Insight

August 25, 2022

Details on the Biden Administration’s $10,000 Federal Student Loan Forgiveness

- On August 24, President Biden announced $10,000 blanket loan forgiveness for borrowers of federal student loans who make less than $125,000 per year and for married borrowers whose combined spousal income is less than $250,000 per year.

- The prescribed individual and spousal income caps are at least in the 89th percentile of 2021 U.S. annual income distributions, meaning lower, middle, and even still many higher-income borrowers will receive forgiveness in some amount.

- The amount of forgiveness increases to $20,000 for borrowers who have also received a Pell Grant as an undergraduate student – reducing the regressive nature of blanket loan forgiveness.

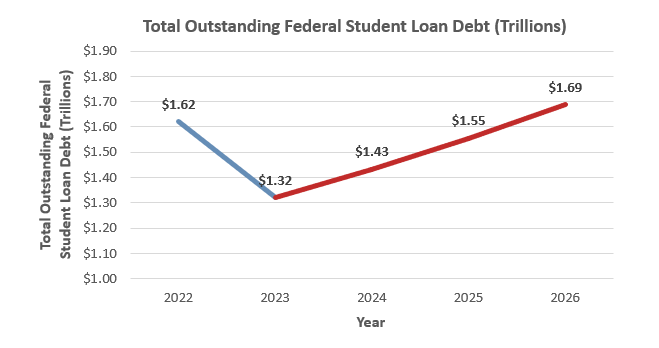

- Blanket loan forgiveness in any amount unfairly shifts large educational costs to taxpayers and would only delay historical trends in outstanding federal student loan debt: By 2026, the total amount of federal student loan debt will likely bounce back to present levels.

Introduction

On August 24, President Biden announced $10,000 forgiveness for borrowers of federal student loans who make less than $125,000 per year and for married borrowers whose combined income is less than $250,000 per year. The American Action Forum has previously demonstrated the regressive nature of blanket federal student loan forgiveness. Because higher-income families hold the majority of federal student loan debt, they would receive most of the forgiveness. The order’s provision to increase the amount of forgiveness for Pell Grant recipients, who are usually of lower-income backgrounds, would likely reduce the regressive nature of blanket loan forgiveness. Nevertheless, an annual income of $125,000 is in the 89th percentile of the 2021 U.S. individual income distribution, while an annual combined spousal income of $250,000 is in the 93rd percentile of the 2021 U.S. household income distribution.[4] Lower-income borrowers, and indeed most higher-income borrowers, will still qualify for at least $10,000 in forgiveness.

Blanket loan forgiveness in any amount does nothing to increase educational attainment or lower costs. It simply shifts costs to taxpayers. Blanket loan forgiveness also introduces a new set of disincentives for future borrowers to pay back what they owe, presenting a clear moral hazard. What’s more, the administration’s blanket loan forgiveness plan will be expensive and does nothing to reverse, and only delay, historical trends in outstanding federal student loan debt: By 2026, the total amount of federal student loan debt will likely bounce back to present levels.

Details on the Forgiveness Program

Under the administration’s plan, federal student loans borrowers who make less than $125,000 per year as an individual – and if married, less than $250,000 in combined income – are eligible to receive $10,000 in forgiveness. The Department of Education (ED) will use either 2020 or 2021 adjusted gross incomes to determine eligibility. Borrowers who fall under those caps and at one point received a Pell Grant to pay for their undergraduate tuition are eligible to receive $20,000 in forgiveness. Borrowers who surpass those income caps, whether or not they received a Pell Grant before, are not eligible for any forgiveness. In the near future, ED will create an application process whereby borrowers will self-certify their incomes, along with the types of federal student loans they have and their outstanding balances. ED will then base its decision to extend individual forgiveness on those applications.

All federally owned student loans are eligible for forgiveness under President Biden’s plan. This includes direct loans, Stafford loans, Perkins loans, as well as Grad and Parent Plus Loans. While Federal Family Education Loans (FFEL) are backed by the federal government, most are held by private lenders. Those held by private lenders are not eligible to receive forgiveness unless the borrower applied for consolidation into a federal direct loan prior to September 29, 2022. The few already held by the federal government are eligible regardless. Private student loans are ineligible for any forgiveness under the plan.

Borrowers do not need to have completed a degree to receive forgiveness. Current students that meet the above standards will therefore be eligible to receive forgiveness. The cutoff date for loan dispersal is June 30, 2022, meaning any loans issued after that date are not eligible for forgiveness. Therefore, any new federal loans disbursed for the fall 2023 semester and beyond will not be eligible for forgiveness under this plan.

Most Borrowers of Federal Student Loans Will Qualify for Forgiveness

The American Action Forum has previously demonstrated the regressive nature of blanket federal student loan forgiveness. More than half of outstanding federal student debt is held by families in the top 40 percent of the income distribution, while the bottom 40 percent of the income distribution holds just about a quarter of the total federal student loan debt. Higher-income families would receive nearly double the amount of loan forgiveness of lower-income families simply because they hold the majority of the debt. Including the provision to increase the amount of forgiveness for Pell Grant recipients, however, would presumably reduce the regressive nature of the program. The White House claims in its factsheet that 87 percent of the loan forgiveness will go toward individual borrowers earning less than $75,000. This may be the case, as Pell Grant recipients, who tend to be of lower-income backgrounds, are to receive double the amount of forgiveness of non-Pell Grant recipients under this plan.

