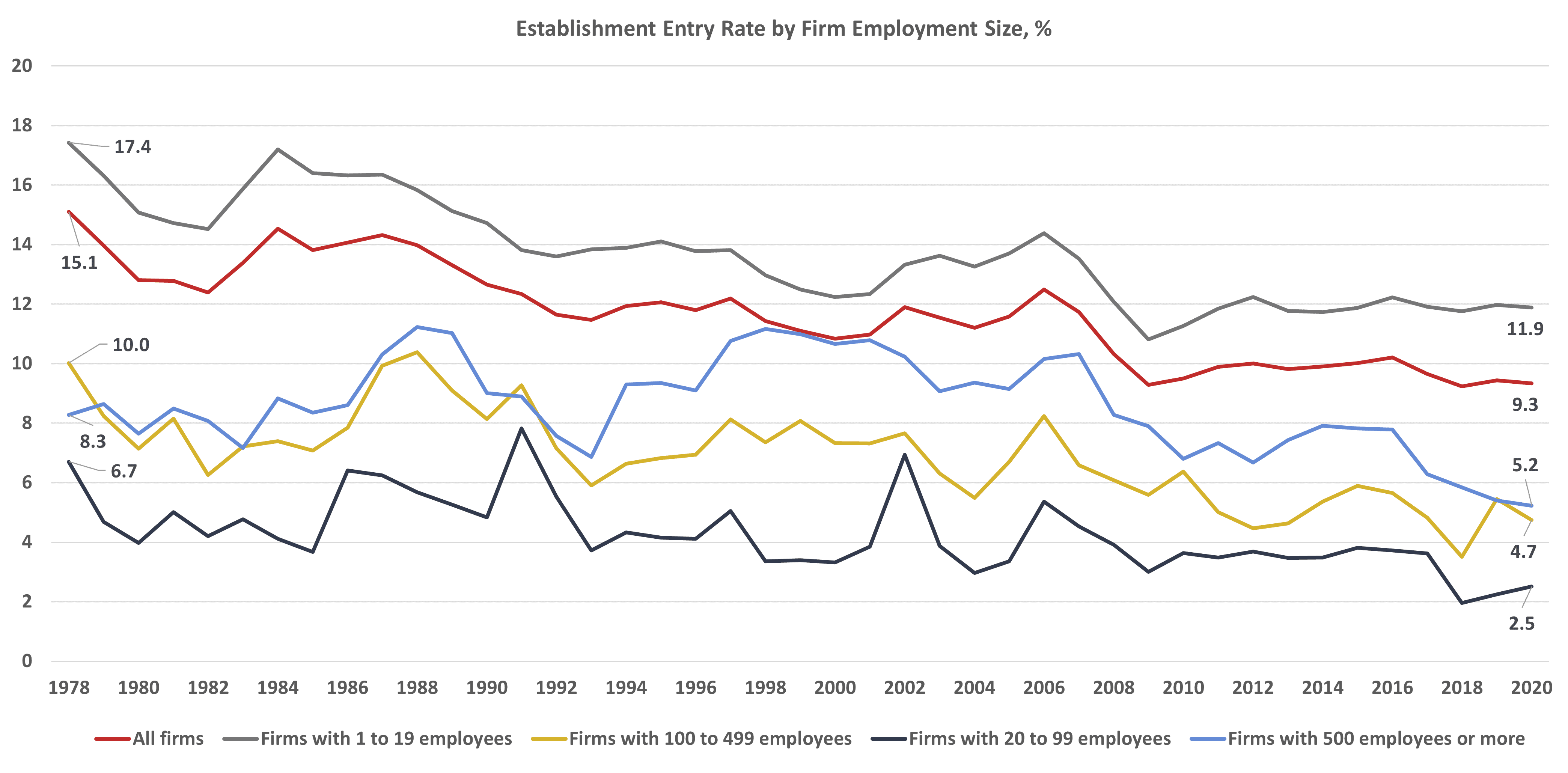

Since the late 1970s, the United States has experienced a downward trend in the establishment entry rate,[1] an indicator of business dynamism. Figure 1 shows the trend in the establishment entry rate based on firm employment size. The entry rate for all firms (shown in red) declined from 15.1 percent in 1978 to 9.3 percent in 2020. Small firms, those with one to 19 employees (shown in gray), suffered an establishment entry rate decline from 17.4–11.9 percent over the same period. Creating an environment encouraging entrepreneurship and business formation is vital to promoting market competition.

