Research

September 14, 2023

Social Security Financing: From FICA to the Trust Funds

Executive Summary

- Social Security, the United States’ most significant safety-net program for retirees, survivors, and the disabled, is primarily funded through FICA (Federal Insurance Contributions Act) taxes withheld from workers’ paychecks.

- These taxes are invested in special Treasury securities held in two Trust Funds, which are credited with FICA tax receipts, but not directly; rather, there is a multistep, multi-agency process, which is subject to revision and can take years.

- This insight examines the complex interaction between payroll taxes and financing of the Social Security system.

Introduction

Social Security is the United States’ most significant safety-net program for retirees, survivors, and the disabled. The program’s primary funding source comes from the 12.4 percent Federal Insurance Contributions Act (FICA) taxes that are withheld from workers’ covered wages. These workers could be forgiven for assuming that cash is sitting in a bank account with their name on it, ready to be collected upon retirement. But the steps from paycheck to Trust Fund are less straightforward. Indeed, the cash employers remit in taxes never touches Social Security, but rather, is credited to the Trust Funds and otherwise spent by the Department of Treasury. Ultimately, the process by which FICA taxes are credited to the Trust Funds is designed to ensure that the program is credited with no less than exactly what it is owed.

This insight reviews Social Security’s complex financial management system, including the path from the collection of FICA payroll taxes, through a maze of government agencies, and finally to the more than 65 million retirees, survivors, and disabled Americans counted among the program’s beneficiaries.

FICA Taxes

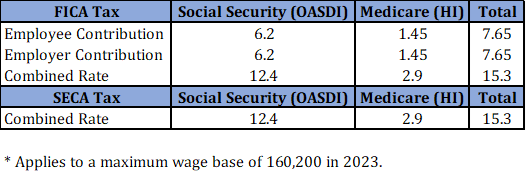

In addition to income, capital gains, and other collections from the federal government, workers and employers pay FICA taxes to fund the nation’s largest social insurance programs: Social Security and Medicare. Programmatically, FICA taxes have two components. The first component is the Old Age, Survivors, and Disability Insurance (OASDI) tax, which is the funding stream devoted to the Social Security program. It is composed of both an employer and an employee levy of 6.2 percent for a combined rate of 12.4 percent.[1] It applies to the Social Security Wage Base, which is the maximum amount of earned income to which the tax rates are applied, effectively capping the amount of taxable income subject to this tax. This wage base adjusts for inflation. In 2023, the wage base will increase to $160,200 from $147,000.[2]

The second programmatic component to FICA taxes is the tax levied on wages devoted to the hospital insurance (HI) trust fund under Medicare. This levy is 1.45 percent and is imposed on both the employer and employee, for a combined tax rate of 2.9 percent. Unlike the OASDI tax, this tax rate is applied to all earnings.[3] The Affordable Care Act imposed an additional 0.9 percentage point tax on individuals making over $200,000 and joint filers making over $250,000.[4]

Figure 1: Payroll Tax Rates

The taxes amount to a combined tax rate of 15.3 percent on all earnings up to $160,200 in 2023, with the combined HI tax of 2.9 percent applied to any earnings beyond. As a parallel to FICA taxes, self-employed individuals are also subject to payroll taxes, namely the Self-Employment Contributions Act (SECA) tax. Acting as employees and employers, the self-employed are subject to the 15.3 percent combined rates for both the OASDI tax and the HI tax.

This analysis is primarily concerned with OASDI and will focus on the interaction between FICA taxes devoted to the Old Age and Survivor’s Insurance (OASI) and Disability Insurance (DI) Trust Funds. The OASI and DI Trust Funds are separate entities but are often spoken of as part of a combined system, and indeed, the allocation of FICA tax collections to the relevant trust funds involves multiple steps involving multiple federal agencies.

The employee and employer components of FICA taxes “live” in sections 3101 and 3111 of the federal tax code, respectively.[5] These provisions impose a rate of tax on applicable wages of 6.2 percent, for the combined rate of 12.4 percent. Yet the law establishing the trust funds into which these funds flow delineates the proportion of FICA taxes that are to be collected for the respective Trust Funds.[6]

Figure 2: Allocation of FICA Taxes

At present, most of the 12.4 percent FICA tax – 10.6 percentage points of the tax – is devoted to the OASI program, while 1.8 percent is devoted to financing the DI program. In 2015, the DI program was facing imminent insolvency. To address the shortfall, Congress enacted the Bipartisan Budget Act of 2015, which reallocated 0.57 percentage points of the FICA tax from the OASI program to the DI program for three years, before reverting to its pre–2016 split.

