Research

November 8, 2023

The Earned Income Tax Credit: Program Design, History, and Options for Reform

Executive Summary

- According to the Internal Revenue Service, 26 million taxpayers claimed the earned income tax credit (EITC) for tax year 2020; the total value of the EITC claimed that year was $59.2 billion against $480.5 billion in qualifying earned income.

- The creation and subsequent expansion of the EITC has been shown to significantly increase workforce participation, particularly among single mothers, and reduce poverty rolls by over 4.5 million Americans per year.

- The program is needlessly complex, which discourages participation and increases payment errors – in 2022 nearly one-in-three EITC payments was improper.

- The basic structure of the program has been largely unchanged for decades and is in need of additional reforms to improve labor participation, reduce poverty, and reduce complexity.

Introduction

The earned income tax credit (EITC) was the nation’s first refundable tax credit and is now its single largest income support program. The credit serves dual roles that have complementary and contradictory aspects. It is at once a work subsidy that is designed to incentivize the return to labor as well as one of the largest anti-poverty programs in the United States. These dual missions reflect certain features of the program: It is administered through the individual income tax code but provides income support in excess of individual income tax liability. It is an antipoverty program but is not tethered to federal poverty measures. The EITC has been effective in encouraging labor participation and lifting the vulnerable from poverty. Nevertheless, the program is plagued by complexity, borne out by high error rates. While Congress has recently temporarily expanded part of the EITC, the basic structure of the program has been largely unchanged for decades. Given the significance of the EITC in both its effects and costs, it remains a program deserving renewed attention from policymakers.

EITC Basics

The EITC provides beneficiaries with a credit against income tax liability and is based on a percentage of “earned income” received by a taxpayer in a given tax year.[1] The value of the credit increases as workers’ earnings increase up to a threshold amount. At a still-higher income threshold, the value of the credit phases out until reaching zero.

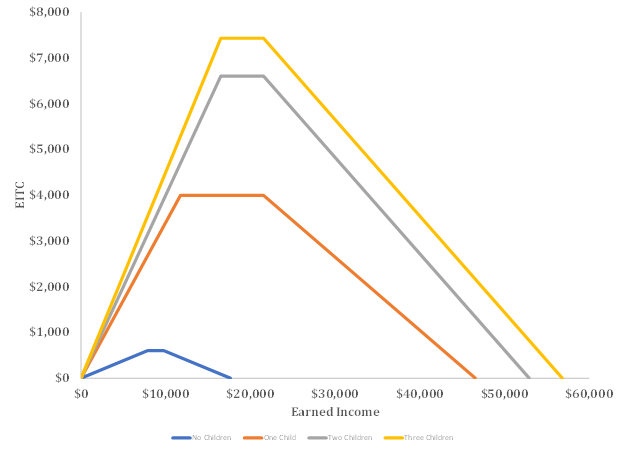

Figure 1: EITC Amount by Income and Family Size

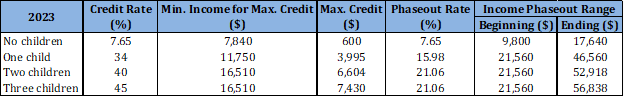

Each of these parameters varies depending on claimants’ number of children. For 2023, the maximum EITC credit amounts are $600, $3,995, $6,604, and $7,430 for claimants with zero, one, two, and three or more children, respectively.

Table 1: 2023 EITC Parameters[2]

To the extent the EITC is nominally and legally a credit based on “earned income,” the definition of earned income is essential to understanding the EITC. The tax code defines earned income as “wages, salaries, tips, and other employee compensation…,” as well as certain self-employment income. Essentially, earned income can generally be understood to be active labor income, as opposed to passive income, or returns to savings, which are excluded from the definition of earned income. Thus, mechanically, the credit scales with the returns to work, but is limited to the lower end of the earned income distribution. The credit also materially depends on family size; the credit is more than six times greater for a single-child household than for a childless household. The credit is therefore at once a work subsidy and a family income transfer program.

