Insight

November 5, 2021

Timeline: The Federal Reserve Responds to the Threat of Coronavirus

Executive Summary

- On March 15, 2020, the Federal Reserve embarked on a large-scale program employing emergency powers in order to stabilize a tumultuous economy under pressure from the novel coronavirus COVID-19.

- Chief among these emergency actions are cutting interest rates effectively to zero and a $700 billion round of quantitative easing.

- Despite these actions, stock prices on Monday took their steepest dive since 1987’s Black Monday, and it remains to be seen whether enough liquidity has been injected into the market to prevent the financial system from widespread failures.

Most Recent Activity

November 3, 2021 – Fed Announces that it will Reduce Pace of Asset Purchases

Eighteen months after initiating emergency actions that included slashing its key interest rate to zero percent, the creation and revival of nine emergency lending facilities, and an ambitious program of quantitative easing, the Fed has at last announced that it will begin to pull back on supporting the economy, with the first step a reduction in the rate of asset purchase through the quantitative easing program. Until now the Fed has been buying in the region of $120 billion in assets per month; under the new program the Fed will reduce this by $15 billion per month with a view to completing exiting quantitative easing by the middle of 2022. The move signals both optimism on the part of the Fed as to the state of the economy and also wariness as to the threat of inflation which is at its highest rate in decades. It seems likely that the next move on the Fed’s part will be to raise rates from the near zero at which it has sat since April 2020.

Context

As financial markets reel in response to the unique threat posed by COVID-19, Chairman of the Federal Reserve Jerome Powell noted in a surprise press briefing on Sunday, March 15, “The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook.” The Federal Reserve (the Fed) took the opportunity to embark on a slew of emergency actions, most notably slashing its key interest rate to 0 percent and launching an ambitious round of quantitative easing (QE). Presented below is a summary of actions taken this week by the Fed in an attempt to shore up the economy.

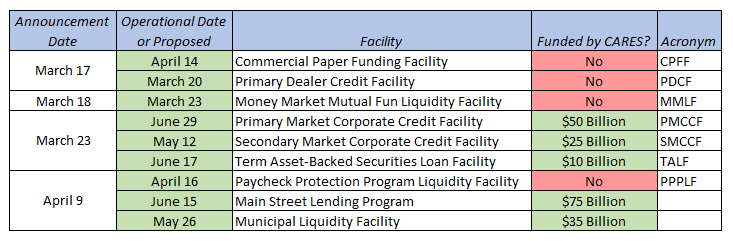

Glossary and timeline of Fed emergency lending facilities

The Fed’s Response

March 15, 2020 – The Fed Funds Rate Cut to Zero

The federal fund rate, used as a benchmark for short-term lending and the rate to which most consumer rates are pegged, serves as a stand-in for interest rates for the American economy. Despite considerable pressure, the Fed has been reluctant to lower the federal fund rate over the past two years, eventually lowering the rate from 2.25 percent to 2 percent in August 2019, with further minor cuts in September and October. Despite dropping the rate 50 basis points on March 3, this was evidently not enough, and on Sunday, March 16, the Fed took the dramatic step to lower the federal fund rate to 0 percent.

March 15, 2020 – Quantitative Easing

In addition to cutting the federal funds rate to zero, the Fed also announced a new round of QE, a controversial tool for boosting the economy last employed in any significant way as a result of the 2007 – 2008 financial crisis. Quantitative easing, also known as large scale asset purchases, typically involves a central bank itself purchasing government bonds or other long-term securities in order to restore confidence and, crucially, add liquidity back into the market. The Fed announced that it would commence the QE program with an immediate $80 billion buy ($40 billion on Monday, $40 billion on Tuesday) but would purchase “at least” $700 billion in assets over the coming months with no limit.

March 15, 2020 – Encouraging Use of the Discount Window

One of the Fed’s many roles in the economy is to act as lender of last resort. It does this by providing banks with what is called the “discount window,” which banks can use as an emergency source of funding. Historically banks have been loath to use this facility, as it has previously signaled to the market that a bank is in extreme distress. Banks are, however, pushing back on this stigma with the Financial Services Forum, an advocacy forum representing U.S. banking giants, putting out a press release indicating that all its members would be using this facility. The Fed announced that it would encourage use of the discount window by lowering the primary credit rate 150 basis points, designed to encourage a more “active” use of the window.

