Insight

April 9, 2020

Fed Announces Extensive New Measures to Support the Economy (Updated)

Executive Summary

- On March 23 and April 9, the Federal Reserve (Fed) expanded on the already decisive deployment of tools from its monetary policy arsenal in seeking to mitigate the economic impacts of the coronavirus.

- In addition to expanding the powers of existing programs, the Fed has now announced the creation of nine new emergency lending facilities designed to provide aid across the economy and backed by billions of dollars of support from the Treasury.

- These new programs will supplement and support the relief provided by the Treasury and the Small Business Administration (SBA) in implementing the Coronavirus Aid, Relief, and Economic Security Act.

Context

In its most sweeping and dramatic intervention in the economy to date, the Federal Reserve (Fed) on March 23 announced a series of measures employing a wide range of the monetary policy authorities available to it, all with the aim to “support smooth market functioning.” Since then, the Fed has followed up with near-daily tweaks to monetary policy and its supervisory authority, much of it designed to free up capital that banks can use to lend to distressed sectors of the economy.

On April 9, the Fed publicized details of an additional $2.3 trillion in loan support to businesses via the creation of three new lending facilities. These programs have been built with the Coronavirus Aid, Relief, and Economic Security (CARES) Act in mind and will directly support the work of the Treasury and the Small Business Administration (SBA) in implementing the relief mandated by the CARES Act.

This piece provides an overview of these developments.

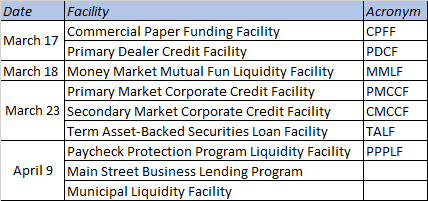

Glossary and timeline of Fed emergency lending facilities

March 23

Quantitative easing

With the goal of supporting critical market functioning, the Fed will expand its quantitative easing (QE) program to include purchases of commercial mortgage-backed securities in its mortgage-backed security purchases. As previously noted, the Fed announced the first round of QE on March 15, committing to the purchase of “at least” $500 billion in Treasury securities and $200 billion in mortgage-backed securities (MBS). While this morning’s announcement does not appear to expand the Fed’s program beyond the $700 billion to which it has already committed, the Fed will now include agency commercial MBS in its agency MBS purchases.

Establishes three new emergency lending facilities

PMCCF and SMCCF

Two of these facilities, a Primary Market Corporate Credit Facility (PMCCF) and a Secondary Market Corporate Credit Facility (SMCCF), will support access to credit for large employers via the purchase of corporate debt.

The PMCCF will provide bridge financing for four years via the issue of new bonds and loans with the end result being uninterrupted access to credit for businesses. The facility will be open to investment-grade companies who may elect to defer principal and interest payments for six months, or longer at the Fed’s discretion, in order to have additional cash on hand.

The SMCCF will purchase investment-grade bonds from U.S. listed companies and U.S. listed exchange-traded funds from the secondary market. The SMCFF will operate with the goal of providing ”broad exposure to the market for U.S. investment grade corporate bonds.”

TALF

Although the Fed’s press announcement speaks of the ”establishment” of a Term Asset-Backed Securities Loan Facility (TALF), the Fed first created the TALF program during the 2007–2008 financial crisis. Where the PMCCF and the SMCCF are aimed at restoring market liquidity by ensuring that large employers retain access to credit, the TALF instead is focused on small businesses and consumers. The TALF program provides financing to investors willing to invest in financial instrument securitizations backed by small businesses and consumers. These securitizations include, for example, student loans, credit card loans, and auto loans in the asset-backed securities (ABS) market. Without this financial incentive provided to investors, the previous financial crisis made clear that investors would no longer invest in these asset-class securitizations. Without a market for small business and consumer loans, lenders simply stopped making loans to consumers and small businesses. TALF is therefore vital to maintaining access to credit for small businesses and consumers. In the previous iteration of TALF, the Fed, via the Federal Reserve Bank of New York, loaned “up to $200 billion on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans.”

The resurrection of TALF had been widely anticipated by policy and market analysts. The Structured Finance Association (SFA) published a letter on March 22 calling for reinstatement of TALF and noting a need to reform the program to include, for example, a wider range of eligible collateral. It remains to be seen whether the Fed will modify TALF 2.0 and, if so, how.

Financing

The Fed estimates that these three programs will provide up to $300 billion in new financing. Support for the programs will come from the Treasury Department’s Exchange Stabilization Fund (ESF), which will provide up to $300 billion in new financing. This arrangement between the Fed and Treasury must be considered in light of the third coronavirus stimulus package (the CARES Act) that is currently being negotiated in the Senate. One of the provisions of this proposed bill significantly alters the operation of the ESF, which was granted emergency powers during the 2007–-08 financial crisis that were then removed after the crisis had passed. The proposed bill would once again return those emergency powers, allowing the Treasury through the ESF to guarantee money market mutual funds, and would also provide for $425 billion in discretionary funding that the Treasury Secretary might invest in loans and securities in support of Fed liquidity programs including PMCCF, SMCCF, and TALF.

