Research

March 23, 2023

Health and Economy Baseline Estimates

Entering the 2023 plan year, the insurance market continues to see challenges from costs, uninsured individuals, and access to care. The Center for Health and Economy (H&E) is dedicated to assessing the impact of proposed reforms that attempt to address these issues. The following report details the most recent updates to the H&E baseline estimates of insurance coverage, federal budgetary impact, plan choice, and the premium landscape of health insurance for Americans under the age of 65.

KEY FINDINGS:

- The individual market includes an estimated 16 million members in 2023, with 13 million lives covered through subsidized insurance offered in the Health Insurance Marketplace; the total size of the individual market is estimated to decline throughout the budget window—sinking to 8 million in 2033.

- As premiums and health care costs rise, plans chosen in the individual market are expected to shift toward lower-cost options; highly subsidized enrollment in Silver plans is projected to fade as a percentage of enrollment on the individual market, while enrollment in Bronze plans will grow among both subsidized and unsubsidized consumers.

- The family glitch fix is now accounted for in the estimates and has increased the number of those insured through the individual market by approximately 1 million.

- The health insurance coverage provisions under current law for the non-elderly are estimated to increase federal outlays by $6.73 trillion from 2023–2033.

INSURANCE COVERAGE

H&E estimates there are 258 million non-elderly U.S. residents with health insurance in 2023—93 percent of the total non-elderly population. Estimates of health insurance coverage encompass four primary categories: the individual market, employer-sponsored insurance, Medicaid, and other public insurance. The individual market is divided into two subsets: subsidized and unsubsidized coverage. Subsidized coverage is purchased through the Health Insurance Marketplace, and unsubsidized coverage is composed of similar insurance plans purchased either directly from the insurer (represented in Other Non-Group Insurance) or through the Marketplace without financial assistance. H&E makes no distinction between unsubsidized enrollees through the Marketplace and households that purchase individual market insurance directly from an insurer. Estimates concerning Medicaid also include beneficiaries of the Children’s Health Insurance Program. Other public insurance is primarily composed of Medicare coverage for disabled persons, but also includes Tricare, the Indian Health Service, and other federal health care programs for specific populations.

The enrollment for the Health Insurance Marketplace in 2023 is partially calibrated to the effectuated enrollment reported by the Centers for Medicare and Medicaid Service (CMS) for the 2022 program year. In 2023, H&E estimates there are 18 million uninsured. This is approximately 8 million less than H&E’s earlier estimates due to the impact of the American Rescue Plan Act signed into law in 2021 with enhanced subsidies through 2022 and extended through 2025. In addition, the Medicaid population has increased substantially as part of COVID-19 emergency action for 2023. By 2024, the number of uninsured, non-elderly Americans is projected to increase to 26 million—9 percent of the total non-elderly population. The decrease in insured Americans is primarily the result of 2024 premium increases in the individual market as well as the elimination of some Medicaid eligibility due to COVID-19 emergency measures. The average population of non-elderly Medicaid beneficiaries is estimated to be 79 million in 2023, will decrease significantly to 72 million in 2024, and then rise to 77 million by 2033.[1] These estimates are subject to the uncertainty of each state’s decision regarding Medicaid expansion but take into consideration North Carolina’s 2023 decision to expand Medicaid.

H&E does not make any assumptions about future state take-up of the Medicaid expansion due to the many variables involved in projecting the magnitude of the effects of potential future expansions. Because of this, the Medicaid enrollment and spending reflected in this baseline only reflect the projected costs and enrollment of the Medicaid program if it were to remain as it currently is.

The individual market is estimated to decline from 16 million covered lives in 2022 to 8 million in 2033, driven by premium increases in the Marketplace. The decrease in coverage through the individual market is in part offset by an increase in those insured through Medicaid. The family glitch fix is now accounted for in the estimates and has increased the number of individual market insured by approximately 1 million.

As seen in Table 1, the number of individuals with unsubsidized, individual market insurance is expected to decrease. Unsubsidized enrollment will continue at the same level from 4 million from 2026–2033 with variations no greater than 250,000–500,000. Currently the expanded subsidies through 2026 are reducing the unsubsidized population by 2 million until 2026. Rising costs and higher income contributions for subsidized enrollees are estimated to lead to higher uninsured numbers later in the analysis period.

