Research

December 17, 2020

Economic Headwinds and a Public Option

Executive Summary

- President-elect Joe Biden’s public option proposal seeks to provide an affordable health insurance choice for Americans by limiting out-of-pocket costs, keeping premiums down, and negotiating better rates from providers and drug manufacturers.

- According to recent research, while it is possible to structure a public option so that the deficit is reduced, the most likely structure—where premiums are subsidized and provider reimbursement resembles private coverage—would cost an estimated $718 billion over 10 years.

- Finding the revenue to finance such a plan could result in a 0.7 point increase in the hospital insurance tax, a 12.4 percentage point increase on upper incomes, or perhaps some version of a wealth tax, which would cost workers $430 billion in lost wages.

- The near-term economic impact of the most likely tax changes ranges from 0.1 to 0.6 percentage point declines in gross domestic product.

Introduction

President-elect Joe Biden campaigned on the promise of establishing a public health insurance option for Americans who are not eligible for Medicare or Medicaid. Biden’s public option, which would likely be sold through the Affordable Care Act’s (ACA) health insurance marketplaces, would be “like Medicare,” according to Biden’s campaign website.[1] The brief policy summary on the website goes on to say, “the Biden public option will reduce costs for patients by negotiating lower prices from hospitals and other health care providers.” The Biden public option would also offer “better” care coordination and would cover primary care without copayments. Finally, the public option would explicitly be open to people with offers of employer-sponsored insurance (ESI).

The proposal does not address costs, premiums or financing. Biden has proposed separately, however, making ACA premium tax credits available to those with incomes above 400 percent of the federal poverty level (FPL) and increasing the generosity of those tax credits. It is reasonable to assume that the public option, which is intended to be more affordable than other insurance options, would be subsidized at the same or even a more generous level than other options offered in the ACA marketplaces. This brief analysis explores the most likely public option proposal structure, corresponding tax increases, and overall cost impact. This is the first in a series of short pieces on the potential effects of a public option.

Possible Structural Scenarios

With so few details, estimating the likely deficit impact of a public option is difficult, though Biden’s campaign has suggested the plan could cost $750 billion over 10 years.[2] In a report published in January 2020, Hoover Institute scholars Tom Church, Daniel Heil, and Lahnee Chen provided a detailed analysis of the possible savings and costs associated with a public option.[3] The report details three scenarios with four variations of each, for a total of 12 variations. Most relevant to this report are two variations of the first and third scenarios that most closely reflect the Biden proposal and provide a lower and upper bound for the deficit impact.

Scenario 1: Actuarially Sound Premiums with Varying Reimbursement Rates and Market Participation

The report details four variations on this scenario, two in which the public option is only available to those in the individual and small-group market, and two in which the public option is also extended to large-group plans. Because Biden has said his public option will be available to everyone who has ESI, a scenario where those in the large group market are able to access the public option is closest to the Biden proposal, so this analysis only considers the large group-inclusive scenarios. It should be noted that the report assumes employers will be able to purchase public option plans on behalf of their employees, but it is unclear if Biden intends this, or if his plan would only give employees the option of electing the public plan in lieu of ESI.

- Scenario 1a: In this scenario the report assumes that premiums will remain actuarially sound, or in other words, that enrollees will pay premiums set high enough to cover 100 percent of health care costs. Further, it assumes that payment rates for providers will remain the same as Medicare rates over time. This is most often how proponents of a public option frame their proposals. In such a scenario, the total impact would be a net deficit reduction of $769 billion over 10 years.

- Scenario 1b: In this scenario, the report argues that provider groups would be negatively impacted by the low Medicare reimbursement rates and that over a five-year period Congress would respond to provider lobbying by increasing reimbursement rates to the levels paid by private insurance. This is consistent with congressional behavior historically in the face of cuts to provider reimbursement. In this scenario, the net deficit reduction drops to $523 billion over 10 years.

Table 1: Premiums Are Not Artificially Capped and Remain Actuarially Fair

| Reimbursement at Medicare Levels | Reimbursement Grows to Private Levels over 5 Years | |

| Enrollment in 2025 | 107,922,891 | 79,397,133 |

| Revenue ($B) | $649 | $438 |

| Outlay ($B) | -$120 | -$83 |

| Deficit (=)/Surplus (-) ($B) | -$769 | -$523 |

Both scenarios are unlikely because Congress and the administration will feel pressure both to increase provider reimbursement over time and—given the Biden campaign’s emphasis on affordability—to adjust, control, and subsidize premiums. Nonetheless, these scenarios show the extreme bound, and the potential for savings from a public option, if policymakers’ historical tendencies to mitigate provider cuts and patient cost increases in federal programs were checked.

