Insight

October 3, 2022

Legislating Stablecoins

Executive Summary

- Congress is still behind the curve on the development of a federal framework for digital assets, but a particular legislative effort on stablecoins led by House Financial Services Committee leadership and the Treasury Department may represent a promising opportunity in what would be Congress’ first foray into significant crypto regulation.

- Stablecoins, a specific class of cryptocurrencies, avoid the risk of high volatility associated with crypto because their value is “pegged” to another asset, usually the U.S. dollar, which makes them far more attractive as a medium of exchange.

- Any stablecoin legislation must, above all else, allow non-banks to develop and issue stablecoins under an appropriate supervisory framework and capital plan.

Context

2022 has seen an unprecedented level of congressional activity in the areas of fintech, cryptocurrencies, and other digital assets. In March, the Biden Administration released an executive order embarking on a whole-of-government, comprehensive approach to the regulation of cryptocurrencies and other digital assets. This was soon followed by discussion drafts, white papers, bipartisan bills, and even a sweeping proposal seeking to establish a complete regulatory framework for cryptocurrencies.

Many of these proposals face a difficult path through Congress. One (delayed) bipartisan effort in particular, however, is believed to have the best chance of becoming law – due both to the proposal’s sponsors and its focus in scope. For months, Chairwoman of the House Financial Services Committee Maxine Waters, Ranking Member Patrick McHenry, and Treasury Secretary Janet Yellen have negotiated a federal framework for stablecoins, a class of digital assets. The bill has not been formally released, although the Treasury Department has reportedly insisted on provisions requiring stablecoin issuers to hold client assets separately from their own. Even draft legislative text still commands significant bipartisan support given the legal certainty provided by any regulatory framework, and the effort still represents the best shot for Congress to pass detailed crypto legislation. This raises the question: What are stablecoins and how should they be regulated?

An Introduction to Stablecoins

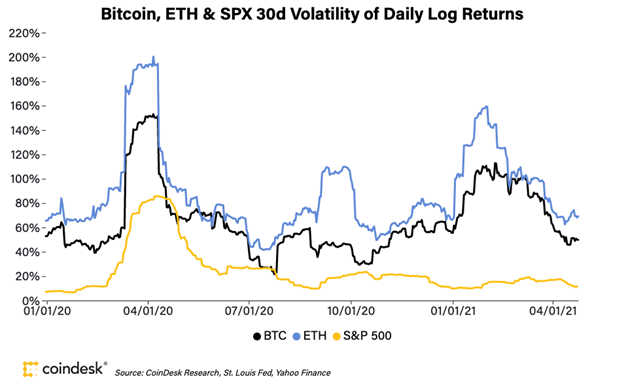

While bitcoin remains the most popular cryptocurrency on the market, and makes up about $400 billion of the $2.6 trillion total market value of all cryptocurrency, one of its most significant drawbacks remains its high volatility (technically a measure of dispersion around the mean value of a security, but more generally rapid or significant fluctuations in value as defined by the market). While today the total market value of all cryptocurrency is roughly $1 trillion, this figure was over $3 trillion in November 2021. The chart below shows the daily log return (a calculation of return on equity) of the first and second most significant cryptocurrencies, bitcoin and Ethereum, by comparison to the average volatility of the S&P 500.

While many in the industry like to speculate that bitcoin volatility is decreasing as the asset moves out of the “price discovery” phase, bitcoin still remains a risky speculation and, more important, unsuitable as a currency for wide use given the uncertain nature of its purchasing power. The hypothetical volatility of a cryptocurrency, however, decreases significantly when the price of that cryptocurrency is “pegged” to another asset; this is doubly so where that separate asset is not correlated to the crypto market, and exponentially so when the pegged asset is something as stable as a fiat-controlled currency such as the U.S. dollar.

These cryptocurrencies are classified as stablecoins, by virtue of having their value derived from another asset. As a result, stablecoins are not subject to high volatility and therefore become suitable as a medium of exchange or currency. The largest stablecoin by market capitalization (and the fifth-largest cryptocurrency on the market) is Tether, valued at $67 billion, followed by USD Coin, valued at $50 billion. Not all stablecoins present the same risk profiles, however, and investors and consumers should examine both the quality and provenance of the assets backing particular stablecoins and the audit and disclosure regimes many of these firms undergo, voluntarily or otherwise.

Legislating Stablecoins

In the absence of a federal, whole-of-government unified approach to crypto regulation, the market is overseen by a patchwork of partial and inconsistent rulemakings emerging from the federal financial regulators. This lack of regulatory clarity led to the March release of the presidential executive order directing federal agencies to coordinate their regulatory efforts.