To claim the EITC, taxpayers must file an income tax return. This is an important consideration in the design of this policy and is one key tradeoff in the design of an anti-poverty program. In general, U.S. citizens and residents under 65 must file income tax returns if their gross income meets certain thresholds – $12,950 for single filers and $25,900 for married couples.[3] Yet the maximum EITC credit is available for potential beneficiaries at well below this threshold. Accordingly, there is a risk that the benefit will not be claimed by otherwise eligible recipients by failing to file a return.

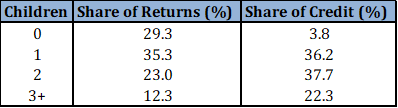

According to the Internal Revenue Service (IRS), 26 million taxpayers claimed the EITC for tax year 2020.[4] The total value of the EITC claimed by taxpayers for 2020 was $59.2 billion against $480.5 billion in qualifying earned income. Comparing the relative shares of claims and EITC awards reveals the effect of the comparatively small value of the EITC for childless workers. Where that cohort is responsible for nearly a third of tax returns claiming the EITC, it only received about 4 percent of the total EITC credit award for the tax year.

Table 2: Share of EITC Returns and Claims by Family Size

The EITC is somewhat unique among income tax credits in that it is refundable – in fact, the EITC was the first and only refundable tax credit for nearly 20 years. Conceptually, a tax expenditure is often short-handed to “spending through the tax code.” That is somewhat misleading, as only a particular set of tax expenditures involves federal spending or outlays: refundable credits. Indeed, refundable credits somewhat blur the line between taxation and spending. In general, refundable tax credits are features of the individual and corporation income tax code and provide a credit or a dollar-amount reduction in income tax liability. Unlike typical tax credits, however, to the extent that a refundable credit exceeds a taxpayer’s income tax liability, any excess is paid directly, or refunded, to the taxpayer.

With respect to the EITC, the majority of the credit was awarded through a refund. According to the IRS, 87 percent, $51.7 billion of the $59.2 billion in EITC credit claimed for 2020, was disbursed through a refund to the claimant.

The Evolution of the EITC

The United States maintains myriad public assistance programs that variously provide support for certain aspects of wellbeing such as housing, health, and food. The United States also provides assistance based on certain individual characteristics such as age or disability. Further, the United States also subsidizes certain activities or behaviors such as child-rearing and charitable giving. The EITC is designed to subsidize the decision to work. Such “work bonus” policies were debated in Congress in the early 1970s and were informed to some degree from Milton Friedman’s work on negative income taxes. [5]

It was not until the Tax Reduction Act of 1975 was signed by Gerald Ford on March 29, 1975, that this policy found a place in law. Among other provisions, the law created the first refundable tax credit, the earned income tax credit, on a temporary basis. The provision provided a 10 percent tax credit on up to $4,000 in earned income for workers with one or more children.[6] Uniquely, any credit in excess of the taxpayer’s tax liability would be refunded as a direct payment.

Enacted as a temporary measure, the EITC was scheduled to expire in 1976, but was annually extended three subsequent times without substantive revision.[7] In 1978, the EITC was made permanent and expanded to 10 percent on up to $5,000 in earned income, phasing down on income above $6,000. The credit was essentially unchanged for the next six years until 1984, when the credit was increased to 11 percent on up to $5000 before phasing out for recipients with income above $6,500. In 1986, as part of the sweeping Tax Reform Act, the EITC credit rate was increased to 14 percent, while the relevant income thresholds were permanently indexed for inflation.[8]

Thus, over the first 10 years of the EITC’s existence, the basic structure remained relatively intact. Beginning with the Omnibus Budget Reconciliation Act of 1990 (OBRA90), however, the EITC was reorientated more substantially toward reducing family poverty. OBRA90 established two new formulas for claiming the credit, one for workers with one child and a second formula for workers with two or more children. The law also increased the credit rate from 14 percent to an eventual 17.5 percent and 18.5 percent for the two formulas, respectively.[9]