Scenario 2: Premiums Are Indexed to Inflation

As in the first scenario, the report offers four variations, while this analysis focuses on the two scenarios that are closest to what Biden has proposed.

- Scenario 2a: In this scenario, the report assumes that provider reimbursement stays locked at Medicare rates, but it assumes that lawmakers, subject to pressure from constituents, will find it politically untenable to maintain actuarially sound premiums and will instead limit premium growth to the rate of inflation. Under this scenario, the deficit is reduced by $284 over 10 years.

- Scenario 2b: In this scenario the report assumes that Congress will yield to pressure from both providers and plan enrollees and will increase provider reimbursement over five years until it is the same as private insurance while also limiting premium growth to the rate of inflation. In this scenario, the deficit increases by $718 billion over 10 years.

Table 2: Premiums Are Indexed to Inflation

| Reimbursement at Medicare Levels | Reimbursement Grows to Private Levels over 5 Years | |

| Enrollment in 2025 | 123,800,476 | 123,800,476 |

| Revenue ($B) | $859 | $859 |

| Outlay ($B) | $575 | $1,577 |

| Deficit (=)/Surplus (-) ($B) | -$284 | $718 |

Like the earlier scenarios, scenario 2a results in some measure of deficit reduction. Nevertheless, all three scenarios that reduce the deficit require policymakers to substantially reduce provider payments or maintain enrollee costs at high actuarial costs that are unlikely to make the public option attractive and that run contrary to President-elect Biden’s stated objectives. The most likely scenario is the last one, which anticipates a reversion to the mean in terms of policymaker behavior: increasing provider reimbursement over time, and acting to limit enrollee costs through federal subsidies. In this scenario, the report projects an increase in the federal deficit of $718 billion over 10 years. This figure is, in fact, roughly in line with the Biden campaign’s own cost estimate of $750 billion over 10 years.

Broad-Based Financing

Assuming that the proposed public option bill is written to be budget neutral and may even be passed using the budget reconciliation process, it will be necessary to finance the project at a total of approximately $718 billion. This analysis assumes that the authors of the legislation will use the payroll tax, an upper-income tax, or a wealth tax. Financing with payroll taxes would make households financially worse off, though the negative impact is spread broadly throughout the population. Financing with an upper-income tax would affect fewer taxpayers in a much more substantial way and have a more negative economic growth impact. Finally, financing with a wealth tax would ultimately shift costs to workers with lower pay and have the most consequential economic growth cost. This analysis discusses each of these options and their estimated impacts in turn below. Notably, these potential tax increases do not include revenue that will need to be raised just to shore up the soon-to-be-insolvent Medicare Trust Fund. Adding a public option to that already-substantial bill should not be taken lightly.

The FICA Tax System

The federal tax system has four means of taxation: income, payroll, corporate, and other (e.g. excise taxes, Federal Reserve Remittances, certain fees). Payroll taxes are the second-largest type of federal taxation by share of revenue collected, bringing in $1.3 trillion in fiscal year 2020, or 38 percent of all total revenue collected in the last fiscal year.[4]

Payroll taxes, technically the Federal Insurance Contributions Act (FICA) taxes, fund the nation’s large social insurance programs: Social Security and Medicare. Programmatically, FICA taxes have two components. The first component is the Old-Age, Survivors, and Disability Insurance (OASDI) tax, which is the funding stream devoted to the Social Security program. It is comprised of both an employer and an employee levy of 6.2 percent for a combined rate of 12.4 percent.[5] It applies to the Social Security Wage Base, which is the maximum amount of earned income to which the tax rates are applied; this provision effectively caps the amount of taxable income subject to this tax. This wage base adjusts for inflation. In 2021, the wage base will increase from $137,700 to $142,800.[6]

The second programmatic component to FICA taxes is the tax levied on wages devoted to the hospital insurance (HI) trust fund under Medicare. This levy is 1.45 percent and is imposed on both the employer and employee, for a combined tax rate of 2.9 percent. Unlike the OASDI tax, this tax rate is applied to all earnings. The ACA also applied an additional HI surtax of 0.9 percent on earned income exceeding $200,000 for individuals filing as single, and $250,000 for married couples filing jointly.[7]

Combined, FICA taxes amount to a rate of 15.3 percent on all earnings up to $142,800 in 2021, with the combined HI tax of 2.9 percent applied to any earnings beyond, plus the applicable HI surtax. As a parallel to FICA taxes, self-employed individuals are also subject to payroll taxes, namely the Self-Employment Contributions Act (SECA) tax. Acting as employees and employers, the self-employed are subject to the 15.3 percent combined rates for both OASDI and HI taxes.