Most Americans are familiar with the fact that these taxes are generally withheld from employees’ paychecks, along with income tax and other deductions, and remitted to the Internal Revenue Service (IRS) on a periodic basis by employers. The timing of employer remittances of withheld taxes generally varies by the size of employer, with smaller firms allowed more time to remit withheld taxes. From the employee’s perspective, there is little difference between the employee and the employer-share of the payroll tax or the OASI and DI shares of tax – 12.4 percent is taken out in total. Thus, there is a somewhat artificial distinction between taxpayers of the payroll tax: The tax base is ultimately the employee’s wages. Accordingly, it is generally understood that the tax burden – the economic incidence as opposed to the legal incidence – falls entirely on the employee.[7]

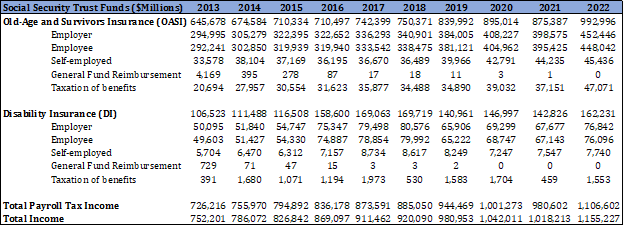

Figure 3: Trust Fund Income

The tax code does not specify what portion of the 12.4 percent should be allocated to the OASDI Trust Funds, or the other sources of income – over $1.1 trillion in 2022 – to the Social Security system.[8] Rather, the apportionment and depositing of funds into the relevant Trust Funds is a somewhat more complex process than it appears at first glance. Employers will typically remit withheld taxes to the IRS in periodic lump sums. Payroll firms facilitate this transaction for many employers, but fundamentally, employers are not required to distinguish between income and payroll taxes that they remit to the Treasury. Recall, as well, that the timing of remittances by employers varies by firm size.[9] Whenever they are legally due, employers submit payroll tax payments to Treasury by electronic transfer to a Federal Reserve depository institution. Thus, the income for the Social Security program enters the Social Security system by first flowing into the Treasury Department General Fund as comingled U.S. dollars. Sorting which dollars go where is a multi-stage process that essentially begins with the imposition of the employer and employee FICA taxes and ends with the appropriate amount of funding credited to the Trust Funds through a process that can ultimately take years.

Funding the Old Age, Survivors, and Disability Insurance Trust Funds

On any given day, the federal government engages in tens of billions of transactions flowing into and out of the federal government’s checking account with the Federal Reserve.[10] This is but one measure of the complexity and scope of the federal government’s financial footprint. As managing Trustee of the Social Security Trust Funds, Treasury is the agency designated to execute the financial operations of the OASI and DI Trust Funds. The patterns of financial flows between Social Security’s income – primarily but not exclusively FICA tax receipts – and expenditures do not necessarily overlap and require daily management of the Funds’ balances.[11]

This requires daily investments and redemptions of the securities in which those Trust Funds are invested. As noted above, the income earmarked to the OASDI Trust Funds largely flows into the Treasury in periodic, comingled sums, but Treasury must manage the Trust Funds’ balances daily, through the crediting and redemption of special Treasury securities, from the Government Account Series (GAS).[12] The cash payments received by Treasury are not generally parceled out to Trust Funds, but rather, in lieu of cash, Treasury issues GAS securities to the federal Trust Funds, including OASDI. Treasury invests the OASDI Trust Funds with Special Issues (SI) of GAS securities as a means of crediting the Funds for payroll tax receipts (and other Fund income such as interest payments). These securities are not generally available for sale to the public, but rather serve as a mechanism for appropriately crediting the Trust Funds for which the receipts are intended, while facilitating the efficient management of Treasury’s debt and cash requirements.

Interest rates on GAS series are set by formula and are calculated for the forgoing month on the last business day of the preceding month. The current formula was established in 1960 and sets the interest rate for SI securities issued over the following month as the average market yield on marketable interest-bearing securities of the federal government. These are not due or callable until after four years. The average yield must then be rounded to the nearest eighth of 1 percent.[13] The average effective interest rate for securities held by the OASDI Trust Funds in 2022 was 2.4 percent.[14]

The OASDI Trust Funds are invested in two forms of SI security. The first type of SI securities is certificates of indebtedness that are issued on a daily basis and mature on June 30 of the year in which they are issued. The other form of SI securities is bonds, with maturities of one to four years, and are issued on June 30 of every year upon the maturation of either type of SI security. At the end of 2022, about 93 percent, or $2.6 trillion, of the $2.8 trillion in SI securities held in the OASDI Trust Funds were invested in SI bonds.[15] This somewhat misleads, however, as to the role SI certificates play in the daily operations of the OASDI Trust Funds. Over the course of 2022, the OASDI funds received $1.38 trillion in SI securities, and disposed of $1.42 trillion in securities, for a net change in the funds balance of about $40 billion. About 85 percent of the securities received, and about 73 percent of securities disposed of, were in the form of SI certificates.[16]