March 15, 2020 – Flexibility in Bank Capital Requirements

Modern banks are subject to a wide range of capital requirements, from total loss absorbing capacity (TLAC) to a variety of buffers, including countercyclical and buffers based on international size and prominence (for more information on capital bank requirements, see here). These buffers are intended to act as emergency reserves that a bank can dip into in times of stress. The Fed announced on Sunday that it would support banks using these funds, which normally are not considered accessible, to lend to households and businesses impacted by coronavirus, provided that lending occur in a safe and sound manner. For smaller lenders, the Fed also reduced reserve requirements to zero.

March 15, 2020 – Coordinated International Action to Lower Pricing on U.S. Dollar Liquidity Swap Arrangements

The Fed, in coordination with the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank, announced a coordinated effort to lower pricing on standing U.S. dollar liquidity swap arrangements by 25 basis points, and to offer U.S. dollars with an 84-day maturity in addition to the usual weekly maturity. Both of these actions are designed to improve global liquidity of the U.S. dollar.

March 17, 2020 – Creation of a Commercial Paper Funding Facility (CPFF)

Corporate, or commercial, paper is an unsecured, short-term financial instrument critical to business funding. On March 17, the Fed announced the creation of a new facility with the authority to buy corporate paper from issuers who might otherwise have difficulty selling the paper on the market, at a cost of the three-month overnight index swap rate plus 200 basis points. Treasury Secretary Steven Mnuchin noted in a press briefing that the cost of this facility could be as high as $1 trillion but that he did not expect it to rise so high. The Treasury will provide $10 billion of credit protection to the Fed for the CPFF from the Treasury’s Exchange Stabilization Fund.

March 17, 2020 – Creation of a Primary Dealer Credit Facility (PDCF)

In a related move, the Fed also announced that it would re-establish a facility offering collateralized loans to large broker-dealers. The Fed will accept a wide range of permissible capital, including corporate paper, in an attempt to encourage these investors to participate in the corporate paper market, and the market more generally.

March 18, 2020 – Creation of a Money Market Mutual Fund Liquidity Facility (MMLF)

Similarly, the Fed also announced that it would establish a facility offering collateralized loans to large banks who buy assets from money market mutual funds. A money market mutual fund is a form of mutual fund that invests only in highly liquid instruments and as a result offers high liquidity with a low level of risk. Again, the Fed will accept a wide range of permissible capital, including corporate paper, in an attempt to encourage these investors to participate in the money market mutual fund market, and the market more generally.

March 19, 2020 – U.S. Dollar Liquidity Swap Arrangements Extended to More International Central Banks

Currency swap arrangements, previously extended and modified with the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank, expanded to include arrangements with the Reserve Bank of Australia, the Banco Central do Brasil, the Danmarks Nationalbank (Denmark), the Bank of Korea, the Banco de Mexico, the Norges Bank (Norway), the Reserve Bank of New Zealand, the Monetary Authority of Singapore, and the Sveriges Riksbank (Sweden).

March 20, 2020 – Frequency of U.S. Dollar Liquidity Swap Operations Updated To Daily

The Fed, in coordination with the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank, announced a coordinated effort to improve the liquidity of U.S. dollar swaps by increasing the frequency of 7-day maturity operations from weekly to daily.

March 20, 2020 – MMLF Will Now Accept Municipal Debt

The Money Market Mutual Fund Liquidity Facility (MMLF), in co-ordination with the Federal Reserve Bank of Boston, expanded the list of acceptable collateral required for a loan to include high-quality municipal debt.

March 23, 2020 – Fed Announces Extensive New Measures To Support The Economy

In its most sweeping and dramatic intervention in the economy to date, the Fed announced a series of measures employing a wide range of the monetary policy authorities available to it, all with the aim to “support smooth market functioning”. The Fed:

– Expanded its quantitative easing program (see March 15) to include purchases of commercial mortgage-backed securities in its mortgage-backed security purchases.