Expands existing programs

On March 17, the Fed announced the creation of a Commercial Paper Funding Facility (CPFF). Corporate, or commercial, paper is an unsecured, short-term financial instrument critical to business funding. The CPFF has been invested with the authority to buy corporate paper from issuers who might otherwise have difficulty selling the paper on the market, at a cost of the three-month overnight index swap rate plus 200 basis points. Treasury Secretary Steven Mnuchin noted in a press briefing that the cost of this facility could be as high as $1 trillion but that he did not expect it to rise so high. Again, the CPFF is backed by the Treasury, which will provide $10 billion of credit protection to the Fed from the ESF.

On March 23, the Fed expanded the list of acceptable collateral that the CPFF would consider. This list will now include high-quality, tax-exempt commercial paper as eligible securities. The Fed will also lower the price to use the CPFF facility – although it has not as of yet said how or by how much.

On March 18, the Fed announced the creation of a Money Market Mutual Fund Liquidity Facility (MMLF). This facility offers collateralized loans to large banks that buy assets from money market mutual funds. A money market mutual fund is a form of mutual fund that invests only in highly liquid instruments and as a result offers high liquidity with a low level of risk. Again, the Fed will accept a wide range of permissible capital, including corporate paper, in an attempt to encourage these investors to participate in the money market mutual fund market, and the market more generally.

On March 23, the Fed also expanded the list of acceptable collateral the MMLF would consider. This list will now cover a wider range of securities including municipal variable rate demand notes (VRDNs) and bank certificates of deposit.

April 9

Establishes three new emergency lending facilities

PPPLF

The key weakness of the relief provided by the CARES Act to small businesses via the Paycheck Protection Program (PPP) is that, as enacted, the Act requires that lenders who originate these loans, designed to be forgiven, hold them on their balance sheets for at least several weeks. Putting aside the problems of banks holding a significant portfolio of non-performing loans, this requirement also meant that once banks hit their personal cap of PPP lending (as determined by their capital requirements) banks could not lend any more, regardless of any remaining funds appropriated by CARES to the SBA.

As announced earlier that week in the light of a difficult roll out of the PPP, the Fed created a new lending facility, the Paycheck Protection Program Loan Facility (PPPLF), that will extend credit to lenders that put up the PPP loans they have already originated as collateral. As a result, the Fed will now buy PPP loans from lenders, freeing lenders up to originate new PPP loans if possible, but most crucially taking the risk of these non-performing loans away from banks and private industry. The Fed did not announce that there would be any cap on the support it provides businesses under the PPPLF, but the PPP itself is still limited to the $350 billion as provided by CARES.

Main Street Business Lending Program

In establishing a Main Street Business Lending Program, the Fed has made good on a commitment first made on March 23. Under this program, the Fed will purchase up to $600 billion in 4-year loans to companies employing up to 10,000 workers or with revenues of less than $2.5 billion, with any required payments on these loans deferred a year. Banks will retain 5 percent of any loans sold to the Fed under the Main Street Business Lending Program, and must make a commitment to retain payroll to the extent possible, in addition to the proscriptions on share buybacks found in the CARES Act. Firms who have already taken advantage of a PPP loan are not prohibited from also taking out a Main Street loan. The Treasury will provide $75 billion in funding toward this program from funds appropriated by the CARES Act.

Municipal Liquidity Facility

The Fed also sets aside $500 billion to buy the debt of states (including the District of Columbia), cities with a population over 1 million, and counties with a population over 2 million. The Treasury will provide $35 billion in credit protection for the Fed toward this program from funds appropriated by the CARES Act.

Expands existing programs

The Fed will provide additional funding to its PMCCF, SMCCF, and TALF programs. Although the size of the TALF facility will remain $100 billion, the Fed will expand funding such that these three programs now support up to $850 billion in credit backed by $85 billion in credit protection for the Fed. In addition, the Fed will expand the list of assets eligible for the TALF program to include triple-A rated tranches of both outstanding commercial MBS and newly issued collateralized loan obligations (CLOs).

Conclusions

The Fed has moved more decisively and more quickly in the last month than in the previous century of its operation. In its most recent press release, the Fed noted that the economy will face severe disruptions and that “[a]ggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.” With nine new emergency lending facilities in addition to the deployment of a slew of other monetary policy authorities, the Fed has demonstrated that it recognizes the scale of the problem ahead and is moving fast in seeking to stave off the worst.