Estimating Deposits

The critical linkage between the collection of FICA taxes and the accurate crediting of these receipts to the Trust Funds with SI securities is the process by which multiple agencies estimate receipts for which the funds should be credited. Benefits payment typically occur on the third day of the month for some beneficiaries, or Wednesdays throughout the month depending on beneficiaries’ dates of birth and other factors.[17] By law, beneficiaries are entitled to payment of their eligible benefit, provided that benefit is funded. Social Security can only legally pay benefits up to the limit of the program’s resources. The securities in the OASDI Trust Funds provide the legal instrument for liquidating benefit payments. Those securities are redeemed as necessary with Treasury, which issues cash payments to eligible beneficiaries. This is essentially the reverse of the process by which the Trust Funds are invested. Determining exactly how to credit Trust Funds accurately from lump sum payments that are comingled with other taxes, however, is a necessary challenge.

While the FICA regime can be found within the U.S. Tax Code, the mechanism for connecting FICA revenue to Trust Fund deposits is housed in another section of federal law entirely.[18] The law governing the OASDI Trust Funds specifies that Social Security taxes collected under FICA shall be deposited in the OASDI Trust Funds “on the basis of estimates by the Secretary of the Treasury….” The estimating process bridges the gap between the tax collection and investment in the Social Security Trust Funds.

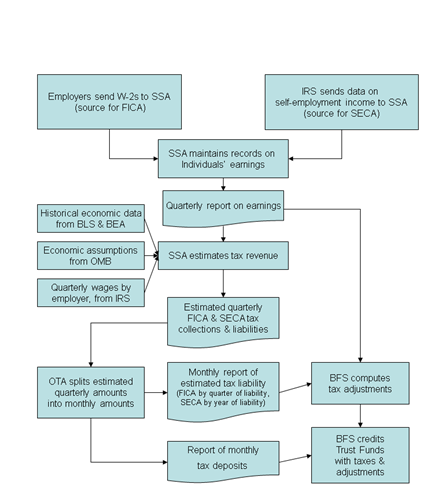

Figure 4: Trust Fund Deposit Estimating Process[19]

As Managing Trustee, the Treasury Department’s responsibilities include executing the daily deposit and redemption of securities. Yet Treasury does not know exactly how much of a given type of tax remittance has come into Treasury on any given day. Rather, it relies on estimates to credit the Trust Funds for FICA taxes received. The estimates are prepared with the input of multiple executive agencies but are primarily a joint effort between Treasury and the Social Security Administration (SSA). The process is broadly specified in statute and is further articulated in a memorandum of understanding between SSA and Treasury.[20]

SSA is responsible for maintaining records on wages subject to FICA and SECA taxes. As part of the tax estimation and Trust Fund depositing process, SSA prepares estimates for future quarterly tax liabilities based on earnings data it maintains. SSA provides these quarterly estimates to Treasury, which uses the estimates to calculate estimated monthly FICA tax collections.[21] Treasury further estimates the proportion of FICA taxes collected as a share of overall tax collections for the month. It applies this ratio to daily tax receipts – recall that tax payments are comingled – to estimate the amount of FICA tax receipts that should be credited to the OASI and DI Trust Funds. Treasury repeats this process daily throughout the month until the estimated receipt amount for the month has been credited to the Fund. If actual receipts exceed the monthly estimate, Treasury ceases further investment in the Trust Funds for the month. If actual receipts fall short of the monthly estimate, Treasury credits the Trust Funds with the difference at the end of the month.

SSA is responsible for certifying wages subject to FICA on a quarterly basis. Treasury and SSA rebalance the Fund accordingly, depending on whether wage revisions increase or decrease Fund income more than otherwise. SSA may revise its estimates for wages as far back as 1937. This ensures that over the long run the appropriate share of covered wages was deposited.

Perhaps the most important concept in this process is that the law governing the Trust Funds makes clear that the OASDI Trust Funds are funded with a percentage (the applicable tax rates) of covered wages. The basic unit of measure in the estimating and crediting of FICA taxes has little to do with the actual amount of FICA taxes collected. Thus, the Trust Funds are owed the taxable share of wages tabulated by SSA, essentially whether Treasury can collect the revenue or not.

Policy Interactions

Recent and future tax debates have been and will likely be primarily animated by individual and corporate income taxes. Yet for many taxpayers, FICA taxes form the largest federal tax liability. Payroll taxes are generally considered regressive taxes to the extent that the effective tax rate is inversely proportional to income – lower-income workers pay a greater share of payroll tax than do higher-income workers. Historical reforms to the Social Security system have also included payroll tax increases, which have increased the effective tax rates on lower-income workers under the payroll tax. In general, due to the linkage between FICA taxes and the financing of Social Security, FICA taxes are typically not considered in isolation of that program.