In the first of the major Clinton-era budget deals, the Omnibus Budget Reconciliation Act of 1993, the EITC was expanded again. The expansion included increases in the relevant credit rates to the rates that largely prevail today of 34 percent for workers with one child and 40 percent for workers with two children. More significant, OBRA93 created a new formula for childless workers. Under the new formula, eligible childless workers could receive a credit of 7.65 percent – the same rate as the employee of federal payroll taxes – on up to $4,000 in earned income. At the time, the value of the credit amounted to $306, whereas workers with one or two or more children could receive up to $2,038 and $2,528, respectively, at the time.[10]

The basic architecture of the credit and the credit rates have been largely unchanged since, with two exceptions. In 2001, under the Economic Growth and Tax Relief Reconciliation Act (EGTRRA), new formulas were added to increase the income thresholds at which the credit phases-out for married couples filing jointly. Previously, the structure of the credit was such that for some families the value of the credit was less than if the couple had filed separately. Increasing the phase-out thresholds can mitigate this effect for joint-filers.[11] The basic structure remained largely unchanged until 2009, when President Obama signed the American Recovery and Reinvestment Act (ARRA) into law. ARRA further reduced potential marriage penalties by increasing the income thresholds for the credit phase-out, but more important, created a new formula tier for workers with three or more children. This new tier maintained the income thresholds of the two-child formula but included a higher credit rate of 45 percent (compared to 40 percent).[12] The new tier was enacted as a temporary measure, but much like the EITC itself was made permanent in legislation enacted in 2015.[13] Since then, no major permanent changes to the basic structure of the EITC have occurred.

The EITC as a Work Incentive and Anti-poverty Program

The EITC is a policy that serves multiple public policy interests. It is at once a work incentive in that it is only available to workers, as well as an antipoverty program, to the extent it mitigates poverty among the working poor. This dual mandate introduces tradeoffs in policy design that can inform future reform efforts.

The EITC as a Work Incentive

Mechanically, the value of the EITC scales with work during the phase-in, for which earned income is the proxy. This necessarily incentivizes the return to work on the margin, but it also mitigates a steep tax on the decision to enter the workforce at all. Among the considerations in the design of the EITC was relief against the payroll tax.[14] The payroll tax is generally considered a regressive tax to the extent that the effective tax rate is inversely proportional to income: Lower-income workers pay a greater share of payroll tax than do higher-income workers. The payroll tax creates a steep marginal effective tax rate for labor market entrants. In the absence of any other policy, the first dollar of income for new workers is taxed steeply. This disincentivizes the decision to work more so than if the payroll tax were progressively structured.

The EITC was not, however, designed to fully mirror the payroll tax system. Indeed, offsetting the regressivity of the payroll tax was but one rationale for its creation. Accordingly, the evolution of the EITC has not been in lockstep with the payroll tax, and the degree to which the EITC offsets payroll tax liability varies by income and family size. In general, the EITC offsets the employee share of the payroll tax for parents (married or unmarried) with at least one child, while single, childless workers typically retain a net positive payroll (employee-side) of the payroll tax. Accordingly, the credit rate and phase-outs of the EITC have been largely abstracted from the payroll tax rates.

There is a robust literature on the work incentive effects of the EITC.[15] A common finding is that the creation and subsequent expansion of the EITC significantly increased workforce participation among single mothers. Indeed, it may well have been the single most significant contributor to the increase in workforce participation among single mothers in the 1990s.[16] In general, the literature observes a clear and compelling finding that the EITC strongly encouraged single mothers to enter the workforce. [17] Once within the workforce, however, the incentives of the EITC shift and can be somewhat neutral or could incentivize a reduction in labor supply. This incentive is particularly noteworthy as workers’ incomes rise through the credit phase-out range. The reduction of the credit imposes a marginal tax on the workers income – a disincentive to supply labor.[18] There is, however, little in the empirical evidence that this effect is robust, though there may be challenges in identifying the effect among workers.[19]