– Established three new emergency lending facilities, a Primary Market Corporate Credit Facility (PMCCF) and a Secondary Market Corporate Credit Facility (SMCCF) to support credit to large employers, and a revival of the Term Asset-Backed Securities Loan Facility (TALF) to provide liquidity for outstanding corporate bonds. These three programs will support up to $300 billion in new financing options for firms, backed by the Treasury Department’s Exchange Stabilization Fund (ESF) which will provide $30 billion in equity to these facilities.

– Expands the powers of two existing programs, the CPFF and PDCF (see March 17 and 18). The MMLF, which already accepted a broad range of collateral including corporate paper, will now cover a wider range of securities including municipal variable rate demand notes (VRDNs) and bank certificates of deposit. Similarly, the list of acceptable corporate paper that the CPFF would consider acceptable will now include high-quality, tax-exempt commercial paper as eligible securities. The Fed will also lower the price to use the CPFF facility.

– In addition, the Fed noted that it expects to announce shortly a fourth new program, to be called the Main Street Business Lending Program, designed to support small and medium-sized businesses. This program will support the work of the Small Business Administration (SBA).

For additional information on these developments, see here.

March 23, 2020 – Technical Changes to Total Loss Absorbing Capacity (TLAC)

Having already demonstrated on March 15 that the Fed, to encourage greater lending, would employ flexibility in allowing banks to use otherwise impermissible capital reserves, the Fed announced a technical rule change that amends the implementation of a rule impacting banks’ requirements to maintain total loss absorbing capacity (TLAC). The interim final rule, imposing restrictions on TLAC, will be phased in gradually to avoid cutting into the capital available to banks too significantly.

March 24, 2020 – Fed Delays Implementation Of Foreign Banking Organization (FBO) Maximum Daily Overdraft Rule

In another move designed to ease operating restrictions on depository institutions, but in this case foreign banking organizations (FBO), the Fed announced a six-month delay to an incoming new rule. This intraday capital rule is designed to cap the maximum daily overdraft available to FBOs in their accounts at the Fed. By delaying implementation the Fed hopes that both it and FBOs can instead focus on ‘heightened priorities’.

March 24, 2020 – Fed Scales Back Non-Critical Oversight

Perhaps in recognition that the Fed only has so many resources, March 24 also saw the Fed announce that it would scale back non-critical oversight of the financial institutions it regulates, with the impact most felt at smaller firms. The Fed will pivot from examinations as usual to “monitoring and outreach to help financial institutions of all sizes understand the challenges and risks of the current environment.” Crucially, however, banks that are required to submit capital adequacy plans will still be required to do so by April 6, although at this stage most of the largest U.S. financial institutions would be nearing completion of work required for this anyway.

March 26, 2020 – Fed Provides Reporting Relief For Small Financial Institutions

Recognizing that businesses are suffering staffing and other disruptions at this time, the Fed announced that it would not take action against any firm with less than $5 billion in total assets that submit financial statements after filing deadlines. This provides only 30 day’s grace, however, and the Fed recommends that firms likely to be in this position contact their Reserve Bank in advance.

March 26, 2020 – New York Fed To Buy Commercial Mortgage-Backed Securities

The New York Federal Reserve announced that it would begin purchasing securities backed by commercial mortgages for the first time. The New York Fed announced the immediate purchase of $1 billion fixed-rate Fannie Mae Delegated Underwriting and Servicing pools, with a 10-year loan term, with a further $3 billion to be purchased the following week. The New York Fed noted that the securities in question would primarily be backed by multifamily housing blocks, such as apartment buildings, but that this effort may be expanded to cover other commercial mortgages.

March 30, 2020 – Fed and Banking Regulators Ease Impact of Rulemakings on Banks

The Fed, in coordination with the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC), announced two new actions designed to promote bank lending, in one case hastening the implementation of a new rulemaking, and in the other delaying. For the first, banks may now adopt early a new methodology for measuring counterparty risk. The rule, known as the “standardized approach for measuring counterparty credit risk” (SA-CCR), better reflects safety and soundness improvements in the derivatives market. For the second, the agencies have released an interim final rule concerning the calculation of “current expected credit loss” (CECL), an upcoming rule that would significantly and adversely impact how banks calculate their losses. This interim final rule would allow for the implementation of this new standard over an additional two years to the three-year postponement period already in place.

