Insight

October 25, 2018

Sizing Up the Proposed HRA Rule

Executive Summary

- Before the Affordable Care Act (ACA), Health Reimbursement Arrangements (HRAs) allowed employees to use tax-preferred dollars to purchase individual market insurance or a la carte health care services; the ACA outlawed most uses of HRAs.

- The Trump Administration has introduced a rule that would allow employees to purchase ACA-compliant individual market insurance; the rule contains stipulations intended to prevent employers from moving less healthy employees onto the individual market.

- An analysis of the rule by the Treasury Department indicates the rule could boost individual market enrollment, helping to stabilize the market, while decreasing the number of people without insurance.

Introduction

On Tuesday, the Trump Administration released a proposed rule that would expand the use of Health Reimbursement Arrangements (HRAs) by rolling back Obama Administration-era regulations.[1] The following summarizes how current law treats HRAs and what the proposed rule would do.

Background

Before the Affordable Care Act (ACA), HRAs served as a vehicle that allowed employees to purchase a non-group insurance plan of their choice or a la carte health care services. Employees could then submit receipts to their employer, who would then reimburse them for those expenditures with pre-tax dollars. This arrangement was appealing to employers—especially small employers—as they could provide employees the means to purchase health insurance without assuming the risk.

Several requirements in the ACA – the Essential Health Benefits and removal of annual and lifetime limits on health insurance – severely curtailed this option. HRAs were considered a form of group plan under the ACA, meaning that any employer offering a stand-alone HRA would violate the ACA and expose themselves to crippling penalties. HRAs have a limit on spending, which was considered an annual limit even when the HRA was enough to purchase individual market insurance. The ACA all but eliminated this form of HRA with the exception of the qualified small employer health reimbursement arrangements (QSEHRA) created by the 21st Century Cures Act.[2] Firms with 50 or fewer employees use QSEHRAs for premiums of ACA-compliant qualified health plans (QHP). Currently, roughly 10 percent of group plans couple an HRA with some sort of high-deductible health plan.[3]

What the Proposed Rule Would Do

The proposed rule would expand HRAs by removing current rules barring the use of HRAs for purchasing individual market insurance. The rule stipulates that HRAs must be used to purchase individual market insurance for the HRA to be legal. As the rule is currently proposed, the HRA must be used to buy a QHP; an HRA could not be used to purchase a short term limited duration insurance plan (STLDI). The proposed rule does state, however, that the administration is seeking comment as to whether it should allow HRAs to be used for STLDIs.

The proposed rule predicts that, in the absence of restrictions, employers would seek to place their unhealthy employees into HRAs so that they could take on less risk in their traditional group plans. Such a scenario would increase adverse selection in the individual market and increase premiums. The proposed rule seeks to prevent this by placing restrictions on how employers decide who receives an HRA versus traditional group insurance. Employers can only discriminate based on different “classes” of employees that are defined in the rule. The classes are as follows:

- Full time;

- Part time;

- Seasonal;

- Employees covered by a collective bargaining agreement;

- Employees that have not satisfied a waiting period for coverage;

- Employees who have not attained age 25 prior to the beginning of the plan year;

- Foreign employees who work abroad; and

- Employees whose primary site of employment is in the same rating area.

Employers would be unable to change the generosity of the HRA within a class based on health. Within a class, employers would only be able to alter the generosity of an HRA based on age and household size, parameters which coincide with the ACA’s community rating guidelines for insurers.

Next, the proposed rule would give those eligible for premium tax credits in the individual market the ability to opt out of their HRA and into the tax credit. It stipulates that employers must notify their employees if their HRA affects their ability to claim the ACA’s premium tax credit, cost sharing reductions, or both.