Antipoverty Effects

The EITC began as a temporary program to accomplish many policy aims at once. Since its enactment, the policy has expanded to provide substantially more assistance to more workers, scaling with family size. In 2021, according to Census data, the EITC was responsible for lifting 3.4 million workers out of poverty, and has over the last 20 years annually reduced poverty levels by an average of 4.7 million Americans.[20] Over the same period, the EITC has, on average, has taken 2.5 million children out of poverty.[21] Reducing poverty in childhood has knock-on effects over the lifetime of the child. As noted in prior American Action Forum (AAF) research, the EITC, along with the child tax credit (CTC), have been linked to improvements in infant health, as well as higher test scores, high school graduation rates, and college attendance, ultimately increasing hours worked and wages earned by child beneficiaries in adulthood.[22]

Most of the major changes to the EITC since its enactment have been substantially oriented to antipoverty goals rather than to work incentives. Yet the work-incentive goals can complement the antipoverty effects to the extent that the work incentive induces employment that, combined with the credit, can alleviate poverty. Indeed, one study found that including the work-incentive effects in estimates of the EITC’s effect on poverty reduction suggests that the ETIC’s antipoverty effects could be understated by 50 percent.[23]

Complexity

The EITC is a robust antipoverty program that encourages work. The efficient delivery of this program necessarily informs how effective those incentives will be. The EITC suffers from several design elements that complicate uptake. First, as noted above, the EITC requires recipients to file income taxes. Individuals with incomes below the filing requirement thresholds are eligible for the EITC, but many do not file, forgoing the benefit. An additional consideration is reflected in the credit’s design itself: It is complicated to compute. It relies on an alternative definition of income and varies with income and family size over time (given the inflation indexing). Those elements introduce additional layers of complexity. To the extent the EITC varies substantially by family size, it is very much dependent on the definition and documentation of qualifying children. According to an Urban Institute study, only about 50 percent of qualifying children live in households headed by a married couple. The upshot is that nearly half of qualifying children live with a single parent or in a household that is characterized as multigenerational, cohabiting household, or a family with at least one non-biological child.[24] These features all combine to increase complexity and reduce uptake.

Increased complexity imposes costs on beneficiaries, to the extent that low-income workers rely on paid tax-preparers to comply with the tax code, as well as on the national fisc. The EITC also suffers from reliably high levels of improper payments. In 2022, the EITC suffered an improper payment rate of nearly 32 percent. While this is somewhat elevated, historically the improper payment rate has averaged about 25 percent.[25]

EITC Design Reform Options

The EITC has served to increase labor force participation, most particularly among single mothers, and has lifted millions of families and children out of poverty. The work incentive effects should not be overstated, however, and while the work and anti-poverty effects reduce the cost of other aspects of the federal safety net, the program is nevertheless costly. Indeed, the cost of the EITC alone is larger than the budgets of six federal departments.[26] Given these constraints and the fact that the EITC is indexed for inflation, significant expansions of the income thresholds or credit rates for the EITC are unlikely and budgetarily unwise. There is research that the current structure of the EITC is fairly close to optimal in its scope and scale.[27]

One exception to the constraint on expanding the credit is with respect to childless workers. The credit for these workers is substantially less generous than that for parents. In 2021, President Biden signed the American Rescue Plan Act (ARPA) into law, which increased the childless credit to 15.3 percent and increased the relevant income thresholds. While the credit rate doubled, the combined effects of the change nearly tripled the value of the credit.[28] Unlike past temporary increases, this COVID-era policy was allowed to revert to the pre-ARPA level.

It is unclear what the labor or antipoverty effects on eligible workers were from this temporary expansion, but that research should inform future design. There is relatively scant empirical research on the effects of childless EITC on labor supply, in part because the program has not been substantially expanded in the manner of the EITC more generally, which provided opportunities for researchers to measure the effects of the expansions.[29] The structure and generosity of the credit do not align well with either the work incentive or antipoverty goals of the program. In fact, the childless EITC credit was enacted to nominally offset a gas tax increase.[30] The maximum credit is insufficient to materially reduce poverty, and the income thresholds do not map against market-wage opportunities. Specifically, for a worker making minimum wage, their annual income would be nearly past the phase-out range of the credit.