March 31, 2020 – Fed Postpones Bank Control Framework

In January 2020 the Fed finalized a new framework by which it determines what constitutes “control,” or ownership, within a bank organizational hierarchy. If a corporate entity has control over a bank, it is subject to additional and enhanced scrutiny. The effective date of this new framework has been postponed six months from the original date of April 1 to September 30 2020.

March 31, 2020 – Fed Establishes New Temporary Repo Facility

The Fed established a new temporary facility (FIMA Repo Facility) allowing foreign banks to exchange Treasury securities – temporarily – for U.S. dollars via repurchase agreements. This significantly increases the availability of the U.S. dollar in that this provides a source that does not rely on the outright sale of securities. The new facility will commence April 6 and be available for six months.

April 1, 2020 – Fed Loosens Bank Capital Requirement

The supplementary leverage ratio (SLR) is a secondary capital ratio that applies only to banks holding more than $250 million in consolidated assets. Like all capital ratios, the SLR requires bank holding companies to hold additional and sufficient capital against a time of need. On April 1st the Fed announced that it would loosen the requirements of the SLR on the banks to which it applies. Like many of the Fed’s actions, the intent here is to free up capital so that lenders can continue to provide the economy with credit, with the Fed noting that any other use of these additional funds (including in returns to shareholders) is prohibited.

April 6, 2020 – Fed Implements CARES Act Community Bank Capital Ratio

The Coronavirus Aid, Relief, and Economic Security (CARES) Act contains several provisions decreasing the regulatory burden on banks with a view to freeing up capital that can then be made available to businesses. One of these provisions requires the federal banking regulators to lower the leverage ratio (the most basic capital requirement) of community banks to 8 percent. On April 6 the Fed announced two interim rules implementing this directive but noted that this would be a temporary measure, with the community bank leverage ratio returning to 9 percent by 2022.

April 6, 2020 – Fed Announces Three New Emergency Lending Facilities Designed to Implement the CARES Act

To implement the relief provided by the CARES Act and support the work of Treasury and the Small Business Administration (SBA), the Fed:

– Announced a new emergency lending facility, the Paycheck Protection Program Liquidity Facility (PPPFL), that will purchase Payment Protection Program (PPP) loans from lenders, freeing those banks to continue lending under the PPP, and most crucially, removing these non-performing loans from the balance sheets of private industry;

– Announced a new emergency lending facility, the Main Street Business Lending Program, that will purchase $600 billion of debt from companies employing up to 10,000 workers or with revenues of less than $2.5 billion, with any required payments on these loans deferred a year;

– Announced a new emergency lending facility, the Municipal Liquidity Facility, that will purchase $500 billion of debt from states and cities with populations over 1 million; and

– Expanded the scope of three existing facilities, the PMCCF, SMCCF, and TALF. These programs will now support up to $850 billion in credit. In addition, the Fed has expanded the list of eligible assets for participation in the TALF program.

For additional information on these developments, see here.

April 23, 2020 – Fed Commits to Transparent Disclosure of Companies Receiving Financial Aid

The Fed will release on a monthly basis details on the participants in and relief provided by some of the Fed’s emergency lending facilities, including the:

- Names and details of participants in each facility;

- Amounts borrowed and interest rate charged; and

- Overall costs, revenues, and fees for each facility.

Fed Chair Jerome Powell noted, “The Federal Reserve is committed to transparency and accountability by providing the public and Congress detailed information about our actions to support the economy during this difficult time.”

April 23, 2020 – Fed Increases Availability of Intraday Credit

The Fed announced several temporary actions designed to boost the availability of intraday credit it offers by suspending uncollateralized intraday credit limits and waiving some overdraft fees for program participants.