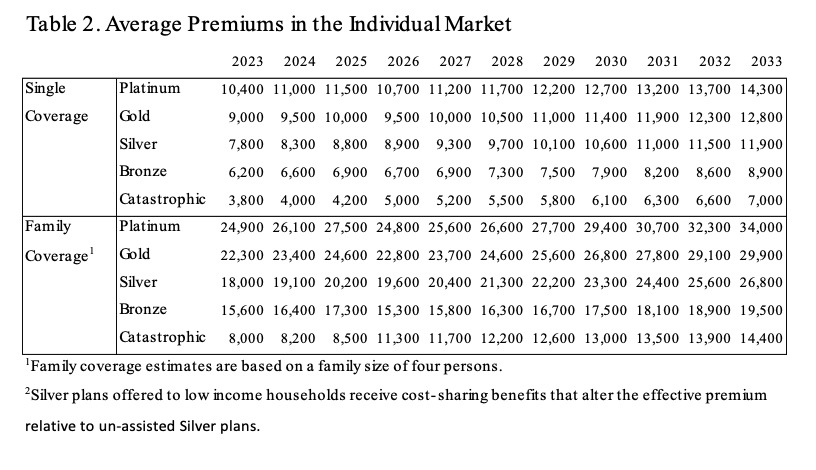

PREMIUMS

Estimates of the subsidy-eligible premiums available in the Marketplace are calculated using publicly available data on plans offered in the Federally Facilitated Marketplaces. Premium estimates for unsubsidized health insurance are calculated from a sample of plans available through the Robert Wood Johnson Foundation.[2] In both cases, H&E uses the default age rating curve put forth by the Department of Health and Human Services and by individual states to impute the applicable premium for a household. For simplification and comparability, H&E uses a standard family size of four (two adults and two children) when estimating family premiums. Subsidy payments and tax revenue are adjusted for the appropriate average family size in budget impact estimates.

Subsidized insurance plans offered in the Marketplace are divided into four categories— Platinum, Gold, Silver, and Bronze—that correspond to four approximate actuarial values—90 percent, 80 percent, 70 percent, and 60 percent. The actuarial value refers to the expected percentage of annual medical expenses covered by the insurance plan.

Eligible households may purchase subsidized coverage for a specified percentage of household income that ranges from 2.01–9.56 percent in 2023–2033, depending on income. For 2023 and 2025, the range is from zero to 8.5 percent depending on income and continues through all income levels above 136 percent. A federal subsidy pays the remaining portion of the premium that is not covered by the household’s specified income contribution. This specified income contribution is also subject to annual increases if the annual increase in health insurance costs exceeds a measure of household income growth.

It is important to note that, because of additional cost-sharing assistance, the plan designs categorized as Silver vary significantly in actuarial value across different income categories. For enrollees in the marketplace that earn between 100–150 percent of the federal poverty level (FPL), Silver plans have an actuarial value of 94 percent, the highest of any plan offered in the Marketplace. For enrollees earning between 150–200 percent of FPL, Silver plans have an actuarial value of 87 percent, and for enrollees earning between 200–250 percent of FPL, Silver plans have a 73 percent actuarial value. H&E estimates the unsubsidized premiums for these high-value Silver plans using the true actuarial value of the plan, rather than the Silver plan price.

Unsubsidized insurance plans, purchased in the Marketplace or directly from an insurer, are similar in design and price to those eligible for subsidies. The Affordable Care Act (ACA) requires that all health insurance plans meet certain requirements to certify as qualified coverage.

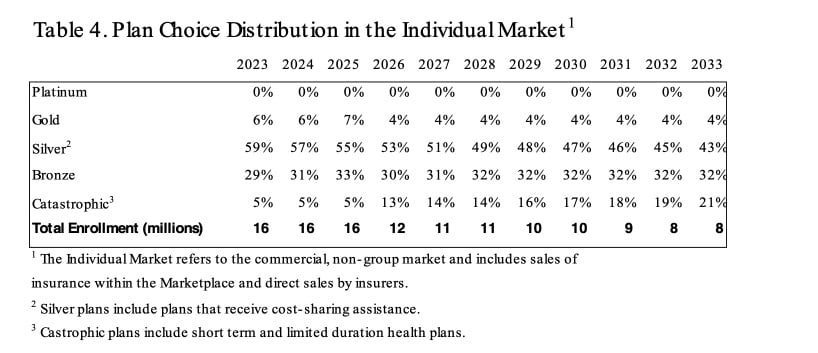

PLAN CHOICE

H&E assumes an underlying health insurance cost growth of 5 percent throughout the rest of the 10-year window as premium increases were above 5 percent between 2024–2033 and are projected to increase at similar levels moving forward.[3] Actual year-over-year premium growth estimates vary as a result of changes in the enrollment mix and other factors. Due to growing applicable income contribution rates, subsidized premium growth for some plan designs is expected to exceed the underlying health insurance growth rate.