In seeking to remedy this problem, Congress must create a flexible and tailored framework for stablecoins that addresses the following questions:

What Is a Stablecoin?

While stablecoins are among the more concrete concepts in the crypto debate, as a category cryptocurrencies still pose something of a definitional headache. If the primary purpose of a cryptocurrency is to be used to pay for goods and services, it may be appropriate to classify it as a commodity, like a metal. If instead a cryptocurrency is primarily a financially tradeable instrument, it may be appropriate to classify it as a security. If the primary purpose is a medium of exchange, store of value, and unit of account – the traditional characteristics of money – then instead it may be best to regulate them as forms of digital cash. The regulatory regimes for all differ significantly and would fundamentally influence the development of the industry. More specifically, should the term “stablecoin” become protected and only be used by certain types of issuer?

What Is a Stablecoin Issuer?

Most cryptocurrencies and stablecoins are issued by a relatively new class of financial vehicle, the fintech – so called because they share the properties of both financial services firms and technology firms. Fintechs are typically fast, nimble startups seeking to challenge entrenched financial services providers by providing traditional services better, reaching underserved markets, or offering brand-new combinations of products and product offerings. Despite these advantages, in November 2021 the President’s Working Group on Financial Markets issued a report on stablecoins that recommended that banks, and only banks, be able to issue stablecoins. The only reason for this recommendation appears to be that an extensive and crippling regulatory environment already exists for banks but not for fintechs.

By issuing cryptocurrencies and seeking to challenge the supremacy of established banks, many fintechs have morphed from back-office service providers to increasingly providing customer-focused finance options. In short, many of these quasi-banks provide quasi-bank-like services, without the exhaustive bank supervision and oversight regulatory system. Most concerns can be addressed without the full panoply of depository regulation by virtue of sufficient capital requirements. Requiring stablecoin issuers to be fully reserved with high-quality liquid assets will make those issuers unlikely to suffer a run in the event of broader market pressures or instability. Congress should also consider other elements of good prudential regulation, such as the creation of a detailed and clear disclosures regime. That banks currently are more closely regulated should not exclude all other entities from offering up stablecoin and other crypto product offerings in order to ensure a highly competitive and efficient market – particularly when the stablecoin market is currently defined by non-banks. Throttling the ability of non-banks to compete will significantly reduce competition and development in this new industry.

Which Agency Should Regulate Stablecoins?

What regulatory oversight exists has been the subject of a turf war between the financial regulators. The currency aspects of cryptocurrencies concern the Federal Reserve and Treasury, the commodity aspects the Commodity Futures Trading Commission (CFTC), and the securities aspects the Securities and Exchange Commission (SEC). The responsible regulator may even differ depending on the cryptocurrency issuer, with parties ranging from the Fed, to the Office of the Comptroller of the Currency (OCC), to even the Small Business Administration (SBA). The Federal Deposit Insurance Corporation (FDIC) is waiting in the wings if any of these fintechs require bank charters (usually to deny them). Even outside of the federal financial services regulators, there are broader privacy and security issues that might concern the National Economic Council or the Financial Stability Oversight Council (FSOC). Likewise, from a regulatory standpoint most significant positive policy development is being driven at the state level. Any broad federal frameworks should not undo what little progress has been made.

What Is the Right Balance of Legislation?

Even if the federal government can address these preliminary questions to determine how it should regulate cryptocurrencies, the government will also have to strike the correct balance as to how much regulation is needed. Push the balance too far in one direction, and the federal government will overly burden cryptocurrency issuers, discourage innovation, and harm U.S. global market competitiveness. Push it too far in the other direction, and the federal government may fail to adequately protect both consumers and investors.

Congress should seek to strike the right balance. Already, more than $100 billion-referenced stablecoins are in circulation and have become the preferred medium of exchange for the entire digital asset economy. As stablecoins become more widely adopted, and they’re used to facilitate traditional commerce (say, buying items on Amazon), lawmakers should work to establish an accommodating framework for these assets to help support this novel economic activity.

Conclusions

By creating a predictable regulatory environment, the federal government can spur growth in the development of digital assets and encourage U.S. fintechs to compete in global markets while providing protection for American consumers buying and trading in stablecoins and other digital assets. At the very least, Congress must ensure that it does not exclude non-banks from stablecoin offerings in a market in which traditional banks are neither operating nor innovating at all.