April 23, 2020 – Fed to Expand Access to PPPLF Program

In light of additional funds that Congress will make available to the Payment Protection Program (PPP), the Fed announced that it would expand access to its Paycheck Protection Program Liquidity Facility (PPPLF) to additional lenders. In particular, the intention of the bill that authorizes additional PPP funds is to expand access to the program to non-depository lenders including community development financial institutions. The Fed will make the PPPLF available to these lenders.

April 24, 2020 – Fed Reports $85 billion Released under Emergency Lending Facilities

In reporting to Congress details of emergency lending provided under the Section 13(3) emergency lending programs, the Fed confirmed that it has provided at least $85 billion in funding via three of its programs. The Fed reported that it had $51 billion in outstanding loans under the money market mutual fund facility (MMLF), $34.5 billion under the primary dealer credit facility (PDCF), and $249 million under the commercial paper funding facility (CPFF).

April 27, 2020 – Fed Expands Access to Municipal Lending Facility

The Fed expanded access to the Municipal Liquidity Facility, the emergency lending facility designed to purchase $500 billion of debt from states and cities with populations over 1 million. The facility is now available to counties with a population of at least 500,000 and cities with a population of at least 250,000, up from previous requirements of 2 million for counties and 1 million for cities. This expands the program from some thirty participants to 210, and now covers all fifty states and the District of Columbia. At the same time the Fed announced modifications to the program such that loan notes of 36 months – up from 24 – will now be accepted, and extended the duration of the program to 31 December 2020.

April 30, 2020 – Fed Expands Main Street Lending Program

On announcing the Main Street Lending Program the Fed had previously indicated that to be eligible businesses must have no greater than 10,000 employees and have up to only $2.5 billion in revenue. Following a comment period these limitations have been raised to 15,000 employees and $5 billion in revenue. The Fed will also lower the minimum loan size from $1 million to $500,000. Banks will now retain a higher percentage of some loans, ranging between 5 and 15 percent depending on loan type, with the Fed purchasing the remainder. The Fed did not indicate that the size of the program would change (with the Fed previously noting that it intended to purchase $600 billion of debt) but did indicate that Treasury will provide $75 billion for this program under the Coronavirus Aid, Relief, and Economic Security Act. Perhaps most crucially, the Fed has not yet indicated a start date for this program.

May 4, 2020 – Fed Confirms PMCCF and CMCCF Programs to Enter Operation “Early May”.

The Fed confirmed a start date of “early May” for the emergency lending programs devoted to buying corporate bonds, the Primary Market Corporate Credit Facility (PMCCF) and Secondary Market Corporate Credit Facility (SMCCF), via an updated FAQ section on its website.

May 5, 2020 – Fed Modifies Liquidity Coverage Ratio (LCR) for Banks Participating in Emergency Lending Facilities

Following modifications to both total-loss absorbing capacity (TLAC) on March 23 and the supplementary leverage ratio (SLR) on April 1, the Fed announced another alteration impacting bank capital requirements, specifically the liquidity coverage ratio (LCR). In an interim final rule the Fed announced that any sources of funding obtained via the use of the Money Market Mutual Fund Liquidity Facility (MMLF) or the Paycheck Protection Program Liquidity Facility (PPPLF) will not count negatively towards a bank’s liquidity requirements, to encourage participation in these programs.

May 11, 2020 – Fed Releases Term Sheet for Municipal Liquidity Facility Clarifying Pricing

The Fed published updates to the Municipal Liquidity Facility term sheet that, in addition to expanding the eligibility of issuers that since the onset of the crisis have had their rating downgraded, for the first time provided a specific pricing formula for use of the facility.

May 12, 2020 – Fed Clarifies PPPLF and TALF Disclosures and Updates TALF Term Sheet

The Fed outlined the information that it will provide on a monthly basis for the TALF and PPLF facilities, which will include recipient, size of loan, interest rate charged, value of collateral provided, and overall fees. The Fed also provided an updated term sheet for the TALF program noting that the program will initially make $100 billion in loans available. The TALF does not however have a start date and the Fed has not at this point provided one.