There has been longstanding, bipartisan interest in expanding the childless EITC. For example, President Obama proposed an expansion in the administration’s budget, and more recently by the Bipartisan Policy Center (BPC), among others.[31] Under the BPC proposal, the childless EITC would increase (compared to current law) the credit rate to the ARPA rate of 15.3 percent. Former Speaker of the House Paul Ryan also proposed a similar increase to 15.3 percent, among other changes. AAF found that this expansion would have increased employment of childless adults by 8.3 million, where 4.6 million are single and 3.7 million are married. When compared to then-current law, the proposal would have given give an additional $1.3 billion to individuals in poverty while lifting 89,800 out of poverty. The program would have also targeted an additional 2.2 million individuals below 150 percent of the poverty line, giving them $2.7 billion. [32]

AAF estimated this expansion to cost nearly $14 billion at the time, however. Going forward, the Congressional Budget Office has estimated that expanding the childless ETIC would cost $135 billion through 2031.[33]

Beyond expanding the program for childless adults, alternative approaches to reform could be considered. In 2005, President George W. Bush convened a blue-ribbon commission to examine comprehensive tax reform options. Among the proposals advanced by the panel was to separate the CTC into its refundable and non-refundable components. The refundable component of the CTC would be combined with the EITC to create a work credit.[34] As now, the credit would scale with work and vary by family size. Harmonizing both credits’ eligibility rules, particularly related to qualifying children, would reduce the complexity that gives rise to errors in the EITC program. A somewhat similar approach has also been serially proposed by the Taxpayer Advocate Service (TAS), the IRS’ internal watchdog, in its annual report to Congress.[35] TAS has proposed, among other reforms, eliminating the family size component entirely from the EITC, reorienting entirely to a work credit. Under this proposal, the CTC would be reformed to replace the child-dependent aspect of the EITC. According to TAS, this would significantly reduce complexity within the EITC.

Beyond the design parameters of the credit itself, there have also been alternative approaches to the budgetary treatment of the EITC. For years, the EITC was, along with the CTC, unique in its refundability, which affects both federal revenues and spending. Refundable tax credits have grown over time, however, as has the tendency of policymakers to route social programs through the tax code.

The modern EITC is predominantly an income support program delivered through direct payments to taxpayers. In 1996, 80 percent of the EITC was delivered as a direct payment in excess of tax liability. Nearly a quarter century later, this composition remains relatively stable at 87 percent.[36]

Consolidating existing income support programs and tax credits into family and work credits was proposed by AAF in past work.[37] AAF proposed moving these policies entirely to the spending side of the federal ledger. Alternative approaches that would reorient such policies to entirely the revenue side of the federal budget are also possible, such as the EITC reform approach taken in the Tax Reform Act of 2014.[38] That approach recharacterized the refundable portion of the EITC as an income tax refund against payroll taxes. This reorientation does not necessarily affect the beneficiary – though timing of benefit receipt can depend on the manner in which it is claimed – but could illuminate policymakers’ approach to reform efforts.

Of note, there is some tension in ease of administrability and other program design goals, which include both distributional as well as overall budgetary considerations. In lieu of the EITC, consider a flat benefit of $500 to every taxpayer. This program would be relatively easier to target and administer. But for the same public expenditure, one could target the support on more needy populations. Each layer of eligibility requirements comes additional complexity, however. Refundable credits to include the CTC, EITC, as well as others, have faced historically high levels of improper payments.[39] Indeed, programs that were entirely on the spending side of the ledger may be less error-prone in comparison. While this comparison may understate the relative administrative costs, [40] it is likely that other design and related considerations more substantially animate payment errors.[41]

Conclusion

The EITC is a critical safety-net program that serves over 26 million workers in the United States. It is significant in its material effects on labor and poverty reduction, as well as the program’s cost to taxpayers. The program has served these two goals relatively well, but is needlessly complex, which discourages participation and challenges proper administration. The basic structure of the program has been largely unchanged for decades and is in need of additional reforms to improve labor participation, reduce poverty, and reduce complexity.