Table 3: U.S. FICA Taxes

Financing a Public Option Through the Payroll Tax

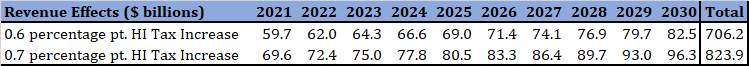

The FICA tax system is more akin to social insurance premiums rather than a revenue collection mechanism in that the taxes collected are entirely earmarked for social insurance programs. Indeed, Social Security benefits are somewhat tethered to payroll tax payments. To the extent the federal government would provide a new health insurance product, the most logical mechanism for financing the cost of this product above related premiums would be the FICA tax system. Assuming the financing mechanism were enacted in 2021, the tax would need to generate at least $718 billion over 10 years. Based on estimates generated using the open-source Tax-Brain, an HI tax increase of between 0.6 and 0.7 percentage points would generate adequate revenue to finance a $718 billion 10-year deficit arising from a new, public health insurance program.[8]

Table 4: Revenue Effects of Payroll Tax Increases

Note that a 0.6 percentage point increase would be slightly insufficient to finance a $718 billion deficit shock but is nevertheless roughly budget neutral. Were this reform enacted through the budget reconciliation process, however, strict budget neutrality would be required. Accordingly, this analysis assumes a 0.7 percentage point increase in the broad-based HI tax rate. Under this assumption, the base HI tax rate would be increased to 3.6 percent, taking the combined FICA rate to 16 percent for all wages under the taxable wage cap. The HI surtax would continue to apply as under current law.

An across-the-board HI tax increase would reflect a relatively modest rate increase on a very broad tax base. Accordingly, the tax increase would result in relatively small changes in after-tax income and would largely reflect the distribution of taxable income. For example, for taxpayers making $20,000-$30,000 in 2021, the tax increase would amount to $100.4 per year, while for taxpayers making over $1 million per year, the average tax change would amount to $6,491.70 per year. For both taxpayers, however, this change would reduce their relative after-tax income by 0.2 percent. Owing to interactive effects with the individual income tax system, for a relatively small share of taxpayers with negative liabilities under current law, the tax change could result in decreases in individual liabilities for certain taxpayers. For all affected taxpayers, however, a 0.7 percent HI tax increase would reduce after-tax income by an average of 0.3 percent. The average annual tax change for all taxpayers would be $387.30 in 2021.

Table 5: Distribution Table (2021)

Economic Effects

The rationale for financing a federal health insurance product through a payroll tax is rooted in equity and efficiency. With a large tax base, a relatively modest rate increase can raise significant revenue with fewer distortions than would be the case if the public option were financed through a narrower tax, such as just on higher income earners or other surtaxes. Of course, this approach would also end up taxing some of the lower-income earners who are presumably uninsured in order to create a public option that would allow them a somewhat more affordable health insurance alternative.

Over the short term, all else equal, one would expect to see a modest decline in aggregate demand under this tax. While the payroll tax system is more stable than the individual and corporate income tax systems, it has recently figured more prominently in debates over fiscal intervention. Indeed, during the Great Recession, Congress enacted a two-year, two-percentage point decrease in the OASDI tax rate seeking to spur economic growth. As noted by analysts at the Penn-Wharton Budget Model, the literature on the economic effects of payroll tax changes is “mixed.”[9]

For instance, the Congressional Budget Office (CBO) studied employment effects per million dollars’ expenditure on certain policies and found a considerable range of possible employment effects from payroll tax relief.[10] A reduction in the employee-side of the FICA tax effectively raises a worker’s cash wages. With more money in their pockets at the end of each pay period, these workers should then spend more, boosting consumer demand, and ultimately hiring. CBO and other analysts estimated that employee-side payroll relief would be susceptible to this phenomenon. [11],[12] Subsequent research suggests these estimates were correct.[13] CBO observed that it expected that the majority of the temporary increase in take-home pay would be saved rather than spent. Payroll tax changes could be structured to reduce the employer-side of the FICA tax, but over the long term, economists generally agree that the tax is borne by labor.[14] Accordingly, one would expect a 0.7 percentage point increase in the HI rate to have a modest effect on gross domestic product (GDP) in the near term, to reflect the demand shock. Previous estimates calculated that the temporary payroll tax holiday may have increased real GDP growth by on the order of 2/3rds of a percentage point in 2012.[15] This suggests a decline in the rate of real GDP over the near term of on the order of 0.1-0.2 percentage points if the HI tax were increased by enough to cover the budget shortfall. Over the longer term, the evidence suggests that this tax change would not substantially change the trajectory of long-term economic growth. [16]