May 11, 2020 – New York Fed Announces Start Date for CMCCF of May 12

The New York Fed released a press release indicating that the Secondary Market Corporate Credit Facility (CMCCF) would begin the purchase of ETFs on May 12. This is the only Fed emergency lending facility to date with the authority to purchase financial instruments rated below investment grade, although this is expected to be only a small subset of the total portfolio.

May 15, 2020 – Fed Provides First Report to Congress on PPPLF Facility

On May 15 the Fed provided a report to Congress on the status of the PPPLF facility, in its first detailed disclosure of funds disbursed under one of the few emergency lending facilities currently operational. 600 banks have so far tapped the Fed’s program for about $30 billion in loans, a small fraction of the roughly $530 billion issued through the PPP.

May 15, 2020 – Fed Loosens Bank Capital Requirement (Again)

On April 1 the Fed relaxed a key bank capital requirement, the supplementary leverage ratio (SLR), as it applies to bank holding companies. On May 15 the Fed extended this temporary requirement modification to cover more banks, in this case to include bank subsidiaries with insured deposits.

May 19, 2020 – Main Street Business Lending Program and Municipal Liquidity Facility Programs to Commence “End of May”

Fed Chair Jerome Powell, testifying before the Senate Committee on Banking, Housing, and Urban Affairs, provided scheduled commencement dates of before the end of May, or at most a few days into June, for the Main Street Business Lending Program and Municipal Liquidity Facility programs.

May 20, 2020 – TALF to Commence June 17

The Federal Reserve Bank of New York announced that it would begin taking requests for emergency lending under the TALF program on June 17. The first loan closing date will be June 25. Treasury will finance the TALF funding vehicle with a $10 billion equity investment provided for by the CARES Act.

June 3, 2020 – Municipal Liquidity Facility Opens and Access Once Again Expanded

In an update to the relevant FAQ section specific to the Municipal Lending Facility, the Fed revealed that the facility has been in operation since May 26. In addition, Bloomberg reported that Illinois is due to become the first state to avail itself of the facility, entering into an agreement to sell $1.2 billion of one-year general obligation certificates to the Fed. Illinois has the lowest credit rating of any U.S. state, only one level above “junk.”

The Fed also took the opportunity to once again expand access to the Municipal Liquidity Facility. In addition to the municipalities already eligible, the Fed committed to a rule change that will ensure that there are at least two cities or counties in every state from whom the Fed will be capable of buying promissory notes.

June 8, 2020 – Fed Significantly Expands Access to Proposed Main Street Lending Facility

The Fed Board introduced sweeping changes to the Main Street Lending Program as proposed in order to make it possible for a wider range of small and medium-sized businesses to apply. These program changes include:

- Lowering the minimum loan size for certain loans to $250,000 from $500,000;

- Increasing the maximum loan size for all facilities;

- Increasing the term of each loan option to five years, from four years;

- Extending the repayment period for all loans by delaying principal payments for two years, rather than one; and

- Raising the Fed’s participation to 95% for all loans.

The Main Street Lending Facility still does not have an announced date of operation.

June 15, 2020 – Main Street Lending Facility Opens for Lender Registration

The Federal Reserve Bank of Boston, administrator of the Main Street Lending Program, announced the opening of lender registration for the three emergency lending facilities under the $600 billion program. Banks “are encouraged to begin making Main Street program loans immediately” to eligible firms, with the Fed purchasing 95 percent of bank participations “through the lender portal soon.” The minimum loan size is $250,000 for new loans, and borrowers will have two years before they have to begin repaying the five-year loans. Unlike the PPP, no forgiveness will be extended, although firms must still make “commercially reasonable efforts” to retain employees but do not have to attest specifically that they will do so.

June 15, 2020 – Fed Expands SMCCF, Begins Buying Debt Directly From Large Corporations

The Federal announced that the SMCCF would begin an additional round of facility purchases on June 16. In a first for the emergency lending programs, the Fed will create an index that will purchase individual company bonds from eligible entities without requiring those companies to apply to the Fed directly for aid. This new ability of the SMCCF is in addition to the existing powers of this program to purchase exchange-traded funds (ETFs).