Figure 1

*Source: United States Census Bureau Business Dynamics Statistics

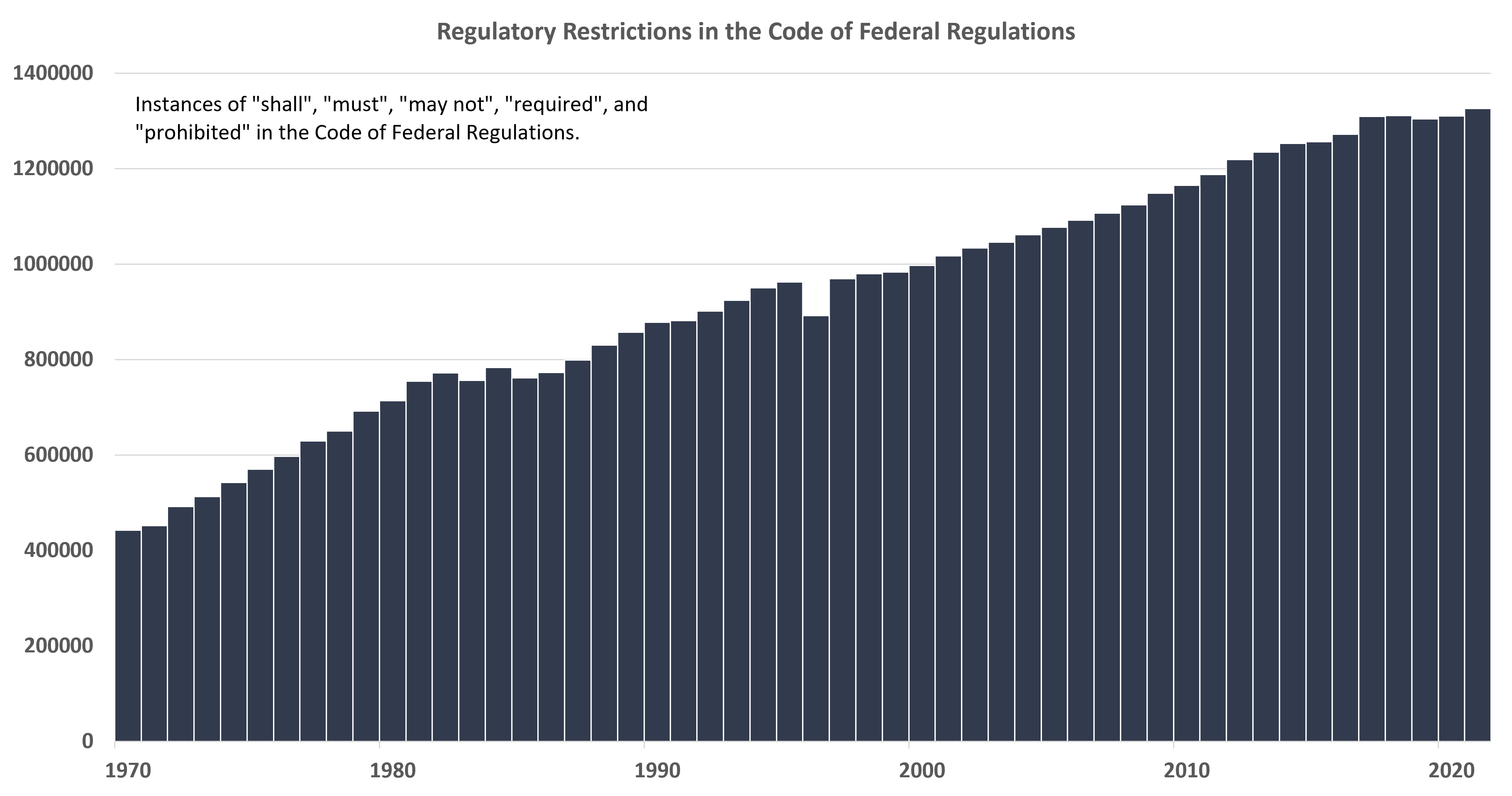

While the establishment entry rate dropped over this period, the number of federal regulations exploded. The Mercatus Center at George Mason University developed a dataset quantifying the regulatory restrictions called RegData. The dataset measures the number of restrictions in the Code of Federal Regulations (CFR) by “counting select words and phrases that are typically used in legal language to create binding obligations or prohibitions” including “shall,” “must,” “may not,” “required,” and “prohibited.” The data show that these phrases appeared in the CFR slightly more than 442,000 times in 1970 before ballooning to just shy of 1.326 million in 2021, an increase of more than 17,000 each year. The growth path of these regulations is shown in Figure 2.

Figure 2

*Data source: RegData from Mercatus Center at George Mason University, RegData United States 4.1

The Effects of Regulatory Barriers on Firm Entry

Mercatus Center research used these data to measure the effects of regulation on firm entry, firm deaths, and hiring. When controlling for economic factors, the study found “that a 10 percent increase in regulation leads to a 0.5 percent reduction in new firm births and a 0.9 percent reduction in hiring.” It further noted that the “overall level of federal regulation increased by 24 percent” between 1998 and 2011, meaning that “federal regulation reduced the entry of new firms by 1.2 percent and reduced hiring by 2.2 percent.” It concluded that “returning to the level of regulation in effect in 1998 would lead to the creation of 30 new firms and hiring of 530 new employees every year for an average industry.”

The study also found a statistically significant relationship between an increase in regulation and a reduction in firm deaths among large firms (those with 500 or more employees). It found that a 10 percent increase in regulation is associated with a 0.9 percent reduction in large firm deaths. This result supports the hypothesis that regulatory restrictions not only reduce new competitors from forming, but also help solidify the market presence of large incumbents.

A study by Gutierrez and Philippon found additional evidence supporting the claim that increased regulation limits free entry and the hypothesis that large firms may benefit from increased regulation. Also using RegData, the study found that “a doubling of the regulation index, leads to a 2.5% lower annual growth rate in the number of small firms relative to large ones.” The study also measured the impact of changes in regulations on profits. The study showed that when an industry experiences an increase in regulatory restrictions by more than 5,000, these industries “experienced large increases in profit margins over the following three years, relative to other industries.”

The evidence showed that government imposed regulatory barriers inhibit competition and further entrench the market dominance of incumbent firms.