More recently, some policymakers have been reconsidering FICA taxes beyond their primary role as sources of finance for Social Security. [22] The most conspicuous recent example is the 2010 payroll tax reduction enacted as part of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010.[23] The cost estimate for this policy outlines the broad flow of funds involved.[24] The law reduced payroll tax liabilities by 2 percentage points and specified that any forgone FICA revenue would be replenished with a general fund transfer. It is important to note, however, that the mechanism for estimating and crediting the Trust Fund is abstracted from actual FICA collections. Rather, the investment of SI GAS securities in the Trust Fund is a function of the tax liability (based on the applicable rate) on certified wages.

An alternative approach would have essentially directed SSA and Treasury to ignore the reduced payroll rate in the calculation of applicable tax liabilities. This would have given rise to general fund transfers to make up the difference between the actual (reduced) FICA receipts and the higher estimated liabilities. Budgetarily, the policy would be identical to the payroll tax holiday – a reduction in FICA receipts, which is replenished through a general fund transfer that increases on-budget direct spending and increases off-budget offsetting collections to fund Social Security spending held harmless by the decreased FICA receipts.

This architecture remains available to policymakers considering tax policy reforms involving the payroll tax. One example of payroll tax reform is an earned income tax credit (EITC) proposal from the Tax Reform Act of 2014.[25] The proposal created a credit against employee-side payroll taxes that were refundable through the individual income tax code. Uniquely, the proposal characterized the payroll credit as an income tax revenue loss for budgetary purposes. A separate but related issue concerns how the OASDI Trust Fund would be affected. The regime through which the OASDI Trust Fund is credited with tax receipts is designed to credit the Fund on what should be owed, rather than what is collected. Treasury makes up any difference through the issuance of securities. Historically, changes in payroll taxes have been largely a function of ensuring additional funding for Social Security. It thus follows that the applicable tax rate and the relevant percentage for crediting the fund for tax receipts are related, but that need not be the case. Thus a policy that reduced FICA tax receipts, but maintained a regime that credited the trust fund as if that change did not occur, would see the Trust Fund held harmless from the reduced payroll receipts.

Conclusion

The Social Security program has a complex financial management system that begins with the worker and winds through a maze of federal agencies before ultimately completing with payments to its millions of beneficiaries. While labyrinthine, the process by which FICA taxes are disbursed to the Trust Funds is designed to ensure that the program is credited with no less than exactly what it is owed. This design feature animates the interaction of tax policy and the funding mechanism for Social Security.

[1] http://www.ssa.gov/pressoffice/factsheets/HowAreSocialSecurity.htm

[2] https://www.ssa.gov/oact/cola/cbb.html

[3] http://www.ssa.gov/pressoffice/colafacts.htm

[4] http://www.jct.gov/publications.html?func=startdown&id=3672

[5] https://www.law.cornell.edu/uscode/text/26/3101; https://www.law.cornell.edu/uscode/text/26/3111

[6] https://www.law.cornell.edu/uscode/text/42/401

[7] http://www.cbo.gov/ftpdocs/88xx/doc8885/12-11-HistoricalTaxRates.pdf

[8] https://www.ssa.gov/OACT/STATS/table3c3.html

[9] https://www.ssa.gov/OACT/ProgData/taxflow.html#liability

[10] https://fsapps.fiscal.treasury.gov/dts/files/23041400.pdf

[11] https://www.ssa.gov/policy/docs/ssb/v75n1/v75n1p1.html#mt23

[12] https://fiscaldata.treasury.gov/datasets/monthly-statement-public-debt/summary-of-treasury-securities-outstanding

[13] https://www.ssa.gov/OACT/ProgData/intrateformula.html

[14] https://www.ssa.gov/OACT/ProgData/effectiveRates.html

[15] https://www.ssa.gov/cgi-bin/transactions.cgi

[16] Ibid.

[17] https://www.ssa.gov/pubs/EN-05-10031-2023.pdf

[18] https://www.law.cornell.edu/uscode/text/42/401

[19] https://www.ssa.gov/OACT/ProgData/taxflowchart.html

[20] https://www.ssa.gov/OACT/ProgData/taxflow.html#liability

[21] For example in Q1 of 2023, SSA estimates that Treasury will collect $277.2 billion, see: https://www.ssa.gov/cgi-bin/taxreport.cgi

[22] https://www.americanactionforum.org/research/reassessing-the-budgetary-treatment-of-refundable-tax-credits/

[23] https://www.congress.gov/bill/111th-congress/house-bill/4853

[24] https://www.cbo.gov/sites/default/files/111th-congress-2009-2010/costestimate/sa47530.pdf

[25] https://www.govinfo.gov/content/pkg/CPRT-113WPRT89455/pdf/CPRT-113WPRT89455.pdf#page=97