Insight

December 13, 2021

Dear CBO…

Executive Summary

- The Congressional Budget Office (CBO) estimated that the Build Back Better Act (BBBA) would add over $367 billion to federal deficits over the next decade.

- The estimate makes clear that the Act in its current form is not—contrary to proponents’ claims—paid for; moreover, it does not take into account the use of “sunsets” to hide even greater costs of the BBBA’s policies if they were made permanent.

- According to an analysis by the CBO, if the artificially expiring policies in the BBBA were extended, as their sponsors fully intend, the BBBA would add an additional $3 trillion to the deficit.

Introduction

On December 10, CBO released an analysis of the Build Back Better Act (BBBA) that assumed 18 policies were made permanent, rather than “sunset” (expire) within the 10-year budget estimating window. Sunsetting policies within the budget window is among the most well-worn budget gimmicks, and the BBBA is hardly unique in this architecture. The president and the congressional majority have publicly vowed that the BBBA would be fully offset, which—had they actually done it—would have been a commendable departure from recent practice. But the BBBA does not meet this goal even with the gimmickry. Without it, the BBBA falls several trillion short. Indeed, according to the CBO, these sunsets mask about $2.6 trillion in additional deficits on top the $12 trillion deficits the federal government is projected to run over the next decade, raising the total cost to $3 trillion.

Sunsetting

Both parties have exploited the use of” sunsetting” a program—or artificially ending the program before the end of the 10-year budget window—to make the program appear less costly. To the extent that the cost of federal legislation is typically assessed over 10 years, therein lies the advantage of sunsetting policies. But this dynamic doesn’t always matter. Rather, costs, as the U.S. debt of over 100 percent of gross domestic product suggests, are not the preeminent concern of legislators. There is both a practical and a rhetorical utility in obfuscating the costs of the policies in the BBBA, however. First, because congressional Democrats have chosen to legislate the BBBA through the budget reconciliation process, cost considerations are critical to assessing compliance with the rules governing the process. The second reason for hiding costs is purely political – the majority does not have the votes to pay for the full 10 years of the BBBA. The BBBA includes sunsets for 18 major policies, allowing them to expire variously after 1-7 years. The last several months of congressional negotiations over the BBBA have to a large extent been over how to pay for the spending. Sunsetting the policies makes that chore easier, allowing legislators to minimize the pain that comes from the offsetting tax increases to be spread over a longer period of time.

The Budgetary Effects of the BBBA

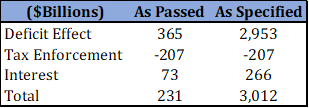

Last month, the CBO issued its formal cost estimate for the BBBA. The estimate, which followed all of the laws, rules, guidelines, and customs that dictate congressional budget estimating, found that the BBBA as passed by the House of Representatives would increase the deficit by over $360 billion over 10 years. But as noted, this is a function of the costs being obscured by sunsets. It is substantially a temporary spending bill with permanent tax increases. As the CBO analysis makes clear, however, the budget engineering in the BBBA is sizeable. If the 18 policies that are artificially sunset in the BBBA were extended, they would cost a combined $2.95 trillion by 2031. The biggest driver of this extra spending is from the child tax credit extension, which costs about $185 billion for a single year. For context, this exceeds the discretionary budgets of every federal agency but the Department of Defense. Yet if made permanent, as the sponsors of the BBBA intend, it would cost $1.6 trillion.

Extending policies such as child care and preschool subsidies, Earned Income Tax Credit expansion, and 15 other major policies would add about $1.2 trillion in additional deficits that are masked by sunsetting. The CBO also included offsetting tax enforcement revenue and debt service costs, neither of which is included in the formal cost estimate.

The CBO analysis was done at the request of the ranking members of the House and Senate Budget Committees and is responsive to that request. It is not a formal cost estimate and will have no procedural relevance to the reconciliation process. It is an entirely appropriate assessment of the budgetary implications of the BBBA, however, as the bill’s sponsors have been entirely candid about their desire and intention to make the policies permanent. Notwithstanding that, the Democrats have responded to CBO’s analysis with a letter-writing campaign of their own. In a separate response to a letter from Senate Majority Leader Chuck Schumer, the CBO affirmed that the above-cited analysis of the BBBA essentially does not include any additional assumptions or specifications related to offsets. That is because there are no vestigial offsets in the BBBA the way there is for spending. The implication of Sen. Schumer’s hasty rhetorical cover is that congressional Democrats have every intention of making these policies permanent, but they will figure out how to pay for them later. With control of the White House, the Senate, and the House, and the reconciliation process at their disposal, there’s nothing to stop them from doing so now.

Conclusion

The BBBA has been knocking around Capitol Hill for the better part of a year. Democrats coalesced around a package of legislation that would materially expand federal entitlements and other spending initiatives, while nominally offsetting those commitments with long-promised tax increases. The challenge has been that there is a broad spectrum of views among Democrats over the scope and scale of both sides of the ledger in the BBBA. Rather than substantially bridging those gaps, legislators instead have leaned on an old budget trick to paper over the policy disagreements among congressional Democrats. It is hardly the first time this trick has been used and it won’t be the last.