An annual income of $125,000 is in the 89th percentile of the 2021 U.S. individual income distribution, while an annual combined spousal income of $250,000 is in the 93rd percentile.[5] Because the income caps are at the high end of their respective income distributions, large swaths of higher-income borrowers, who tend to have higher outstanding balances, will still receive at least $10,000 in forgiveness. The Pell Grant provision simply shifts the relative proportion of total forgiveness toward borrowers on the lower end of the income distribution. The plan overall still allows many higher-income borrowers to receive forgiveness in some form.

Unfair to Many Americans

Blanket loan forgiveness is unfair to many Americans. Those who did not go to college are among the taxpayers liable for the debt of those receiving forgiveness. Those without a college degree are not alone in shouldering this liability, however. Individuals who have attended college without taking out loans, along with those who already paid off their loans, would not benefit from blanket loan forgiveness whatsoever. They, along with those who did not pursue post-secondary education to avoid taking on student debt, will not benefit from blanket loan forgiveness.

Blanket Loan Forgiveness Creates a Moral Hazard for Future Students and Borrowers

Blanket loan forgiveness does nothing to lower the cost of higher education and may even produce higher costs for students. Universities now have less incentive to find ways to lower tuition because their current or former students have now been bailed out by the federal government. The expectation for future forgiveness will persist into the future, as well. Students entering college in the fall 2023 semester and beyond will still pay the same tuition rates as before, if not more, but they will now enter with the assumption that they will receive loan forgiveness at some point. In turn, they could now be incentivized to take out more loans than necessary, and not pay in a timely fashion – or at all – presenting a clear moral hazard. Because the income caps are so high, the vast majority of current and future college students will be subject to moral hazard.

Chart 1 projects what could happen to total outstanding federal student loan debt after $10,000 blanket loan forgiveness has been enacted. It uses historical annual growth rates of federal student loan debt to calculate an average annual growth rate. As of the second quarter of 2022, the outstanding federal student loan balance stood at about $1.62 trillion. A $10,000 blanket loan forgiveness in 2022 would reduce the outstanding balance by about $300 billion, bringing the total to $1.32 trillion. Nevertheless, because blanket loan forgiveness would do nothing to lower the cost of college, and those students entering post-secondary education in 2023 and beyond would still take out loans like before – if not in greater volume – the outstanding federal student loan debt would likely bounce right back to current levels by 2026.

Chart 1: Projected Total Outstanding Federal Student Loan Debt[6]

*The real figures are shown in blue. The projected figures are shown in red. The $1.62 trillion figure was the actual outstanding federal student loan debt as of the second quarter of 2022. The $1.32 trillion for 2023 is the projected figure of the year’s outstanding federal student loan balance after a blanket $10,000 forgiveness.

Conclusion

Blanket loan forgiveness in any amount is not educational reform. It does not raise educational attainment or bring down the cost of college. Such a plan simply introduces new problems at prohibitive cost, while doing little to nothing to reform the student loan program. The federal student loan system will now be subject to a strong moral hazard that creates a disincentive for future borrowers from all income backgrounds to repay their loans. Colleges will also have less of an incentive to lower tuition and costs, under the assumption that the federal government will enact another round of student loan forgiveness in the future. Blanket loan forgiveness adds hundreds of billions of dollars to the federal deficit and puts those who never attended college or have already paid off their loans on the hook for the debt. Finally, a blanket loan forgiveness policy only delays, but does not reverse, historical trends in outstanding federal student loan debt: By 2026, the total amount of federal student loan debt could revert to present levels.

[1] https://www.npr.org/2022/09/29/1125923528/biden-student-loans-debt-cancellation-ffel-perkins

[2] https://studentaid.gov/data-center

[3] https://studentaid.gov/debt-relief-announcement/one-time-cancellation

[4] Determined by the Author’s analysis of Current Population Survey (CPS) data. Sarah Flood, Miriam King, Renae Rodgers, Steven Ruggles, J. Robert Warren and Michael Westberry. Integrated Public Use Microdata Series, Current Population Survey: Version 9.0 [dataset]. Minneapolis, MN: IPUMS, 2021. https://doi.org/10.18128/D030.V9.0

IPUMS-CPS, University of Minnesota, www.ipums.org.

https://cps.ipums.org/cps/

[5] Determined by the Author’s analysis of Current Population Survey (CPS) data. Sarah Flood, Miriam King, Renae Rodgers, Steven Ruggles, J. Robert Warren and Michael Westberry. Integrated Public Use Microdata Series, Current Population Survey: Version 9.0 [dataset]. Minneapolis, MN: IPUMS, 2021. https://doi.org/10.18128/D030.V9.0

IPUMS-CPS, University of Minnesota, www.ipums.org.

https://cps.ipums.org/cps/

[6] https://studentaid.gov/data-center