[2] https://www.taxpolicycenter.org/statistics/eitc-parameters; https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/earned-income-and-earned-income-tax-credit-eitc-tables

[3] https://www.irs.gov/publications/p501#en_US_2022_publink1000220687

[4] https://www.irs.gov/pub/irs-soi/20in25ic.xls

[5] https://www.cbo.gov/sites/default/files/113th-congress-2013-2014/reports/43767_RefundableTaxCredits_2012_0_0.pdf

[6] https://www.govinfo.gov/content/pkg/STATUTE-89/pdf/STATUTE-89-Pg26.pdf

[7] https://crsreports.congress.gov/product/pdf/R/R44825/10

[8] Ibid.

[9] OBRA90 phased in the credit rate increases over 3 years.

[10] https://crsreports.congress.gov/product/pdf/R/R44825/10

[11] https://www.jct.gov/publications/2001/jcx-8-01/

[12] https://www.congress.gov/111/plaws/publ5/PLAW-111publ5.pdf

[13] https://www.congress.gov/114/plaws/publ113/PLAW-114publ113.pdf

[14] https://www.americanactionforum.org/research/reassessing-the-budgetary-treatment-of-refundable-tax-credits/

[15] Bruce D. Meyer and Douglas Holtz-Eakin, eds., Making Work Pay: The Earned Income Tax Credit and Its Impact on America’s Families (New York: Russell Sage Foundation, 2001)

[16] https://www.cbpp.org/research/federal-tax/eitc-and-child-tax-credit-promote-work-reduce-poverty-and-support-childrens#_ftnref14

[17] https://www.nber.org/system/files/working_papers/w11729/w11729.pdf

[18] https://www.cato.org/cato-handbook-policymakers/cato-handbook-policymakers-9th-edition-2022/earned-income-tax-credit#work-incentives-and-disincentives

[19] https://www.nber.org/system/files/working_papers/w11729/w11729.pdf

[20] https://www2.census.gov/programs-surveys/demo/tables/p60/277/Impact-on-Poverty.xlsx

[21] Ibid.

[22] https://www.americanactionforum.org/research/child-poverty-and-the-effects-of-anti-poverty-programs/#_edn16

[23] https://www.cbpp.org/research/federal-tax/eitc-and-child-tax-credit-promote-work-reduce-poverty-and-support-childrens#_ftnref14

[24] https://www.urban.org/research/publication/increasing-family-complexity-and-volatility-difficulty-determining-child-tax-benefits

[25] https://www.paymentaccuracy.gov/payment-accuracy-the-numbers/

[26] https://www.whitehouse.gov/wp-content/uploads/2022/03/hist04z1_fy2023.xlsx

[27] See https://www.russellsage.org/sites/default/files/MakingWorkPay-download.pdf

[28] https://crsreports.congress.gov/product/pdf/R/R44825/10

[29] https://crsreports.congress.gov/product/pdf/R/R44057/13

[30] https://www.aei.org/wp-content/uploads/2021/07/Reforming-tax-credits-to-promote-child-opportunity-and-aid-working-families.pdf?x91208

[31] https://bipartisanpolicy.org/download/?file=/wp-content/uploads/2021/08/BPC-CTC-EITC.pdf

[32] https://www.americanactionforum.org/research/the-work-and-safety-net-effects-of-expanding-the-childless-eitc/

[33] https://www.pgpf.org/blog/2022/02/what-are-the-costs-of-permanently-expanding-the-ctc-and-the-eitc

[34] https://govinfo.library.unt.edu/taxreformpanel/final-report/TaxPanel_5-7.pdf

[35] https://www.taxpayeradvocate.irs.gov/reports/2022-annual-report-to-congress/full-report/

[36] https://www.irs.gov/pub/irs-soi/96in25ic.xls

[37] https://www.pgpf.org/sites/default/files/PGPF-American-Action-Forum-Solutions-Initiative-2019.pdf

[38] https://www.americanactionforum.org/research/reassessing-the-budgetary-treatment-of-refundable-tax-credits/

[39] https://taxfoundation.org/blog/irs-tax-credits-overpayments/

[40] https://crsreports.congress.gov/product/pdf/R/R43873/8

[41] https://bipartisanpolicy.org/download/?file=/wp- content/uploads/2022/09/BPC_Roadmap_for_CTC_and_EITC_RV2.pdf