U.S. Bank Regulation and Newly Chartered Banks

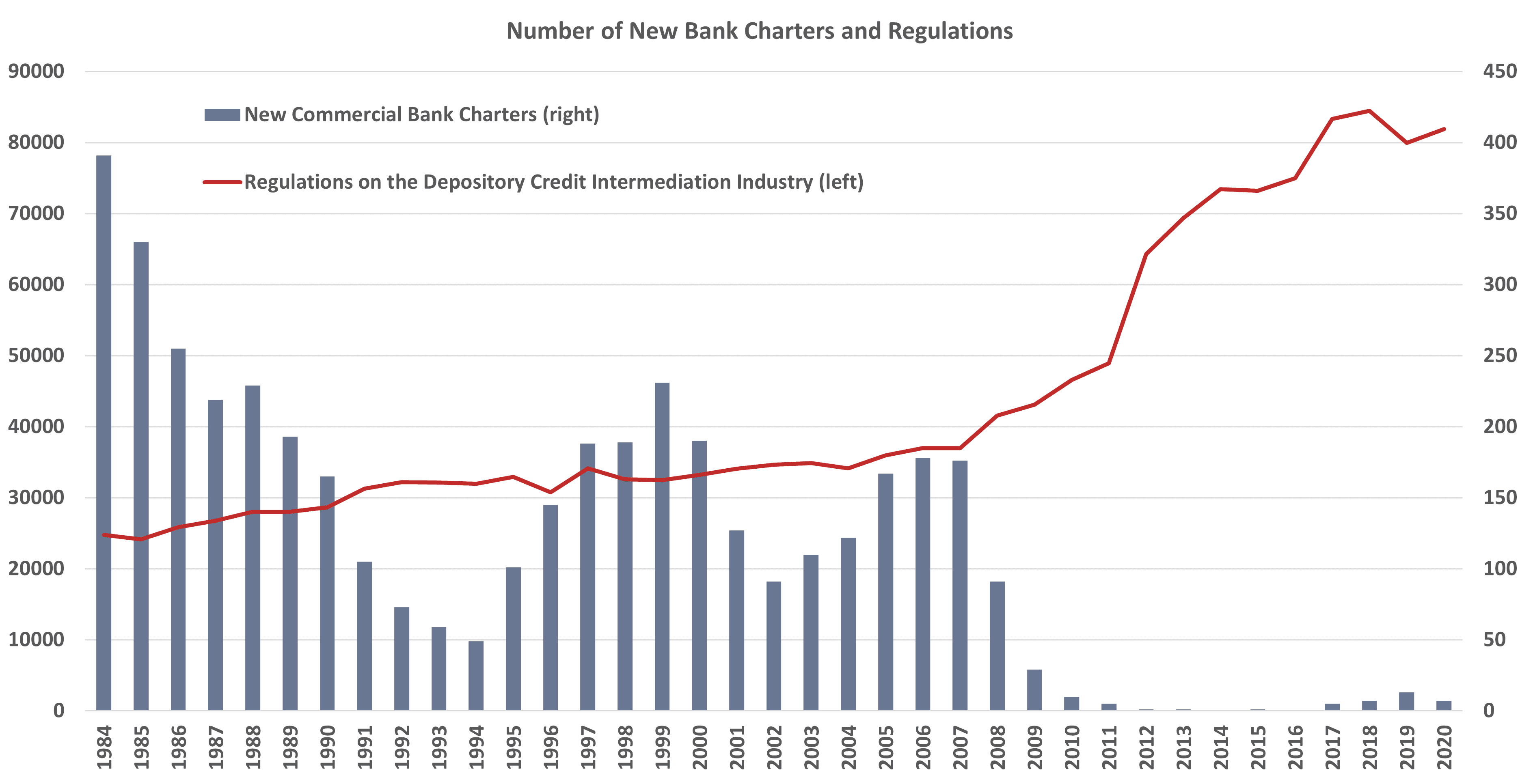

In response to the financial crisis of 2008—2009, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act. This act included 144 finalized regulations at a cost of $38.9 billion and nearly 83 million hours of paperwork.

Prior to the Dodd-Frank’s passage and ensuing barrage of regulations, there was an average of 170 new bank charters issued annually between 1984–2007. In the decade following Dodd-Frank (2011–2020), the annual average plummeted to four (Figure 3). At the same time, the number of regulations on the depository credit intermediation industry – which includes commercial banks – counted by RegData went from nearly 49,000–82,000.

