Insight

March 23, 2020

Evaluating CARES Assistance to the Airlines

Executive Summary

- The U.S. Senate CARES Act provides $58 billion in loans and loans guarantees to the aviation industry, as well as relief from jet fuel excise taxation.

- CARES also imposes a $425,000 salary cap and further limitations on “golden parachutes” for departing executives of on any firm that accepts these loans.

- After 9/11 the federal government provided nearly $7 billion in grants and loan guarantee disbursements to airlines but subjected the loan approval and award process to an oversight board – the Air Transportation Stabilization Board.

Introduction

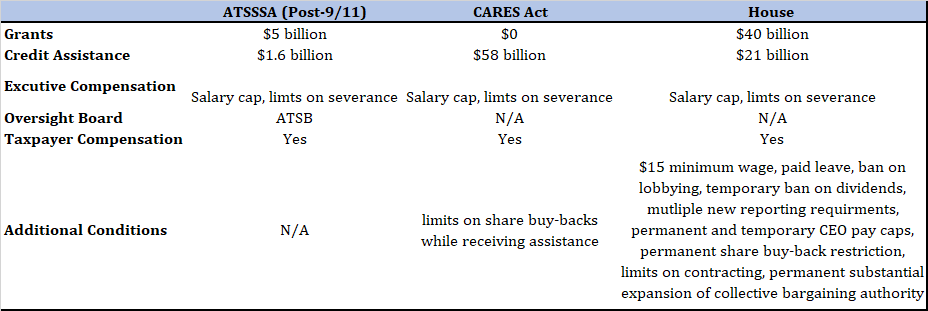

On March 22, the Senate majority introduced a revised “phase 3” of the legislative response to the COVID-19 pandemic, the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Among other provisions the Act provides $58 billion in loans and loan guarantees to the passenger and cargo airline industry. The CARES Act attaches some strings to these public funds by restricting compensation and stock buy-backs by participating firms for the duration of the firms’ participation in the program. Speaker Pelosi has reportedly drafted competing legislation that includes assistance to struggling industries such as the airlines, but with substantial changes to participating firms’ underlying cost structures. In the wake of the attacks on 9/11, Congress enacted the Air Transportation Safety and System Stabilization Act (ATSSSA), which provided financial assistance to U.S. airlines, largely through grants and loan guarantees, but paired with restrictions and oversight. As the Congress considers how to assist industries critical to keeping Americans employed, and supplied during the crisis, the ATSSSA provides a useful model designing policy for airline financial assistance policy.

A Brief History of the ATSSSA

On September 22nd, President Bush signed H.R. 2926 (ATSSSA) into law to provide federal assistance to U.S. airline carriers in the wake of the 2001 terrorist attacks. The ATSSA include four major components: direct financial assistance to airlines, assistance to airlines in war and terrorist insurance, tax provisions, and compensation to victims of the hijackings. The direct financial assistance provision took two forms: $5 billion in direct grants for compensation for federal actions and subsequent losses, and up to $10 billion credit assistance in the form of loan guarantees. The ATSSA also provided tax assistance to the airlines, allowing carriers to delay an estimated $1.4 billion in remittances of certain tax payments by the airlines for 180 days. Congress established the Air Transportation Stability Board (ATSB) to oversee administration of the loan program.

The financial assistance was not without strings. Any airline accepting financial assistance was required to agree to limit executive compensation to $300,000 and preclude severance agreements of more than twice an employee’s base pay, a limitation on so-called “golden parachutes.”

The ATSB was composed of the Secretary of the Treasury, the Secretary of Transportation, the Chairman of the Federal Reserve, and the Comptroller of the Currency in a nonvoting capacity. The ATSB was empowered to evaluate applications by airlines and provide up to $10 billion in direct loans or loan guarantees. Importantly, the ATSSSA included provisions that required that the federal government was compensated for the risk of the credit assistance, in the form of warrants, options, or other financial instruments. The ATSSSA also imposed fees, compensation restrictions, and other reporting requirements on borrowers. Ultimately, the airlines only received $1.626 billion in credit assistance, substantially less than was initially expected. Owing to fees, improved credit conditions, and other factors, the subsidy cost of this credit assistance was ultimately negative, which is to say that the taxpayer made money.

Current Developments[1]

The current iteration of the CARES Act includes a package of financial assistance for the airlines. The Act provide up to $50 billion in loans or loan guarantees to passenger airlines and $8 billion for cargo airlines. The Act suspends the collection of excise taxes on kerosene used in commercial aviation until 2021. The Tax Foundation estimates this will cost $8 billion. Under the CARES Act, firms must demonstrate need and must submit to compensation restrictions nearly identical to those imposed under ATSSSA. Under the CARES Act, firms must limit executive compensation to $425,000 and must restrict executive severance in the same way as was imposed under ATSSA. Bowing to populist opposition to stock buy-backs, the CARES Act also restricts such equity purchases by participating firms until the firm pays back the loans. The CARES Act does not establish an oversight board in the same vein as was done with ATSSA, but rather devolves the administration of the program to the Department of the Treasury.

The House of Representatives is reportedly drafting competing legislation with $40 billion in direct payments to airlines and related contractors, plus an additional $21 billion in loans. However, these measures are paired with both temporary and permanent changes to these forms business practices. The House approach includes substantial new costs on participating employers including permanent new wage and collective bargaining mandates, a host of temporary restrictions and reporting requirements.

Conclusion

The United States is facing a public health crisis that demands an unprecedented public health response. The United States must take emergency measures to preserve critical infrastructure, and the 2001 ATSSSA model is a valuable case study for policymakers as they consider further measures to address the coronavirus crisis. At present, the Senate is considering legislation that mirrors this approach in part but diverges in the nature of the assistance and the level of oversight. The House of Representatives instead appears to prefer to impose new costly policies on employers at a time of crisis.

[1]These elements are reflected in draft legislation and are subject to change.