Financing a Public Option Through an Upper Income Tax or Wealth Tax

If the United States were to enact a public health insurance product with inadequate financing through premiums, a broad-based payroll tax increase could be the most efficient option for offsetting the deficit shock, despite its drawbacks. The economics of raising an equivalent amount of revenue on a narrower tax base would require higher tax rates and greater disincentives to work, save, and invest. As a candidate, Biden proposed imposing Social Security payroll taxes on incomes above $400,000, adding a substantial marginal tax increase – 12.4 percentage points – on income above that level. While this increase would raise a similar amount of revenue as the 0.7 percent HI tax increase, it would come with somewhat higher economic costs. According to the Tax Foundation, under this proposal higher-income workers would see a decline in after-tax income of over 2 percentage points – 10 times higher than the decline under a 0.7 percentage point HI increase. The cost to the economy from the substantially higher tax rate would be a GDP decline of 0.28 percent and a loss of 350,000 jobs.[17]

Similarly, instead of a broad-based labor income tax, policymakers could consider a wealth tax, similar in structure to those proposed by Senators Elizabeth Warren and Bernie Sanders in their respective presidential campaigns. While substantially smaller in terms of revenue requirements, a wealth tax to finance a new public health insurance product would, nevertheless, impose costs to the economy through the same channels as would have the proposals from Senators Warren and Sanders. Under a wealth tax, a taxpayer must pay a percentage of their assessed net worth every year. While typically couched as a relatively small share of a taxpayer’s wealth, on an annual basis, a wealth tax can translate into very high effective tax rates. Under Senator Warren’s proposal, the wealth tax rate would start at 2 percent on wealth above $50 million and rise to 6 percent on wealth above $1 billion. For taxpayers earning 2 percent or less on their investments, this tax would amount to at least a 100 percent effective rate and would have a significant chilling effect on saving and investment. With reduced investment comes reduced productivity and ultimately reduced wages. According to estimates performed by EY, Senator Warren’s wealth tax proposal, were it enacted, would have reduced U.S. GDP by 0.6 percentage points ($706 billion) over the first five years, $1.1 trillion over the second five years, and then $283 billion annually over the long run (in 2018 dollars). The associated forgone economic activity would necessarily show up in lost wages: $1.2 trillion (in 2018 dollars) in lost earnings over the first 10 years, and ultimately, for every dollar of revenue raised, workers would lose more than 60 cents of earnings. Were this relationship to remain consistent with more modest wealth taxes, a wealth tax needed to finance a $718 billion deficit shock would cost workers $430 billion in lost wages.

Conclusion

In addition to the revenue needed to shore up the severely underfunded Medicare Trust Fund and the taxes already increased to fund the ACA, the imposition of a public option may necessarily result in further tax increases on payroll, high-income earners, wealth, or some combination of the three. Those categories each have markedly different impacts on wages and economic growth, but any of these options will have negative impacts on wages and growth. Should policymakers take up President-elect Biden’s public option plan, careful consideration of its tax implications in the current economic climate is a necessity.

[1] https://joebiden.com/healthcare/#

[2] https://www.politico.com/story/2019/07/15/joe-biden-health-care-plan-1415850

[3] https://americashealthcarefuture.org/wp-content/uploads/2020/01/Final-The-Fiscal-Effects-Of-The-Public-Option-1.24.20.pdf

[4] https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0920.pdf

[5] http://www.ssa.gov/pressoffice/factsheets/HowAreSocialSecurity.htm

[6] https://www.ssa.gov/OACT/COLA/cbb.html

[7] https://www.ssa.gov/oact/progdata/taxRates.html

[8] See: https://compute.studio/PSLmodels/Tax-Brain/

[9] https://budgetmodel.wharton.upenn.edu/issues/2020/3/12/president-trump-payroll-tax-holiday

[10] http://www.cbo.gov/ftpdocs/124xx/doc12437/11-15-Outlook_Stimulus_Testimony.pdf

[11] http://www.nber.org/papers/w15421

[12] https://www.cbo.gov/sites/default/files/112th-congress-2011-2012/reports/11-15-outlookstimulustestimony.pdf

[13] https://www.nber.org/system/files/working_papers/w21220/w21220.pdf

[14] https://www.cbo.gov/publication/24725

[15] https://www.cbpp.org/research/letting-payroll-tax-cut-expire-would-shrink-worker-paychecks-and-damage-weak-economy#_ftn5

[16] https://taxfoundation.org/global-evidence-taxes-and-economic-growth-payroll-taxes-have-no-effect/

[17] https://taxfoundation.org/2020-payroll-tax-proposals/#_ftn11