Figure 3

*Data from FDIC and RegData, RegData United States 4.0 dataset

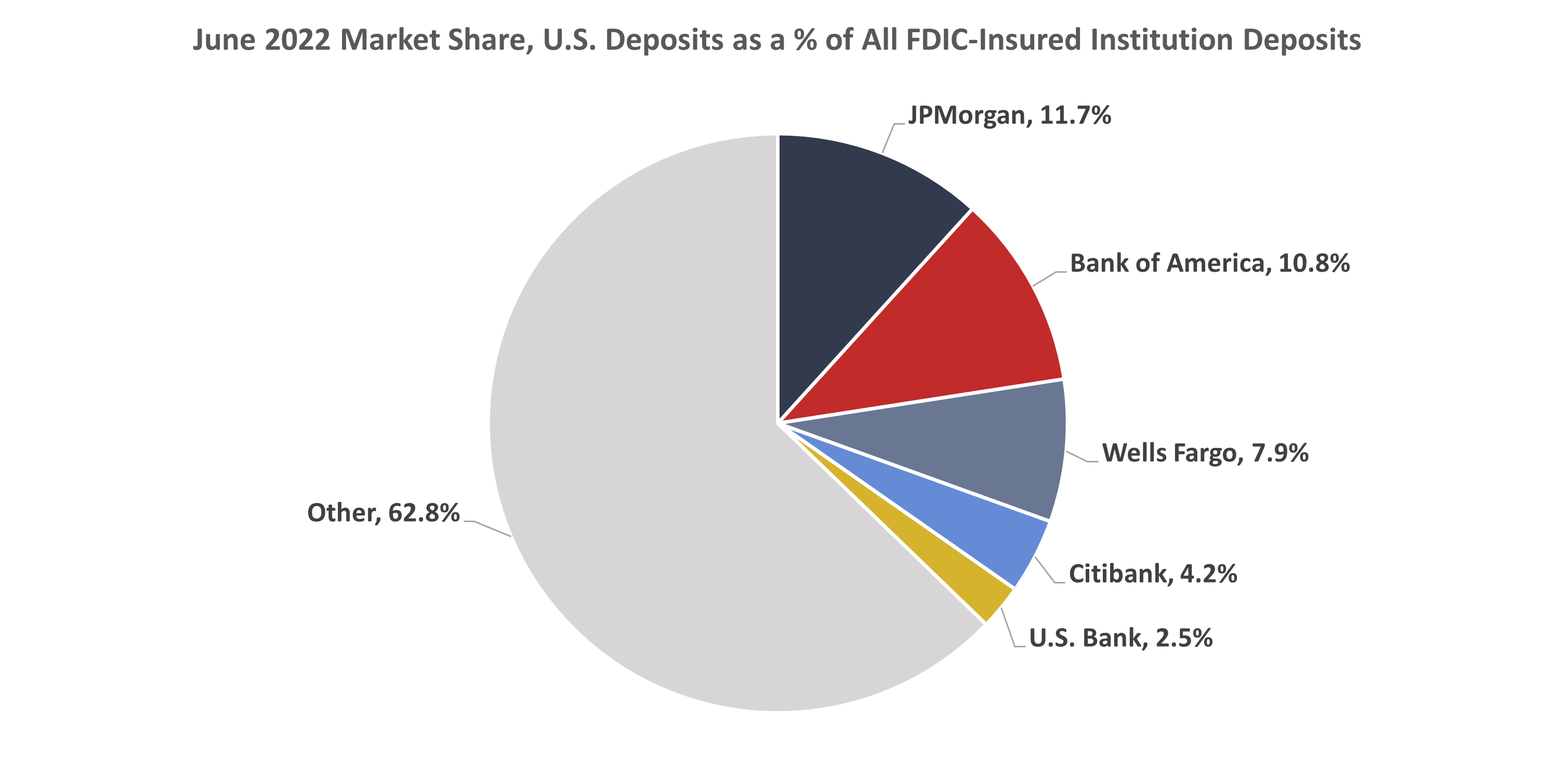

Meanwhile, the combined market share of the five largest banks, as measured by share of U.S. deposits at all FDIC-insured institutions, increased from 24 percent in 2007 to 37 percent by 2022, shown in Figure 4.

Figure 4

*Source: Federal Deposit Insurance Corporation

While the rise of interstate banking beginning in the 1980s and the macroeconomic conditions following the financial crisis likely have a more causal effect on the depressed number of newly chartered banks, the data show that additional banking regulations are negatively correlated with newly chartered commercial banks. At the same time, the market share of incumbent firms increased. This evidence further supports the notion that government regulations create barriers that limit the formation of new competitors while promoting an environment beneficial to incumbent firms.

Conclusions

President Biden’s efforts to promote competition in the U.S. economy has been thwarted, in part, by his administration’s continued onslaught of excessive regulation. New regulatory costs of $318 billion and more than 218 million hours of paperwork during the first two years of his term have added to government-created barriers to entry.

These regulatory barriers are negatively associated with firm births, which means that new competitors are limited from entering the market. Furthermore, these barriers have provided incumbent firms with a business environment conducive to increased profit margins.

[1] Census Calculation: 100 * (establishments entry at time t divided by average of establishments at t and t-1)