June 15, 2020 – Fed Requests Feedback on Extending Main Street Lending Program to Nonprofits

The Fed also announced that it was seeking feedback on a proposal to extend the Main Street Lending Program to nonprofits; specifically 501(c)(3) and 501(c)(19) organizations with 50 to 15,000 employees. Nonprofits with endowments exceeding $3 billion would not be eligible. Public feedback on the proposal is requested by June 22.

June 29, 2020 – Primary Market Corporate Credit Facility Begins Operation

The Fed announced the commencement of the last 13(3) emergency lending facility to begin operation, the Primary Market Corporate Credit Facility (PMCCF). The PMCCF and the Secondary Market Corporate Credit Facility (SMCCF) will together provide credit to large businesses by providing a facility where firms can issue bonds directly to the Fed for a fee. Under the PMCCF and the SMCCF the Fed will lend up to $750 billion. The Fed will offer this facility in addition to directly buying company debt directly from the market via a separate initiative.

July 17, 2020 – Fed Begins Purchasing Loans Through Main Street Lending Program; Opens Program to Non-Profits

The Fed disclosed in its weekly reserve balance report that it had purchased $12 million in loans via the Main Street Lending Program in its first day of operation. As some analysts question the takeup of the program, the Fed also announced that it had modified the Main Street Lending Facility to allow a wider range of non-profits to apply, including hospitals and schools, by lowering program requirements for nonprofits from 50 employees to just 10.

July 28, 2020 – Fed Extends All Emergency Lending Programs Through 2020

The Fed extended all emergency lending programs that would otherwise have expired on September 30 through December 31, with the result that all nine programs will be in operation throughout 2020.

September 30, 2020 – Fed Extends Big Bank Prohibition on Share Buybacks Through 2020

Immediately following this year’s stress tests, the Fed announced that all banks with over $100 million in assets would be prohibited from making share repurchases in order to preserve liquidity at the nation’s largest lenders. The Fed’s September 30 announcement extends this prohibition through the rest of 2020. The Fed will also cap allowable dividends based on recent income and remains committed to a second stress test exercise before 2021.

October 30, 2020 – Fed Lowers Main Street Lending Program Minimum Loan Amount to $100,000

Six months after the Fed’s flagship emergency lending program, the Main Street Lending Program, entered operation the Fed has committed a paltry $3.7 billion of the $75 billion authorized by the CARES Act. In an effort to encourage participation the Fed once again amended the program term sheet, lowering the minimum loan amount from $250,000 to $100,000 to open access to the Main Street Lending Program to smaller businesses.

November 3, 2021 – Fed Announces that it will Reduce Pace of Asset Purchases

Eighteen months after initiating emergency actions that included slashing its key interest rate to zero percent, the creation and revival of nine emergency lending facilities, and an ambitious program of quantitative easing, the Fed has at last announced that it will begin to pull back on supporting the economy, with the first step a reduction in the rate of asset purchase through the quantitative easing program. Until now the Fed has been buying in the region of $120 billion in assets per month; under the new program the Fed will reduce this by $15 billion per month with a view to completing exiting quantitative easing by the middle of 2022. The move signals both optimism on the part of the Fed as to the state of the economy and also wariness as to the threat of inflation which is at its highest rate in decades. It seems likely that the next move on the Fed’s part will be to raise rates from the near zero at which it has sat since April 2020.

Conclusions

“We’re going to go in strong,” said Fed Chairman Jerome Powell in his press briefing Sunday evening, and “we will restore market functioning.” Despite Sunday’s emergency announcement and the Fed’s implementation of crisis-era monetary policy, however, all major stock indices were down after trading on Monday, with the Dow Jones seeing a 13 percent fall – the most severe decline since 1987’s Black Monday. Both the Dow and the S&P 500 closed at their weakest in three years.

Clearly it is too soon to see the actual economic impacts of the Fed’s emergency measures, but short-term investor confidence is not the most important measure of success for the Fed at this juncture. Instead the Fed will have to be judged on whether these measures, and the measures to come, have ensured the market possesses the necessary liquidity to allow business to continue with something resembling normalcy.