Finally, the proposed rule would create “excepted benefit” HRAs so that employers could reimburse employees for various qualified medical expenses. These are HRAs that could be offered on top of an employee’s traditional group coverage, Medicare, TRICARE, or individual health insurance coverage. The rule sets out four main stipulations for an HRA to qualify as an excepted benefit HRA:

- Other group plan coverage must be made available to the employee;

- Employers could not offer more than $1,800 in 2020, an amount that would grow by inflation for subsequent years;

- The HRA could not be used for premiums for individual health insurance, group health insurance, or Medicare parts B or D, although it could be used for STLDI or COBRA premiums; and

- Excepted benefits HRAs must have uniform availability—employers couldn’t discriminate based on health status—and the proposed rule requests comment on what additional standards are needed to prevent health discrimination for excepted benefit HRAs.

Why It Matters

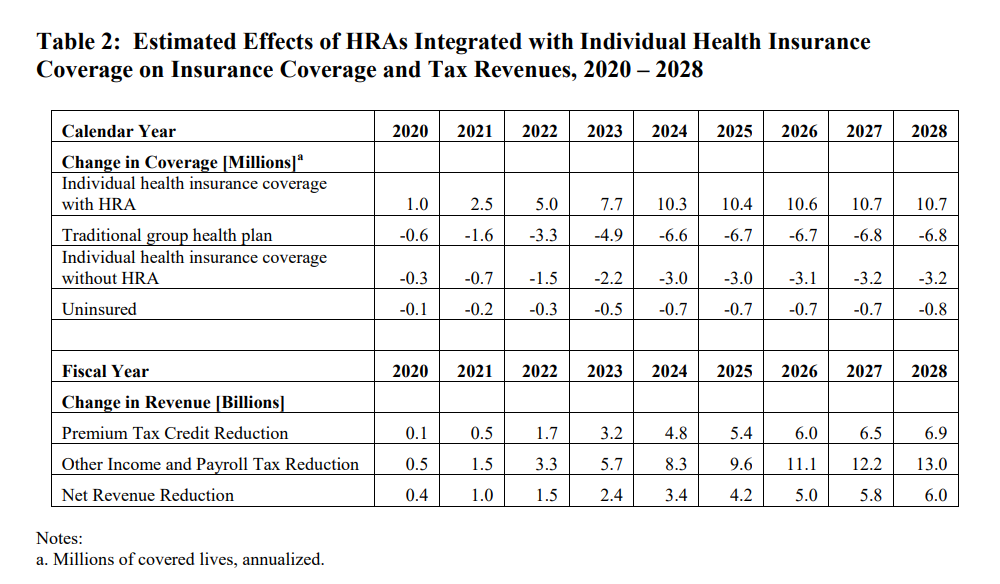

HRAs were an unnecessary casualty of the ACA. This proposed rule should give employers, who were forced into all-or-nothing decisions regarding their employees’ health care, some flexibility and relief. And it comes with some Treasury Department analysis to back this claim up. The table below gives an overview of Treasury’s findings.

A few figures from the table stick out. The number of uninsured is expected to decrease and federal revenues are expected to decrease on net, but, most significantly, individual market insurance coverage is expected to increase by over 10 million by the year 2024. This jump would double the number of people in the individual market and would likely have significant effects on premiums and overall stability in the individual market. The Treasury estimates the ratio of relatively health to relatively unhealthy people in the group market currently is 4:1. The Treasury estimated that if the 10 million entering the individual marketplace is representative of the current group marketplace, then premiums are estimated to go down by 3 percent. If a disproportionate number of unhealthy employees enter the individual market, then premiums could rise. The proposed rule does take discrete steps to prevent such adverse selection from happening, however.

Overall, the administration’s proposed rule on HRAs would give employers and employees more health care options, which could lead to potential increases in the number of insured individuals. It does so while taking steps to limit the exposure to increased health care costs that employees with pre-existing conditions might have. And the proposed rule could even reduce premiums in the individual market while doubling its size.

[1] https://s3.amazonaws.com/public-inspection.federalregister.gov/2018-23183.pdf

[2] https://www.congress.gov/bill/114th-congress/house-bill/6

[3] http://files.kff.org/attachment/Report-Employer-Health-Benefits-Annual-Survey-2018