H&E uses the subsidized and unsubsidized Marketplace enrollment in each metal level after the first year to calibrate plan preferences in the individual market and estimate plan choices throughout the 10-year analysis window.

H&E estimates that the large enrollment in Silver plans in 2023 among subsidized insurance plans will give way to higher enrollment in Bronze plans as premiums rise and consumers with less generous subsidy amounts adjust to higher premiums. The majority of Silver plan enrollment is estimated to be predominantly composed of households eligible for extra cost-sharing benefits. As the market grows to include more households that are eligible for premium credits, the distribution of subsidized enrollment among the four metal levels is expected to become less evenly distributed later in the budget window.

Beyond 2023, lower-cost insurance plans are estimated to gain market share, shifting away from more generous plans in response to the steadily rising cost of health insurance. Throughout the budget window, Silver plan enrollment is expected to dominate the Health Insurance Marketplace as cost-sharing benefits are only available for Silver plans. As time passes and premiums rise, however, enrollment in Bronze plans is expected to increase.

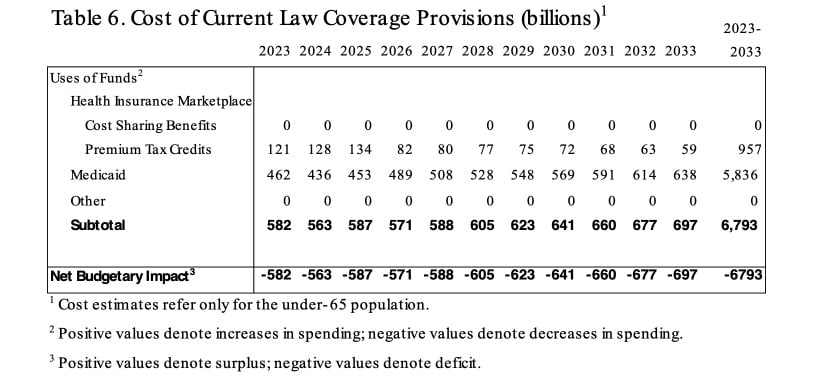

BUDGET

H&E estimates the impact on the federal budget of the major health insurance coverage provisions of current law with regard to the non-elderly population. Budget impact estimates do not include estimates for non-ACA tax expenditures encoded in current law, such as the employer-sponsored health insurance tax expenditure.[4],[5]

Medicaid coverage and expenditure estimates are calculated based on the number of states that had chosen to implement Medicaid expansion by March 1, 2023. These predictions are sensitive to future state-level decisions on expansion as well as new program waivers that alter the design of a state’s Medicaid program.

Over the decade spanning between 2023–2033, H&E estimates that non-elderly coverage provisions under current law will cost $6.79 trillion. The ACA introduced a number of taxes that are not directly related to the health insurance coverage of the non-elderly population and are therefore not included in this report. H&E’s estimate is slightly less than its 2022 baseline owing to the increasing cost of plan coverage and decrease in the number of individuals being able to able to purchase subsidized individual insurance plans. In 2012, the Congressional Budget Office estimated non-coverage provisions of the ACA to reduce the deficit by $1.28 trillion by 2014.[6]

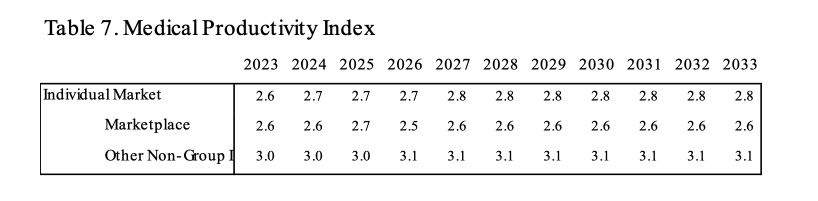

PRODUCTIVITY AND ACCESS

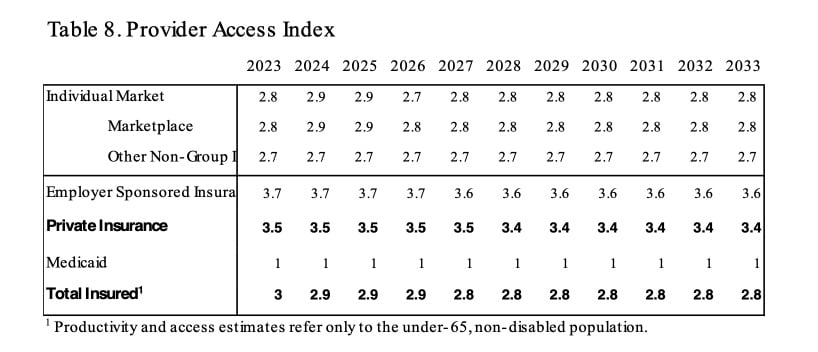

The Provider Access Index (PAI) is designed to reflect the availability of primary and specialty physicians and facilities. Plans with large networks, such as Platinum plans offered in the individual market, are ascribed high scores for providing exceptional access. Bronze and other low-cost plans that afford access only to limited networks are ascribed low PAI scores. The index ranges from a low of 1.0 to a high of 5.0.4

CHANGES FROM PREVIOUS BASELINE ESTIMATES

As an organization, H&E is constantly reevaluating the assumptions and technical methods that are used to create baseline and proposed estimates of health insurance coverage provisions under current law. This publication is the seventh comprehensive baseline report, and the fifth to include detailed estimates on the net budgetary impact of the ACA and Medicaid for individuals under 65.

For this baseline, H&E updated the under-65 microsimulation model. Just like the model used in previous estimates, the new under-65 model employs micro-data available through the Medical Expenditure Panel Survey to analyze the effects of health policies on the health insurance plan choices of the under-65 population and interpret the resulting impact on national coverage, average insurance premiums, the federal budget, and the accessibility and efficiency of health care. The updated model utilizes recent integrated private health insurance choice data that allows H&E to make improved predictions regarding the individual marketplace.

UNCERTAINTY IN PROJECTIONS

H&E uses a peer-reviewed micro-simulation model of the health insurance market to analyze various aspects of the health care system.5 As with all economic forecasting, H&E estimates are associated with substantial uncertainty. While the estimates provide good indication on the nation’s health care outlook, there are a wide range of possible scenarios that can result from policy changes, and current assumptions are unlikely to remain accurate over the course of the next 10 years.

Aside from the potential policy changes, premium increases in the individual market are a substantial area of uncertainty in this report. In May 2021, CMS reported that new enrollment during the Special Enrollment Period combined with additional subsidies for the Marketplace in 2021 and 2022 plan years yielded nearly 1 million new enrollees.[7] H&E also accounted for the extension of these subsidies through 2025. While H&E’s estimates reflect this impact as well, it is important to note that the estimates are net enrollment for an annual period as opposed to a quarterly report of new plan enrollment as opposed net annual plan enrollment. The impact of emergency COVID-19 Medicaid eligibility has made a significant impact in these estimates. H&E assumes that while premium subsidies will be available for those previously eligible for Medicaid, it estimated the demand for individual insurance will be significantly less than eligibility for tax credits. Premiums could also decrease if Congress were to appropriate funds required by law to assist insurers beyond plan year 2025 with the burden of offering plans with increased cost-sharing assistance.

[1] H&E’s method for estimating Medicaid enrollment was also part of the under-65 model update. As a result, Medicaid enrollment is higher than in previous baselines, accounting for all of the under-65 Medicaid population with the exception of those that are dually eligible for Medicare and Medicaid.

[2] Accessed at: https://www.hixcompare.org/

[3] Centers for Medicare and Medicaid Services. National Health Expenditure Data. Accessed at: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/

[4] The CBO estimates that the tax exclusion for employer sponsored insurance will cost $3.4 trillion over 10 years. See Distribution of Major Tax Expenditures in the Individual Income Tax System, Congressional Budget Office, May 2013, at: http://www.cbo.gov/sites/default/files/cbofiles/attachments/43768_DistributionTaxExpenditures.pdf

[5] In past baselines, H&E has included various estimates related to the employer sponsored insurance market that included: the excise tax on high cost employer sponsored plans, Medical Productivity in the employer marketplace, and Provider Access in the employer marketplace. These were left out of this baseline do to the update of the under-65 model.

[6] Elmendorf, Douglas W., “Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act,” Congressional Budget Office, July 24, 2012, available at: http://www.cbo.gov/sites/default/files/cbofiles/attachments/43471-hr6079.pdf

[7] https://www.nytimes.com/2021/05/06/upshot/obamacare-signups.html